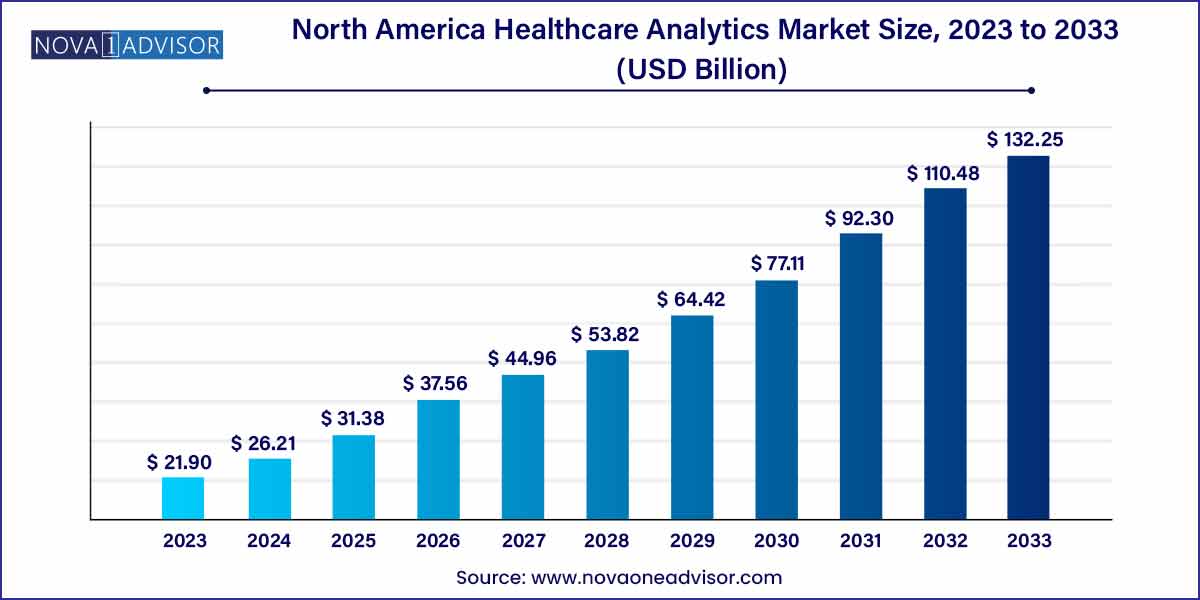

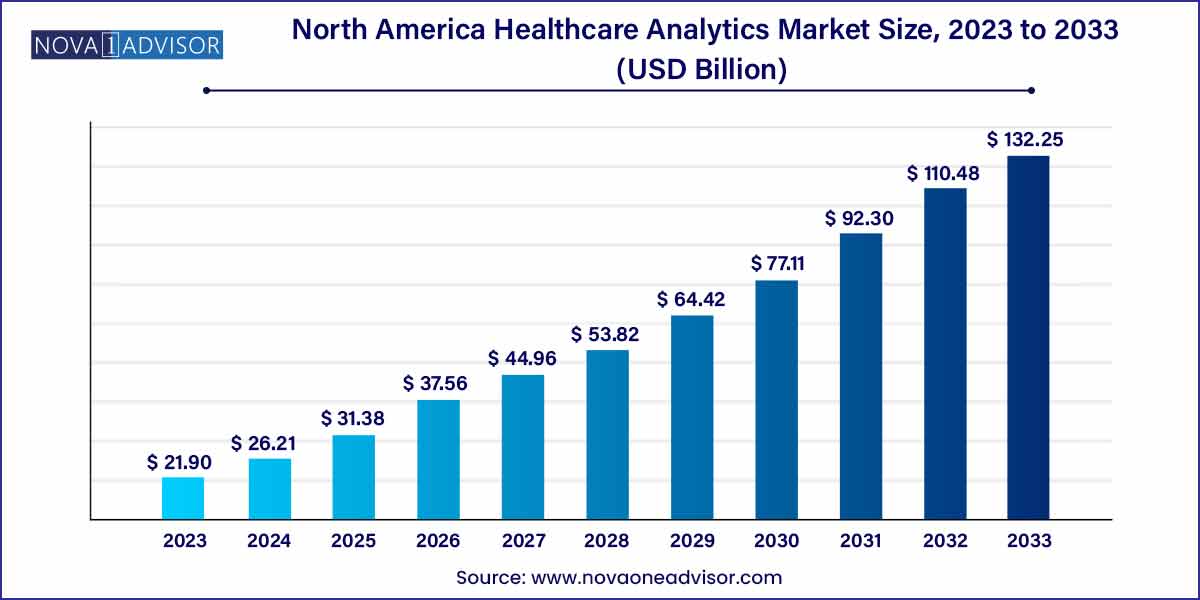

The North America healthcare analytics market size was estimated at USD 21.90 billion in 2023 and is projected to hit around USD 132.25 billion by 2033, growing at a CAGR of 19.7% during the forecast period from 2024 to 2033.

Key Takeaways:

- The healthcare analytics market in U.S. accounted for around 83.19% of the total North America healthcare analytics market.

- Descriptive analysis held the largest market share of 45.19% in 2023

- Services dominated the market with a share of 42.12% in 2023.

- The services segment is anticipated to register fastest growth rate during the forecast period,

- On-premises dominated the market with a revenue share of 47.18% in 2023.

- The cloud-based segment is projected to grow at the fastest growth rate during the forecast period

- Financial applications held the largest market share of 36.13% in 2023.

- Life science companies dominated the market with a revenue share of 44.13% in 2023.

- Healthcare providers is expected to show highest growth rate in the forecast period,

Market Overview

The North America Healthcare Analytics Market is transforming the delivery, management, and financing of healthcare through the integration of data-driven technologies. As healthcare systems in the U.S. and Canada evolve to meet growing demands for efficiency, cost control, and improved outcomes, analytics has emerged as a cornerstone in the pursuit of value-based care.

Healthcare analytics involves the systematic use of data and related business insights developed through statistical, quantitative, predictive, and cognitive models to drive decisions and improve health outcomes. It is deployed across payer, provider, and life sciences organizations, encompassing clinical analytics for better diagnoses and treatment, financial analytics for cost management, and operational analytics for system optimization.

The U.S., as the largest market in the region, is leading the adoption of AI-powered predictive tools, population health dashboards, and real-time analytics platforms in hospitals and insurance companies. Meanwhile, Canada’s universal healthcare model is investing in data infrastructure and interoperability to improve public health decision-making and resource allocation.

Healthcare analytics is no longer limited to large institutions; its scope has extended to small and mid-size hospitals, physician practices, and research firms, enabled by scalable cloud-based platforms. From fraud detection in insurance claims to optimizing surgical workflows, analytics has cemented its role as a strategic asset in North American healthcare ecosystems.

Major Trends in the Market

-

Adoption of Value-Based Care Models: Payers and providers are using analytics to align care quality with reimbursement frameworks.

-

Integration of AI and Machine Learning: Advanced algorithms are enabling predictive modeling, early diagnosis, and personalized treatment planning.

-

Real-Time and Streamed Data Analytics: Transition from retrospective data review to real-time decision support at the point of care.

-

Data Interoperability and Standardization Efforts: Industry-wide push for seamless EHR integration and standardized data protocols.

-

Cloud Migration of Healthcare IT Infrastructure: Increased preference for cloud-based solutions for flexibility, scalability, and lower maintenance.

-

Rise of Population Health Management (PHM): Use of analytics to segment patient populations, identify risks, and tailor preventive strategies.

-

Cybersecurity-Focused Analytics Tools: Integration of anomaly detection and threat intelligence to safeguard sensitive health data.

North America Healthcare Analytics Market Report Scope

Key Market Driver: Rising Demand for Predictive and Preventive Healthcare

A key driver of the North American healthcare analytics market is the shift from reactive to predictive and preventive healthcare, enabled by advanced analytics platforms. With increasing chronic disease prevalence, aging populations, and spiraling healthcare costs, stakeholders are investing in tools that can anticipate risks, prevent hospitalizations, and enable early interventions.

Hospitals use predictive analytics to forecast ICU admissions or patient deterioration, while insurers rely on risk-scoring models to identify high-cost beneficiaries before costly events occur. For example, machine learning models trained on EHR and claims data can predict diabetic complications or cardiac events, allowing pre-emptive outreach by care managers.

Analytics has empowered decision-makers to move upstream in the care continuum from treating illness to managing health making it indispensable to future-ready healthcare systems.

Key Market Restraint: Data Privacy and Interoperability Challenges

One of the most prominent restraints in the North American healthcare analytics market is data fragmentation and privacy concerns. Despite the widespread digitization of health records, interoperability between different EHR platforms, labs, and payer databases remains limited. This hinders the seamless aggregation and analysis of data.

Moreover, compliance with data protection laws such as HIPAA (in the U.S.) and PHIPA (in Canada) imposes strict controls on how data is accessed, shared, and used. These regulations, while necessary for patient privacy, complicate data-sharing agreements and slow down innovation, particularly in cross-organizational or cross-border analytics projects.

Concerns around cybersecurity, consent management, and ethical use of AI in decision-making further constrain the pace at which analytics platforms are adopted especially among smaller healthcare providers lacking robust IT infrastructure.

Key Market Opportunity: Expansion of Remote Patient Monitoring and Virtual Care

The rise of telehealth and remote patient monitoring (RPM), particularly post-pandemic, offers a vast opportunity for healthcare analytics in North America. With wearable devices, mobile apps, and connected home health systems collecting vast amounts of patient data, analytics platforms are being used to synthesize this information into actionable insights.

Healthcare organizations are now deploying AI-powered dashboards that aggregate vitals, activity levels, medication adherence, and symptom reports to identify deviations from care plans. This is particularly beneficial for chronic disease management, elder care, and post-acute care settings.

Analytics-powered RPM not only enhances clinical decision-making but also supports risk stratification, early warnings, and virtual triage, enabling providers to allocate resources efficiently while keeping patients out of hospitals.

Segmental Analysis

By Type

Descriptive analysis dominated the North America market, serving as the foundation of healthcare analytics. It helps organizations understand historical patterns and trends, such as hospital readmissions, medication errors, and claim rejections. Descriptive tools are widely deployed in EHR systems, claims processing platforms, and performance reporting modules. Hospitals use it to monitor length of stay, patient throughput, and quality indicators, making it essential for both clinical and administrative decision-making.

Predictive analysis is the fastest-growing segment, driven by the rise of machine learning and big data tools that anticipate future outcomes. From predicting patient deterioration to identifying high-risk patients for targeted interventions, predictive analytics is reshaping how care is delivered. For example, healthcare providers use AI models to forecast patient no-shows, hospital re-admissions, and disease outbreaks—leading to proactive resource planning and personalized care strategies.

By Component

Software dominated the market as healthcare organizations invested heavily in analytics platforms integrated with EHRs, practice management systems, and financial dashboards. Vendors like Epic, Cerner, and IBM Watson Health provide solutions for data aggregation, visualization, and real-time analysis. Software platforms are essential for implementing analytics across functions like clinical decision support, population health management, and fraud detection.

Services are the fastest-growing component, especially analytics-as-a-service (AaaS) models. Consulting, system integration, data warehousing, and training services are in high demand as providers and payers seek third-party expertise to implement and maintain analytics tools. Outsourcing analytics services to specialized vendors also allows organizations to focus on their core competencies while still harnessing cutting-edge data capabilities.

By Delivery Mode

On-premises solutions dominated the early market, particularly among large hospitals and payer organizations with internal IT teams and compliance mandates. These setups offer higher control, customization, and data security, making them attractive to organizations with sensitive datasets or complex infrastructure.

Cloud-based analytics platforms are growing fastest, especially among small- and medium-sized healthcare facilities. Cloud solutions offer lower upfront costs, flexible scalability, faster deployment, and real-time access to data. The pandemic accelerated cloud migration, with many providers opting for remote-accessible platforms that could integrate multiple data sources and support virtual care workflows.

By Application

Clinical applications dominated the North America market, encompassing tools for care optimization, diagnostic support, population health, and treatment planning. Hospitals rely on analytics to reduce hospital-acquired infections, improve patient safety scores, and manage chronic disease cohorts. Analytics has also improved early diagnosis of conditions like sepsis, enabling timely intervention.

Financial analytics is a rapidly growing segment, especially in a value-based care environment. Payers and providers use analytics to manage billing cycles, reduce denials, identify coding errors, and analyze cost drivers. For example, revenue cycle management systems embedded with analytics can improve claim accuracy, reduce bad debt, and forecast payer performance.

By End-use

Healthcare providers are the dominant end-users, deploying analytics to improve patient care quality, streamline workflows, and comply with regulatory reporting. Hospitals are using analytics to track surgical outcomes, patient satisfaction, staffing levels, and resource utilization. Provider networks and ACOs rely on advanced analytics to manage shared risk contracts and quality benchmarks.

Healthcare payers are adopting analytics rapidly, particularly for fraud detection, risk adjustment, and member engagement. Insurers analyze claims data to uncover anomalies, optimize reimbursements, and reduce overutilization. Payers also use predictive models for premium pricing, member retention, and chronic disease outreach.

Country-Level Analysis

United States

The United States leads the North American healthcare analytics market, accounting for the majority share. The U.S. boasts a highly complex healthcare system with massive volumes of data generated through EHRs, insurance claims, pharmacy records, and mobile health apps. Government incentives, like the CMS quality programs and MACRA, have spurred analytics adoption among providers.

Private insurers, hospital networks, and research institutions in the U.S. use analytics extensively for value-based contracting, clinical trial matching, and chronic care management. Companies such as UnitedHealth Group and Anthem have developed in-house analytics platforms that rival those of tech giants. The growth of health tech startups and the entrance of players like Google Health and Amazon further fuel innovation.

Canada

Canada is emerging as a strong secondary market, with provincial healthcare systems investing in data integration and analytics to improve public health delivery. Organizations like Canada Health Infoway are spearheading nationwide data initiatives, while individual provinces have launched population health dashboards and AI projects.

Hospitals in Ontario and British Columbia are deploying predictive analytics to manage emergency department flow and ICU occupancy. Although adoption has been slower due to stricter privacy laws and centralized healthcare governance, Canada's market is poised for rapid growth as funding and policy alignment improve.

Recent Developments

-

April 2025 – Cerner Corporation launched its new cloud-native analytics platform integrated with AI-driven clinical decision support for U.S. health systems.

-

March 2025 – IBM Watson Health announced collaboration with a Canadian public health agency to deploy predictive analytics for managing future pandemic preparedness.

-

February 2025 – Optum Analytics (UnitedHealth Group) rolled out an advanced revenue integrity tool using NLP to identify billing inconsistencies in real time.

-

January 2025 – Epic Systems upgraded its “Cognitive Computing Toolkit” to help physicians detect sepsis and deteriorating patient conditions 4–6 hours earlier.

-

December 2024 – McKesson Corporation introduced a suite of financial analytics tools aimed at pharmacy benefit managers and retail clinics.

Key North America Healthcare Analytics Companies:

- McKesson Corporation

- Optum, Inc.

- IBM

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- Elsevier

- Medeanalytics, Inc.

- Truven Health Analytics, Inc.

- Allscripts Healthcare Solutions, Inc

- Cerner Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America Healthcare Analytics market.

By Type

- Descriptive Analysis

- Predictive Analysis

- Prescriptive Analysis

By Component

- Software

- Hardware

- Services

By Delivery Mode

- On-premises

- Web-hosted

- Cloud-based

By Application

- Clinical

- Financial

- Operational and Administrative

By End-use

- Healthcare Payers

- Healthcare Providers

- Life Science Companies

By Regional