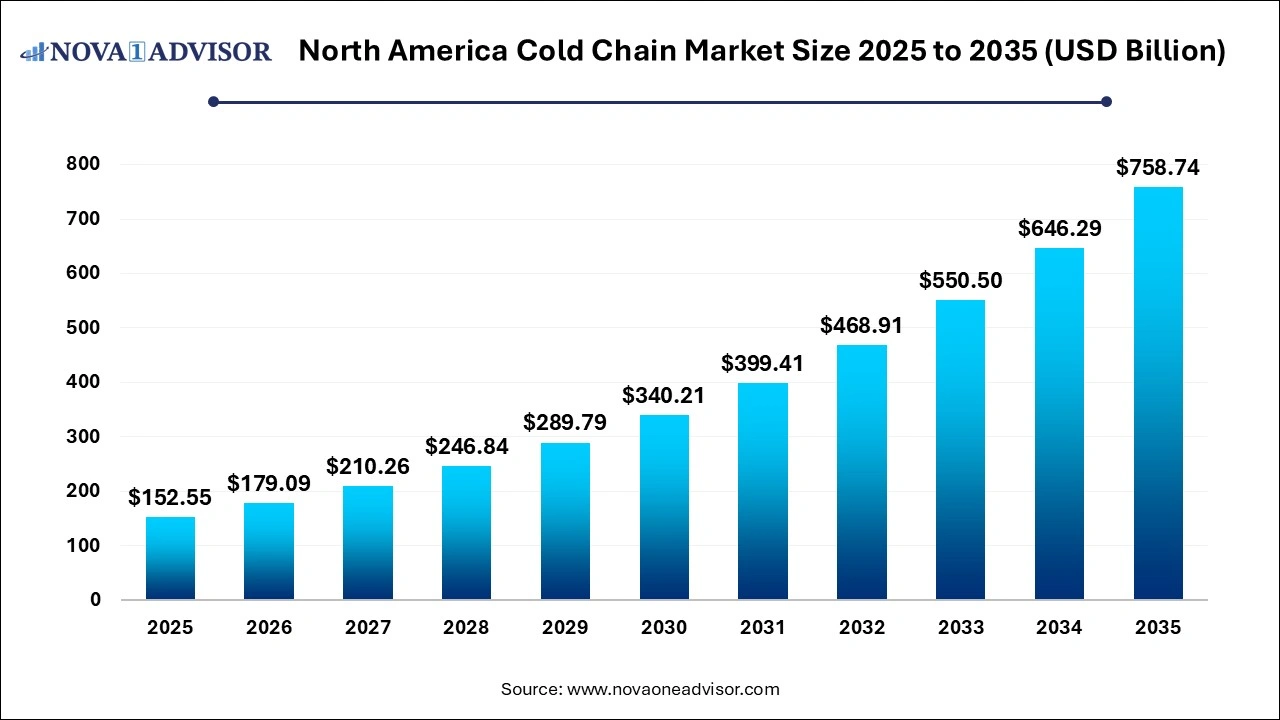

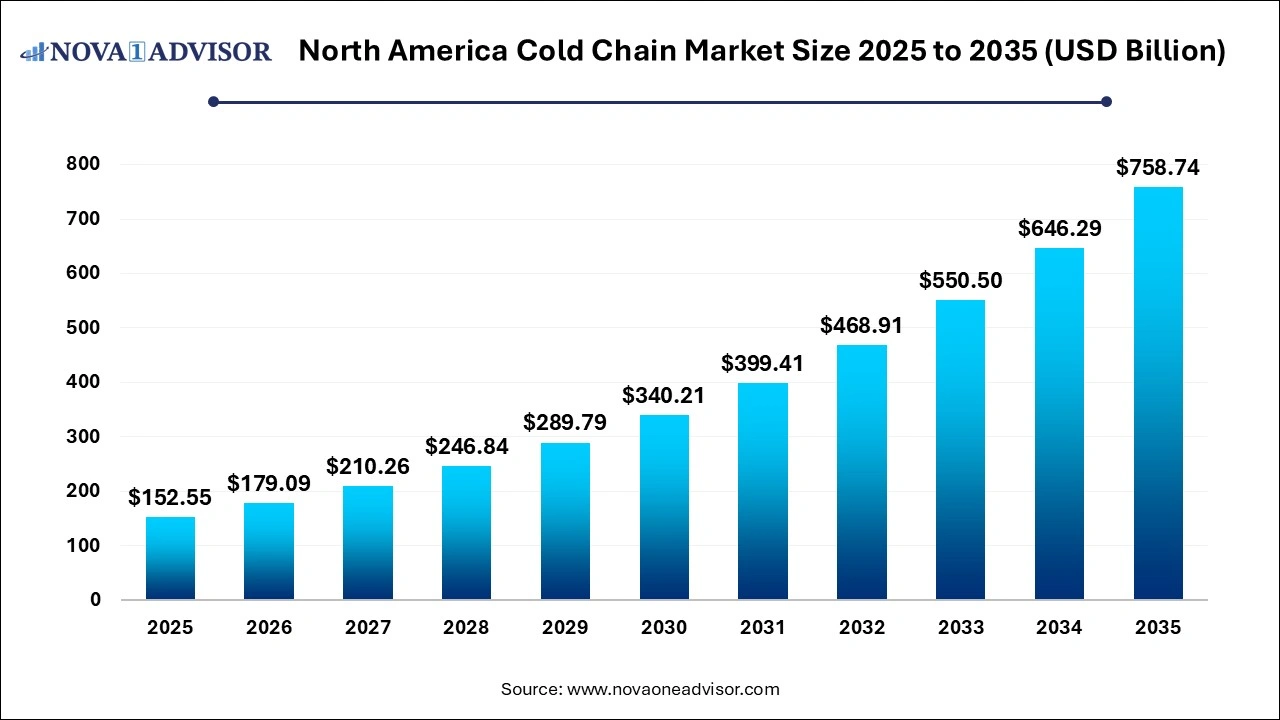

North America Cold Chain Market Size and Growth 2026 to 2035

The North America cold chain market size was exhibited at USD 152.55 billion in 2025 and is projected to hit around USD 758.74 billion by 2035, growing at a CAGR of 17.4% during the forecast period 2026 to 2035.

North America Cold Chain Market Key Takeaways:

- Among these, the storage segment dominated in 2025, gaining a market share of 61.7%.

- The monitoring components segment is anticipated to witness the fastest growth, growing at a CAGR of 19.9% throughout the forecast period.

- The product segment dominated the overall market, gaining a revenue share of 68.0% in 2024. It is expected to witness a CAGR of 18.2% during the forecast period.

- The materials segment is anticipated to witness a faster CAGR of 19.7% throughout the forecast period.

- The fish, meat & seafood segment dominated the market, gaining a revenue share of 20.5% in 2025. It is projected to register a CAGR of 14.4% during the forecast period.

- The processed food segment is anticipated to witness the fastest CAGR of 19.2% throughout the forecast period.

- The U.S. cold chain market dominated in 2024, gaining a revenue share of 71.1%. It is expected to grow at a CAGR of 15.8% throughout the forecast period.

- The Canadian cold chain market is anticipated to witness the fastest CAGR of 20.0% throughout the forecast period.

Market Overview

The cold chain market in North America plays an indispensable role in preserving the integrity of perishable goods across industries such as pharmaceutical, agriculture, processed food, and chemicals. This sophisticated logistics ecosystem involves the management of temperature-sensitive products through a tightly coordinated supply chain that includes storage, transportation, monitoring, and packaging solutions.

Over the past decade, the North American cold chain sector has evolved significantly, driven by the growing consumption of frozen and chilled food products, the expanding footprint of e-commerce grocery delivery, and the high-value pharmaceutical distribution network. The pandemic accelerated the demand for cold chain logistics, particularly in the healthcare sector, where the rollout of temperature-sensitive COVID-19 vaccines underscored the importance of robust infrastructure.

As consumer expectations around product freshness, safety, and delivery timelines increase, manufacturers and retailers alike are prioritizing investments in refrigerated logistics. The market is also seeing substantial innovation, from Internet of Things (IoT)-enabled monitoring components to advanced packaging technologies designed to maintain specific thermal profiles. Additionally, regulatory mandates from food safety authorities and pharmaceutical bodies continue to influence the development and operation of cold chain systems.

Major Trends in the Market

-

Digitization of Cold Chain Logistics: The adoption of IoT sensors, real-time temperature monitoring, GPS tracking, and predictive analytics is revolutionizing supply chain visibility.

-

Sustainable and Eco-Friendly Packaging: Demand for recyclable, biodegradable, and reusable cold chain packaging materials is rising due to environmental regulations and consumer pressure.

-

Cold Chain Expansion in Last-Mile Delivery: The rise of e-grocery, meal kits, and direct-to-consumer pharma shipments is pushing innovations in small-format insulated boxes and mobile cold rooms.

-

Pharma Cold Chain Growth Post-COVID: The need for ultra-cold storage and secure, validated logistics for biologics, vaccines, and clinical trials is expanding rapidly.

-

Energy-Efficient Refrigeration Systems: Manufacturers are investing in low-GWP (global warming potential) refrigerants and solar-powered reefer containers to reduce emissions and costs.

Report Scope of North America Cold Chain Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 179.09 Billion |

| Market Size by 2035 |

USD 758.74 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Packaging, Equipment, Application, Country |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Americold Logistics, Inc.; Burris Logistics; LINEAGE LOGISTICS HOLDING, LLC; Wabash National Corporation; United States Refrigerated Storage; Tippmann Group; NFI Industries; Penske; Seafrigo Group; NewCold; CONESTOGA REFRIGERATED STORAGE; Sonoco ThermoSafe (Sonoco Products Company) |

Key Market Driver: Rising Demand for Perishable Food and Pharma Products

One of the most significant drivers in the North America cold chain market is the surging demand for temperature-sensitive food and pharmaceutical products. Urbanization, changing consumer lifestyles, and the preference for convenience have led to increased consumption of frozen fruits, dairy, seafood, ready-to-eat meals, and fresh produce across the region. This change requires a robust cold chain to maintain quality, extend shelf life, and meet regulatory compliance.

In the pharmaceutical industry, the growth of biologics, mRNA vaccines, and personalized medicine has significantly increased the demand for validated cold storage and secure logistics. For instance, the distribution of COVID-19 vaccines required storage temperatures as low as -70°C, prompting investments in cryogenic containers and ultra-low temperature freezers. With many new therapies relying on fragile biological structures, the cold chain has become essential for ensuring efficacy from production to patient delivery.

Key Market Restraint: Infrastructure Disparity and Operational Costs

A key restraint in the North America cold chain market is the disparity in infrastructure quality and the high cost of maintaining cold chain systems. While the U.S. and parts of Canada boast advanced logistics networks, rural and underserved regions still lack consistent cold chain infrastructure. This gap limits the efficiency of supply chains, particularly for time-sensitive goods like vaccines and seafood.

Moreover, operating cold chain logistics involves significant energy consumption, regulatory compliance costs, and equipment maintenance expenses. Running reefer trucks, cold storage warehouses, and temperature-controlled packaging systems requires continuous power and advanced technology, both of which are capital-intensive. Smaller players often find it difficult to absorb these costs or upgrade outdated infrastructure, thereby limiting market participation and efficiency.

Key Market Opportunity: Integration of IoT and Predictive Analytics

A notable opportunity in the market is the integration of IoT sensors, blockchain, and predictive analytics to create intelligent cold chain ecosystems. Smart monitoring components can provide real-time alerts on temperature deviations, equipment failures, or route delays, ensuring that corrective action can be taken before spoilage occurs. When linked to centralized platforms, these technologies offer end-to-end traceability, enhance customer trust, and reduce inventory waste.

Furthermore, predictive analytics can optimize route planning, energy consumption, and asset utilization. For instance, AI-powered logistics software can anticipate demand surges for frozen food during heatwaves or flu seasons for vaccines and pre-position stock accordingly. As regulatory bodies increase scrutiny on chain-of-custody documentation, digital traceability will become not just a value-added feature but a compliance necessity.

North America Cold Chain Market By Type Insights

Storage infrastructure, particularly cold warehouses, dominated the North America cold chain market, serving as the backbone of the supply chain by allowing for bulk storage and inventory management of temperature-sensitive goods. On-grid cold storage facilities form the majority, being energy-reliable and integrated with urban logistics systems. These are used extensively by food processing plants, pharmaceutical distributors, and e-commerce grocery fulfillment centers. The introduction of automated racking systems and solar-powered refrigeration in warehouses is improving energy efficiency and throughput.

Off-grid and reefer container storage solutions are witnessing the fastest growth, driven by the need to extend cold chain capabilities to rural areas, mobile units, and disaster recovery scenarios. Reefer containers are especially popular for sea and intermodal transport, while off-grid solutions powered by solar or hybrid systems are enabling cold storage where electrical infrastructure is limited. These solutions are vital for reaching remote communities in Canada and Mexico and are increasingly being used by NGOs for vaccine delivery in underserved areas.

North America Cold Chain Market By Packaging Insights

Insulated containers and boxes represent the dominant cold chain packaging format, especially in pharmaceutical and perishable food logistics. With various payload sizes ranging from petite (0.9–2.7 liters) to large (32–66 liters), these boxes provide flexibility and thermal stability for diverse use casesfrom transporting insulin vials to fresh seafood. Pharmaceutical companies also rely on cold chain bags, vaccine bags, and pallet shippers to meet strict thermal compliance during international transit.

Cold packs and temperature-controlled labels are among the fastest-growing subsegments, as they offer complementary features that ensure continuous thermal integrity and provide tamper-proof documentation. Smart labels that change color based on temperature excursions are being widely used in vaccine distribution, while gel and phase-change packs are preferred for reusable and eco-conscious packaging systems. The demand for lightweight, recyclable cold packs has also surged due to sustainability goals.

North America Cold Chain Market By Application Insights

Pharmaceuticals and dairy products dominate cold chain applications, primarily due to their stringent thermal sensitivity and regulatory requirements. Vaccines, blood products, and biologics demand uninterrupted temperature maintenance from manufacture to administration. Similarly, milk, cheese, and ice cream require robust refrigeration to prevent spoilage and contamination. Pharma cold chains also benefit from significant government and private investments, particularly in post-COVID healthcare infrastructure.

Processed food and bakery/confectionery products are growing fastest, thanks to changing consumer lifestyles and demand for convenience food. Items such as ready-to-eat meals, frozen pizza, and packaged desserts require a reliable cold chain to preserve texture and flavor. Additionally, urbanization and dual-income households are boosting demand for chilled and frozen ready meals, prompting retailers to expand cold chain capabilities at the retail and last-mile level.

North America Cold Chain Market By Regional Insights

United States

The U.S. leads the North America cold chain market with the most advanced infrastructure, regulatory frameworks, and technology integration. Food safety mandates by the FDA and compliance requirements under the Drug Supply Chain Security Act (DSCSA) have fostered adoption of end-to-end cold chain solutions. The country also sees significant investment in life sciences and food retailing, creating consistent demand for cold storage and distribution. Companies like Americold and Lineage Logistics dominate warehousing, while FedEx and UPS control much of the pharma transportation.

Canada

Canada’s cold chain market is expanding steadily, with strong demand in perishable exports like seafood and produce, as well as an aging population driving pharmaceutical needs. Provincial healthcare systems and stringent import/export controls ensure compliance, while sustainability goals encourage innovations like solar-powered reefer trucks. Cold chain challenges in remote and arctic communities are being met with off-grid storage and drone delivery pilots.

Mexico

Mexico is seeing rapid cold chain growth due to its expanding processed food sector and increasing pharma imports. Trade agreements like USMCA have accelerated investment in cross-border logistics infrastructure. However, gaps in rural refrigeration access, power grid stability, and enforcement of temperature control standards remain barriers. That said, efforts by major logistics firms and international NGOs are improving rural vaccine access and agri-export reliability.

Some of the prominent players in the North America cold chain market include:

- Americold Logistics, Inc.,

- Burris Logistics

- LINEAGE LOGISTICS HOLDING, LLC

- Wabash National Corporation

- United States Refrigerated Storage

- Tippmann Group

- NFI Industries

- Penske

- Seafrigo Group

- NewCold

- CONESTOGA REFRIGERATED STORAGE

- Sonoc ThermoSafe (Sonoco Products Company)

Recent Developments

-

Lineage Logistics (April 2025) announced the opening of a fully automated, 100,000-pallet cold storage facility in Texas, leveraging robotics and AI to optimize inventory flow.

-

Americold Realty Trust (March 2025) began construction on a new cold storage hub in Ontario, Canada, aimed at improving perishable goods throughput from port to retail.

-

UPS Healthcare (February 2025) launched a dedicated cold chain logistics program for biosimilars and clinical trials across the U.S. and Mexico, including validated packaging and tracking software.

-

Carrier Transicold (January 2025) introduced a new line of electric reefer systems for trucks, reducing fuel consumption and enabling zero-emission last-mile cold deliveries.

-

Softbox (December 2024) unveiled recyclable cold chain packaging with biodegradable insulation material, aimed at the pharma e-commerce segment in North America.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the North America cold chain market

By Type

-

-

- Sensors

- RFID Devices

- Telematics

- Networking Devices

By Packaging

-

-

- Dairy

- Pharmaceuticals

- Fishery

- Horticulture

-

- Insulated Containers & Boxes

-

-

-

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

-

-

-

- Cold Chain Bags/Vaccine Bags

- Corrugated Boxes

- Others

-

-

- Cold Packs

- Labels

- Temperature-controlled Pallet Shippers

-

-

- EPS

- PUR

- VIP

- Cryogenic Tanks

- Others

By Equipment

- Storage Equipment

- Transportation Equipment

By Application

- Fruits & Vegetables

- Fruits Pulp & Concentrates

- Dairy Products

-

- Milk

- Butter

- Cheese

- Ice Cream

- Fish, Meat, And Seafood

- Processed Food

- Pharmaceuticals

- Bakery & Confectionary

- Others

By Country