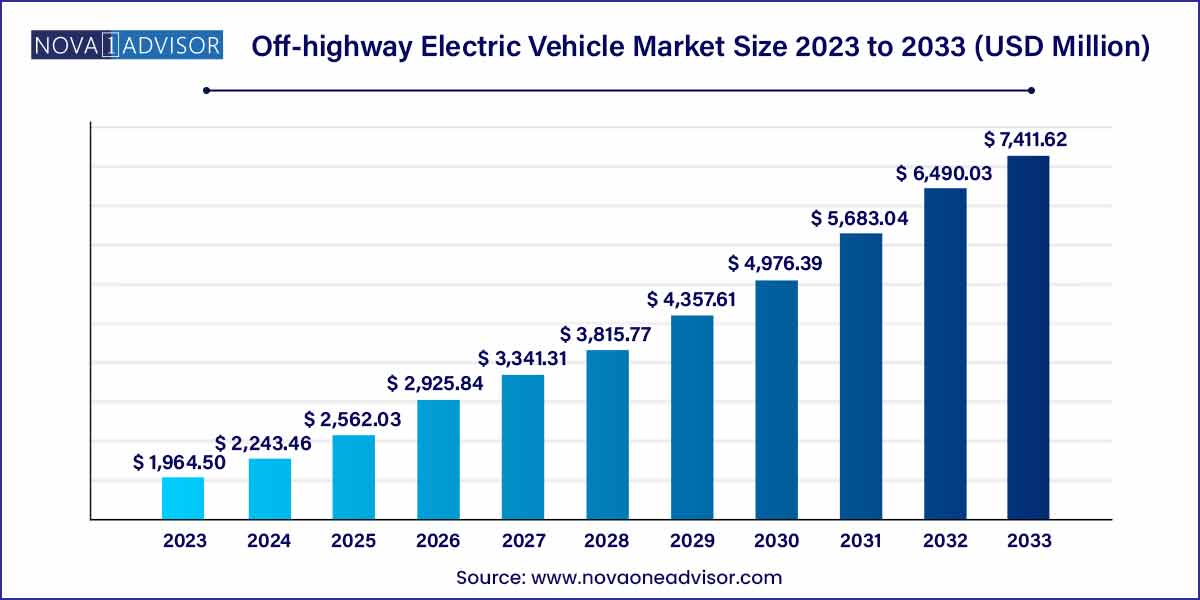

The global off-highway electric vehicle market size was exhibited at USD 1,964.50 million in 2023 and is projected to hit around USD 7,411.62 million by 2033, growing at a CAGR of 14.2% during the forecast period of 2024 to 2033.

Key Takeaways:

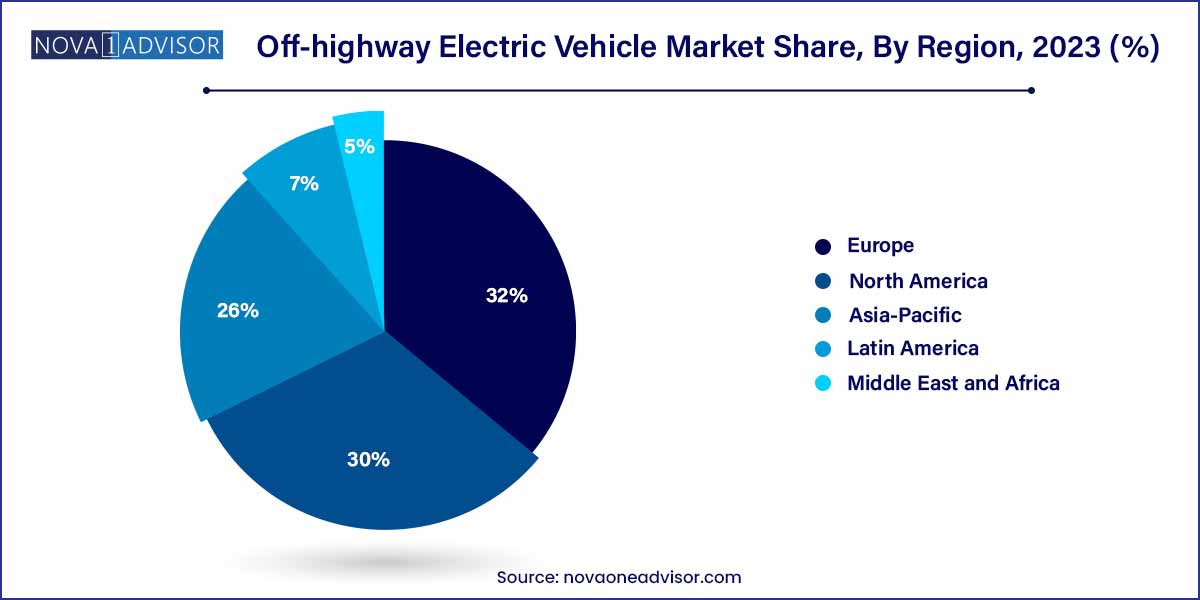

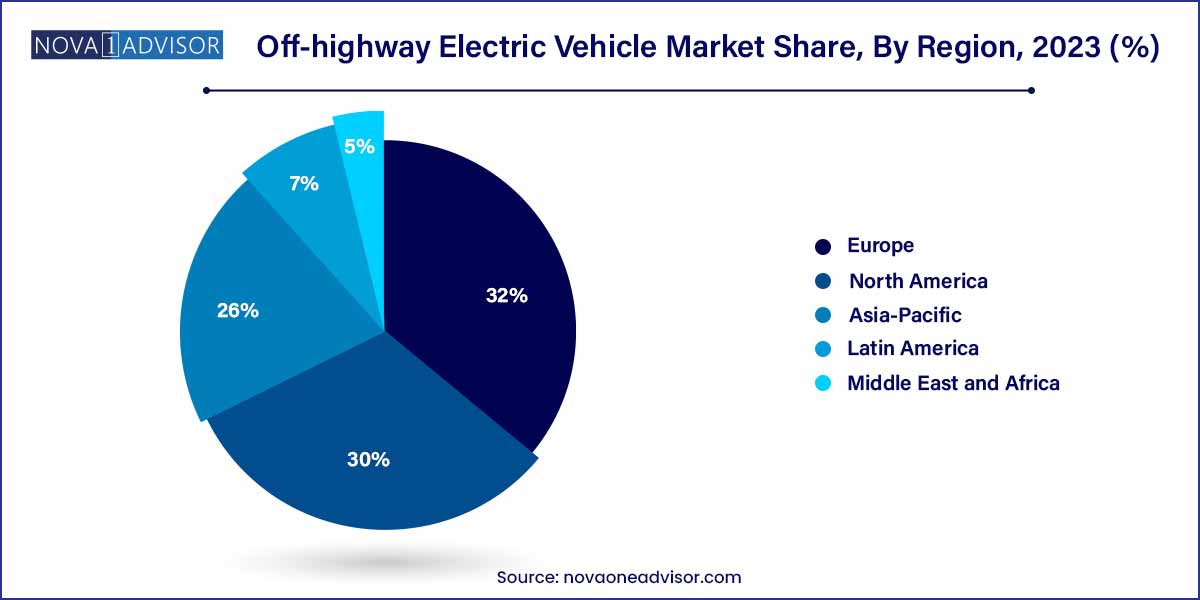

- North America accounted for the largest revenue share of 26% in 2023.

- The agriculture segment accounted for the largest revenue share of around 24% in 2023 in the global off-highway electric vehicle market.

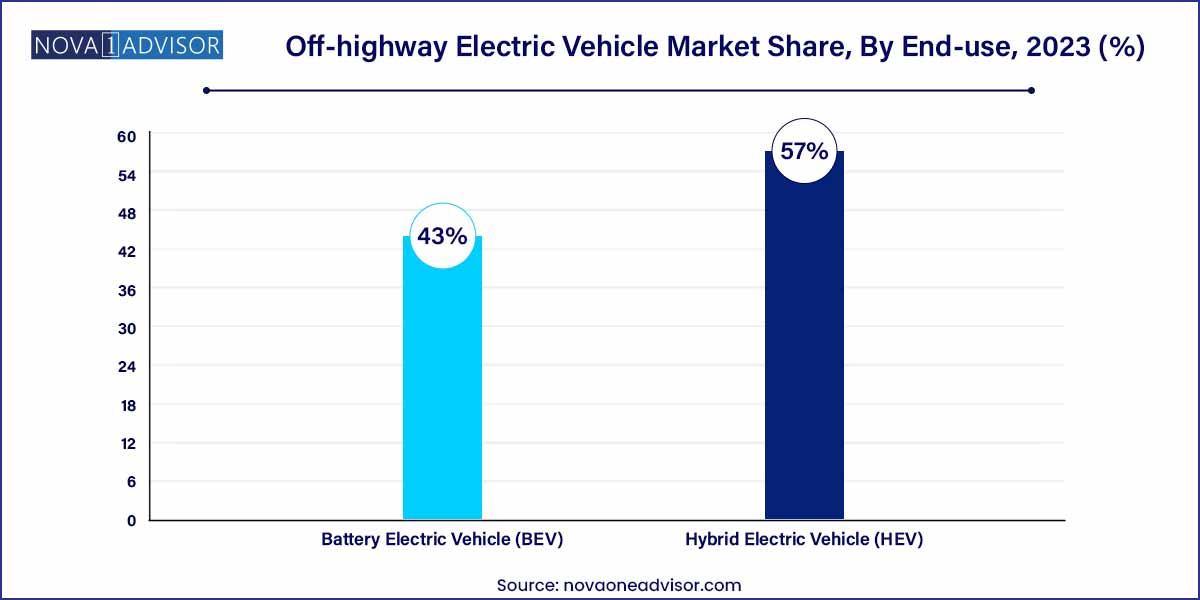

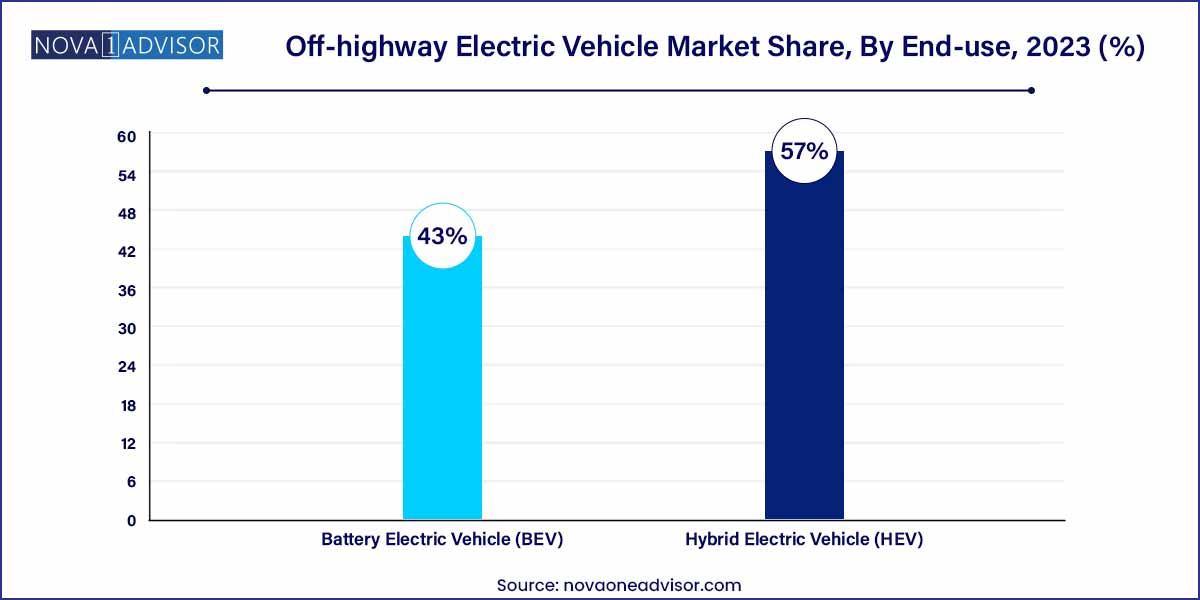

- The hybrid electric vehicle (HEV) segment accounted for the largest revenue share of 57% in 2023.

Market Overview

The off-highway electric vehicle (EV) market is rapidly emerging as a transformative force within the industrial and heavy equipment sectors. Encompassing electric machinery used in construction, mining, and agriculture, this market is driven by a confluence of sustainability mandates, economic efficiencies, and advancements in battery technologies. With the growing awareness of carbon footprints and the tightening of emissions regulations, manufacturers and operators are shifting from internal combustion engines (ICE) to electric propulsion systems across a variety of off-road applications.

Off-highway electric vehicles are particularly valuable in environments where noise reduction, zero-emission zones, and operational efficiency are paramount. In underground mining, for example, electric vehicles eliminate diesel particulate emissions, improving air quality and reducing ventilation costs. In agriculture and construction, they offer quieter operations, better torque control, and lower long-term operating expenses. As governments worldwide push for cleaner industrial practices and provide incentives for low-emission equipment, demand for electric off-highway vehicles continues to climb.

With major OEMs investing in R&D and launching electric variants of tractors, loaders, excavators, and haulers, the off-highway EV market is poised for significant growth. The transition is further accelerated by improvements in battery energy density, fast-charging capabilities, and integrated telematics platforms that enable remote diagnostics and energy optimization.

Off-Highway Electric Vehicle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1,964.50 Million |

| Market Size by 2033 |

USD 7,411.62 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 14.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Propulsion, Storage Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Caterpillar; Volvo Construction Equipment AB; Komatsu Ltd.; Deere & Company; Sandvik AB; Hitachi Construction Machinery Co., Ltd.; Epiroc AB; Doosan Corporation; J C Bamford Excavators Ltd.; CNH Industrial N.V. |

Off-highway Electric Vehicle Market Dynamics

- Environmental Regulations and Sustainability Drive Adoption:

The Off-highway Electric Vehicle (OHEV) market dynamics are significantly influenced by the growing stringency of environmental regulations worldwide. Governments and regulatory bodies are imposing stringent emission standards and promoting sustainable practices, compelling industries to shift towards cleaner alternatives. Off-highway electric vehicles, with their minimal carbon footprint and reduced emissions, align with these regulations and contribute to achieving sustainability goals.

- Advancements in Battery Technology and Energy Efficiency:

Another pivotal dynamic shaping the off-highway electric vehicle market is the continuous evolution and improvement in battery technology. Breakthroughs in energy storage solutions have led to enhanced performance, increased energy density, and extended operational ranges for off-highway electric vehicles. This progress addresses one of the key challenges in the adoption of electric vehicles: limited battery life and range. As batteries become more efficient, off-highway electric vehicles offer longer operating hours, reduced downtime, and increased productivity.

Off-highway Electric Vehicle Market Restraint

- High Initial Costs and Infrastructure Challenges:

A significant restraint in the off-highway electric vehicle (OHEV) market is the high initial costs associated with electric vehicles compared to their traditional counterparts. The upfront investment required for manufacturing and purchasing off-highway electric vehicles, including the cost of advanced batteries, remains a considerable barrier for many businesses. Additionally, the need for charging infrastructure in remote or challenging terrains where off-highway vehicles operate poses a practical challenge. Establishing a robust and widespread charging infrastructure for off-highway electric vehicles in such environments requires substantial investment and logistical planning.

- Limited Operational Range and Charging Concerns:

The off-highway electric vehicle market faces restraints in terms of the limited operational range of electric vehicles and concerns related to charging. Unlike traditional off-highway vehicles that can refuel quickly, electric vehicles often require longer charging times, and the availability of charging stations in remote areas can be a challenge.

Off-highway Electric Vehicle Market Opportunity

- Government Incentives and Subsidies for Electric Vehicles:

A significant opportunity in the Off-highway Electric Vehicle (OHEV) market stems from the increasing support and incentives provided by governments worldwide. Many governments are offering financial incentives, subsidies, and tax credits to encourage the adoption of electric vehicles across various sectors, including off-highway applications. These incentives not only help offset the initial higher costs of electric vehicles but also contribute to creating a favorable business environment.

- Technological Innovation and Customization for Specific Applications:

The off-highway electric vehicle market offers a significant opportunity through technological innovation and customization to meet specific industry needs. As technology continues to advance, there is an opportunity to develop off-highway electric vehicles tailored to the unique requirements of diverse applications such as construction, agriculture, and mining. Customization can involve creating specialized electric vehicles with enhanced capabilities, durability, and efficiency for specific tasks. Manufacturers that invest in research and development to design electric vehicles optimized for particular applications can gain a competitive edge in the market.

Off-highway Electric Vehicle Market Challenges

- Limited Infrastructure for Charging in Remote Areas:

One of the primary challenges in the off-highway electric vehicle (OHEV) market revolves around the limited infrastructure for charging, particularly in remote or off-road locations where many off-highway vehicles operate. Unlike urban environments with well-established charging networks for electric vehicles, remote construction sites, agricultural fields, or mining operations may lack the necessary charging infrastructure. Overcoming this challenge requires significant investment and strategic planning to develop a reliable and extensive charging network that caters to the unique operational demands of off-highway electric vehicles.

- Weight and Size Constraints of Advanced Battery Technology:

Another critical challenge facing the off-highway electric vehicle market is the weight and size constraints associated with advanced battery technology. While advancements in batteries have improved energy density and performance, the sheer size and weight of these batteries can pose challenges, especially in applications where minimizing weight is crucial, such as construction and mining equipment. The added weight can impact the overall efficiency and maneuverability of off-highway electric vehicles, limiting their effectiveness in certain tasks.

Segments Insights:

Application Insights

The construction segment dominates the off-highway electric vehicle market, due to the high volume of earthmoving and material-handling equipment used in urban development, infrastructure projects, and residential construction. Electric mini-excavators, loaders, and compact track loaders are increasingly preferred for urban jobsites where noise and emissions are strictly regulated. OEMs such as Volvo CE and Caterpillar are actively launching electric variants to serve this market.

The mining segment is the fastest-growing application, driven by the need to reduce emissions and improve worker safety in confined, poorly ventilated environments. Electric haul trucks and loaders are already being deployed in underground mines, with notable success in reducing diesel fumes and improving energy efficiency. The potential to drastically lower ventilation costs—one of the largest operational expenses in mining makes electric vehicles especially attractive in this segment.

Propulsion Insights

Battery Electric Vehicles (BEVs) dominate the propulsion segment, supported by advancements in lithium-ion battery technologies and the desire for fully emission-free operation. BEVs are ideal for applications where downtime can be scheduled for charging, and where emissions reduction is a high priority. Their quiet operation, low vibration, and energy recovery capabilities make them increasingly popular across construction and agriculture.

Hybrid Electric Vehicles (HEVs) are experiencing strong growth, especially in applications that require longer duty cycles or operate in remote areas with limited charging infrastructure. HEVs combine diesel engines with electric motors, offering reduced emissions while maintaining operational flexibility. Some HEVs are designed to operate entirely in electric mode for short durations, making them suitable for emission-sensitive environments.

Regional Insights

Europe dominates the off-highway electric vehicle market, driven by strong environmental regulations, progressive infrastructure development, and OEM commitment to electrification. Countries like Norway, Germany, and the Netherlands are implementing emission-free construction zones, especially in city centers, pushing contractors toward electric machinery. European OEMs are also leading in innovation and deployment of electric solutions across construction and mining sectors.

Asia-Pacific is the fastest-growing region, due to rapid infrastructure expansion, agricultural modernization, and strong government support for clean energy technologies. China, in particular, is investing heavily in electrification across all vehicle segments, including off-highway equipment. Domestic manufacturers are receiving subsidies for R&D, while cities are pushing for electric construction zones. India, Indonesia, and Vietnam are also beginning to explore electrification to meet carbon reduction goals.

Some of the prominent players in the off-highway electric vehicle market include:

- Caterpillar

- Volvo Construction Equipment AB

- Komatsu Ltd.

- Deere & Company

- Sandvik AB

- Hitachi Construction Machinery Co., Ltd.

- Epiroc AB

- Doosan Corporation

- J C Bamford Excavators Ltd.

- CNH Industrial N.V.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global off-highway electric vehicle market.

Application

- Construction

- Agriculture

- Mining

Propulsion

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

Storage Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)