North America Adhesives And Sealants Market Size and Research

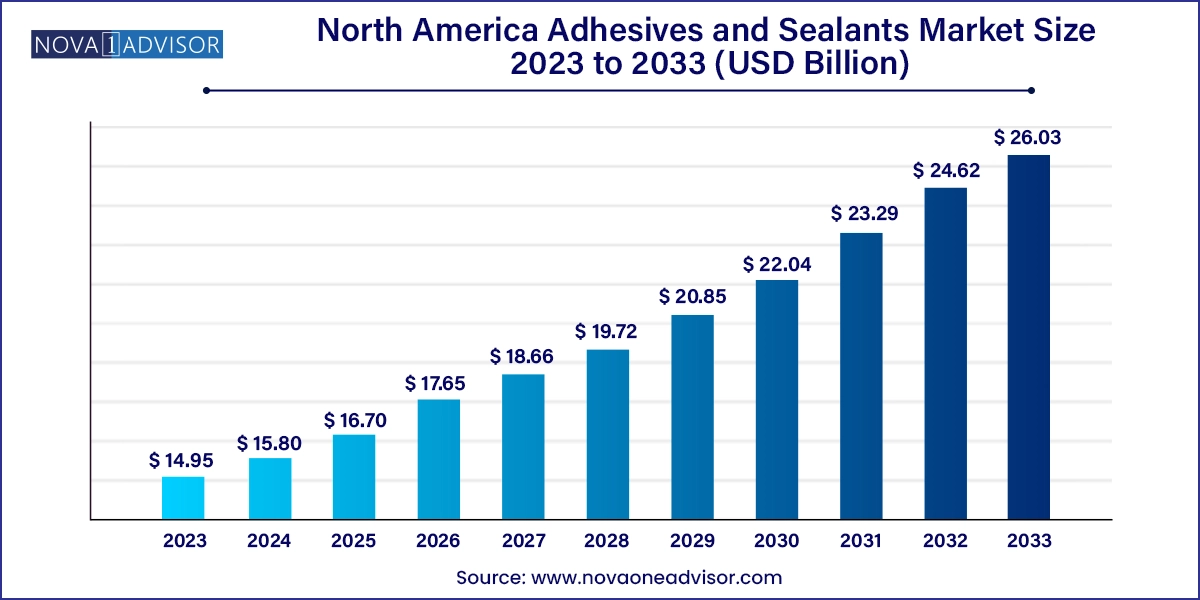

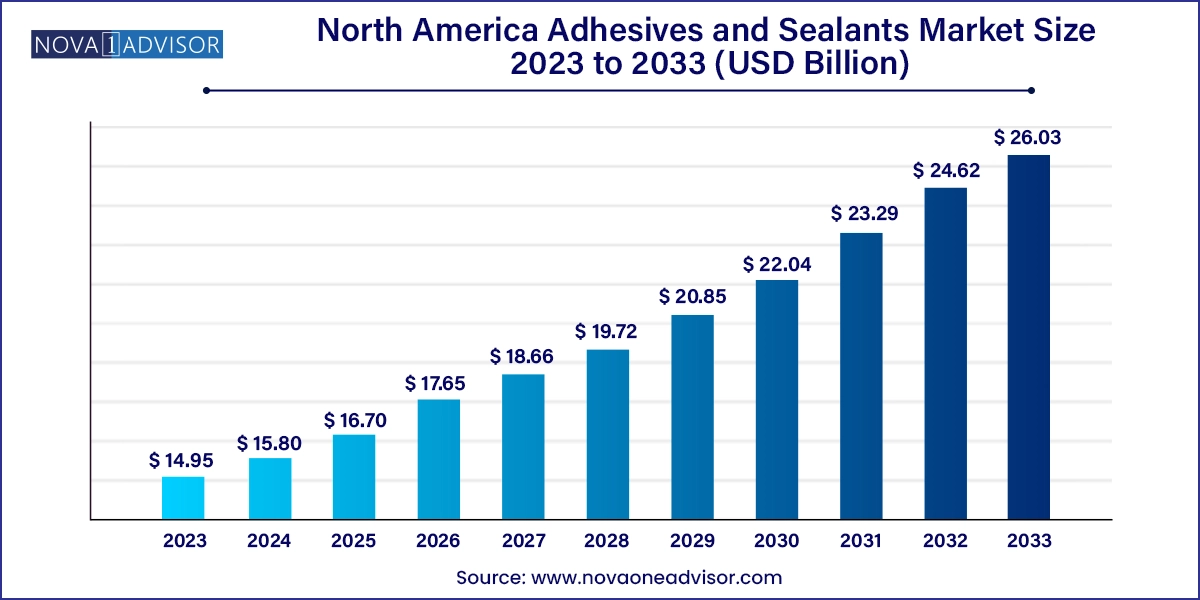

The North America adhesives and sealants market size was exhibited at USD 14.95 billion in 2023 and is projected to hit around USD 26.03 billion by 2033, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

North America Adhesives And Sealants Market Key Takeaways:

- Water-based dominated the market with the highest revenue share of 23.5% in 2023.

- Solvent-based are expected to experience a notable growth rate of 7.8% from 2024 to 2033.

- Acrylic adhesives dominated the market with a revenue share of 36.7% in 2023.

- Ethylene Vinyl Acetate (EVA) adhesives are projected to experience the second-fastest growth in revenue in the North America adhesives market, with a CAGR of 6.5% from 2024 to 2033.

- The paper and packaging sector dominated the market with a revenue share of 29.4% in 2023.

- The furniture and woodworking segment is projected to witness the fastest growth in terms of revenue, with a CAGR of 9.6% from 2024 to 2033.

- Silicones dominated the market with the highest revenue share of 34.0% in 2023.

- Acrylic sealants are projected to witness the second-fastest growth in terms of revenue, with a CAGR of 6.2% from 2024 to 2033.

- The construction sector dominated the market with the highest revenue share in 2023.

- The packaging segment is projected to witness the second-fastest growth in terms of revenue, with a CAGR of 7.9% from 2024 to 2033.

Market Overview

The North America Adhesives and Sealants Market is a foundational pillar of various industrial and consumer-centric sectors, driven by increasing demand from automotive, construction, packaging, electronics, medical, and DIY applications. Adhesives are used for bonding surfaces, offering alternatives to mechanical fasteners, while sealants fill gaps and protect surfaces from environmental elements such as moisture, heat, and chemicals.

The market in North America is characterized by advanced manufacturing capabilities, a strong base of end-user industries, and a regulatory environment that encourages sustainable and performance-driven innovation. With rising demand for lightweight materials, fuel-efficient vehicles, green construction, and flexible packaging, the adhesives and sealants industry is experiencing a steady growth trajectory.

The U.S. leads the region in both production and consumption, with Canada and Mexico supporting a growing manufacturing base and expanding automotive and construction sectors. Increasing adoption of water-based and hot-melt adhesives, as well as the development of bio-based and solvent-free sealants, reflect the region’s ongoing transition toward eco-conscious and regulatory-compliant solutions.

Major Trends in the Market

-

Shift Toward Water-Based and Hot-Melt Technologies: Low-VOC formulations are replacing solvent-based products in packaging, woodworking, and consumer applications.

-

Rising Demand for Lightweight Automotive Solutions: Adhesives are increasingly used in place of mechanical fasteners for better fuel efficiency and safety in vehicles.

-

Growth in Modular Construction and Prefab Housing: Sealants and structural adhesives are critical in panel joining and leak prevention for prefabricated buildings.

-

Customization and Specialty Formulations: Tailored adhesives and sealants are being developed for specific substrate combinations, curing profiles, and environmental conditions.

-

Smart Adhesives and Conductive Sealants: The emergence of functional adhesives for electronic circuits, wearables, and smart medical devices is a new growth area.

-

Sustainable and Bio-Based Alternatives: Bio-adhesives and recyclable sealants are gaining traction due to increasing corporate sustainability commitments and government regulations.

-

Expansion of E-Commerce Packaging Needs: Tamper-evident adhesives and re-sealable closures are in high demand to serve the booming online retail sector.

Report Scope of North America Adhesives And Sealants Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 15.80 Billion |

| Market Size by 2033 |

USD 26.03 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Product, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico |

| Key Companies Profiled |

Henkel Corporation; Sika AG; 3M; H.B. Fuller Company; Evonik Industries; RPM International Inc.; Dow; Wacker Chemie AG; Arkema; Arkema Group |

Key Market Driver: Expansion in Building and Construction Activities

One of the most potent drivers of the North American adhesives and sealants market is the resurgence of construction activity, particularly in the residential and commercial building segments. Adhesives are used extensively in flooring, wall panels, insulation, roofing, and window installation, while sealants are critical in ensuring air and water tightness, energy efficiency, and long-term durability.

Government initiatives such as the U.S. Infrastructure Investment and Jobs Act, which allocates billions for public transportation, bridges, and affordable housing, are fueling demand for high-performance materials. Moreover, the ongoing trend of green building certification (e.g., LEED) is encouraging the use of low-emission, solvent-free, and energy-saving sealants.

In Canada, similar investments in urban infrastructure and commercial real estate are propelling the use of adhesives and sealants in drywall bonding, HVAC insulation, and waterproofing systems. In Mexico, urbanization and industrial expansion are increasing consumption of sealants for commercial façades and adhesives for tile installation.

Key Market Restraint: Regulatory Pressure on VOC Emissions and Raw Material Costs

The adhesives and sealants market in North America faces regulatory challenges, especially concerning volatile organic compounds (VOCs). Many solvent-based adhesives and certain sealant formulations release VOCs during curing, contributing to indoor air pollution and smog formation. Regulatory bodies such as the Environmental Protection Agency (EPA) and California Air Resources Board (CARB) have set strict guidelines on acceptable VOC levels, leading to reformulation costs and compliance barriers.

Another critical restraint is the fluctuation in raw material prices, especially for petroleum-derived chemicals like polyurethane, epoxy resins, and acrylics. Supply chain disruptions such as those witnessed during the COVID-19 pandemic—and geopolitical factors can significantly impact production costs and lead times. Small and mid-sized manufacturers, in particular, struggle to maintain margins in such volatile environments.

Key Market Opportunity: Adoption of Bio-Based and Hybrid Adhesives

As sustainability becomes a major corporate and consumer priority, bio-based adhesives and sealants represent a major growth opportunity in North America. These products, made from renewable resources such as soybean oil, starches, natural rubber, and lignin, offer a low-carbon, biodegradable alternative to petroleum-based counterparts.

There is growing interest in sectors like furniture manufacturing, paper packaging, and medical devices, where bio-based adhesives can match performance while offering a marketing advantage in sustainability-conscious markets. Additionally, hybrid adhesives that combine organic and inorganic components are being developed to enhance performance in extreme conditions, especially in construction and automotive sectors.

Government incentives and certifications such as USDA BioPreferred and GreenGuard Certification are also supporting the commercialization of these alternatives. Manufacturers that invest in scalable, cost-competitive green chemistry stand to capture an increasing share of the North American market.

North America Adhesives And Sealants Market By Adhesives Technology Insights

Water-based adhesives dominated the market, driven by their low toxicity, regulatory compliance, and excellent performance on porous surfaces such as paper and cardboard. These adhesives are widely used in packaging, woodworking, labels, and bookbinding. The absence of VOCs and ease of clean-up make them highly attractive to manufacturers operating in indoor environments or with sustainability certifications. Packaging companies and printers prefer water-based adhesives for food-safe and child-friendly applications.

Hot melt adhesives are the fastest-growing segment, gaining rapid traction due to their instant bond strength, long shelf life, and minimal waste. These adhesives are used in disposable hygiene products, carton sealing, automotive assembly, and consumer goods packaging. Hot melts also support high-speed application in automated manufacturing lines, contributing to their growing adoption. Their flexibility across substrates like metal, plastic, and paperboard further strengthens their market positioning.

North America Adhesives And Sealants Market By Adhesives Product Insights

Acrylic adhesives held the largest market share, owing to their strong adhesion, weather resistance, and versatility across multiple industries. They are widely used in construction panels, automotive trims, and medical tapes. Their high UV resistance and excellent aging properties make them suitable for long-term outdoor applications.

Polyurethane adhesives are the fastest-growing, particularly in automotive and construction applications. Their superior elasticity, shock resistance, and bonding capabilities on dissimilar substrates make them ideal for structural applications, including windshield bonding, insulation panels, and composite bonding. PU adhesives are also increasingly being tailored for thermal and acoustic insulation, aligning with green building standards.

North America Adhesives And Sealants Market By Adhesives Application Insights

Paper and packaging dominated the adhesives application segment, reflecting the sheer volume and frequency of use in corrugated boxes, folding cartons, flexible pouches, and labels. The rise of e-commerce has magnified this trend, especially in the U.S. and Canada, where consumers expect secure, tamper-evident, and branded packaging. Water-based and hot melt adhesives are particularly preferred here due to their food safety compliance and ease of recycling.

Automotive and transportation are the fastest-growing applications, driven by the move toward lightweighting, noise damping, and aesthetic flexibility in vehicle design. Adhesives are used in place of welding or screws to improve structural integrity, reduce weight, and allow for seamless design. Interior trim bonding, battery casing adhesion, and glass panel mounting are just a few high-growth applications.

North America Adhesives And Sealants Market By Sealants Product Insights

Silicones dominated the sealants market, prized for their flexibility, water resistance, and temperature stability. These sealants are widely used in bathrooms, kitchens, construction joints, and electrical enclosures. Their inert chemical nature also makes them suitable for medical and food-contact applications.

.webp)

Polyurethanes are the fastest-growing sealant product, favored in automotive, construction, and industrial assemblies for their durability, adhesion to varied substrates, and vibration dampening qualities. PU sealants are replacing traditional caulks in heavy-duty construction applications, offering longer life and better performance.

North America Adhesives And Sealants Market By Sealants Application Insights

Construction was the dominant sealant application, encompassing floor joints, window glazing, expansion joints, and fire-rated seals. As North America experiences a construction boom, sealants play an integral role in maintaining weatherproofing, energy efficiency, and structural safety.

Automotive is the fastest-growing application, where sealants are used to prevent noise, vibration, and water intrusion. With the rise of electric vehicles (EVs), sealants are also critical in battery protection, thermal insulation, and electronic sealing.

Country Insights

United States

The U.S. dominates the adhesives and sealants market in North America, driven by robust demand from the packaging, construction, automotive, and aerospace sectors. The presence of major manufacturers, R&D capabilities, and access to advanced raw materials gives the U.S. a significant competitive edge. Companies are also leading innovation in green adhesives, medical-grade sealants, and smart bonding systems. Regulatory bodies like OSHA and the EPA are influencing trends toward VOC-free, energy-efficient formulations.

Canada

Canada is focusing on eco-friendly infrastructure, green building certifications, and automotive component manufacturing. Sealant usage in extreme cold environments requires high elasticity and UV resistance, driving the demand for silicones and PUs. Toronto, Montreal, and Vancouver serve as hubs for packaging and consumer product assembly, supporting adhesive growth.

Mexico

Mexico is a fast-developing market, especially in the automotive and packaging sectors. As international manufacturers establish assembly plants across the country, the demand for adhesives and sealants is growing for trim bonding, component sealing, and export packaging. Mexico’s trade integration under USMCA further enhances its role as a key node in the North American manufacturing supply chain.

Some of the prominent players in the North America adhesives and sealants market include:

- Henkel Corporation

- Sika AG

- 3M

- H.B. Fuller Company

- Evonik Industries

- RPM International Inc.

- Dow

- Wacker Chemie AG

- Arkema

- Arkema Group

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America adhesives and sealants market

North America Adhesives Technology

- Water based

- Solvent based

- Hot melt

- Other Technology

North America Adhesives Product

- Acrylic

- Epoxy

- EVA

- Polyurethanes

- PVA

- Styrenic block

- Other Products

North America Adhesives Application

- Automotive & Transportation

- Building & Construction

- Consumer & DIY

- Footwear & Leather

- Furniture & Woodworking

- Medical

- Paper & Packaging

- Other Products

North America Sealants Product

- Silicones

- Polyurethanes

- Acrylic

- Polyvinyl acetate

- Other Products

North America Sealants Application

- Construction

- Automotive

- Packaging

- Assembly

- Consumers

- Other Products

North America Sealants Country

.webp)