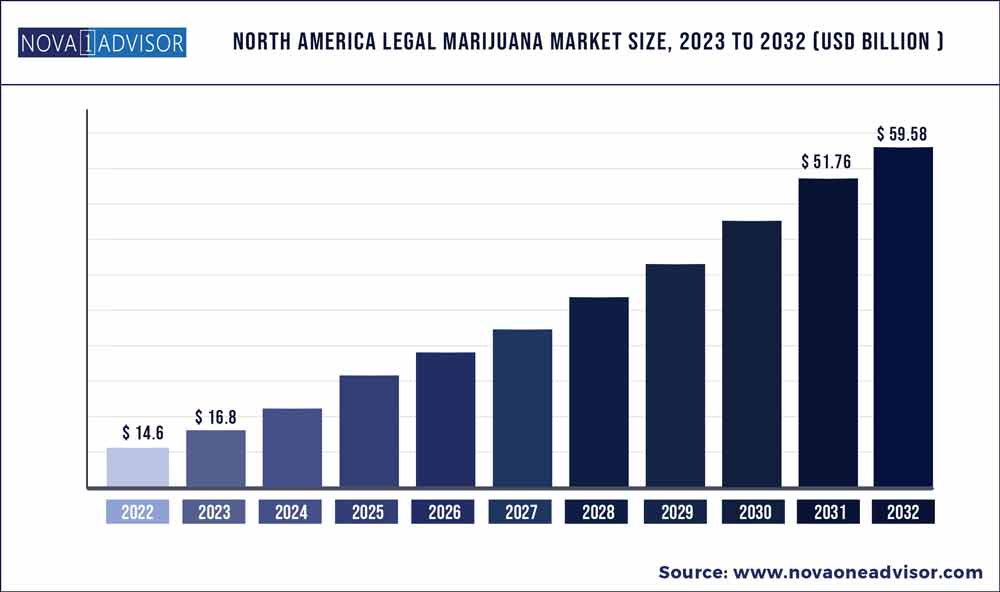

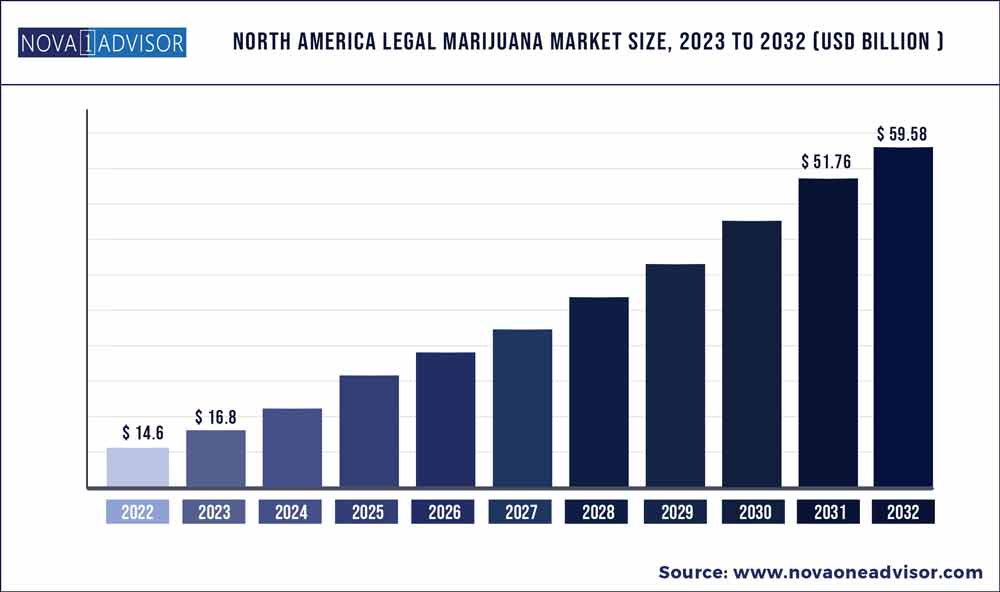

The North America legal marijuana market size was estimated at USD 14.6 billion in 2022 and is expected to surpass around USD 59.58 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 15.1% during the forecast period 2023 to 2032.

Key Takeaways:

- The legalization has allowed CBD oil to be used extensively in different medical applications, due to which it had the largest revenue share of 54.7% in 2022 and is anticipated to register the fastest growth rate of 15.5%.

- The legal marijuana market has been extensively used for treating chronic pain, and thus has the largest revenue share of 25.9% as of 2022.

- Tourette's syndrome is expected to register the fastest growth over the forecast period.

- Medical use with a revenue share of 78.6% in 2022, emerged to be the largest category.

- Adult use is anticipated to register the fastest growth rate of 19.11% during the forecast years.

- In 2022, U.S. accounted for the largest revenue share of 86.9%. One of the major factors driving the growth of the market

- During the forecast period, Canada is anticipated to register the fastest growth rate of 17.3%.

North America Legal Marijuana Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 16.8 Billion |

| Market Size by 2032 |

USD 59.58 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 15.1% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Product type, Marijuana type, Medical use, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Canopy Growth Corporation; Aphria, Inc.; Aurora Cannabis; Tilray; Organigram Holdings, Inc.; Lexaria Bioscience Corp.; ABcann Medicinals, Inc. (Part of Vivo Cannabis); The Cronos Group; Wayland Group Corp. (Maricann Group Inc.); CannTrust Holdings |

Increase in the legalization of cannabis has resulted in monumental growth of the market. People are becoming increasingly aware of the benefits and doctors are also prescribing marijuana-based medications to relieve symptoms of various diseases like epilepsy, Alzheimer’s, Parkinson’s, and even Tourette’s syndrome. Research and development surrounding uses and benefits have also gained traction and are also propelling growth.

Recently, the state of New Jersey granted legalization of recreational use of marijuana to be sold under federally regulated outlets. The increase in the legitimization of marijuana has greatly affected the growth of the market. Hence, health practitioners, physicians, and other authorized healthcare professionals can prescribe cannabis-based treatments for various indications. It has been a potent treatment for reducing nausea caused due to chemotherapy treatments, epileptic seizures as well as chronic pain, and other neurological diseases. Many reforms regarding the legalization of marijuana have been voted upon by the U.S. government which have the potential to make marijuana a federally legal drug. This has also had a positive impact on the growth of the industry.

At present, the medicinal products made from marijuana have also come under federally controlled substances. Cancer, chronic pain, Tourette’s, etc. are some of the conditions for which CBD products are routinely prescribed as alternate medications. The increasing prevalence of cancer and other chronic conditions is expected to drive the growth in North America. Medical practitioners are favoring the use of these products over conventional products since they are not habit-forming, all of these factors have been significant contributors to the growth of the market.

In the products category, the largest revenue share was held by the oil segment, since the region has legitimized medicinal use across the majority of the regions, CBD oil, and other derivatives containing oil extracted from marijuana have been the primary focus of the industry. It is also the fastest-growing category due to its high demand in various applications and its benefits over traditional prescription medicines, especially for chronic pain, nausea, and epileptic seizure, these have been key factors driving the growth of the market.

In the medical use segment, the chronic pain category had the largest market share in 2022. As studied and researched, CBD oil and other extracts from marijuana are potent in reducing the sensation of pain and are not habit-forming like pain medications, opioids, etc. The fastest-growing category has been the Tourette’s syndrome, even though marijuana is linked with creating a sense of euphoria which ideally should increase occurrences of tics in the disease, marijuana was studied to have reduced tics in Tourette’s patients. All these factors are key to the growth of the market.

In the marijuana type, medical use held the largest share and has contributed significantly to the overall market growth due to the high demand for these products for medical purposes across the region. However, recreational use has been gaining a lot of traction, this has been a result of recent legalizations across U.S. and Canada to curb the illicit trade of the drug in the region. A survey conducted by the Pew Research Center stated more than 60% of respondents felt that recreational use should be legalized in the U.S., these statistics prove that the wide general acceptance and demand has grown over time and is driving the growth of the market in North America.

COVID-19 pandemic saw an increase in demand for marijuana and it was stockpiled like an item of necessity during the initial phase of the pandemic. In Canada, more than 800 companies big and small are involved in the sale and processing of cannabis. A report by Deloitte Canada found that for every single USD, for revenue and capital expenditure, the cannabis industry adds USD 1.09 to the country’s GDP. It has created a plethora of jobs since the businesses have been legitimized. This has all contributed significantly to the growth of the market.

Product Insights

Marijuana can be used as whole flowers (dried) or as extracted oil, mostly containing CBD. The legalization has allowed CBD oil to be used extensively in different medical applications, due to which it had the largest revenue share of 54.7% in 2022 and is anticipated to register the fastest growth rate of 15.5%. Flowers are generally used for recreational purposes. The legalization in the U.S. is primarily for medicinal use which majorly uses CBD oil, a common extract or derivative from marijuana. CBD oil is extensively used in easing epileptic seizures, chronic pain, arthritic pain, nausea, etc., contributing significantly to the growth of the market.

Due to its prowess in varied applications, it is also the fastest-growing product type over the forecast period. The attitude of the medical fraternity toward legal cannabis has brought about a huge change in the market, which has resulted in more prescriptions with less skepticism, resulting in growth. North America is the forerunner in setting out clear regulations on the use and business surrounding marijuana. People are increasingly using CBD oils and other extracts for skincare products as well as the medical applications resulting in the growth of the market.

Medical Use Insights

The legal marijuana market has been extensively used for treating chronic pain, and thus has the largest revenue share of 25.9% as of 2022. Medical use has prompted physicians and medical practitioners to prescribe cannabis-based products for various medical conditions. CBD oil an extract from marijuana has been used for the treatment of various conditions.

Chronic pain treatment through CBD oil. For people suffering from chronic pain, rather than using regular pain medications, opioids which are both habit-forming, CBD oil provides an alternative to these providing better benefits by reducing pain perception and improving mood, thus driving the growth of the market.

Tourette's syndrome is expected to register the fastest growth over the forecast period. In a study conducted on 4 subjects, in contrast to its usual effects of euphoria, CBD help alleviates symptoms of Tourette’s. Cannabidiol which ideally should have exacerbated the symptoms was in contrast able to reduce tics in patients with Tourette’s.

The Tourette Association of America found that more than 45% of parents with children suffering from Tourette’s syndrome feel that the current medication for the symptoms is not adequate and additional research for better medication needs to be done. The association has funded 5 large-scale studies on the controlled use of medical marijuana in Canada, Israel, and the U.S.

Marijuana Type Insights

Medical use with a revenue share of 78.6% in 2022, emerged to be the largest category. The high rate of legalization across the U.S. and Canada has resulted in the growth of the market. According to New York Times, the sales of legal cannabis increased by 46% in 2020, in comparison to 2019, despite lockdowns. Several studies evaluating the benefits of marijuana have been conducted studying benefits in movement disorders in Huntington’s, Tourette's syndrome, and Parkinson’s disease. Apart from these, its use in relieving stress and anxiety has seen a jump in recent years.

Adult use is anticipated to register the fastest growth rate of 19.11% during the forecast years. The attitudes toward the use of cannabis have been changing, with more and more states across the U.S. granting legalization to recreational or adult-use marijuana, the growth has been substantial. The demand for the same has grown multi-fold. According to a survey done by the Pew Research Center, 60% of adults are in favor of legalizing recreational use, and a total of 91% of adults across the U.S. are in favor of legalizing marijuana for either medicinal use or recreational use.

The popularity of marijuana use varies according to age, an average of 7 in 10 adults under 30 are in favor of legalizing marijuana, whereas only 32% of adults above the age of 75 say it should be legal. All of these factors have been fueling the growth of the market in North America.

Country Insights

The changes in attitudes of government and people have helped the legal marijuana industry flourish in the U.S. and Canada. Both the countries have legalized marijuana for medical as well as recreational use, it is still a federally regulated drug. In 2022, U.S. accounted for the largest revenue share of 86.9%. One of the major factors driving the growth of the market is the presence of cannabis cultivators, and producers, which has created a steady supply chain as per the increasing demand for both medical as well as recreational use marijuana. The opening of several federally regulated retail outlets has also contributed to the market growth to a great extent.

During the forecast period, Canada is anticipated to register the fastest growth rate of 17.3%. Since its legalization recreational use has contributed a significant amount to the country’s GDP, a total of USD 43.5 billion. The booming industry has created upwards of 98,000 jobs and more than USD 15 billion in government taxes. The number of government-approved stores has to a great extent limited the use of illicit trade in marijuana buying and selling business across Canada. Above mentioned factors have had a lasting impact on the Canadian legal marijuana market and will continue to drive growth in this segment in the forecast period.

Key Companies & Market Share Insights

The legal marijuana business across North America has been proliferating at a fast pace, in line with recent legitimization, the growth of this industry has gained a lot of momentum. Government initiatives have led the small industry players to make space for themselves in this highly fragmented market. The presence of large and small players in the industry has given rise to a lot of competition and in turn has resulted in several mergers and acquisition activities, resulting in the positive growth of the overall market.

Furthermore, the introduction of new product categories has also gained a lot of traction and people across the region are using these products with unmatched enthusiasm, be it gummies, oils, tinctures, and pet food among others. This has resulted in massive growth across all segments of the legal marijuana market. Companies like Canopy Growth Corporation, Aphira, Inc. Tilray, and Lexaria Bioscience Corp. have dominated the industry. Some prominent players in the North America legal marijuana market include:

- Canopy Growth Corporation

- Aphria, Inc.

- Aurora Cannabis

- Tilray

- Organigram Holdings, Inc

- Lexaria Bioscience Corp.

- ABcann Medicinals, Inc. (Part of Vivo Cannabis)

- The Cronos Group

- Wayland Group Corp. (Maricann Group Inc.)

- CannTrust Holdings

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the North America Legal Marijuana market.

By Product Type

By Marijuana Type

By Medical Use

- Cancer

- Chronic Pain

- Depression and Anxiety

- Arthritis

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Post-Traumatic Stress Disorder (PTSD)

- Alzheimer’s

- Parkinson’s

- Tourette’s

- Others

By Regional