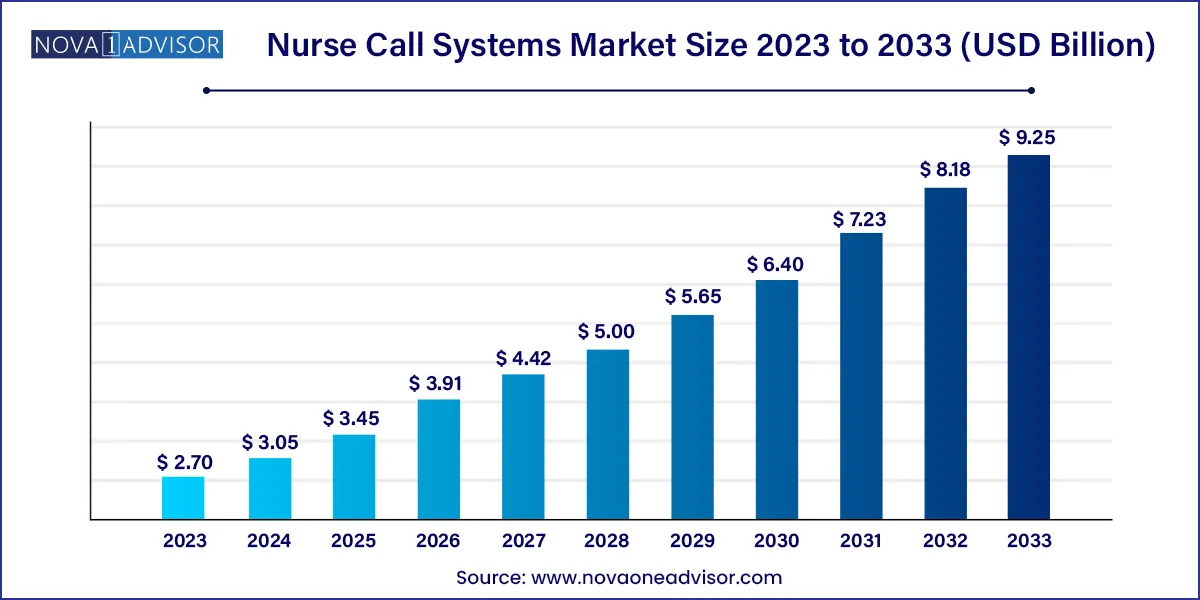

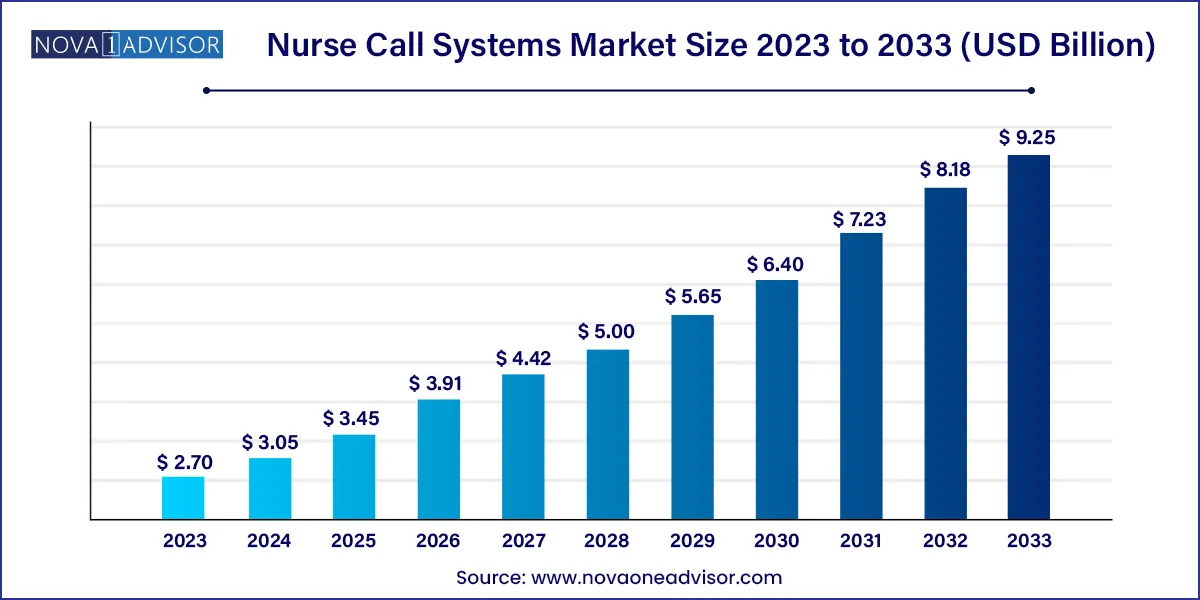

The global nurse call systems market size was exhibited at USD 2.70 billion in 2023 and is projected to hit around USD 9.25 billion by 2033, growing at a CAGR of 13.11% during the forecast period 2024 to 2033.

Key Takeaways:

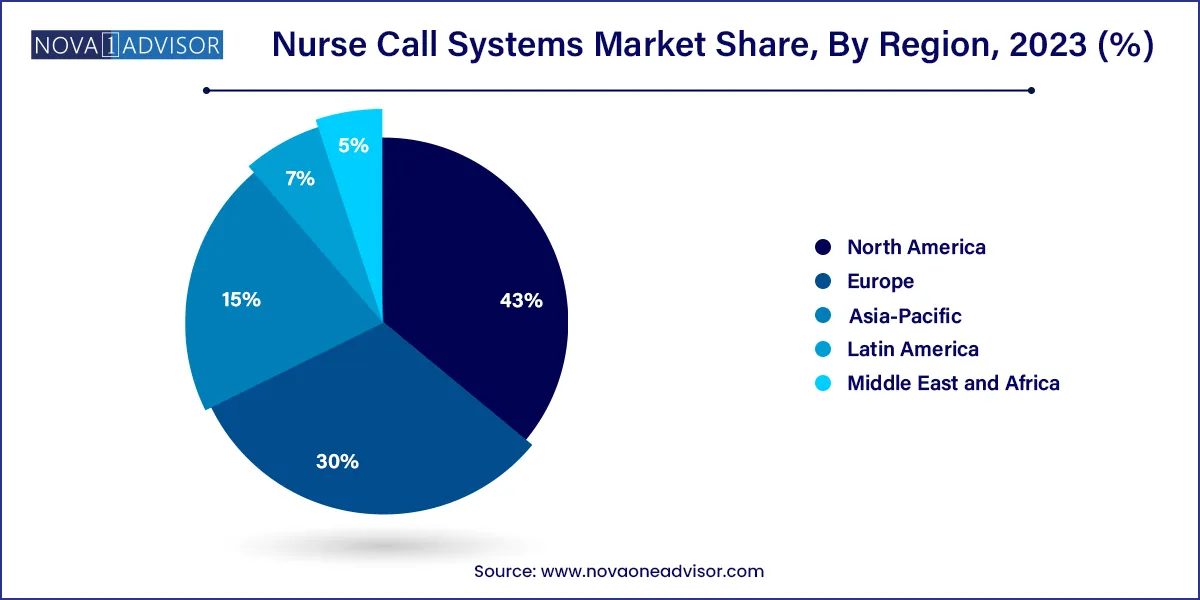

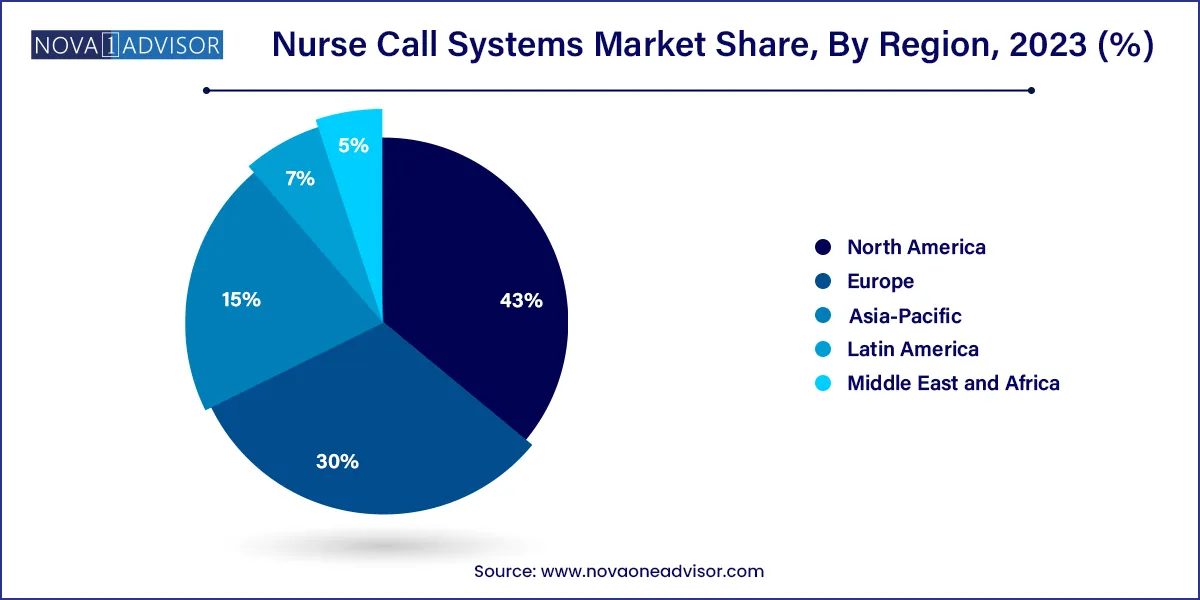

- North America dominated the overall market with a revenue share of over 43.0% in 2023.

- The wired communication equipment segment held the largest revenue share of over 53.9% in 2023.

- The integrated communication systems dominated the market in 2023 with a revenue share of over 26.3%.

- The wanderer control segment accounted for the largest revenue share of over 34.7% in 2023.

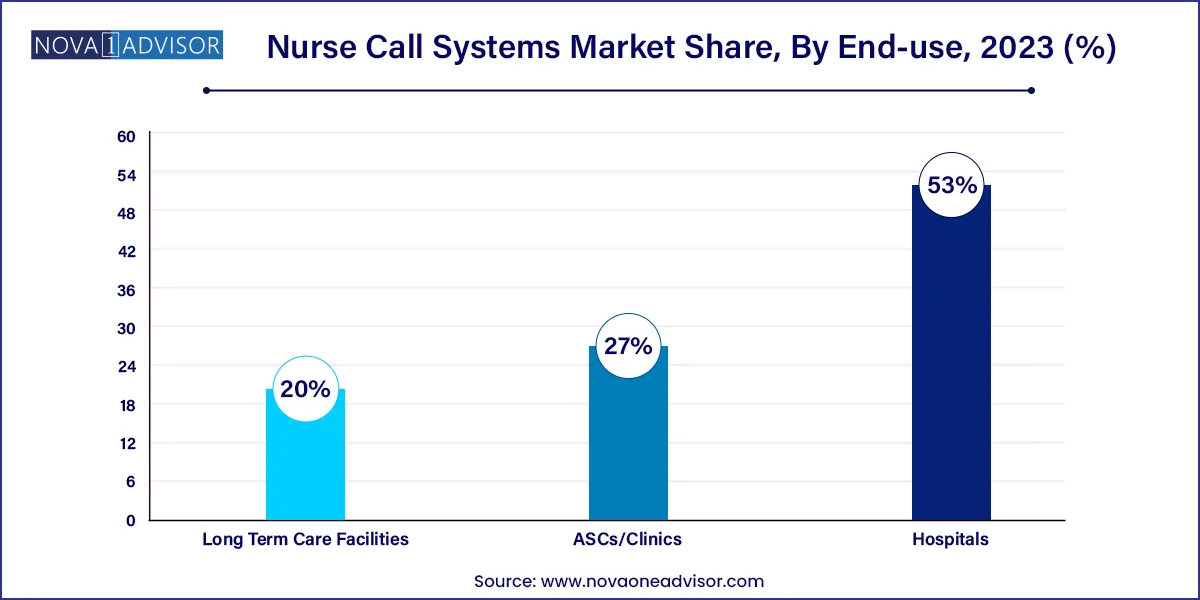

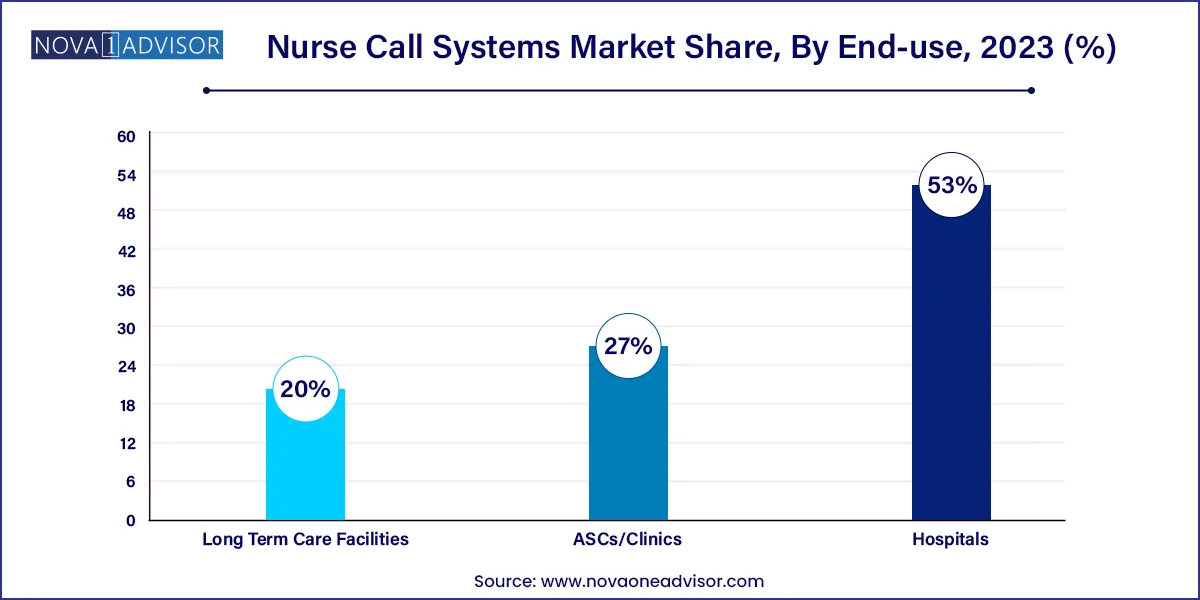

- The hospital segment held the largest revenue share of over 53.0% in 2023.

Market Overview

The global nurse call systems market plays a pivotal role in modern healthcare infrastructure, functioning as an essential communication channel between patients and caregivers. Originally conceptualized for patient alert systems, nurse call solutions have evolved into comprehensive, integrated communication platforms that enhance workflow efficiency, ensure patient safety, and improve staff coordination. Rising demand for quality care, especially among geriatric and chronically ill populations, has pushed healthcare providers to adopt more responsive and intelligent nurse call technologies.

Hospitals, long-term care facilities, and ambulatory surgical centers rely on nurse call systems for timely patient assistance, emergency alerts, fall prevention, and coordination of care. The increasing burden on nursing staff, exacerbated by global healthcare workforce shortages, is further driving the demand for smart solutions that automate routine processes and optimize workflow. As healthcare delivery becomes more digital, nurse call systems are being integrated with real-time location systems (RTLS), electronic health records (EHR), and mobile health apps, transforming them into critical tools for patient-centered care delivery.

Major Trends in the Market

-

Shift from analog to digital nurse call systems

-

Integration of nurse call platforms with mobile devices and smartphones

-

Adoption of wireless and cloud-based communication systems

-

Real-time location tracking integrated into nurse call workflows

-

Growing use of AI-driven alerts and patient prioritization algorithms

-

Customization for long-term and home healthcare environments

-

Increased demand for modular systems and scalable architecture

-

Interoperability with EHRs and hospital information systems (HIS)

-

Expansion of voice-assisted and touchless communication tools

-

Regulatory emphasis on patient safety and healthcare quality standards

Nurse Call Systems Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.05 Billion |

| Market Size by 2033 |

USD 9.25 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 13.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Tyco SimplexGrinnell; Hill-Rom Holding, Inc.; Rauland-Borg Corporation; Honeywell International, Inc.; Ascom Holding; TekTone Sound and Signal Mfg., Inc.; Azure Healthcare; Stanley Healthcare; Critical Alert Systems LLC; West-Com Nurse Call Systems, Inc.; JNL Technologies; Cornell Communications. |

Key Market Driver: Aging Population and Rise in Chronic Diseases

A significant driver for the nurse call systems market is the growing elderly population and the rising incidence of chronic illnesses. Globally, the number of people aged 65 and above is increasing rapidly, with projections estimating over 1.5 billion seniors by 2050. This demographic shift places a heavy burden on healthcare services, particularly in long-term and assisted living facilities where constant patient monitoring and rapid response are essential.

Nurse call systems offer elderly and chronically ill patients a direct lifeline to care providers, allowing immediate help requests in case of discomfort, falls, or medical emergencies. These systems also support staff in managing time-sensitive needs efficiently. As the prevalence of Alzheimer’s, cardiovascular diseases, and mobility-related issues rises, nurse call systems are becoming indispensable in ensuring safety, independence, and improved outcomes for aging populations.

Key Market Restraint: High Installation and Maintenance Costs

While the benefits of advanced nurse call systems are substantial, their high initial installation and maintenance costs act as a significant restraint, particularly for smaller clinics and rural healthcare facilities. Comprehensive wired systems require infrastructural changes, cabling, and specialized installation, which can be cost-prohibitive. Moreover, upgrading legacy systems to integrate with current hospital management software adds to the complexity and expense.

In addition to the hardware costs, ongoing software updates, service contracts, and staff training requirements increase the total cost of ownership. This financial burden often leads to delayed adoption in low- and middle-income countries where healthcare budgets are limited. Without policy-level incentives or reimbursement schemes, market penetration in these regions remains a challenge.

Key Market Opportunity: Wireless and Cloud-Based System Expansion

The advent of wireless and cloud-based communication technologies presents a transformative opportunity in the nurse call systems market. Wireless platforms significantly reduce installation complexity and cost, enabling faster deployment and scalability. They are particularly suitable for retrofitting older buildings and expanding long-term care or home healthcare facilities without major construction.

Cloud-based systems allow centralized management, data analytics, and integration with mobile apps. Real-time alerts can be routed directly to smartphones or wearable devices of nurses and caregivers, reducing response time and enhancing accountability. Additionally, remote monitoring and predictive maintenance powered by IoT sensors ensure system reliability. As the healthcare industry increasingly embraces digital transformation, cloud and wireless nurse call systems will unlock new growth avenues.

Segments Insights:

By Technology Insights

Wired communication equipment dominates the market, particularly in large hospitals and academic medical centers where reliability and security are paramount. Wired systems are known for their stable performance and are less susceptible to interference. In critical care environments where seamless communication is non-negotiable, wired nurse call systems provide high-quality service and compliance with stringent regulations.

Wireless communication equipment is the fastest-growing segment, fueled by its flexibility, cost-efficiency, and adaptability in various care settings. Wireless systems are ideal for long-term care homes, temporary healthcare facilities, and areas with evolving infrastructure needs. The ability to integrate wireless nurse call solutions with mobile phones, tablets, and cloud platforms is accelerating adoption across healthcare networks seeking rapid deployment and expansion.

By Type Insights

Integrated communication systems dominate the market, offering multi-functional capabilities including patient calling, staff communication, emergency alarms, and workflow management. These systems streamline operations in complex healthcare settings and improve interdepartmental coordination. Their ability to integrate with hospital information systems makes them the first choice for institutions aiming to enhance operational efficiency.

Mobile systems are emerging as the fastest-growing type, driven by the proliferation of smartphones and mobile-first software interfaces. Mobile nurse call apps allow healthcare professionals to receive alerts, prioritize tasks, and document care activities in real time. These systems are especially useful in homecare and ambulatory settings where mobility is essential and infrastructure is minimal.

By Application Insights

Alarms & communications remain the primary application segment, accounting for the largest market share. This includes patient-initiated call buttons, bed exit alarms, and emergency pull cords. Their role in ensuring immediate communication between patients and staff underpins their continued dominance, especially in high-acuity care environments.

Fall detection and prevention is the fastest-growing application, due to heightened awareness of patient safety and regulatory scrutiny. Advanced nurse call systems now incorporate sensors and analytics to detect bed exits, sudden movements, or falls. These proactive features are gaining favor in eldercare and rehabilitation settings where fall incidents are frequent and costly.

By End-use Insights

Hospitals dominate the nurse call systems market, owing to their need for large-scale, integrated communication networks. Hospitals use these systems to support acute care, surgical recovery, and maternity wards, with features such as room-level monitoring and staff workflow tracking. Given the increasing patient volumes and demand for shorter response times, hospitals invest heavily in robust nurse call infrastructure.

Long-term care facilities represent the fastest-growing end-use segment, attributed to the global aging population and the rise in chronic care needs. These facilities require tailored nurse call systems that offer high accessibility, easy-to-use interfaces, and integration with mobility aids. Wireless, voice-activated, and wanderer control features are especially valued in senior care homes.

By Regional Insights

North America holds the largest share of the global nurse call systems market, led by the U.S. where high healthcare expenditure, robust regulatory frameworks, and early technology adoption prevail. The presence of leading players, extensive hospital networks, and mandatory patient safety compliance fuel steady demand. Furthermore, ongoing modernization projects across veteran hospitals and nursing homes are accelerating upgrades to smart nurse call platforms.

Asia-Pacific is the fastest-growing region, supported by increasing healthcare investments, expanding hospital infrastructure, and rising elderly populations in countries like China, Japan, and India. Governments are prioritizing digital healthcare, and private hospitals are adopting modular and wireless nurse call systems for scalability. Urbanization and medical tourism are further pushing demand for high-tech communication solutions in the region.

Some of the prominent players in the Nurse call systems market include:

- Hill-Rom Holding, Inc.

- Rauland Corporation

- Honeywell International, Inc.

- Ascom Holding AG

- TekTone Sound and Signal Mfg., Inc.

- Austco Healthcare

- Stanley Healthcare

- Critical Alert Systems LLC

- West-Com Nurse Call Systems, Inc.

- JNL Technologies

- Cornell Communications

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global nurse call systems market.

Technology

- Wired Communication Equipment

- Wireless Communication Equipment

Type

- Integrated Communication Systems

- Buttons

- Mobile Systems

- Intercoms

Application

- Alarms & Communications

- Workflow Optimization

- Wanderer Control

- Fall Detection & Prevention

End-use

- Hospitals

- ASCs/Clinics

- Long Term Care Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)