North America Digital Pathology Market Size, Growth, Trends 2026 to 2035

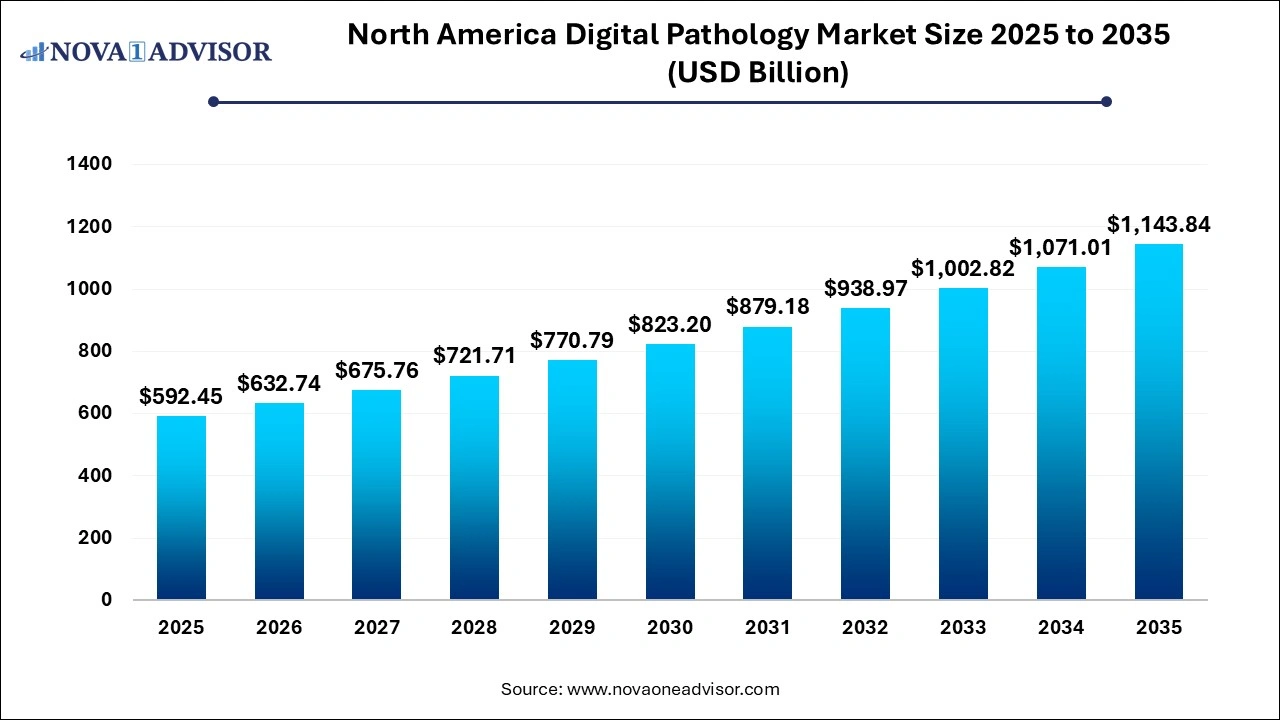

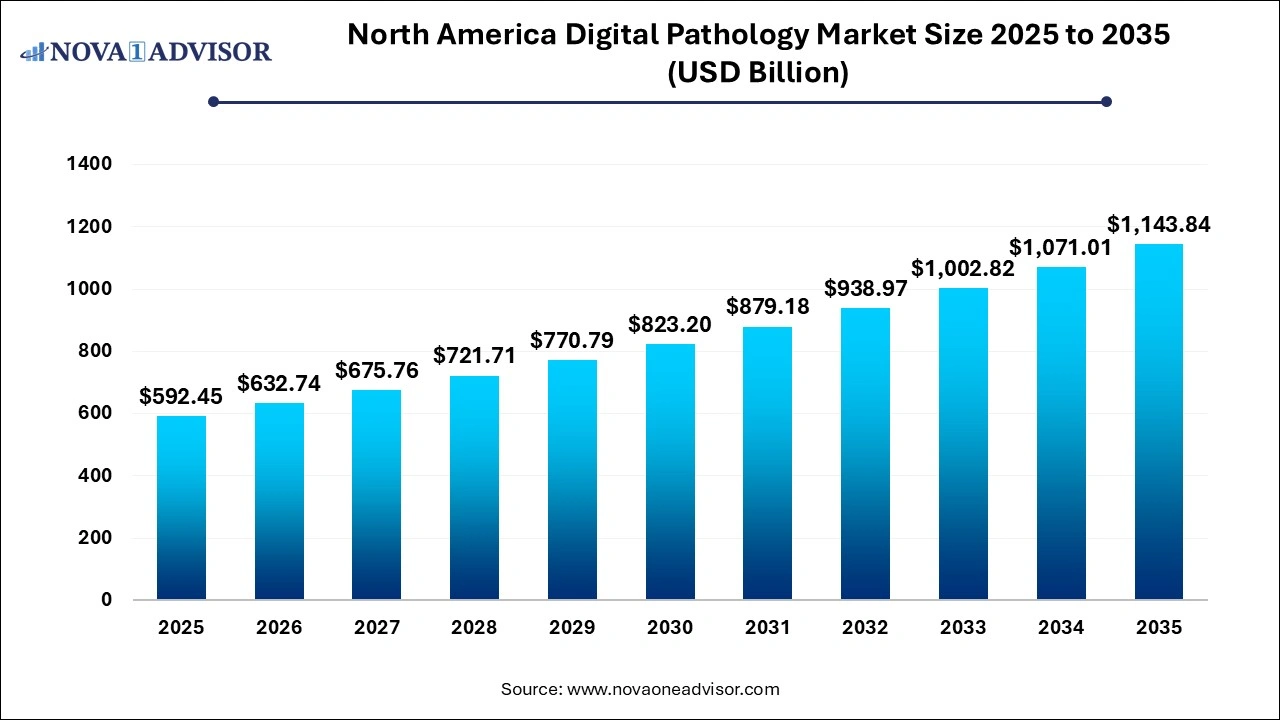

The North America digital pathology market size valued at USD 592.45 million in 2025 and is projected to hit USD 1,143.84 million by 2035, growing at a CAGR of 6.8% from 2026 to 2035.

Key Takeaways:

- The device segment dominated the market and accounted for the largest revenue share of 58.0% in 2025.

- The academic and research institutes segment dominated the North America digital pathology market and held the leading revenue share of 69.0% in 2025.

- The academic research segment dominated the market and accounted for the largest revenue share of 49.0% in 2025.

- In North America, the U.S. dominated the market and accounted for the largest revenue share of 85.5% in 2025.

North America Digital Pathology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 632.74 million |

| Market Size by 2035 |

USD 1,143.84 million |

| Growth Rate From 2026 to 2035 |

CAGR of 6.8% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Application, End use, Country |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Leica Biosystems; Hamamatsu Photonics, Inc.; Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Mikroscan Technologies, 3DHISTECH Ltd., Inspirata, Inc. Visiopharm A/S, Huron Technologies International, Inc. and Sectra AB |

The market is predominantly driven by the growing prevalence of chronic diseases such as cancer. As a consequence of the high prevalence of cancer, pathologists require data that facilitate personalizing therapy for patients. Hence, digital pathology is progressively being selected by pathologists as it has various benefits including accelerated diagnosis rate, diagnostic accuracy, and offers therapeutic recommendations to improve patient outcomes.

The growing number of collaborative agreements to develop as well as expedite the adoption of digital pathology in cancer diagnostics serves as a key growth factor contributing to the market. The use of artificial intelligence in digital pathology has gained momentum in the past years. The increasing need for lowering healthcare costs, increasing importance of big data in healthcare, rising adoption of precision medicine, and declining hardware costs are some factors driving the growth. In addition, increasing usage of artificial intelligence-based analytical tools in healthcare and high capital investments in this field are further propelling the market growth.

During the coronavirus outbreak, the exponential need for home-based workstations and safe clinical informatics systems allowing healthcare professionals to read images remotely and enabling virtual collaboration between their multi-disciplinary care teams has increased. Various histopathology departments in the region faced a reducing workforce and increasing workload during the pandemic. Digital pathology considered being the potential solution for some of the challenges faced by the pathologist, there is an increase in the adoption of digital diagnosis of disease during coronavirus outbreak.

In April 2020, Philips announced that the FDA granted a waiver for home use of consumer monitors with the company's IntelliSite Pathology Solution during the emergency. The temporary exemption of restrictions on remote use of the digital pathology helps pathologists to access whole slide images from home and fasten the diagnosis of histology cases. Some pathology labs that have adopted DP in their workflows across different sites pre-COVID-19, reported improved collaboration, and an average productivity gain of 21.0% with operation efficiency increased by 13.0%. These types of initiatives are anticipated to fuel market growth.

By Product Insights

The device segment dominated the market and accounted for the largest revenue share of 58.0% in 2025. The devices include scanners, clinical-grade computers, and slide management systems. Increasing adoption for academic and research activities and enhanced resolution are the key factors driving the growth of the segment.

Digital pathology also allows the sharing of information for publication and research, diagnostics, and education through the internet. Thus, it reduces the sharing costs. Traditionally, to achieve accurate tumor diagnosis results, multiple tests had to be carried out, which are drastically reduced by a single test performed by a digital pathology system. Increasing the usage rate of the digital imaging systems to facilitate quicker diagnosis, mainly of chronic diseases; the improved uptake of these products serves as the crucial driver for the market.

By End-use Insights

The academic and research institutes segment dominated the North America digital pathology market and held the leading revenue share of 69.0% in 2025. Digital pathology is predominantly used by research institutes, educational institutes, and veterinary pathologists. Academic medical centers, commercial labs, and large independent pathology labs were initial adopters of digital pathology systems. The high penetration in research institutes is due to the high adoption of digital pathology in oncology clinical trials, preclinical GLP pathology, and drug discovery and development.

Hospitals are implementing digital scanners for rapid diagnosis and better outcomes. As of now, it is anticipated to play a critical role in diagnostics as the FDA approved the digital pathology systems for primary diagnosis, further widening its growth potential. Rising cancer prevalence and high demand for better diagnostic and treatment options are further contributing towards the growth.

By Application Insights

The academic research segment dominated the market and accounted for the largest revenue share of 49.0% in 2025. The disease diagnosis segment accounted for a revenue share of 49.0% in 2022. The growth of the academic research segment can be attributed to factors such as an increase in the adoption of digital pathology in various research studies including tumor morphological and biomarker profiling.

The disease diagnosis application segment of digital pathology is anticipated to exhibit the fastest growth. An increasing number of activities by public and private organizations such as the American Society for Clinical Pathology (ASCP) and College of American Pathologists (CAP), which are focused on improving the quality of cancer diagnosis is presenting lucrative growth opportunities. These organizations also aim to achieve ease of consultation through conducting regular training and quality assurance sessions concerning the usage of whole slide images in cancer diagnosis.

Moreover, increasing cancer cases demand a greater number of pathologists and subsequent working hours for cancer diagnosis. As cited in GE healthcare publications, digital pathology allows a pathologist to study approximately 150 slides in a day and, therefore, increases the overall laboratory efficiency by 13.0%. These associated benefits with the use of this technology are anticipated to propel growth in the coming years.

Country Insights

In North America, the U.S. dominated the market and accounted for the largest revenue share of 85.5% in 2025. This growth is attributed to the presence of companies focusing on research activities in digital pathology and the development of advanced tools to improve image analysis in the country.

Key Companies & Market Share Insights

The industry is expected to remain innovation-led, with frequent acquisitions and strategic alliances. Application development along with competent distribution channels will be key for competitive advantage. Leading companies are focusing on strategies such as collaborations, new product developments, research agreements, and mergers and acquisitions to gain a competitive advantage. For instance, in July 2020, Paige, a computational pathology player, received the U.S. FDA 510(k) clearance for the FullFocus, digital pathology image viewer for primary diagnosis. The clearance allowed in vitro diagnostic (IVD) use of FullFocus in conjugation with Philips Ultra-Fast Scanner.

Moreover, in April 2020, FDA approved Sectra's digital pathology module for primary diagnostics. Before this module is only used for research in the U.S. This module can be used in conjunction with the AT2 DX scanner provided by Leica Biosystem. This will intensify the competition in the market as previously the market is dominated by Philips. Some of the prominent market players in the North America digital pathology market include:

- Leica Biosystems

- Hamamatsu Photonics, Inc.

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd

- Mikroscan Technologies

- 3DHISTECH Ltd.

- Inspirata, Inc.

- Visiopharm A/S

- Huron Technologies International, Inc.

- Sectra AB

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Nova one advisor, Inc. has segmented the North America Digital Pathology market.

By Product

By Application

- Drug Discovery & Development

- Academic Research

- Disease Diagnosis

- Cancer Cell Detection

- Others

By End-use

- Cancer Hospitals

- Diagnostic Labs

- Academic & Research Institutes

By Country

U.S.

Canada