North America Electric Vehicles Market Size and Growth

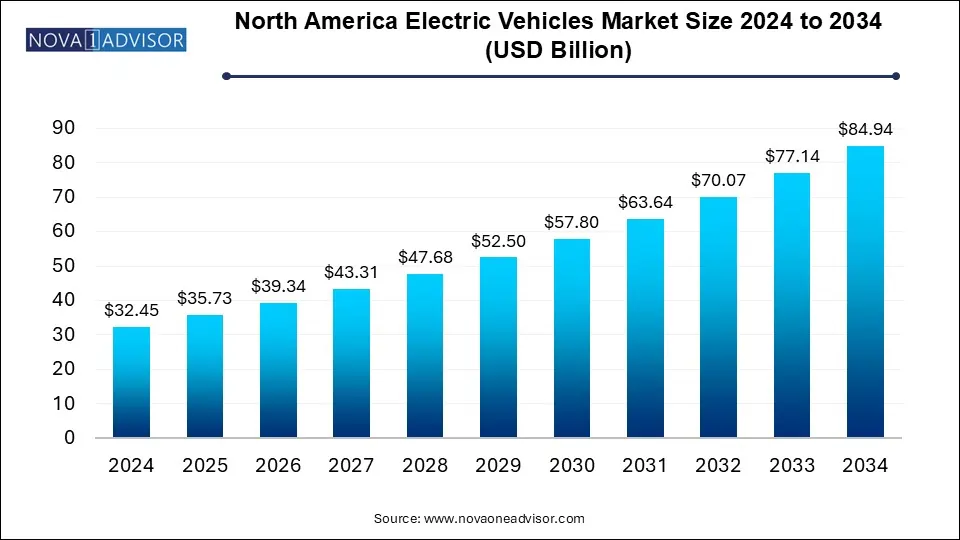

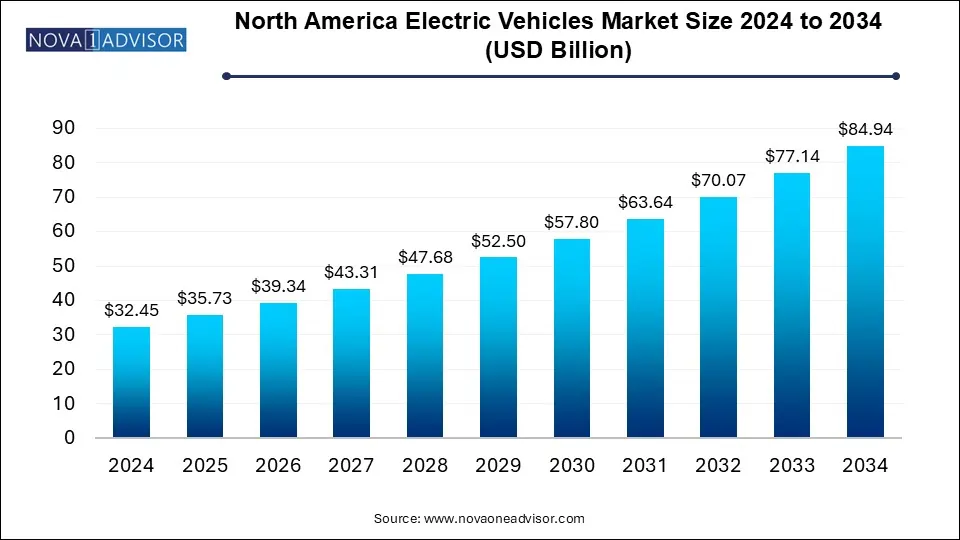

The North America electric vehicles market size was exhibited at USD 32.45 billion in 2024 and is projected to hit around USD 84.94 billion by 2034, growing at a CAGR of 10.1% during the forecast period 2025 to 2034.

North America Electric Vehicles Market Key Takeaways:

- The battery electric vehicles (BEVs) segment dominated the North America electric vehicle market with a revenue share of 75.5% in 2024.

- The Plug-In Hybrid Electric Vehicle (PHEV) segment is anticipated to experience the highest CAGR

- The Passenger Cars and Light Trucks (PCLT) segment dominated the market with the largest share of 98.0% in 2024.

- The commercial vehicle segment is anticipated to experience the fastest CAGR over the forecast period.

- The U.S. electric vehicles market accounted for an 81.9% revenue share as of 2024.

Market Overview

The North American electric vehicles (EV) market has rapidly emerged as one of the most dynamic and strategically important sectors in the global automotive industry. Driven by policy mandates, rising environmental awareness, technological innovation, and significant investment from both private and public sectors, the EV landscape in North America is transitioning from niche adoption to mass-market acceleration.

The market encompasses Battery Electric Vehicles (BEVs), which operate solely on electric power, and Plug-in Hybrid Electric Vehicles (PHEVs), which combine an internal combustion engine with an electric drivetrain. These vehicles are being deployed across both personal transportation (passenger cars and light trucks) and commercial fleet segments. North America particularly the United States has become a fertile ground for innovation, investment, and competition in the EV ecosystem, supported by robust infrastructure plans, OEM expansion strategies, and consumer demand shifts.

In recent years, federal initiatives like the U.S. Inflation Reduction Act (IRA) and Canada’s Zero-Emission Vehicle (ZEV) mandates have reinforced the shift toward electrified transport. Meanwhile, EV startups like Rivian and Lucid are challenging legacy automakers such as Ford and General Motors, both of which are aggressively expanding their EV lineups. In Mexico, strategic moves to position the country as a battery manufacturing and EV assembly hub have begun to materialize, supported by its proximity to the U.S. and strong automotive manufacturing base.

Despite these advances, challenges remain from raw material sourcing for batteries to charging infrastructure deficits. However, the long-term growth trajectory of the North American EV market remains robust, with significant room for expansion in both consumer and commercial sectors.

Major Trends in the Market

-

Surge in Government Incentives: Incentive programs in the U.S., Canada, and Mexico are fueling EV adoption through rebates, tax credits, and charging infrastructure grants.

-

Proliferation of Charging Networks: Private and public investments are leading to an exponential rise in Level 2 and DC fast charging stations.

-

Vertical Integration in EV Manufacturing: Automakers are investing in upstream battery supply chains, including lithium mining and in-house battery cell production.

-

Rise of Electric Light Trucks and SUVs: North American preferences for larger vehicles are driving demand for electric versions of pickups and SUVs.

-

Commercial Fleet Electrification: Delivery companies, municipal fleets, and logistics providers are transitioning to electric vans and trucks to meet sustainability targets.

-

Collaborations Between OEMs and Tech Firms: Automakers are increasingly partnering with software and AI firms to enhance vehicle autonomy and energy efficiency.

-

Battery Recycling and Second-Life Initiatives: Startups and incumbents alike are exploring recycling technologies to handle end-of-life EV batteries.

Report Scope of North America Electric Vehicles Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 35.73 Billion |

| Market Size by 2034 |

USD 84.94 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Vehicle, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

BYD Motors Inc.; Daimler Truck AG; Ford Motor Company; General Motors; Lucid; MITSUBISHI MOTORS CORPORATION; Nissan Motor Co., Ltd.; Tesla; TOYOTA MOTOR CORPORATION; Volkswagen Group |

Market Driver: Policy and Regulatory Push Toward Decarbonization

The most influential driver of EV market growth in North America is the strong policy backing for transport decarbonization. Governments across the region are deploying aggressive targets to phase out internal combustion engine (ICE) vehicles. In the United States, the Biden administration has set an ambitious goal for 50% of all new vehicle sales to be electric by 2030. This goal is underpinned by the Inflation Reduction Act of 2022, which introduced tax incentives for EV buyers and manufacturing subsidies for domestic battery production.

In Canada, the federal government has mandated that 100% of new light-duty vehicle sales must be zero-emission by 2035, with interim targets in 2026 and 2030. Provincial incentives such as those in British Columbia and Quebec further complement federal efforts. Mexico is also aligning its policies with its North American trading partners through automotive agreements and its 2050 net-zero commitment.

These regulations not only stimulate demand through consumer incentives but also push automakers to prioritize EV production. Additionally, environmental regulations on emissions and fuel efficiency are making it increasingly challenging for ICE vehicles to compete on compliance costs, thereby accelerating the market shift.

Market Restraint: Charging Infrastructure Gaps and Range Anxiety

Despite progress, insufficient public charging infrastructure remains a critical barrier to EV adoption in North America. While urban centers in the U.S. and Canada are seeing growing networks of Level 2 and DC fast chargers, rural areas and highway corridors remain underserved. This infrastructure deficit contributes to persistent range anxiety among potential buyers, particularly in large geographies like the U.S. and Canada where travel distances are often significant.

Moreover, the fragmented nature of charging networks with different hardware standards, payment systems, and reliability levels creates a less-than-seamless user experience. In Mexico, the lack of consistent and accessible charging infrastructure outside major cities continues to limit broader EV adoption. Additionally, the time taken for EVs to charge compared to the near-instant refueling of gasoline vehicles remains a psychological and practical hurdle for many consumers.

Addressing these issues requires coordinated investments by governments, utilities, automakers, and charging network providers. However, the scale and pace of infrastructure expansion are yet to fully align with the rapid growth in EV ownership, thereby constraining near-term market potential.

Market Opportunity: Electrification of Commercial Vehicle Fleets

One of the most promising opportunities in the North American EV market lies in the electrification of commercial vehicle fleets. Delivery services, logistics companies, ride-hailing operators, and municipal governments are increasingly transitioning their fleets to electric to meet sustainability goals and reduce operating costs.

Fleet vehicles are ideal candidates for electrification due to predictable routes, central depot charging, and high utilization rates, which amplify savings on fuel and maintenance. In the U.S., Amazon has partnered with Rivian to roll out a fleet of 100,000 electric delivery vans, with thousands already on the road as of 2024. FedEx and UPS are also investing heavily in EVs, collaborating with manufacturers like BrightDrop (a GM subsidiary).

Canada is following a similar path, with Purolator and Canada Post piloting electric delivery vans. In Mexico, Walmart and DHL are exploring electric fleet rollouts in urban centers. This segment offers tremendous growth potential, supported by total cost of ownership (TCO) advantages and growing ESG pressures on corporations to reduce carbon footprints.

North America Electric Vehicles Market By Product Insights

Battery Electric Vehicles (BEVs) dominated the North American EV market due to their zero-emission profile and technological maturity. Leading automakers such as Tesla, Ford, and GM have focused heavily on BEVs, with high-volume models like the Tesla Model Y, Ford Mustang Mach-E, and Chevrolet Bolt setting benchmarks in performance and range. The growing network of DC fast chargers and longer range batteries (now exceeding 300 miles in many models) has made BEVs increasingly viable for both urban and long-distance travel. The tax incentives under the U.S. IRA also disproportionately favor BEVs, further solidifying their leadership position in the market.

However, Plug-in Hybrid Electric Vehicles (PHEVs) are emerging as the fastest-growing product segment, especially among consumers not ready for full electrification. PHEVs offer flexibility by allowing electric driving for short commutes and gasoline use for longer trips, effectively addressing range anxiety. Models like the Toyota RAV4 Prime, Jeep Wrangler 4xe, and BMW X5 xDrive45e have shown strong year-over-year growth. PHEVs are particularly popular in regions with harsh winters or limited charging infrastructure, such as parts of Canada and rural U.S. areas. Their dual-mode capability makes them an attractive transitional solution, boosting their adoption among hesitant buyers.

North America Electric Vehicles Market By Vehicle Insights

Passenger cars held the largest share in the North American EV market, largely due to early adopters favoring compact and midsize electric sedans and hatchbacks. Tesla’s dominance in the passenger segment with models like the Model 3 and Model S has helped drive BEV penetration among individual consumers. Urban commuting patterns, lower operating costs, and attractive lease options have also bolstered demand in this category. Furthermore, regulatory agencies tend to prioritize passenger vehicle electrification to reduce urban emissions, pushing automakers to release an expanding range of sedans and crossovers.

Light trucks, including pickups and SUVs, are the fastest growing segment as North American consumers continue to show a strong preference for larger vehicles. Automakers have responded by launching electric variants such as the Ford F-150 Lightning, Rivian R1T, and Chevrolet Silverado EV. These vehicles combine utility with sustainability, appealing to both traditional truck buyers and eco-conscious consumers. In Canada and the U.S., rural and suburban buyers are increasingly considering electric light trucks due to their towing capabilities and growing charging options. This segment is also benefiting from substantial government subsidies and growing fleet demand in construction and utility services.

Country Insights

United States

The U.S. remains the largest EV market in North America, driven by aggressive federal policies, massive OEM investment, and tech-savvy consumers. As of 2024, EVs accounted for over 8% of new vehicle sales, with that number expected to double by 2027. Tesla leads the market, but new entrants like Rivian, Fisker, and legacy players such as GM and Ford are gaining ground. Federal tax credits, state incentives, and infrastructure funding under the Bipartisan Infrastructure Law are accelerating adoption across all 50 states.

Canada

Canada is making strong strides in EV adoption, bolstered by the federal iZEV rebate program and additional provincial incentives. Cities like Montreal and Vancouver are leading in public charging availability and EV density. The Canadian government has also announced plans to mandate 100% zero-emission new vehicle sales by 2035. Domestic EV production is receiving a boost, with investments from Stellantis, Volkswagen, and battery manufacturers setting up shop in Ontario and Quebec.

Mexico

Mexico is becoming a strategic manufacturing hub for EVs, with companies like Tesla and BMW announcing major investments in gigafactories and assembly plants. While consumer EV adoption is still nascent due to limited infrastructure and higher costs, the export-focused automotive sector is aligning with global electrification trends. Mexico’s proximity to the U.S. and strong trade frameworks under the USMCA position it well for long-term EV market integration.

Some of the prominent players in the North America electric vehicles market include:

- BYD Motors Inc.

- Daimler Truck AG

- Ford Motor Company

- General Motors

- Lucid

- MITSUBISHI MOTORS CORPORATION

- Nissan Motor Co., Ltd.

- Tesla

- TOYOTA MOTOR CORPORATION

- Volkswagen Group

North America Electric Vehicles Market Recent Development

-

April 2025: Tesla announced the expansion of its Gigafactory in Austin, Texas, to include a new battery recycling unit aimed at supporting its sustainability goals.

-

March 2025: Ford revealed plans to launch four new EV models by 2026 under its Model e division, including electric variants of the Explorer and Maverick.

-

February 2025: Volkswagen broke ground on a new battery cell factory in Ontario, Canada, marking its largest EV investment in North America to date.

-

January 2025: General Motors started production of the Chevrolet Silverado EV at its Factory ZERO plant in Michigan.

-

December 2024: BMW Group confirmed its $870 million investment in San Luis Potosí, Mexico, to produce Neue Klasse EVs and build a high-voltage battery assembly facility.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America electric vehicles market

By Product

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

By Vehicle

-

- Passenger Cars

- Light Trucks

By Country