North America Alopecia Market Size and Growth 2026 to 2035

The North America alopecia market size was exhibited at USD 4.55 billion in 2025 and is projected to hit around USD 9.64 billion by 2035, growing at a CAGR of 7.8% during the forecast period 2026 to 2035.

Key Takeaways:

- The pharmaceuticals segment dominated the North American alopecia market with a revenue share of 98.1% in 2025 and is expected to dominate the treatment segment during the forecast period.

- The devices segment is estimated to register a steady growth rate during the projected period.

- The alopecia areata segment dominated the disease type segment with a share of 41.83% in 2025 and is likely to hold the largest share over the forecast period.

- Alopecia universalis is anticipated to grow at the fastest CAGR over the forecast period.

- In 2025, the dermatological clinics led the North America alopecia market with a share of 57.06% and are expected to maintain their dominance over the forecast period.

- The homecare settings segment is anticipated to register the fastest CAGR during the forecast period.

- The male segment held the largest share of 54.38% of the North America alopecia market in 2025.

- The female segment is estimated to grow at the fastest rate over the forecast period.

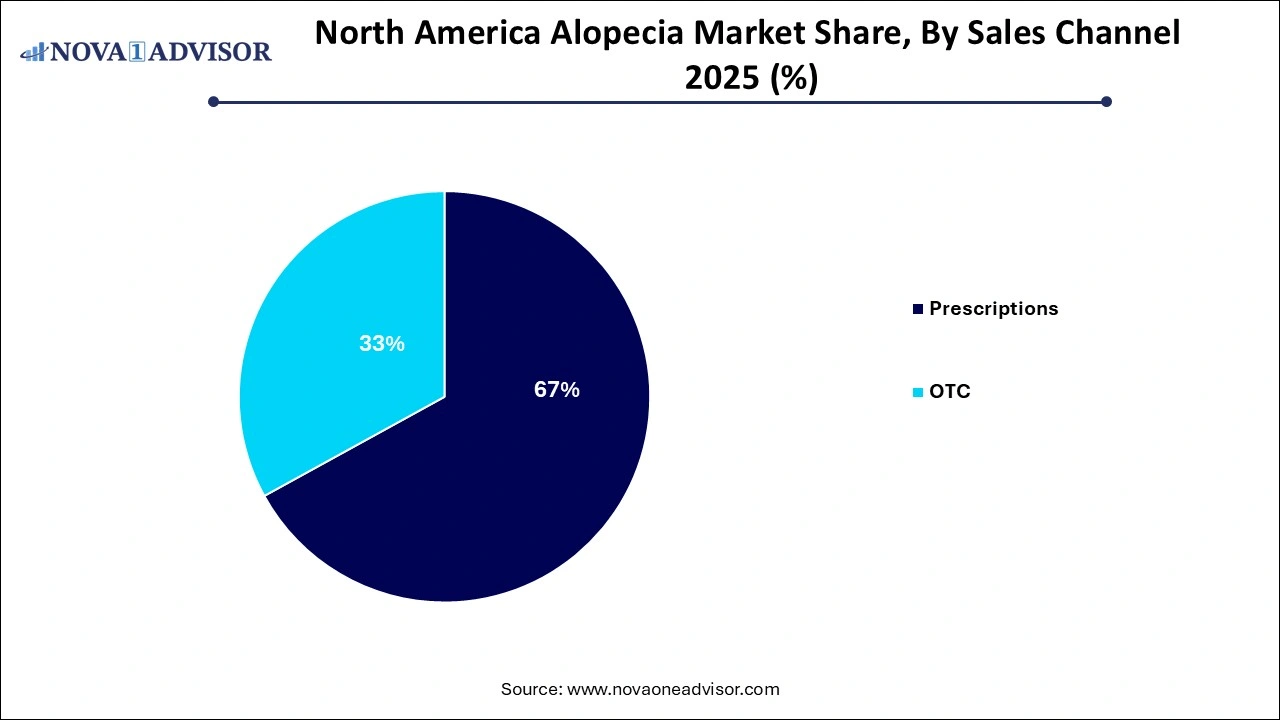

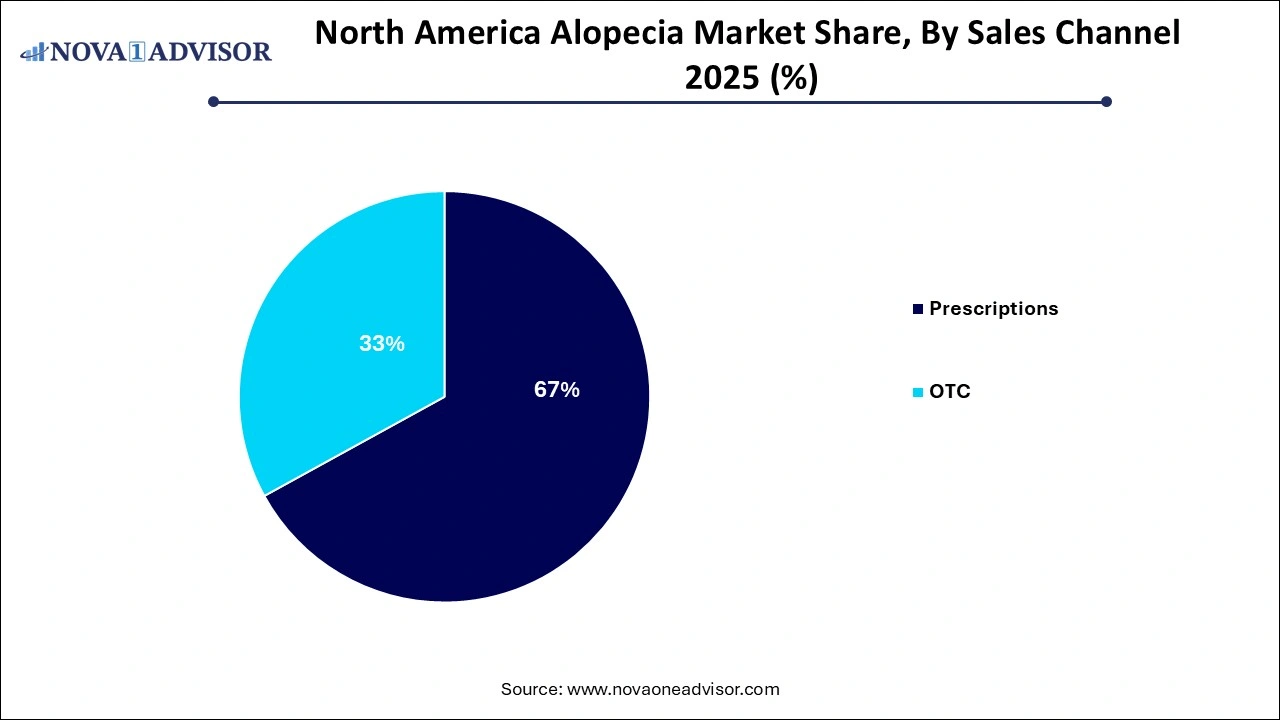

- The prescription segment dominated the North America alopecia industry in 2025, with a share of 67%.

- The U.S. held the largest share of 91.37% of the alopecia market in North America.

North America Alopecia Market Overview

The North America alopecia market is a dynamically evolving healthcare segment, shaped by growing aesthetic consciousness, rising incidence of hair loss, expanding treatment portfolios, and increasing awareness about underlying autoimmune and dermatological disorders. Alopecia, broadly defined as hair loss from the scalp or body, encompasses several disease types, including androgenetic alopecia, alopecia areata, traction alopecia, cicatricial alopecia, alopecia totalis, and alopecia universalis each with different etiologies and demographic profiles.

In North America, the market is witnessing accelerated growth due to both medical and cosmetics motivations. While hereditary hair loss remains the most common form affecting over 50 million men and 30 million women in the U.S. alone other forms such as alopecia areata have garnered medical attention as autoimmune disorders, especially with FDA-approved treatments now available. Furthermore, conditions like traction alopecia are being discussed in the context of cultural practices and personal grooming habits, expanding the market’s socio-medical relevance.

The commercial landscape includes a broad array of offerings, from topical medications (like minoxidil) and oral prescriptions (such as finasteride) to advanced technologies like platelet-rich plasma (PRP) therapy and laser-based devices. This has created a hybrid market involving pharmaceuticals, medical devices, and aesthetic dermatology.

The growing use of teledermatology platforms, online prescription services, and direct-to-consumer sales coupled with increasing insurance coverage for medical-grade alopecia therapies has also broadened access. The market is simultaneously responding to gender-specific needs, with products and campaigns increasingly targeted at female consumers, who have historically been underserved in the alopecia treatment space.

Major Trends in the North America Alopecia Market

-

Growing Adoption of Laser Therapy Devices: Increasing consumer preference for non-invasive and home-based treatments is driving demand for laser caps, combs, and helmets.

-

Rise in PRP (Platelet-Rich Plasma) Treatments: Clinics across North America are increasingly offering PRP therapy as a regenerative approach to manage alopecia, especially among younger patients.

-

Increased Consumer Shift Toward OTC Treatments: Minoxidil-based over-the-counter topical and oral products are gaining popularity due to ease of use and minimal side effects.

-

Personalized Medicine and Genetic Testing: Genetic profiling and personalized alopecia treatments are emerging as key strategies among dermatologists.

-

Higher Incidence of Alopecia Among Women: With increased female awareness and social media influence, women are actively seeking dermatological care, propelling growth in female-centric alopecia treatment segments.

-

Integration of AI in Dermatology: AI-enabled diagnostics in dermatology clinics are improving early detection and monitoring of alopecia conditions.

-

Rise in Teledermatology Services: Post-COVID-19, remote dermatology consultations have surged, making alopecia diagnosis and treatment more accessible in rural and underserved areas.

-

Sustainable and Clean Label Products: Consumers are shifting toward natural and clean-label topical formulations, including herbal treatments for mild to moderate alopecia.

Report Scope of The North America Alopecia Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.90 Billion |

| Market Size by 2035 |

USD 9.64 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Treatment, Disease Type, Sales Channel, End-use, Gender, Country |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

North America |

| Key Companies Profiled |

Cipla Inc; Sun Pharmaceuticals Industries Ltd; Johnson & Johnson Services, Inc; Merck & Co., Inc.; Lexington Intl., LLC; Cirrus Hair Centers; Vita-Cos-Med Klett-Loch GmbH; Transitions Hair; Puretech Health; Curallux, LLC; Dr. Reddy's Laboratories Ltd; GSK plc; Aurobindo Pharma; Mylan N.V. (Viatris, Inc.); Freedom Laser Therapy, Inc.; Apira Science, Inc. (iGrow Laser.); Revian, Inc; Theradome Inc.; LUTRONIC Inc.; WON TECH Co., Ltd; LifeMD; LG Electronics |

Key Market Driver

Rising Prevalence of Androgenetic Alopecia in Younger Populations

One of the primary factors propelling the North American alopecia market is the increasing incidence of androgenetic alopecia among younger age groups. Traditionally associated with aging, hair loss is now being observed in individuals as young as their early 20s. This shift is attributed to a combination of factors such as high stress levels, sedentary lifestyles, poor dietary habits, environmental pollution, and hormonal imbalances. According to the American Academy of Dermatology, androgenetic alopecia affects over 50 million men and 30 million women in the U.S. alone. The social stigma and psychological impact associated with hair loss have led to a spike in demand for effective treatment options, thereby encouraging the proliferation of OTC and prescription therapies, as well as cosmetic procedures.

Key Market Restraint

Adverse Effects and Limited Efficacy of Certain Medications

Despite the availability of various treatment options, many consumers are hesitant to use pharmaceutical products due to potential side effects and inconsistent results. For instance, Finasteride, an oral prescription medication for male pattern baldness, has been linked to sexual side effects, including decreased libido and erectile dysfunction, which deters its usage. Topical corticosteroids, often used in alopecia areata, may cause skin thinning or irritation if used for prolonged periods. The limitations in efficacy of existing medications such as incomplete hair regrowth or recurring alopecia after treatment cessation further restrict consumer confidence and lead to treatment discontinuation. This scenario underscores the need for more effective and safer treatment modalities in the market.

Key Market Opportunity

Advancements in Regenerative Medicine and Stem Cell Therapy

The development of regenerative therapies, including stem cell therapy and PRP (Platelet-Rich Plasma) treatments, presents a promising frontier for the alopecia market. These approaches stimulate hair follicles and support the regeneration of dermal papilla cells responsible for hair growth. Clinical trials in North America are demonstrating encouraging outcomes, positioning regenerative therapies as alternatives to conventional pharmacological treatments. The non-invasive nature, limited side effects, and potential for long-term efficacy of PRP therapy are increasing its adoption in dermatology clinics. In the near future, ongoing research on follicular stem cell implantation and exosome therapy is expected to disrupt the market with more targeted and personalized treatments.

Segmental Insights

By Treatment Insights

Pharmaceuticals dominated the treatment segment in North America, accounting for a significant share due to widespread use of topical and oral therapies. Among pharmaceutical subcategories, Minoxidil remains the most commonly used topical solution due to its FDA approval and over-the-counter availability. The Minoxidil segment continues to gain traction with new foam formulations, improved scalp penetration, and dual-use for male and female pattern baldness. Prescription medications such as Finasteride and corticosteroids are largely used in moderate to severe alopecia cases. The oral Finasteride segment is growing due to increasing male patient preference for convenient treatment options. Simultaneously, OTC oral treatments, including nutraceuticals, are also gaining ground due to a rising preference for drug-free management.

The devices segment is expected to be the fastest-growing during the forecast period. Laser therapy devices particularly laser caps and helmets are becoming increasingly popular due to their non-invasive nature, ease of home use, and supportive clinical evidence. Laser caps using Low-Level Light Therapy (LLLT) are FDA-cleared and are showing significant results in stimulating hair growth, especially in patients with early-stage androgenetic alopecia. Companies like Capillus and iRestore have intensified their marketing efforts, including influencer campaigns and television advertising, thereby boosting product visibility and consumer acceptance.

By Disease Type Insights

Androgenetic Alopecia accounted for the largest market share among disease types. This condition, commonly referred to as male or female pattern baldness, affects millions of individuals across North America. With the availability of proven treatments like Minoxidil and Finasteride, this segment is well established and consistently dominates revenue generation. Additionally, the psychological impact and increasing awareness among women about early signs of hair thinning are catalyzing growth in female androgenetic alopecia treatment.

Traction Alopecia is emerging as the fastest-growing segment. Primarily affecting African-American women due to tight hairstyles and frequent hair manipulation, this condition is gaining clinical attention. Dermatologists are emphasizing early diagnosis and behavioral changes, while newer topical anti-inflammatory products and PRP therapy offer effective treatment options. Awareness campaigns on culturally sensitive hair care practices are also promoting early intervention.

By End-use Insights

Dermatology Clinics dominated the end-use segment. These specialized settings offer advanced diagnostics, PRP therapy, corticosteroid injections, and laser therapies under professional supervision. With rising disposable income, consumers are increasingly opting for expert consultations and customized treatment plans. Dermatology clinics also serve as key platforms for clinical trials and adoption of new technologies like AI-based scalp imaging.

Homecare Settings are witnessing the fastest growth in this segment. The proliferation of OTC products and home-use devices such as laser helmets and caps has democratized alopecia treatment. The convenience and privacy offered by homecare solutions are particularly attractive to younger demographics and female consumers. Online platforms play a crucial role in this segment, offering direct-to-consumer product availability and virtual dermatologist support.

By Gender Insights

The male segment accounted for the largest market share. Male pattern baldness (androgenetic alopecia) is widely prevalent and often begins in early adulthood. This demographic is increasingly investing in both pharmaceutical and cosmetic solutions to counter hair loss. The segment also benefits from well-established awareness and treatment protocols.

The female segment is showing faster growth. Increased emphasis on personal appearance, higher awareness, and social stigma associated with hair thinning in women have led to a surge in treatment-seeking behavior. Treatments specifically designed for women, such as low-dose Minoxidil and hormonal therapies, are becoming more prevalent. The influence of beauty influencers and social media has also propelled interest in advanced hair care products among women.

By Sales Channel Insights

The prescription segment held the largest market share. This is attributed to the high efficacy and dermatologist-recommended usage of drugs like Finasteride and corticosteroids. With insurance coverage for certain treatments, patients are more inclined toward prescription therapies for chronic conditions like alopecia areata and totalis.

The OTC segment is projected to be the fastest-growing. Consumers increasingly prefer self-treatment, especially for mild cases of hair loss. Minoxidil, biotin-based supplements, and herbal formulations are easily accessible without prescriptions, driving robust growth in this category. E-commerce platforms also facilitate easy and discreet purchase, enhancing market penetration.

The OTC segment is projected to be the fastest-growing. Consumers increasingly prefer self-treatment, especially for mild cases of hair loss. Minoxidil, biotin-based supplements, and herbal formulations are easily accessible without prescriptions, driving robust growth in this category. E-commerce platforms also facilitate easy and discreet purchase, enhancing market penetration.

By Country Insights

United States

The U.S. represents the largest market for alopecia treatment in North America, driven by a combination of high prevalence, advanced healthcare infrastructure, and consumer awareness. The country is home to some of the leading dermatology clinics and hair transplant centers globally. According to the National Alopecia Areata Foundation, over 6.8 million people in the U.S. are affected by alopecia areata alone. The availability of FDA-approved medications and rapid adoption of PRP and laser treatments bolster market growth. Additionally, aggressive digital marketing and online sales of OTC products have enabled deeper market penetration. Key urban centers such as New York, Los Angeles, and Chicago are hotspots for aesthetic and dermatological care.

Canada

Canada is witnessing rising cases of alopecia, particularly in urban and suburban populations. Increasing stress, aging, autoimmune disorders, and hormonal changes are contributing to growing alopecia diagnoses. The Canadian dermatology market is increasingly investing in minimally invasive treatment options. Access to dermatologists, although more limited compared to the U.S., is expanding through teledermatology. The Canadian government has been supportive of OTC medication regulation, enabling safe access to popular treatments. With increasing beauty consciousness and a growing immigrant population facing traction alopecia, Canada presents substantial market opportunities.

Some of the prominent players in the North America alopecia market include:

- Cipla Inc.

- Sun Pharmaceuticals Industries Ltd

- Johnson & Johnson Services, Inc

- Merck & Co., Inc.

- Lexington Intl., LLC

- Cirrus Hair Centers

- Vita-Cos-Med Klett-Loch GmbH

- Transitions Hair

- PureTech Health

- Curallux, LLC

- Dr. Reddy's Laboratories Ltd

- GSK plc

- Aurobindo Pharma

- Mylan N.V. (Viatris, Inc.)

- Freedom Laser Therapy, Inc.

- Apira Science, Inc. (iGrow Laser.)

- Revian, Inc

- Theradome

- LUTRONIC

- WON TECH Co., Ltd

- LifeMD

- LG Electronics

Recent Developments

-

February 2025: Pfizer announced positive Phase III results for its investigational oral JAK inhibitor for alopecia areata, showing promising hair regrowth in over 40% of participants.

-

December 2024: Sun Pharma Canada launched a new topical corticosteroid cream specifically targeting inflammatory alopecia types in dermatology clinics across major provinces.

-

October 2024: Capillus Inc. unveiled its next-gen smart laser cap integrated with Bluetooth and app tracking for improved hair regrowth monitoring, launching the product across U.S. and Canadian online platforms.

-

August 2024: Hims & Hers Health Inc. expanded its OTC Minoxidil foam line in Canada, supported by influencer-led digital marketing campaigns aimed at millennial consumers.

-

July 2024: Aclaris Therapeutics began new trials in the U.S. for a topical JAK inhibitor, targeting alopecia totalis and universalis.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the North America alopecia market

Treatment

-

-

- Betamethasone Dipropionate

- Fluocinolone Acetonide

- Finasteride

- Minoxidil

-

-

-

- Minoxidil

- Finasteride

- Corticosteroids

-

- Laser Cap

- Laser Comb

- Laser Helmet

Disease Type

End-use

- Homecare Settings

- Dermatology Clinics

Sales Channel

Gender

Country

The OTC segment is projected to be the fastest-growing. Consumers increasingly prefer self-treatment, especially for mild cases of hair loss. Minoxidil, biotin-based supplements, and herbal formulations are easily accessible without prescriptions, driving robust growth in this category. E-commerce platforms also facilitate easy and discreet purchase, enhancing market penetration.

The OTC segment is projected to be the fastest-growing. Consumers increasingly prefer self-treatment, especially for mild cases of hair loss. Minoxidil, biotin-based supplements, and herbal formulations are easily accessible without prescriptions, driving robust growth in this category. E-commerce platforms also facilitate easy and discreet purchase, enhancing market penetration.