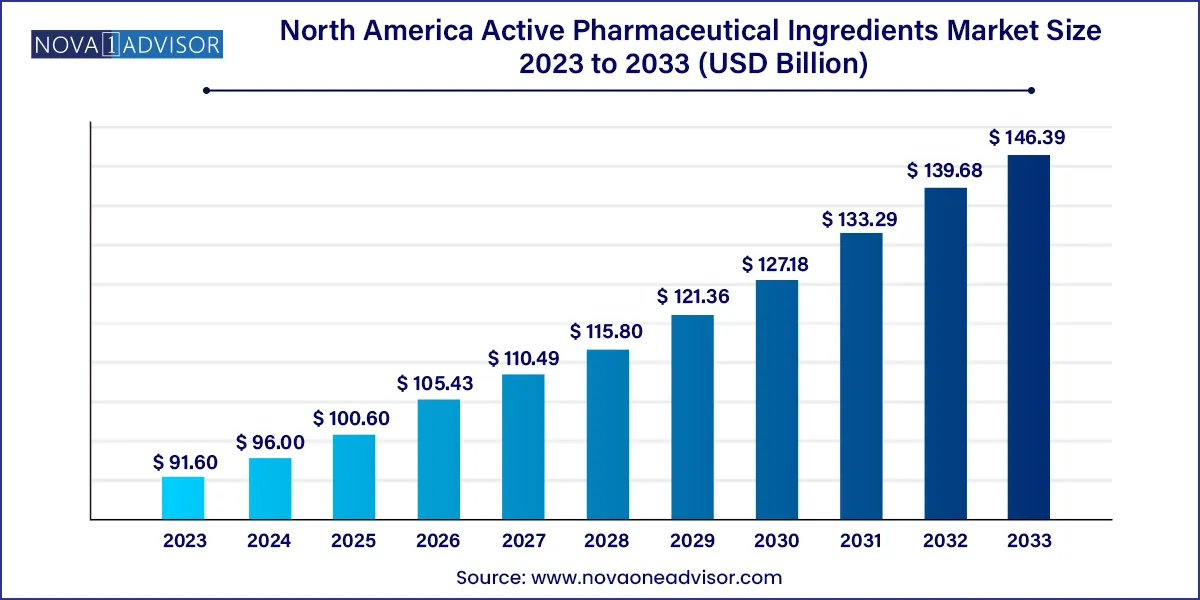

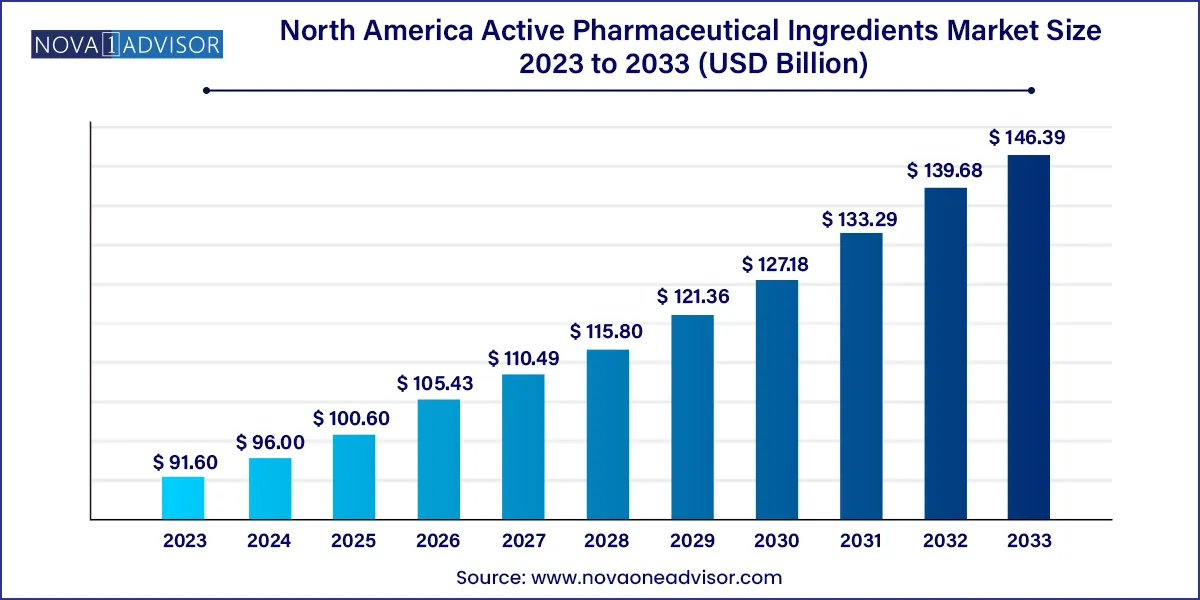

The North America active pharmaceutical ingredients market size was valued at USD 91.60 billion in 2023 and is projected to surpass around USD 146.39 billion by 2033, registering a CAGR of 4.8% over the forecast period of 2024 to 2033.

Key Takeaways:

- North America accrued the largest revenue share of 38.13% in 2023.

- U.S. led the market with a share of 91.89% in 2023.

- Canada is projected to depict the fastest growth rate over the forecast period.

- The synthetic segment held the largest revenue share of 72.9% in 2023.

- Biotech API is expected to witness fastest growth during the forecast period.

- Captive APIs segment held the largest market share of 51.21% in 2023.

- Merchant APIs segment is expected to experience the fastest growth over the forecast period.

- Innovative APIs segment dominated the overall API market with a revenue share of 67.15% in 2023.

- Cardiology segment dominated the API market with a revenue share of 21.14% in 2023.

- Oncology segment is anticipated to grow at the fastest rate over the forecast period.

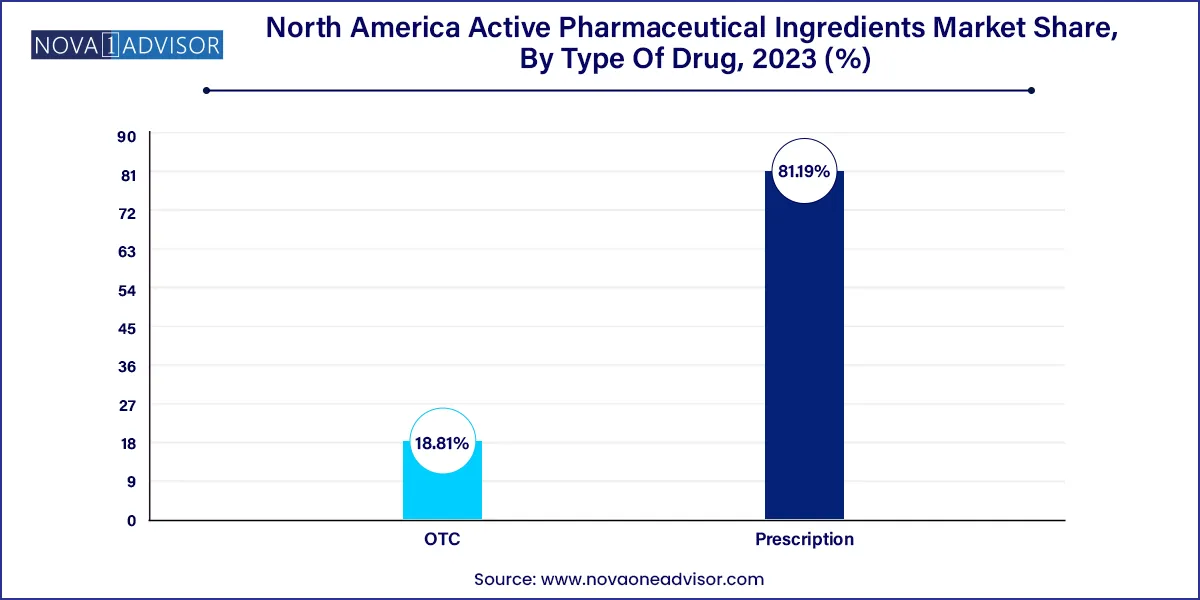

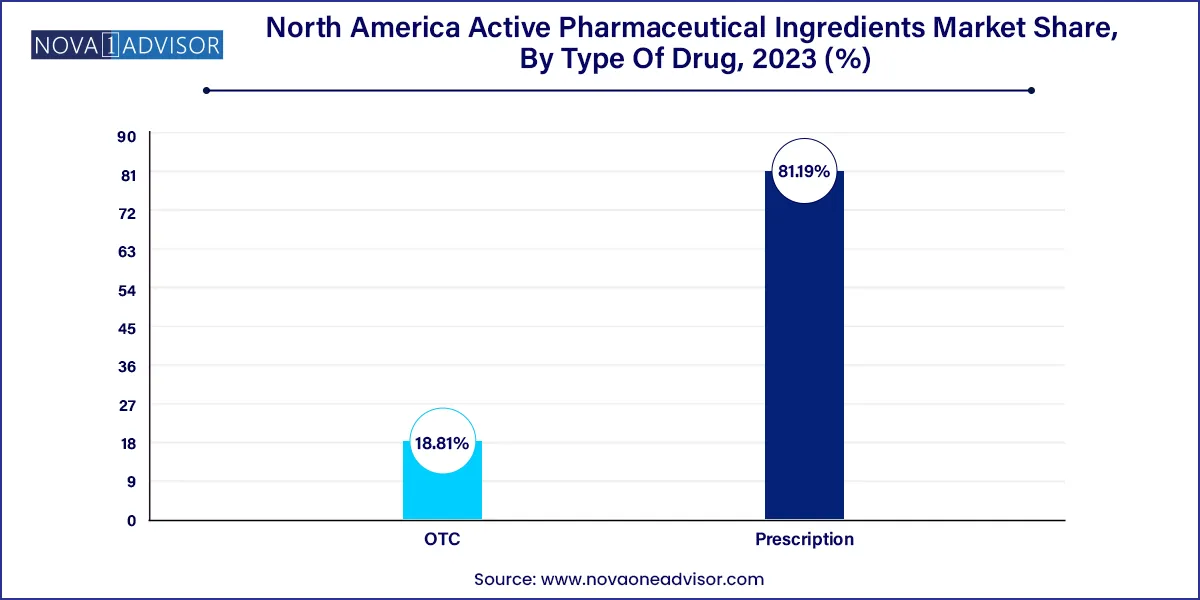

- Prescription dominated the market with a revenue share of 81.19% in 2023.

- OTC segment is expected to depict the fastest growth over the forecast period.

North America Active Pharmaceutical Ingredients Market Overview

The North America Active Pharmaceutical Ingredients (API) market is characterized by a robust landscape driven by various factors. One of the key drivers is the rising incidence of chronic ailments like cancer, diabetes, and cardiovascular diseases. This surge in health issues is creating a heightened demand for APIs, which serve as the fundamental building blocks for numerous pharmaceutical formulations. Additionally, the region's aging population is contributing to the market's growth trajectory, as it necessitates the development of innovative medications to cater to evolving healthcare needs. Technological advancements in manufacturing processes are also playing a pivotal role by enhancing the efficiency and quality of API production. Consequently, pharmaceutical companies are increasingly investing in these technologies, further stimulating market expansion. Moreover, supportive government initiatives aimed at promoting domestic manufacturing and reducing reliance on imports are bolstering the North America API market. Collectively, these factors underscore a promising outlook for the North America Active Pharmaceutical Ingredients market, presenting significant opportunities for industry stakeholders.

North America Active Pharmaceutical Ingredients Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 96.00 Billion |

| Market Size by 2033 |

USD 146.39 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.8% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type of synthesis, type of manufacturer, type, application, type of drug, country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical Industries Ltd.; Cipla Inc.; AbbVie Inc.; Aurobindo Pharma; Sandoz International GmbH (Novartis AG); Viatris Inc.; Fresenius Kabi AG; STADA Arzneimittel AG; Lonza; Curia; Pfizer Inc.; Bristol-Myers Squibb Company; Merck KGaA; Catalent, Inc. |

By Type Of Synthesis Insights

Biotech APIs dominated the North America API market in terms of growth potential. This segment is primarily fueled by the shift toward biological therapeutics that offer higher specificity and reduced side effects. Within biotech APIs, monoclonal antibodies and recombinant proteins are the most prominent due to their widespread application in oncology, immunology, and rare diseases. For example, Amgen and Genentech have heavily invested in recombinant monoclonal antibodies for cancer treatment. These APIs are manufactured using cutting-edge biotechnological tools, including mammalian cell lines and genetic engineering techniques, to achieve desired pharmacokinetic profiles.

The fastest-growing subsegment within biotech APIs is vaccines, propelled by the success of mRNA and vector-based vaccines, especially in light of recent public health emergencies. The focus has now shifted from pandemic-related vaccines to vaccines for RSV, HPV, and even therapeutic cancer vaccines. Biotech APIs for vaccines are being developed using platforms like recombinant DNA technology, ensuring high immunogenicity with low toxicity. Their growth trajectory is also supported by ongoing government immunization programs and public-private partnerships.

In the Synthetic APIs segment, generic APIs dominate due to their cost-effectiveness and large-scale use in chronic disease treatment. Major pharmaceutical players, such as Teva Pharmaceuticals and Mylan (now part of Viatris), are well-known for producing synthetic generic APIs. Their affordability and consistent demand across therapeutic categories ensure stable revenue generation. Synthetic APIs are usually less complex to manufacture, which contributes to their widespread availability and adoption across various dosage forms.

Conversely, innovative synthetic APIs are the fastest-growing within the synthetic category. These include APIs used in novel drug formulations targeting unmet clinical needs. Innovation in drug discovery, especially for central nervous system (CNS) and autoimmune diseases, has pushed synthetic drug manufacturers to develop unique chemical entities (NCEs) that offer better bioavailability and efficacy profiles. These APIs often require multi-step synthesis and specialized containment, driving value-based growth.

By Type Of Manufacturer Insights

Captive APIs led the market as large pharmaceutical companies prefer in-house manufacturing to ensure quality control, IP protection, and supply chain security. Major U.S. players like Pfizer, Merck, and Johnson & Johnson have extensive captive API facilities integrated with their finished dosage manufacturing. These setups offer better control over cost, quality, and regulatory compliance, particularly for high-value biologics and specialty drugs. Captive production is especially common for proprietary or innovative drugs where exclusivity is paramount.

On the other hand, Merchant APIs are growing faster due to the rising trend of outsourcing. Smaller biotech firms, generics manufacturers, and even big pharma looking to reduce overhead costs are partnering with CMOs like Cambrex, Curia, and Lonza. These merchant manufacturers offer scalability, process optimization, and cost advantages, which are crucial in a competitive drug pricing environment. Merchant APIs are vital for meeting surges in demand during public health emergencies or new drug launches.

By Type Insights

Generic APIs dominate the North American market due to the expiration of several blockbuster drug patents, which has opened opportunities for generic drugmakers. With a strong FDA approval pathway for ANDAs (Abbreviated New Drug Applications), companies like Lupin Pharmaceuticals, Apotex, and Teva are capitalizing on this trend. The demand for generic APIs is further driven by cost-conscious healthcare policies and broader insurance coverage for generic drugs.

The innovative API segment is witnessing faster growth, propelled by the surge in R&D investments and technological breakthroughs in drug discovery. These APIs are central to specialty and orphan drug development, which often command premium pricing and enjoy market exclusivity. Pharmaceutical innovators are focusing on new molecular entities (NMEs), often supported by precision medicine frameworks, to develop first-in-class therapies.

By Application Insights

Cardiovascular diseases accounted for the largest market share within the application segment. High prevalence of hypertension, arrhythmias, and coronary artery disease in North America has led to the mass production of APIs for ACE inhibitors, beta blockers, and anticoagulants. Statins and antiplatelet agents, for instance, are staple prescriptions, contributing to the robust demand for cardiovascular APIs. Generic APIs dominate this space due to the high patient volume and affordability concerns.

Oncology emerged as the fastest-growing application segment. With increasing cancer incidence and new drug approvals, there’s heightened demand for both innovative and complex generic APIs. Biotech APIs like monoclonal antibodies, kinase inhibitors, and immune checkpoint inhibitors are at the forefront. Companies are also developing highly targeted APIs for tumor-specific applications, such as HER2-positive breast cancer or EGFR-mutant lung cancer. These trends are backed by rising clinical trials and significant venture capital investments in oncology biotech startups.

By Type Of Drug Insights

Prescription APIs remained dominant in the North America API market. The vast majority of APIs manufactured and consumed are incorporated into prescription drugs, especially for chronic and life-threatening conditions. From antihypertensives to oncology drugs and immunotherapies, prescription APIs serve as the core therapeutic agents in hospital and specialty settings. Regulatory compliance and pharmacovigilance are strictly maintained, ensuring safe use and clinical effectiveness.

However, the OTC API segment is expanding steadily, driven by increased consumer awareness, self-medication trends, and the availability of APIs for non-serious conditions such as cold, flu, allergies, and digestive issues. APIs for analgesics like ibuprofen, antihistamines like loratadine, and antacids are commonly found in OTC drugs, and North America’s retail and pharmacy chains have made these APIs highly accessible to the general population.

By Country Insights

United States

The U.S. represents the largest and most influential API market in North America. Backed by a sophisticated regulatory regime under the FDA and a strong pharmaceutical R&D ecosystem, the country is a global hub for innovative API development. Companies like Pfizer, Merck & Co., and AbbVie lead in both synthetic and biotech APIs. Domestic API production is being prioritized through legislative support, including the U.S. Executive Order on essential drug manufacturing reshoring. Rising cases of chronic diseases and cancer, combined with an aging population, are expected to further drive API demand.

Canada

Canada’s API market is characterized by strong generics and contract manufacturing capabilities. Companies like Apotex and Biovectra are key players. Health Canada’s emphasis on drug quality and self-reliance post-pandemic has encouraged investment in domestic API production. Canada also benefits from bilateral drug trade agreements with the U.S. and EU. Increased funding for life sciences innovation hubs and biotech clusters in provinces like Ontario and British Columbia positions Canada as a strategic player in North America’s API landscape.

Recent Developments

-

Pfizer announced in March 2025 its plan to expand its API manufacturing facility in Kalamazoo, Michigan, to include capabilities for advanced biologics and high-potency APIs.

-

Lonza signed a strategic collaboration in January 2025 with a leading U.S. oncology biotech firm to manufacture clinical and commercial-scale biotech APIs for personalized cancer therapies.

-

Apotex Inc. completed the acquisition of a small molecule API plant in Ontario in December 2024, aimed at reducing import dependency and accelerating domestic production.

-

Catalent reported in February 2025 a $200 million investment to upgrade its biologics API facility in Maryland to meet rising U.S. biotech API demand.

North America Active Pharmaceutical Ingredients Market Top Key Companies:

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Cipla Inc.

- AbbVie Inc.

- Aurobindo Pharma

- Sandoz International GmbH (Novartis AG)

- Viatris Inc.

- Fresenius Kabi AG

- STADA Arzneimittel AG

- Lonza

- Curia

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Merck KGaA

- Catalent, Inc.

North America Active Pharmaceutical Ingredients Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America Active Pharmaceutical Ingredients market.

By Type of Synthesis

- Biotech

- By Biotech APIs Market, by Type

- Generic APIs

- Innovative APIs

- By Biotech APIs Market, by Product

- Monoclonal Antibodies

- Hormones

- Cytokines

- Recombinant Proteins

- Therapeutic Enzymes

- Vaccines

- Blood Factors

- Synthetic

- By Synthetic APIs Market, by Type

- Generic APIs

- Innovative APIs

By Type of Manufacturer

- Captive APIs

- Merchant APIs

By Type

- Generic APIs

- Innovative APIs

By Application

- Cardiovascular Diseases

- Oncology

- CNS and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Others

By Type of Drug

By Country