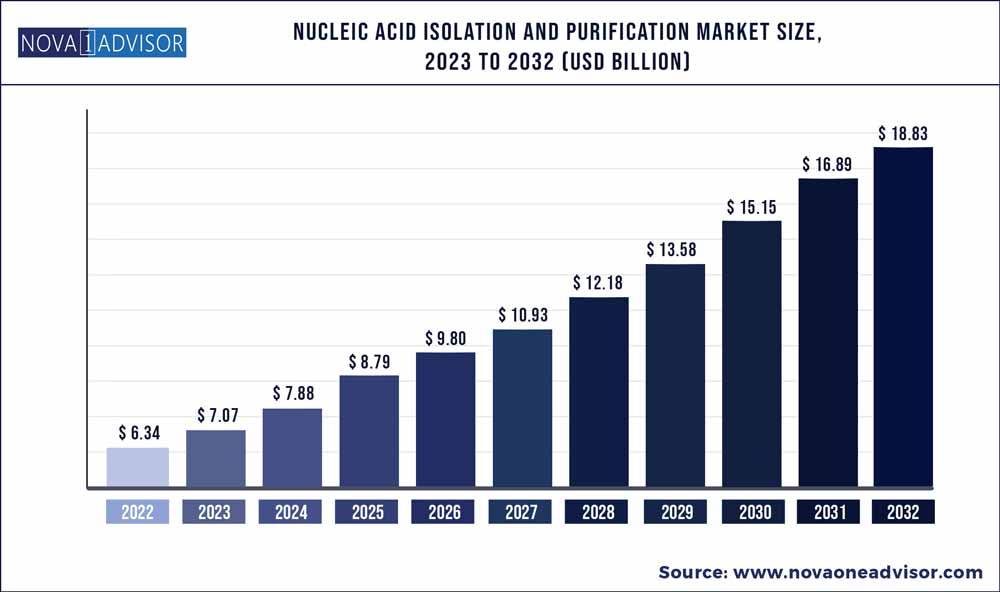

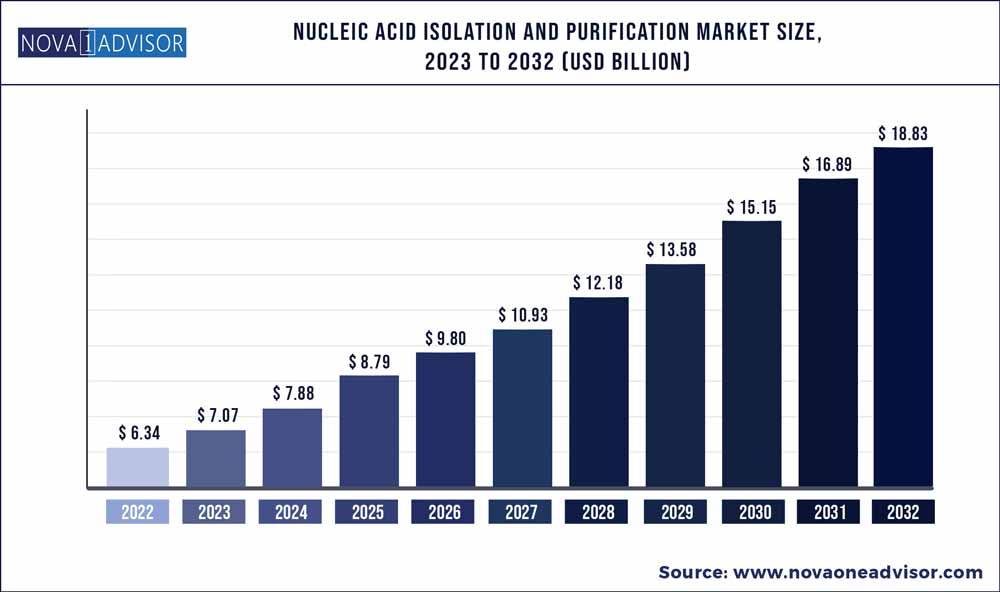

The global nucleic acid isolation and purification market size was exhibited at USD 6.34 billion in 2022 and is projected to hit around USD 18.83 billion by 2032, growing at a CAGR of 11.5% during the forecast period 2023 to 2032.

Key Pointers:

- The kits and reagents segment dominated the market for nucleic acid isolation and purification in 2022 and accounted for the largest revenue share of 79.2%.

- The instruments segment is expected to witness the fastest CAGR of 12.7% over the forecast period.

- The RNA isolation and purification segment dominated the market for nucleic acid isolation and purification and accounted for the largest revenue share of 55.6% in 2022

- DNA isolation and purification is expected to witness lucrative growth of 13.6% during the forecast period.

- The diagnostics segment accounted for the largest revenue share of 37.3% in 2022.

- The drug discovery and development segment is expected to witness a lucrative growth rate of 12.2% over

- The hospitals and diagnostic centers segment dominated the market for nucleic acid isolation and purification and accounted for the largest revenue share of 35.6% in 2022

- Pharmaceutical and biotechnology companies are anticipated to witness the fastest growth rate of 11.9% during the forecast period.

- North America dominated the market for nucleic acid isolation and purification and held the largest revenue share of 38.9% in 2022.

- Asia Pacific is the fastest-growing region in the nucleic acid isolation and purification market.

Nucleic Acid Isolation And Purification Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 7.07 Billion |

| Market Size by 2032 |

USD 18.83 Billion |

| Growth Rate from 2023 to 2032 |

CAGR of 11.5% |

| Base year |

2022 |

| Forecast period |

2023 to 2032 |

| Segments covered |

Product, Type, Method, Application, End-use |

| Regional scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key companies profiled |

QIAGEN; Thermo Fisher Scientific, Inc.; Illumina, Inc.; Danaher; F. Hoffmann-La Roche AG; Merck KGaA; Agilent Technologies; Bio-Rad Laboratories, Inc.; Takara Bio, Inc.; Promega Corporation; New England Biolabs; LGC Limited; Abcam plc; Norgen Biotek Corp; AutoGen, Inc.; Biogenuix; PCR Biosystems, Inc.; MagGenome; Apical Scientific Sdn. Bhd; MACHEREY-NAGEL GmbH & Co. KG |

Key drivers contributing to the market growth are the rise in adoption of sequencing platforms in clinical diagnostics, growth in genomics and enzymology-based research, and increasing investments in R&D pertaining to molecular biology and precision medicine.

The growing collaborations between different companies and organizations in the biotech industry is one of the factors driving the market. For instance, in March 2022, Zymo Research and Tecan partnered to introduce ready-to-use processing products that can streamline DNA or RNA extraction from COVID-19 specimens. The new DreamPrep NAP workstation assists laboratories to effectively and rapidly scale lab testing to provide a larger number of tests, consequently helping in mitigating the spread of the virus.

The development of personalized medicine is another important factor that drives revenue generation in the market for nucleic acid isolation and purification. Next Generation Sequencing (NGS) is becoming increasingly popular in cancer tumor biopsies. Liquid biopsies are an attractive option for cancer diagnostics because the process employs a simple and routine test that can detect cancer at an early stage.

Early diagnosis of cancer is the biggest challenge, and NGS can help effectively tackle the problem, increasing the demand for NGS technology. Therefore, an increase in the use of NGS technology is anticipated to directly impact the adoption of nucleic acid isolation and purification techniques.

Formalin-Fixed Paraffin-Embedded (FFPE) samples that are considered important in determining molecular correlates of carcinogenesis require labor-intensive nucleic acid purification for the sample, and such protocols also damage the nucleic acids. To combat such challenges companies are launching new extraction kits for efficient recovery of nucleic acids.

For instance, in March 2022, Purigen Biosystems, Inc. launched the Ionic FFPE Complete Purification Kit for recovering RNA/DNA from FFPE tissue samples in a single workflow. It helps in streamlining the workflow by reducing hands-on time by around 78% when compared to the manual column or bead-based methods. Hence, such advancements are further boosting the market growth.

Furthermore, the COVID-19 pandemic is acting as a positive catalyst for the growth of the market for nucleic acid isolation and purification. Researchers and companies across the world are focusing on developing specific assays and kits for rapid detection of SARS-CoV-2. For instance, in June 2020, Omega Bio-tek, Inc. launched Mag-Bind Viral RNA Xpress Kit for efficient and rapid isolation of viral RNA. In addition, the company also announced to have a production capacity of 6 million tests per month which brought a dramatic increase in the production capacities.

Some of the prominent players in the Nucleic Acid Isolation And Purification Market include:

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher

- F. Hoffmann-La Roche AG

- Merck KGaA

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Takara Bio, Inc.

- Promega Corporation

- New England Biolabs

- LGC Limited

- Abcam plc

- Norgen Biotek Corp

- AutoGen, Inc.

- Biogenuix

- PCR Biosystems, Inc.

- MagGenome

- Apical Scientific Sdn. Bhd

- MACHEREY-NAGEL GmbH & Co. KG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Nucleic Acid Isolation And Purification market.

By Product

- Kits & Reagents

- Instruments

By Type

- DNA Isolation & Purification

- Genomic DNA Isolation & Purification

- Plasmid DNA Isolation & Purification

- Viral DNA Isolation & Purification

- Other

- RNA Isolation & Purification

- miRNA Isolation & Purification

- mRNA Isolation & Purification

- Total RNA Isolation & Purification

- Other

By Method

- Column-based

- Magnetic Beads

- Reagent-based

- Others

By Application

- Precision Medicine

- Diagnostics

- Drug Discovery & Development

- Agriculture and Animal Research

- Other Applications

By End-use

- Academic Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Hospitals and Diagnostic Centers

- Other End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)