North America Outdoor Furniture Market Size and Trends

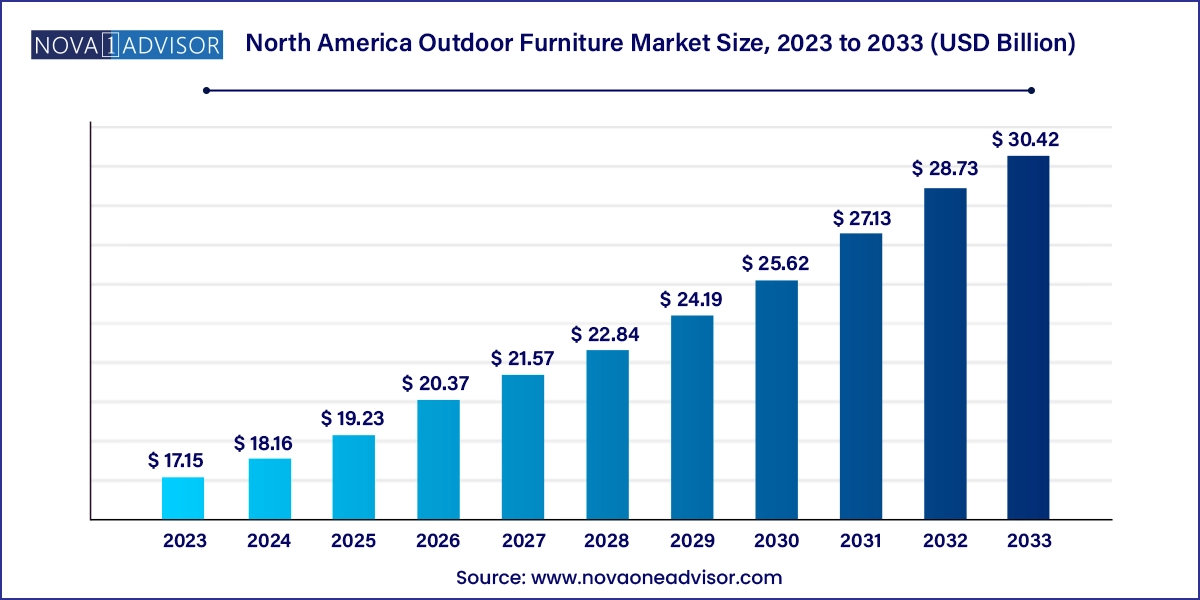

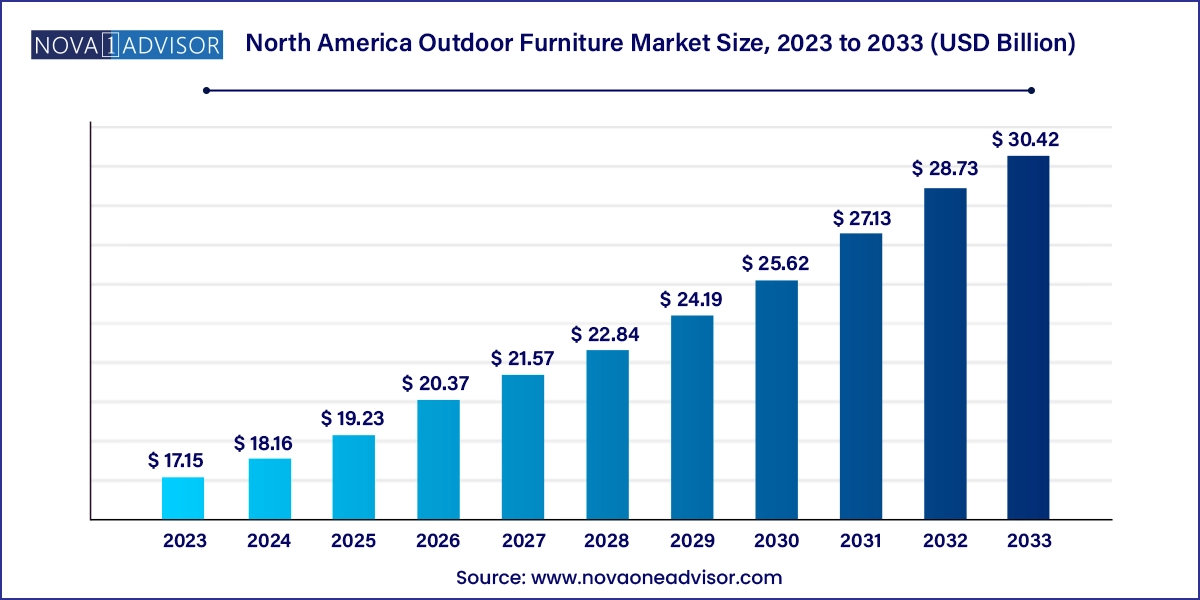

The North America outdoor furniture market size was exhibited at USD 17.15 billion in 2023 and is projected to hit around USD 30.42 billion by 2033, growing at a CAGR of 5.9% during the forecast period 2024 to 2033.

North America Outdoor Furniture Market Key Takeaways:

- The outdoor seating furniture market in North America accounted for a revenue share of 28% in 2023.

- The demand for outdoor tables in North America is projected to grow at a CAGR of 6.6% from 2024 to 2033.

- The North America wooden outdoor furniture market accounted for a revenue share of 66.0% in 2023.

- The demand for metal outdoor furniture market in North America is projected to grow at a CAGR of 6.0% from 2024 to 2033.

- The residential outdoor furniture market in North America accounted for a revenue share of 41.48% in 2023.

- The North America commercial outdoor furniture market is projected to grow at CAGR of 5.8% over the forecast period of 2024-2033.

Market Overview

The North America outdoor furniture market has emerged as a dynamic and steadily growing sector, underpinned by evolving lifestyle preferences, a growing emphasis on outdoor living, and increasing disposable income. As homeowners and businesses across the region seek to elevate the functionality and aesthetics of outdoor spaces, demand for stylish, durable, and weather-resistant furniture continues to rise. Outdoor furniture—which includes seating arrangements, dining setups, loungers, and more—is no longer considered a mere extension of indoor furnishings, but rather an essential component of residential and commercial design strategies.

A notable shift toward spending more time outdoors—whether for leisure, remote work, entertaining guests, or wellness activities—has made patios, balconies, gardens, and rooftops vital living zones in modern North American households. This cultural evolution is driving significant investment in outdoor furnishings that are both functional and design-forward. Homeowners are creating complete outdoor environments with comfortable seating, weather-proof dining areas, and even fire pit lounges and outdoor kitchens.

Commercial establishments, such as hotels, restaurants, resorts, and coworking spaces, are also actively upgrading their outdoor layouts to attract clientele with a better ambiance and experiential value. As climate-conscious consumers demand eco-friendly materials and multi-season durability, manufacturers are responding with innovative solutions, including sustainable woods, UV-resistant plastics, and rust-proof metal finishes.

Digitalization has further fueled this growth, with consumers able to browse, visualize, and order furniture online, often with virtual layout tools. The North American outdoor furniture industry is now poised for expansive growth, supported by strong demand from both urban and suburban areas and characterized by rapid innovations in materials, comfort, and style.

Major Trends in the Market

-

Homeowners Prioritizing Outdoor Living Spaces: Patios, backyards, and decks are being treated as integral living areas, driving investment in modular and luxurious furniture.

-

Growing Popularity of Eco-Friendly and Sustainable Materials: Use of FSC-certified wood, recycled plastics, and metal alloys with low environmental impact is on the rise.

-

Demand for Lightweight and Stackable Furniture: Space-conscious urban consumers are preferring collapsible, foldable, or stackable designs for easy storage and mobility.

-

Integration of Smart Features: Solar-powered tables, USB charging stations, and temperature-controlled seating are entering the mainstream market.

-

Bold and Customizable Aesthetics: Vibrant color palettes, mix-and-match cushions, and customizable fabrics are appealing to millennial and Gen Z buyers.

-

E-commerce Penetration and Virtual Showrooms: Online sales channels now offer AR/VR-based previews to help consumers envision products in their own outdoor spaces.

-

All-Weather Utility: Materials with resistance to sun, rain, mildew, and snow are increasingly demanded in both premium and budget segments.

-

Surge in Outdoor Work-from-Home Setups: Ergonomic, weather-friendly furniture for outdoor workstations is gaining traction in the post-pandemic hybrid work era.

Report Scope of North America Outdoor Furniture Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 18.16 Billion |

| Market Size by 2033 |

USD 30.42 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Material Type, End-use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. Canada, Mexico |

| Key Companies Profiled |

Ashley Furniture Industries, Inc.; Brown Jordan Inc.; Agio International Company, LTD.; Lloyd Flanders, Inc.; Barbeques Galore; Century Furniture LLC.; Kimball International Inc.; Andreu World; Homecrest Outdoor Living; Gloster |

Key Market Driver

Expansion of Outdoor Living as a Lifestyle Choice

A primary driver behind the sustained growth of the North America outdoor furniture market is the increased cultural and economic investment in outdoor living as a lifestyle. Across the U.S., Canada, and Mexico, outdoor spaces are no longer peripheral—they are being actively developed as comfort-rich zones for relaxation, work, wellness, and social interaction. Especially following the COVID-19 pandemic, consumer behavior has shifted significantly toward enhancing outdoor environments for family bonding, remote working, exercise, and entertainment.

In the U.S., for example, new suburban developments often include larger backyard spaces, reflecting the prioritization of outdoor living. This change has fueled demand for sophisticated furniture such as sectional sofas, convertible dining sets, and chaise lounges. Consumers are not only looking for comfort but also durability, innovation, and aesthetic harmony with their architectural style. These developments have made outdoor furniture a recurring investment rather than a seasonal purchase, contributing to market consistency.

Key Market Restraint

Exposure to Climate Extremes and Maintenance Burden

One of the key restraints faced by the North American outdoor furniture market is the challenge posed by climate variability and associated maintenance costs. Outdoor furniture, regardless of material, faces degradation from prolonged exposure to UV radiation, rain, snow, and humidity. This is especially pronounced in regions with harsh winters like Canada and the northern U.S., where furniture often has to be stored indoors for months or requires special weather-proof covers.

Even in sunnier climates, such as the American Southwest, extreme heat and UV exposure can cause warping, fading, or cracking. As a result, consumers are sometimes hesitant to invest in high-end outdoor furniture due to concerns about long-term durability and upkeep. The need for periodic maintenance—such as resealing wood, rust-proofing metals, or replacing faded cushions—adds an operational burden that not all consumers are willing to bear. This restrains market growth, especially among entry-level buyers.

Key Market Opportunity

Commercial Expansion in the Hospitality and Urban Development Sectors

An emerging opportunity within the North America outdoor furniture market lies in the expanding hospitality, urban development, and entertainment sectors. As cities and towns revitalize public spaces and commercial developers build hospitality-centric environments, demand for high-quality outdoor furnishings for rooftops, plazas, restaurants, and resort lounges is rapidly growing.

Restaurants across urban hubs like New York, Toronto, and Mexico City are investing in outdoor seating and open-air dining to enhance capacity and customer experience. Likewise, rooftop lounges, outdoor coworking zones, and mixed-use development projects are focusing on durable, stylish, and modular furniture that complements contemporary design philosophies. The opportunity also extends to municipal governments revamping parks and recreational zones with ergonomic benches, outdoor cafes, and amphitheater-style seating. Manufacturers that can deliver contract-grade products tailored to commercial aesthetics and usage patterns will be well-positioned to tap into this lucrative segment.

North America Outdoor Furniture Market By Product Insights

The outdoor seating furniture market in North America accounted for a revenue share of 28% in 2023. as consumers prioritize comfort and versatility in their outdoor living spaces. These sets—often comprising cushioned chairs, ottomans, and coffee tables—allow users to create cohesive lounge environments for social gatherings, relaxation, or personal leisure. In suburban U.S. neighborhoods and upscale Canadian developments, homeowners are favoring sectional seating that can adapt to various layouts and accommodate larger groups. Brands such as POLYWOOD and Brown Jordan are catering to this demand by offering customizable sets with weatherproof materials and luxury finishes.

Loungers are the fastest-growing segment within the product category, especially in coastal regions and hospitality spaces. Their popularity has surged due to increasing emphasis on wellness and sunbathing. Poolside lounges, reclining chaise sets, and zero-gravity loungers are now integral features in private homes, hotels, and health retreats. In California and Florida, consumers are investing in temperature-regulated loungers with UV-protective fabric for extended outdoor relaxation. The rising appeal of home spas, personal wellness zones, and rooftop tanning decks has made loungers a high-demand, premium-value item.

North America Outdoor Furniture Market By Material Type Insights

The North America wooden outdoor furniture market accounted for a revenue share of 66.0% in 2023. celebrated for its timeless appearance, strength, and eco-conscious appeal. Teak, cedar, and acacia are commonly used in high-end furniture offerings, particularly in residential patios and luxury hospitality venues. American consumers, especially in the Pacific Northwest and Midwest, value wood for its organic charm and sustainability credentials. However, there is a strong emphasis on maintenance, as consumers seek pre-treated or engineered wood options that resist decay and weathering.

Plastic is emerging as the fastest-growing material, thanks to its affordability, ease of molding into creative shapes, and technological advances in recycled polymers. Innovations in HDPE (High-Density Polyethylene) and synthetic resin wicker are helping plastic furniture mimic the look of wood or metal without the associated weight or cost. The material is highly preferred in Mexican resort towns, Canadian patios with extreme weather fluctuations, and budget-conscious segments in the U.S. Moreover, the growing use of ocean-bound and post-consumer plastics is helping manufacturers tap into sustainability-driven markets with circular economy initiatives.

North America Outdoor Furniture Market By End-use Insights

The residential outdoor furniture market in North America accounted for a revenue share of 41.48% in 2023. driven by the rising number of homeowners investing in backyard upgrades, balcony décor, and patio makeovers. Suburban expansion, work-from-home culture, and growing household income have all contributed to the creation of multifunctional outdoor zones. Families are installing dining sets for alfresco meals, hammocks for reading corners, and full lounge areas for evening entertainment. Residential customers also show interest in decorative additions like fire pits, pergolas, and garden swings that complement furniture arrangements.

The North America commercial outdoor furniture market is projected to grow at CAGR of 5.8% over the forecast period of 2024-2033. particularly in hospitality, real estate, and urban planning sectors. Outdoor dining has become a standard across restaurants in post-pandemic North America. Hotels are upgrading outdoor lounges, rooftop bars, and beachfront areas with durable, designer-grade furnishings. In Canada and the U.S., shopping malls and urban plazas are incorporating ergonomic benches and communal seating for better foot traffic engagement. Meanwhile, commercial co-living and rental developments in Mexico are integrating shared outdoor furniture into common areas to attract tenants seeking lifestyle amenities.

Country Insights

United States

The U.S. leads the North American outdoor furniture market, driven by strong homeownership rates, an affinity for outdoor living, and widespread suburban growth. States like California, Texas, and Florida are hotspots for premium outdoor setups, while colder states see a preference for foldable and storable designs. E-commerce giants and specialty retailers like Wayfair, Home Depot, and RH dominate distribution, often offering extensive customization options.

Canada

Canada’s market is shaped by seasonal variations, with a concentrated demand during spring and summer. Consumers often seek foldable or weather-resistant furniture that can be easily stored in the off-season. Modular designs, fire pit furniture, and eco-friendly wooden sets are popular, especially in provinces like British Columbia and Ontario. Sustainability and minimalist design are key drivers of consumer preference.

Mexico

In Mexico, the market is driven by the tourism and hospitality sectors. Outdoor furniture is in high demand in resorts, beachfront properties, and luxury real estate developments. Mexican consumers also value brightly colored, hand-crafted furniture that reflects local cultural aesthetics. Durable plastic and metal furniture is commonly used in public plazas, hotels, and cafes to handle heat and humidity.

Some of the prominent players in the North America outdoor furniture market include:

- Ashley Furniture Industries, Inc.

- Brown Jordan Inc.

- Agio International Company, LTD.

- Lloyd Flanders, Inc.

- Barbeques Galore

- Century Furniture LLC.

- Kimball International Inc.

- Andreu World

- Homecrest Outdoor Living

- Gloster

North America Outdoor Furniture Market Recent Developments

-

February 2024: POLYWOOD launched a new line of outdoor dining sets made entirely from ocean-bound plastic waste, targeting eco-conscious U.S. and Canadian consumers.

-

January 2024: Brown Jordan introduced a modular lounge collection designed specifically for commercial hospitality spaces in Mexico and the southern U.S., combining design elegance with commercial-grade durability.

-

November 2023: Home Depot partnered with AR startup DecoFit to launch an app that allows U.S. customers to visualize outdoor furniture in their actual backyard using augmented reality.

-

October 2023: IKEA Canada expanded its ÄPPLARÖ outdoor collection to include more weather-resistant materials, responding to consumer feedback from colder provinces.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America outdoor furniture market

By Product

- Seating Sets

- Loungers

- Dining Sets

- Chairs

- Table

- Others

By Material Type

By End Use

By Regional