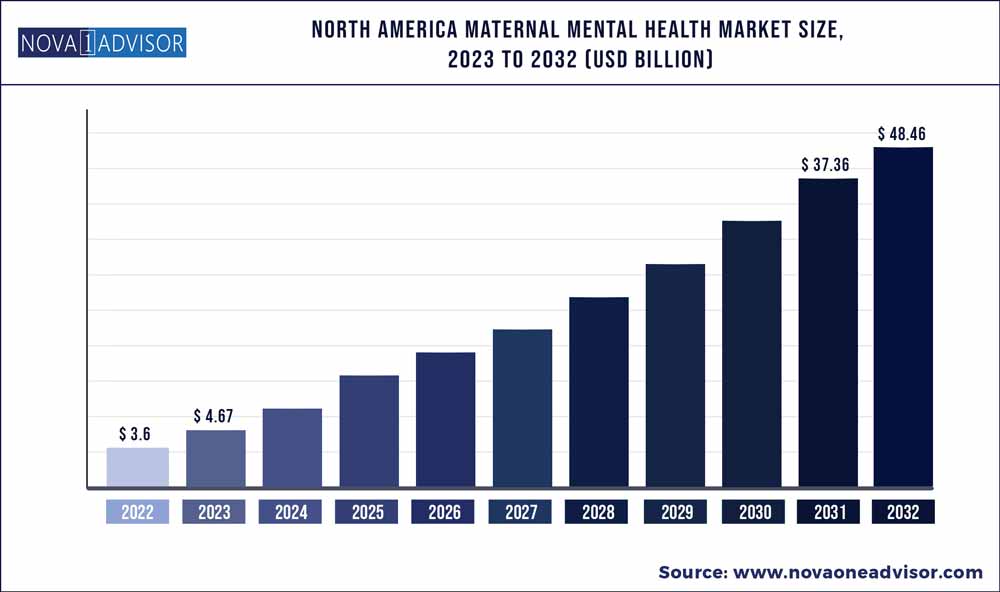

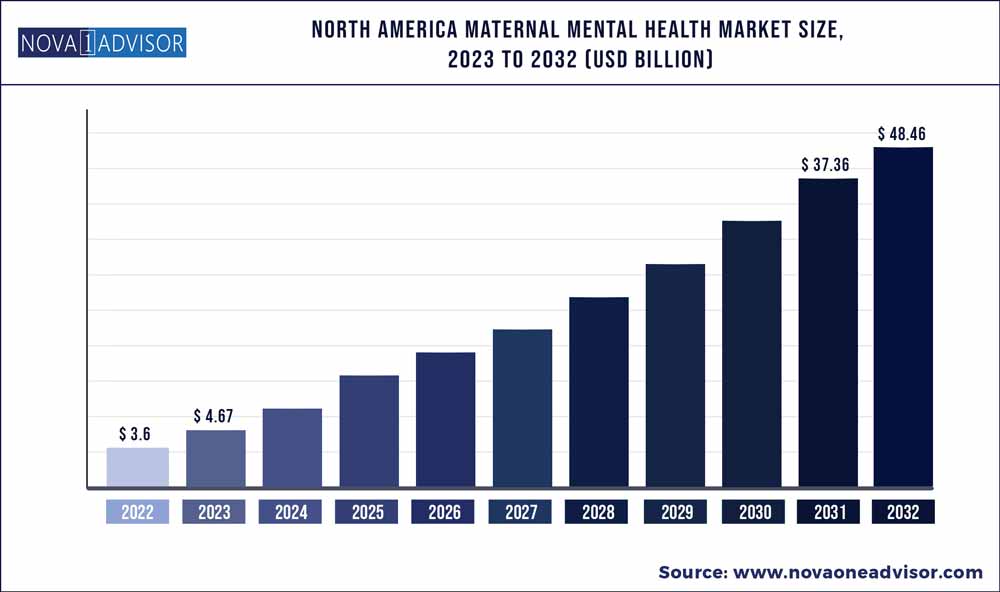

The North America maternal mental health market size was estimated at USD 3.6 billion in 2022 and is expected to hit around USD 48.46 billion by 2032, poised to reach at a notable CAGR of 29.69% during the forecast period 2023 to 2032.

Key Takeaways:

- Based on the disease indication, the pregnancy and postpartum general anxiety segment held a larger share of 34.80% in 2022.

- The interpersonal psychotherapy (IPT) segment held the largest share of 20.95% in 2022 and is expected to grow at the fastest CAGR during the forecast period.

- IPT dominated the market in 2022 as IPT is considered an effective therapy for treating a variety of mental conditions

- The U.S. led the regional market due to factors contributing such as robust government funding, increasing research, and the presence of prominent players

North America Maternal Mental Health Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 4.67 Billion |

| Market Size by 2032 |

USD 48.46 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 29.69% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Disease Indication, Therapy |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Therapy Mama; Canopie; Pfizer Inc; Viatris Inc.; GlaxoSmithKline Inc.; Alembic Pharmaceuticals Limited; Mallinckrodt Inc.; Sage Therapeutics, Inc.; Bausch Health Companies Inc.; Magellan Health, Inc. |

The rise in government funding to reduce maternal mortality, increasing incidence of post-partum depression, rise in awareness programs, and efforts to improve practices around maternal mental health are expected to be major driving factors for the market’s growth. Maternal mental health is crucial as it can impact both the mother's well-being as well as the overall development of the child.

According to the Maternal and Infant Health Assessment (MIHA) survey, one in five women in California, with a recent childbirth, reported symptoms during or after pregnancy that could be consistent with perinatal depression. That is approximately 100,000 women per year. The COVID-19 pandemic has had a profound impact on the mental health of pregnant women and new mothers in the United States.

The unique circumstances caused by the pandemic have introduced unprecedented challenges and stressors that have affected maternal mental well-being. One significant impact is the increased anxiety and fear experienced by pregnant women and new mothers. Concerns about contracting the virus, potential risks to their own as well as the health of their babies, and uncertainties considering the impact of COVID-19 on pregnancy and childbirth have led to heightened levels of anxiety and stress.

Moreover, significant improvement in the awareness programs along with government support are observed as future trends during the study period. The Collaborative Care Model is one of the most effective integrations of behavioral health and general medical services. The Washington State Mental Health Integration Program, Depression Initiative Across Minnesota Offering a New Direction (DIAMOND) project, and a depression care management project at the University of California, Davis are examples of successful implementations.

Although specific postpartum depression rates are unclear, there are certain estimates of the yearly prevalence of postpartum depression among women that are generally acceptable. According to reports, 10% to 20% of new mothers experience clinical postpartum depression of a certain type. In the year following childbirth, one in seven women may have postpartum depression, according to a recent study. Approximately 600,000 cases of postpartum depression are diagnosed each year in the United States, out of the approximately 4 million live births annually.

Furthermore, in September 2022, the March of Dimes launched the Innovation Fund. This venture philanthropy program will invest contributed funds in startup businesses addressing the most urgent problems in mother and infant health. March of Dimes may utilize this knowledge to invest in businesses that have viable ideas to enhance health outcomes and immediately impact the lives of mothers and babies through the Innovation Fund. The strategic investment fund is a new and novel approach that March of Dimes has identified to positively impact health equity, preterm birth, and maternal mortality, accompanying the organization's rich history and ongoing work in education, advocacy, programming, and research.

The quality and scalability of mental health care could be enhanced by unlocking the therapeutic effectiveness, which would also support patients on waiting lists and in between professional visits. For example, Woebot Health announced in January 2023 that the first patient had been enrolled in a pivotal clinical trial to assess the efficacy and safety of WB001, an investigational digital therapeutic for postpartum depression (PPD) that had been granted Breakthrough Device Designation by the U.S. Food and Drug Administration (FDA) in 2021. Women between the ages of 22 and 45 who had childbirth within the last three months and suffer from mild-to-moderate PPD are actively sought out for the multi-center, double-blind, randomized controlled research.

Disease Indication Insights

Based on the disease indication, the pregnancy and postpartum general anxiety segment held a larger share of 34.80% in 2022. According to a study published by the National Center for Biotechnology Information, in 2021, at least one in five women has postpartum anxiety. Treatments for anxiety disorders, such as obsessive-compulsive disorder (OCD), include cognitive behavioral therapy (CBT) and other therapies. Medication is beneficial for certain women and is more successful when used in conjunction with counseling. Benzodiazepines are quick-acting anti-anxiety drugs that are frequently used while waiting for the selective serotonin reuptake inhibitor (SSRI) to act. SSRIs are typically the first-line medications (and the best-studied pharmacological class) for anxiety disorders.

The PPD segment is expected to grow at the fastest CAGR during the forecast period. PPD in the U.S. is a mental well-being condition that affects certain women after giving birth. It is estimated that approximately 10-20% of women experience PPD in the U.S. Recognizing the importance of addressing PPD, healthcare providers and organizations in the U.S. have developed screening protocols, support programs, and mental health services to identify and treat affected women. Continuous government initiatives in the region will offer lucrative opportunities during the study period.

For instance, during 2020-2023, the Michigan Department of Health and Human Services (MDHHS) launched the Mother Infant Health & Equity Improvement Plan (MIHEIP). The Strategic Vision of the Improvement Plan is zero preventable deaths and zero health disparities. At the same time, the state has prioritized the expansion and implementation of universal screening for substance use disorder, employing advanced methods such as electronic screening and telehealth. In addition, MDHHS is trying to support the expansion of High Touch, High Tech (HT2) e-screening for behavioral and mental health, brief intervention, and linkage to services and resources. Currently, 12 prenatal care clinics and two family planning clinics have implemented HT2 statewide, with another six clinics working toward full implementation.

Therapy Insights

The interpersonal psychotherapy (IPT) segment held the largest share of 20.95% in 2022 and is expected to grow at the fastest CAGR during the forecast period. Interpersonal Psychotherapy (IPT) is a type of psychotherapy that focuses on improving interpersonal relationships and resolving interpersonal issues and hence is used as a first-line therapy for PPD.

IPT can be particularly beneficial as it addresses the specific interpersonal challenges that women may face during the perinatal period. In addition, IPT is widely accepted as an effective treatment approach for maternal mental health concerns, particularly perinatal mood disorders such as postpartum depression and anxiety, and especially for depressed breastfeeding women. It is recognized and recommended by various professional organizations and guidelines, such as the American Psychiatric Association (APA), the American College of Obstetricians and Gynecologists (ACOG), the National Institute for Health and Care Excellence (NICE), The Canadian Network for Mood and Anxiety Treatments (CANMAT), and Postpartum Support International (PSI)

Regional Insights

U.S. accounted for the largest revenue share of 90.68% in 2022 and is expected to grow at the fastest CAGR during the forecast period. Robust healthcare infrastructure, increasing incidence of PPD, favorable reimbursement scenario, and growing awareness programs are the major factors driving its growth.

In addition, in June 2022, the Arizona State Legislature passed House Bill 2863, which provided pregnant people who were eligible and enrolled under the state plan with 12 months of continuous eligibility. This bill contained a postpartum coverage extension for Medicaid enrollees. Implementation of such legislation will offer lucrative opportunities during the study period.

Key Companies & Market Share Insights

Key players are adopting various organic and inorganic strategies such as partnerships, mergers and acquisitions, geographical expansion, and strategic collaborations to expand their market presence. For instance, in March 2023, Maven Clinic acquired the digital health company Naytal to accelerate its development in the UK and throughout Europe. The acquisition will instantly augment Maven's ability to serve its growing membership in the UK and deliver on its promise of providing every family, everywhere, with access to high-quality personalized care. Some prominent players in the North America maternal mental health market include:

- Therapy Mama

- Canopie

- Pfizer Inc

- Viatris Inc.

- GlaxoSmithKline Inc.

- Alembic Pharmaceuticals Limited

- Mallinckrodt Inc.

- Sage Therapeutics, Inc.

- Bausch Health Companies Inc.

- Magellan Health, Inc.

- Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the North America Maternal Mental Health market.

By Disease Indication

- Postpartum Depression

- Dysthymia

- Pregnancy and Postpartum General Anxiety

- Pregnancy and Postpartum OCD

- Birth-Related PTSD

- Others

By Therapy

- Antidepressants

- Selective Serotonin Reuptake Inhibitors (SSRIs)

- Tricyclic Antidepressants (TCAs)

- Others

- Interpersonal Psychotherapy (IPT)

- Cognitive Behavioral Therapy (CBT)

- Others

By Regional

- North America

- U.S.

- Canada