North America And Europe eHealth Market Size and Trends

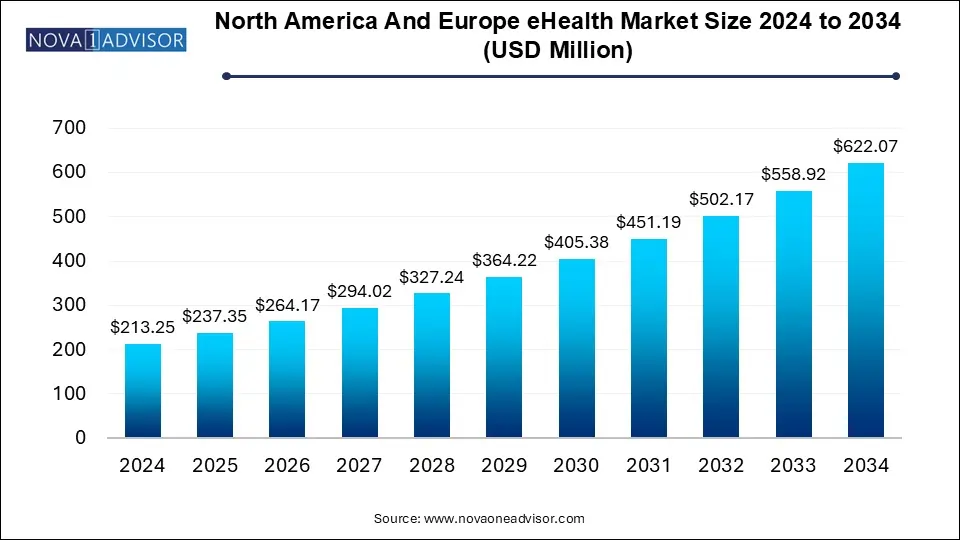

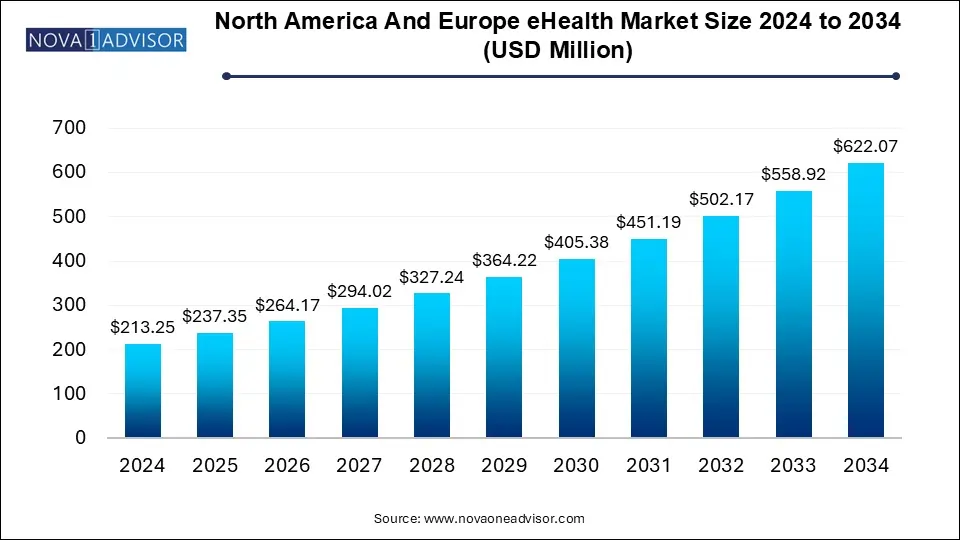

The North America and Europe eHealth market size was exhibited at USD 213.25 million in 2024 and is projected to hit around USD 622.07 million by 2034, growing at a CAGR of 11.3% during the forecast period 2025 to 2034.

North America And Europe eHealth Market Key Takeaways:

- In terms of product, the health information system (HIS) segment held the largest revenue share of over 35.0% in 2024.

- The big data for the health segment is anticipated to grow at a significant CAGR of 12.3% over the forecast period.

- In terms of end-use, the provider segment held the largest revenue share in 2024.

- In terms of services, the monitoring segment held the largest revenue share of over 67.0% in 2024 and it is anticipated to grow at the fastest CAGR of 11.6% over the forecast period.

- Based on region, North America dominated the market in 2024 with a revenue share of over 60.0%.

- Europe is anticipated to grow at the fastest CAGR of 12.3% over the forecast period.

Market Overview

The North America and Europe eHealth market represents a vital and fast-evolving segment within the broader healthcare landscape, driven by digital transformation, rising chronic disease prevalence, and increasing demand for efficient healthcare delivery systems. eHealth, encompassing digital technologies such as Electronic Health Records (EHRs), mHealth applications, telemedicine, Big Data analytics, and Health Information Systems (HIS), is revolutionizing how healthcare services are delivered, accessed, and monitored.

In North America, particularly in the United States, government mandates such as the Health Information Technology for Economic and Clinical Health (HITECH) Act have significantly accelerated EHR adoption. Meanwhile, in Canada, the use of telehealth services surged post-COVID-19, offering remote consultations and minimizing patient backlog. In Europe, nations such as Germany and the UK have integrated eHealth services into national health systems through initiatives like the Digital Healthcare Act (DVG) and NHS Digital, respectively.

The proliferation of smartphones, wearable health-monitoring devices, and improved broadband penetration have been key enablers of eHealth across these regions. As populations age and patient-centric care becomes imperative, eHealth solutions serve to enhance diagnosis accuracy, reduce operational costs, and support preventive care strategies. The market is further bolstered by public-private partnerships, funding grants for innovation, and the increasing interoperability of health IT systems.

Overall, this market is poised to expand considerably over the next decade as digital health becomes integral to national health strategies, offering immense opportunities to technology developers, healthcare providers, and payers.

Major Trends in the Market

-

Rising Integration of Artificial Intelligence (AI) in Diagnostics: AI-enabled diagnostic tools and decision support systems are increasingly being used to improve diagnostic accuracy and clinical workflow.

-

Growth in Remote Patient Monitoring (RPM): With chronic disease management becoming a priority, RPM solutions, especially those integrating wearable tech, are being widely adopted.

-

Increased Investments in mHealth Apps: Mobile applications for medication reminders, mental health support, and chronic disease tracking are seeing massive growth.

-

Expansion of Telemedicine Reimbursement Policies: Governments and insurers in the U.S., UK, and Germany are expanding reimbursement for telehealth services.

-

Interoperability and Data Standardization Initiatives: Cross-border healthcare services and integration across various digital platforms demand standardized data formats and interoperability.

-

Digital Therapeutics (DTx) Gaining Ground: Evidence-based software interventions for managing conditions such as diabetes and depression are becoming mainstream.

-

Cybersecurity in eHealth Becoming Crucial: With more sensitive data being stored online, robust security solutions are essential and in high demand.

Report Scope of North America And Europe eHealth Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 237.35 Million |

| Market Size by 2034 |

USD 622.07 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 11.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Service, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America and Europe |

| Key Companies Profiled |

Allscripts Healthcare, LLC; IBM; Siemens Healthineers; Epic Systems Corporation; Hexoskin, Chronolife SAS; Koninklijke Philips N.V.; Apple Inc.; WHOOP; Silvertree; HealthWatch Ltd.; Athos; Biodevices SA; Emglare; GetEnflux; Bioserenity; AiQ; Athos; Medtronic; Team PRO; Sensori; Supa |

One of the most significant drivers propelling the North America and Europe eHealth market is the accelerated digital transformation of healthcare infrastructure. Over the past few years, the need to modernize legacy healthcare systems has become urgent due to inefficiencies in care delivery, rising operational costs, and growing patient expectations. Governments and health organizations have been actively promoting the adoption of digital solutions, such as EHRs, cloud computing, and telehealth platforms, to streamline workflows, improve clinical decision-making, and facilitate better patient engagement.

For instance, the U.S. government’s “Meaningful Use” program under the HITECH Act incentivized providers to implement certified EHR technology. In Europe, the European Commission's “Digital Single Market” strategy emphasizes the development of cross-border eHealth services. Such initiatives ensure that both patients and providers benefit from real-time access to health data, thus promoting quality care and better outcomes.

Market Restraint – Data Privacy and Interoperability Challenges

Despite its growth potential, the eHealth market faces critical challenges related to data privacy and interoperability. With large volumes of sensitive patient data being collected and shared across digital platforms, ensuring secure storage and transmission becomes a complex task. Each country has its own data protection laws—such as GDPR in Europe and HIPAA in the U.S.—which can lead to compliance difficulties, especially for multinational digital health providers.

Additionally, the lack of standardized data formats and insufficient interoperability between disparate health IT systems can hinder the seamless exchange of information. This fragmentation not only disrupts the care continuum but also affects analytics and clinical decision-making. Healthcare providers often struggle to integrate new tools with existing EHR systems, leading to redundancies and inefficiencies.

A major opportunity in the North America and Europe eHealth market lies in the intersection of personalized medicine and digital health. The surge in demand for tailored healthcare experiences—driven by genomics, AI, and predictive analytics—is fostering the development of customized treatment and wellness plans.

Digital platforms that integrate data from wearables, EHRs, and genetic profiles can now deliver more nuanced insights into individual health risks and response to treatment. For example, mobile apps that track biometric data can help monitor glucose levels in diabetic patients, while AI models predict risk factors for cardiovascular events. This convergence is opening up lucrative opportunities for companies offering intelligent, scalable platforms that align with precision healthcare goals.

North America And Europe eHealth Market By Product Insights

Electronic Health Records (EHR) dominated the product segment of the market in 2024, holding a significant share due to widespread governmental support, especially in the U.S. and the UK. In the U.S., over 95% of hospitals have adopted certified EHR systems. These platforms streamline administrative functions, facilitate the continuity of care, and enhance clinical outcomes by offering real-time access to patient records. Vendors such as Epic Systems and Cerner continue to expand their footprints through integrations with telehealth and AI modules, reinforcing EHRs’ dominance.

Meanwhile, mHealth is the fastest-growing product segment, driven by smartphone penetration and increasing consumer engagement in managing their health. The post-pandemic emphasis on self-care and remote consultation has boosted mHealth apps for medication adherence, mental health, fitness tracking, and chronic disease monitoring. For instance, in Germany, apps like Ada and Vivy have seen exponential downloads after being included in digital health reimbursement frameworks (DiGA).

North America And Europe eHealth Market By End-use Insights

Providers such as hospitals and clinics represent the largest end-use segment, primarily due to their early adoption of EHRs, telemedicine platforms, and diagnostic decision support tools. Their need for integrated solutions for care coordination, patient management, and billing systems makes them the primary customers for comprehensive eHealth platforms. Integrated hospital networks in the U.S. and NHS trusts in the UK have spearheaded the digital shift with government support and private partnerships.

Healthcare consumers are becoming the fastest-growing end-use segment, as patients increasingly take ownership of their health through mobile applications, wearable devices, and online consultation portals. The consumerization of healthcare—enabled by improved UI/UX design, multilingual support, and data visualizations—is transforming how users interact with digital health ecosystems. This trend is especially pronounced among the millennial and Gen Z population in Canada and Germany.

North America And Europe eHealth Market By Services Insights

Monitoring services, especially vital signs monitoring and wearable-based solutions, are the leading service type. The use of wristwear and bodywear devices to track heart rate, sleep cycles, and blood pressure has surged across both regions. Apple, Fitbit, and Withings have led this segment by integrating sophisticated health metrics into consumer-grade devices, often approved for clinical monitoring. The adoption by healthcare providers for remote monitoring of post-operative and chronic disease patients further amplifies its importance.

Specialty services, particularly adherence monitoring and sensor-based services, are witnessing the fastest growth. These services ensure patients follow treatment plans accurately, reducing readmission rates and improving outcomes. Adherence platforms integrated with AI reminders and medication dispensers are gaining traction, especially among the elderly in countries like Sweden and Canada, where remote care delivery is prioritized due to sparse rural populations.

North America And Europe eHealth Market By Regional Insights

United States

The U.S. stands as the most mature and largest eHealth market in North America. Federal policies like the HITECH Act, combined with the Centers for Medicare & Medicaid Services (CMS) reimbursement policies for telehealth, have created fertile ground for digital health proliferation. According to the American Hospital Association, over 76% of hospitals used video and other telecommunication tools to engage patients remotely as of 2024. Moreover, private insurers and venture capital are pouring billions into digital health startups offering AI-based diagnostics, virtual care, and chronic disease management.

Canada

Canada has witnessed a significant uptick in telemedicine adoption, especially in remote and rural provinces. The pan-Canadian initiative "Infoway" is spearheading interoperability between provincial systems, aiming to create a unified patient health record system. Adoption of remote monitoring tools for aging populations, along with e-prescription and appointment scheduling apps, are reshaping Canadian healthcare delivery.

Germany

Germany is a European leader in digital health policy implementation. The Digital Healthcare Act (DVG) has allowed physicians to prescribe health apps, reimbursed under statutory health insurance. Additionally, the Electronic Patient Record (ePA) is gradually becoming mandatory for public health insurance beneficiaries. Startups such as TeleClinic and Ada Health are flourishing under these frameworks.

United Kingdom

The UK’s NHS Digital has been instrumental in the deployment of eHealth services. From EHRs across general practices to the expansion of NHS App functionalities—such as symptom checkers, vaccination tracking, and virtual GP appointments—the digital backbone of UK healthcare is strengthening. The UK government’s £2 billion commitment to digital health transformation post-pandemic underscores its future readiness.

Some of the prominent players in the North America and Europe eHealth market include:

- Allscripts Healthcare, LLC

- IBM

- Siemens Healthineers

- Epic Systems Corporation

- Hexoskin, Chronolife SAS

- Koninklijke Philips N.V.

- Apple Inc.

- WHOOP

- Silvertree

- HealthWatch Ltd.

- Athos

- Biodevices SA

- Emglare

- GetEnflux

- Bioserenity

- AiQ

- Athos

- Medtronic

- Team PRO

- Sensori

- Supa

Recent Developments

-

March 2025: Cerner Corporation, a leading EHR vendor, partnered with Google Cloud to offer AI-based clinical decision support tools in North American and European markets, aiming to reduce clinician burnout.

-

February 2025: Ada Health, a Berlin-based health tech firm, launched a new personalized symptom-checker integration within the NHS App in the UK, expanding its footprint in Europe.

-

January 2025: Teladoc Health introduced new AI-powered telemonitoring solutions tailored for chronic condition management across Canada and the U.S.

-

December 2024: Philips announced the expansion of its HealthSuite platform in Sweden and Germany, focusing on connected care solutions in hospital-to-home transitions.

-

November 2024: Babylon Health secured a partnership with the Canadian healthcare network to roll out its AI chatbot and digital triage tools in primary care clinics across Ontario.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America and Europe eHealth market

By Product

- Big Data for Health

- Electronic Health Record (EHR)

- Health Information Systems (HIS)

- mHealth

- Telemedicine

By Services

-

-

- Wristwear

- Bodywear (Garments)

- Others

-

- Specialty

- Adherence Monitoring

- Accessories

- Diagnostic

- Healthcare Strengthening

- Others

By End-use

- Providers

- Insurers

- Healthcare Consumers

By Regional

-

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway