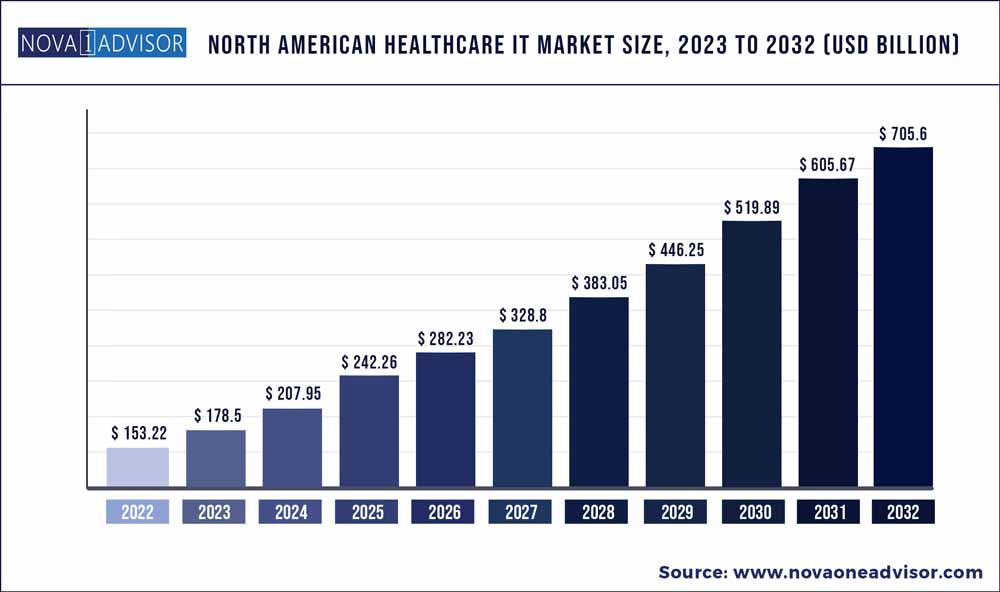

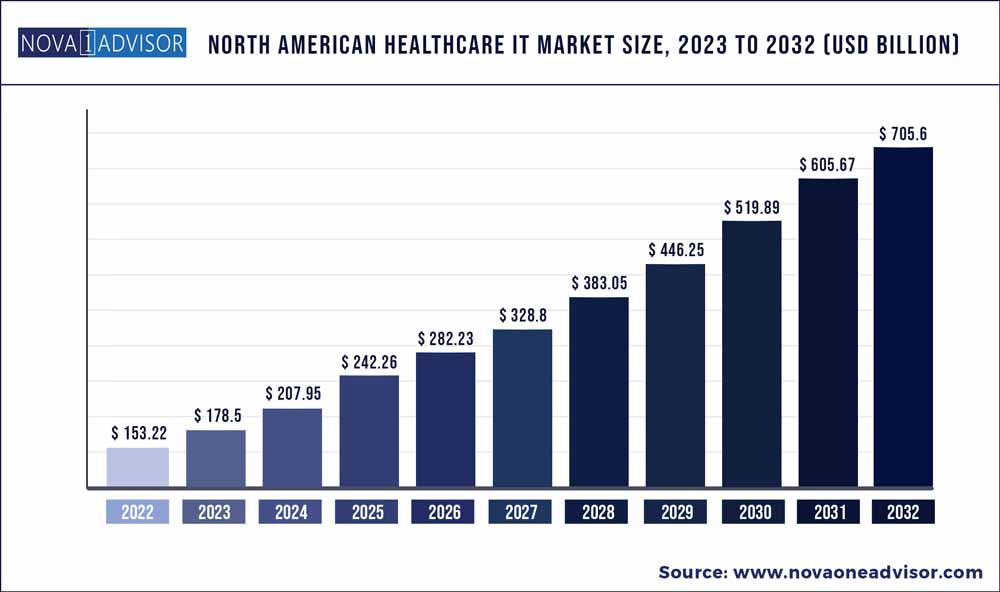

The North America healthcare IT market size was exhibited at USD 153.22 billion in 2022 and is projected to hit around USD 705.6 billion by 2032, growing at a CAGR of 16.5% during the forecast period 2023 to 2032.

Key Pointers:

- The market is segmented into healthcare provider solutions, healthcare payer solutions, and HCIT outsourcing services. In 2022

- The non-clinical solution segment is anticipated accounting for the largest share of the North America healthcare IT industry in 2022

- The services segment accounted for the largest market share in 2022.

- The market is segmented into healthcare providers and healthcare payers. In 2022

Report Scope of the North America healthcare IT Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 178.5 Billion

|

|

Market Size by 2032

|

USD 705.6 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 16.5%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Products and services, Components, and End users

|

The Market growth can be attributed to the growing need to adhere to regulatory guidelines, government initiatives for eHealth, high return on investment (ROI), and rising need to curtail the escalating healthcare costs. However, the lack of in-house IT knowledge and reluctance among end-users to adopt new methods are expected to restrain the overall market growth to a certain extent during the forecast period.

Based on products and services, the healthcare providers segment accounted for the largest share of the North America healthcare IT market in 2022

Based on products and services, the market is segmented into healthcare provider solutions, healthcare payer solutions, and HCIT outsourcing services. In 2022, the healthcare providers segment accounted for the largest share of the North America healthcare IT industry. The need to control the increasing healthcare costs and improve the efficiency of healthcare services by reducing medical errors are the major drivers that propel the demand for healthcare provider solutions.

The non-clinical solutions segment dominated the North America healthcare IT market

Based on the product, the non-clinical solution segment is anticipated accounting for the largest share of the North America healthcare IT industry in 2022. There is a high demand for non-clinical solutions as they increase operational efficiencies, maximize reimbursement, and improve the overall quality of care delivered in healthcare organizations.

By components, the services segment accounted for the largest market share in 2022

Based on components, the North America healthcare IT market is segmented into services, software, and hardware. The services segment accounted for the largest market share in 2022. This is due to the introduction of complex software, the need for integration and interoperability of software, and the growing demand for consulting and outsourcing of various healthcare processes such as revenue cycle management, EHR management, and fraud detection.

By end-user, the healthcare providers segment accounted for the largest share of the North America healthcare IT market in 2022

Based on end-user, the market is segmented into healthcare providers and healthcare payers. In 2022, the healthcare providers segment accounted for the largest share of the North America healthcare IT industry. This is attributed to government initiatives to improve the quality of patient care and the need to control growing healthcare costs & improve the efficiency of healthcare services.

North America will continue to dominate the North America healthcare IT market during the forecast period

The market, by country, is segmented into the US, Canada, and Mexico. US accounted for the largest share of the North America healthcare IT industry in 2022 due to stringent legislative and accreditation requirements regarding healthcare, high adoption rate of HCIT technologies, regulatory requirements regarding patient safety, and the presence of a large number of IT companies, such as EPIC Systems (U.S.), Cerner Corporation (U.S.), McKesson Corporation (U.S.), Infor, Inc. (U.S.), and Allscripts Healthcare Solutions, Inc.

Some of the prominent players in the North America healthcare IT Market include:

- Cerner Corporation (US),

- Allscripts Healthcare Solutions, Inc. (US),

- Epic Systems Corporation (US),

- Change Healthcare (US),

- Optum (US),

- McKesson Corporation (US),

- Oracle Corporation (US),

- GE Healthcare (US),

- Siemens Healthineers (Germany),

- Philips Healthcare (Netherlands),

- Athenahealth, Inc. (US),

- Infor, Inc. (US),

- Cognizant (US),

- Dell Technologies (US),

- CVS Health (US)

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor has segmented the North America healthcare IT market.

By products & services

- Healthcare Provider Solutions

- Clinical Healthcare It Solutions

- Ehrs/Emrs

- Pacs & Vna (Medical Image Management)

- Computerized Physician Order Entry Systems

- Clinical Decision Support Systems

- Eprescribing Solutions

- Radiology Information Systems

- Radiation Dose Management Solutions

- Specialty Information Management Systems

- Medical Image Analysis Systems

- Population Health Management Solutions

- Patient Registry Software

- Healthcare It Integration Systems

- Digital Pathology Solutions

- Practice Management Systems

- Laboratory Information Systems

- Mobile Health Solutions & Applications (Mhealth)

- Telehealth Solutions

- Cardiovascular Information Systems

- Infection Surveillance Solutions

- Non-Clinical Healthcare It Solutions

- Pharmacy Information Systems

- Medication Management Systems

- Barcode Medication Administration Systems

- Medication Inventory Management Systems

- Medication Assurance Systems

- Healthcare Asset Management Software

- Workforce Management Systems

- Revenue Cycle Management Solutions

- Medical Document Management Solutions

- Financial Management Systems

- Healthcare Information Exchanges

- Healthcare Interoperability Solutions

- Healthcare Quality Management Solutions

- Supply Chain Management Solutions

- Procurement Management Solutions

- Inventory Management Solutions

- Healthcare Analytics

- Clinical Analytics

- Financial Analytics

- Operational & Administrative Analytics

- Population Health Analytics

- Customer Relationship Management Solutions

- Healthcare Payer Solutions

- Pharmacy Audit & Analysis Systems

- Revenue Cycle Management Solutions

- Healthcare Analytics Solutions

- Member Eligibility Management Solutions

- Provider Network Management Solutions

- Payment Management Solutions

- Customer Relationship Management Solutions

- Population Health Management Solutions

- Hcit Outsourcing Services

- Provider Hcit Outsourcing Services

- Emr/Medical Document Management Services

- Pharmacy Information Management Services

- Laboratory Information Management Services

- Revenue Cycle Management Services

- Other Provider Outsourcing Services

- Payer Hcit Outsourcing Services

- Claims Management Services

- Integrated Front-End Services & Back-Office Operations

- Member Management Services

- Provider Network Management Services

- Billing & Accounts Management Services

- Analytics & Fraud Management Services

- Hr Services

- Operational Hcit Outsourcing Services

- Business Process Management Services

- Supply Chain Management Services

- Other Operational It Outsourcing Services

- It Infrastructure Management Services

By Components

- Services

- Software

- Hardware

By End-Users

- Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Home Healthcare Agencies, Nursing Homes, & Assisted Living Facilities

- Diagnostic & Imaging Centers

- Pharmacies

- Other Healthcare Providers

- Healthcare Payers

- Private Payers

- Public Payers

By Country