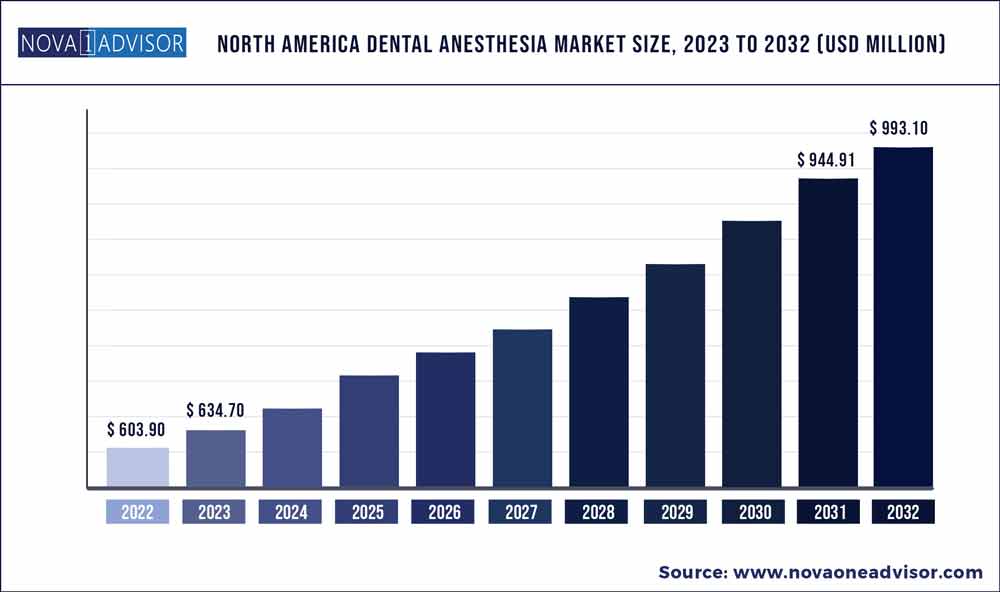

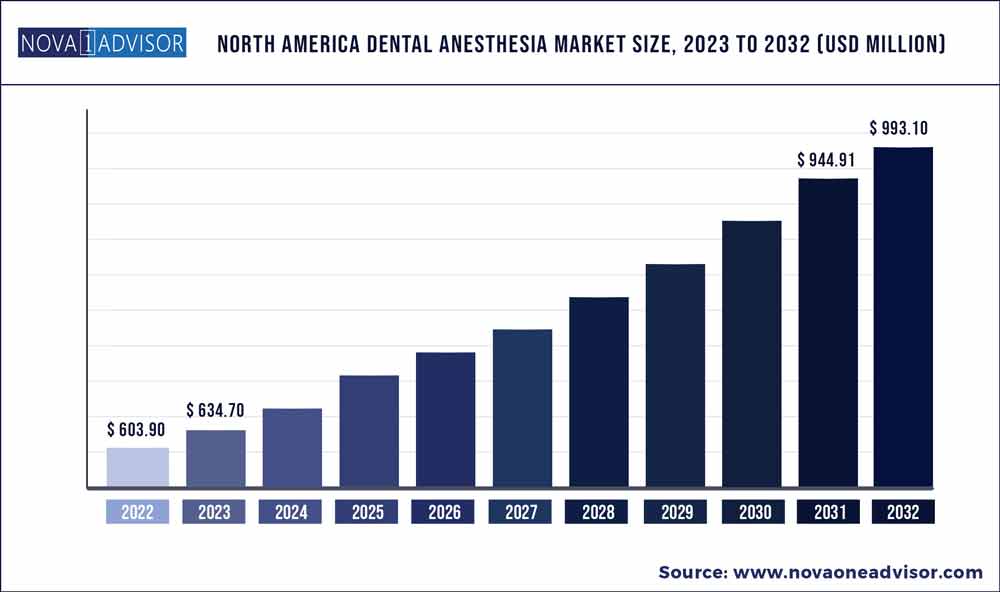

The North America dental anesthesia market size was exhibited at USD 603.9 million in 2022 and is projected to hit around USD 993.1 million by 2032, growing at a CAGR of 5.1% during the forecast period 2023 to 2032.

Key Takeaways:

- Local dental anesthesia dominated the dental anesthesia industry in terms of revenue with a market share of 65.3% in 2022. It is anticipated to continue its dominance with the fastest growth rate of 5.3% over the forecast period.

- Based on the route of administration, the injectable segment dominated the market and held the largest revenue share of 69.7% in 2022.

- The topical segment is expected to witness the fastest growth rate of 5.5% over the forecast period.

- Based on end-use, the dental clinics dominated the market and held the largest revenue share of 68.5% in 2022. It is expected to continue its dominance with the largest CAGR of 5.5% over the forecast period.

- The U.S. held the largest market share of over 84.0% in 2022 and is expected to witness the fastest growth rate (CAGR) of 5.3% of CAGR over the forecast period.

North America Dental Anesthesia Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 634.7million |

| Market Size by 2032 |

USD 993.1 million |

| Growth Rate From 2023 to 2032 |

CAGR of 5.1% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Type, Route of administration, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

| Key Companies Profiled |

Aspen Group; Septodont Holdings; DENTSPLY Sirona; Premier Dental; Pierrel Pharma; Beutlich, Inc.; Henry Schein; DMG America |

The rising prevalence of dental caries, growing awareness related to dental hygiene, and advancements in the field of dental anesthetics are some of the major factors driving the growth of the market. Furthermore, the rise in demand for cosmetic dentistry, and the rise in disposable incomes, will considerably contribute to the growth of the North America dental anesthesia industry during the forecast years.

Dental anesthesia is used to numb specific areas inside the mouth and surrounding areas during dental procedures. It is administered by a dentist or dental anesthesiologist and can be delivered in various forms. Its various forms include injections, topical gels, and sprays. There are different types of dental anesthesia, including local anesthesia, which numbs only the area being treated, and general anesthesia, which induces sleep during the dental procedure.

The increase in the prevalence of dental caries is a major driver of Dental Anesthesia products. According to 2017 CDC statistics, 91% of the U.S. population aged 20 to 64 exhibited dental caries. Such a high caseload of dental caries led to an increased demand for dental anesthesia products, specifically, medicated products. Among these, 27% of people have untreated dental caries.

This has further created opportunities for market growth. Moreover, tooth decay is common among children owing to unhealthy food intake and a lack of oral hygiene. Hence, the young population is at higher risk of dental caries. According to a recent study, nearly 50% of preschool children globally have dental caries. As a result, the need for effective dental anesthesia products for treating dental caries in children is increasing.

According to the Canadian Dental Association, approximately 2.5 school days are missed each year owing to dental problems, accounting for one-third of dental surgeries performed on children between the ages of 1 & 5. Canadians spend 13 billion dollars a year on oral healthcare, injuries, and mostly preventable diseases. Furthermore, gum or periodontal diseases caused by bacteria leading to plaque and mouth cancers are highly prevalent among the geriatric population.

According to World Dental Federation, nearly 30% of individuals aged 65 to 74 globally have no natural teeth, and this percentage is expected to increase with a rapidly aging population. According to the NCBI, more than 53% of the geriatric population has moderate to severe forms of periodontitis disorders. Aging is considered the greatest risk factor for dental diseases, which is anticipated to act as a high-impact rendering driver for the North America dental anesthesia industry.

Awareness regarding dental hygiene has significantly increased over the past few years. Several key players are undertaking initiatives to increase awareness by conducting educational programs.

The American Dental Association (ADA) in partnership with ADA Foundation conducted a National Children's Dental Health Month (NCDHM) campaign in 2017. This program aimed at bringing dental professionals and other healthcare providers together for raising awareness about maintaining oral health among children and adults.

As per the U.S. Center for Disease Control and Prevention (CDC), 84.9% of children aged 2 to 17 and 64.9% of adults above 18 years visited a dentist in 2019. Recently, practicing good dental health is deemed requisite, as it helps in maintaining oral hygiene and helps enhance an individual personality. According to the ADA, 58% of the people in the U.S. visit a dentist at least once a year.

In many countries, such as Germany, the U.S., and Canada, oral health and the appearance of teeth are considered key factors in perceived physical attractiveness, which in turn, is associated with self-confidence and self-esteem. Growing awareness about oral hygiene and restorative dentistry procedures through social media referrals is boosting market growth. However, people in several countries still do not consider dental anesthesia important due to factors such as the high cost of dental treatment and limited or lack of reimbursement schemes.

Type Insights

Based on the type, the North America dental anesthesia industry is segmented into local, general, and sedation. Local dental anesthesia dominated the dental anesthesia industry in terms of revenue with a market share of 65.3% in 2022. It is anticipated to continue its dominance with the fastest growth rate of 5.3% over the forecast period. Local anesthetics are one of the most frequently used medications in dentistry. Local anesthesia, frequently used for short-duration dental operations, temporarily numbs a particular area without impairing awareness. It can either be injected or administered topically.

The route of administration of topical local anesthetics is a useful addition to a dentist's toolkit for pain management, as it provides surface anesthesia that can reduce discomfort from soft tissue lesions, minor gingival & periodontal procedures, and possibly small biopsies. It also reduces pain from anesthetic needle insertion. A dental professional may occasionally combine an anesthetic with a vasopressor, such as epinephrine, to increase its effectiveness and prevent the anesthetic impact from spreading to other parts of the body. Vasopressors are drugs that induce low blood pressure.

Route Of Administration Insights

Based on the route of administration, the injectable segment dominated the market and held the largest revenue share of 69.7% in 2022. Injectable anesthesia is used to numb a specific area of the mouth during dental procedures. It is injected into the gum tissue or inner cheek with a needle, and it works by blocking the nerves that transmit pain signals from that area to the brain. Injectable dental anesthesia is considered safe when administered by a trained dental professional. However, as with any medical procedure, there are potential risks and side effects, such as temporary numbness or tingling of the lips, tongue, or cheeks, swelling, or bruising at the injection site, and allergic reactions.

The topical segment is expected to witness the fastest growth rate of 5.5% over the forecast period. Topical dental anesthesia is a type of anesthesia that is applied directly to the surface of the gums or oral mucosa to provide localized pain relief. It is often used to numb the area before administering injectable anesthesia to make the patient more comfortable during the procedure. Furthermore, the development of new topical anesthesia formulations that offer faster onset times and longer durations of pain relief, makes them more effective and efficient for dental procedures. Additionally, advancements in technology and manufacturing processes have made topical anesthesia more affordable and accessible to dental professionals and patients.

End-Use Insights

Based on end-use, the dental clinics dominated the market and held the largest revenue share of 68.5% in 2022. It is expected to continue its dominance with the largest CAGR of 5.5% over the forecast period. This is owing to the increasing number of solo dental practices globally. Independent dental clinics are expected to grow over the coming years due to the rising competition between care providers and the demand for cost-efficient treatments.

In addition, companies have an extensive delivery network and target dental clinics mainly through direct sales. Additionally, multiple smaller dental clinics tend to cooperatively bring in more customers than a single hospital. According to the American Association of Orthodontics, in 2019, around 200,419 general dentists, and 10,658 orthodontists were actively practicing in the U.S. Furthermore, approximately 79% of orthodontists owned or shared ownership of a practice.

Regional Insights

The North American dental anesthesia industry is expected to be driven owing to technological advancements in the field of diagnosis, a rise in the incidence of dental problems, an increase in dental care services coupled with a rise in the number of dental clinics, and an increase in dental care expenditure. The U.S. held the largest market share of over 84.0% in 2022 and is expected to witness the fastest growth rate (CAGR) of 5.3% of CAGR over the forecast period.

The U.S. dental anesthesia industry is expected to witness lucrative growth due to key factors such as the increasing geriatric population, which is susceptible to dental problems, and the presence of advanced infrastructure & technology. As per the U.S. CDC, one in four adults has an untreated dental issue, and 46% of adults over 30 years of age experience symptoms of gum disease. According to the American Dental Association, 58% of the people in the U.S. visited a dentist once a year, with 15% making an appointment because they were experiencing oral pain.

Key Companies & Market Share Insights

The North American dental anesthesia industry is highly competitive with the presence of both small and major organizations. Key companies in the market are implementing and undertaking major business strategies such as strategic alliances & collaborations, joint ventures, product innovation, and new & innovative product launches. Furthermore, these players also undertake contracts to strengthen their market position and increase their market share.

For instance, in August 2022, Henry Schein, Inc. acquired Midway Dental Supply, a dental distributor serving dental clinics and dental laboratories across the Midwestern U.S. Moreover, in January 2022, Pierrel Pharma launched a new anesthetic delivery system called Orabloc dental needles in the U.S., which is an ultra-thin-walled equipment, with a triple-sharpened tip, and is silicone-coated to ensure painless injection. Some prominent players in the North America dental anesthesia market include:

- Aspen Group

- Septodont Holdings

- DENTSPLY Sirona

- Premier Dental

- Pierrel Pharma

- Beutlich, Inc.

- Henry Schein

- DMG America

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the North America Dental Anesthesia market.

By Type

By Route of Administration

By End-Use

By Regional

- North America

- U.S.

- Canada