The global off-highway vehicle lighting market size was exhibited at USD 974.50 million in 2023 and is projected to hit around USD 2,046.16 million by 2033, growing at a CAGR of 7.7% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

- The halogen segment accounted for the largest revenue share of around 57.9% in 2023.

- The construction segment accounted for the largest share of around 58.5% of the market in 2023.

- Considering the type of vehicle, the tractor segment accounted for the largest share of around 27% of the overall market in 2023.

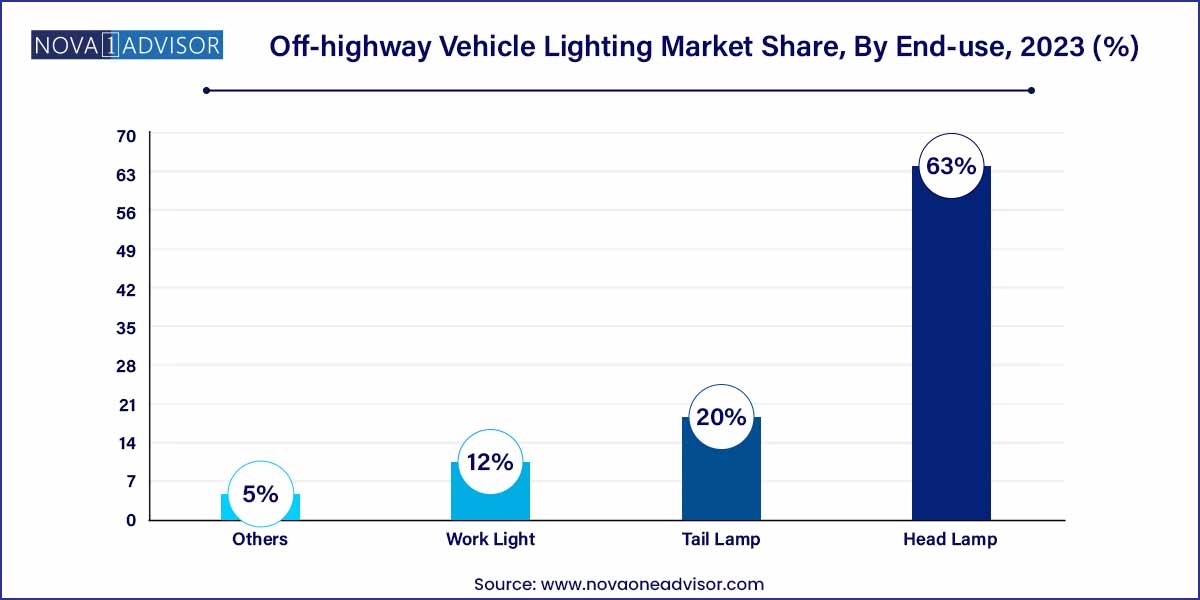

- The headlamp segment accounted for the largest share of over 63.0% of the market in 2023.

Market Overview

The off-highway vehicle lighting market is a critical segment within the broader automotive lighting industry, focusing on vehicles operating in rugged terrains and specialized sectors like construction, agriculture, mining, and forestry. Lighting systems for these vehicles serve essential roles beyond visibility including safety enhancement, operational efficiency, and machine-to-machine communication during complex, low-light operations.

Unlike standard highway vehicles, off-highway equipment such as excavators, tractors, dump trucks, and cranes require specialized, durable, and high-performance lighting solutions capable of withstanding extreme conditions such as dust, vibration, moisture, and wide temperature ranges. As operations shift toward 24/7 cycles to maximize productivity, demand for superior illumination, energy efficiency, and advanced lighting controls has intensified.

The market is undergoing rapid technological advancement, particularly with the introduction of LED, HID, and laser-based lighting technologies. Digitalization trends, environmental regulations, and the push for operational safety are collectively driving innovation. OEMs and aftermarket suppliers are increasingly integrating smart lighting solutions with telematics and automated systems, reinforcing the indispensable nature of advanced lighting in off-highway operations.

Off-highway vehicle lighting Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 974.50 Million |

| Market Size by 2033 |

USD 2,046.16 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End use, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Truck-Lite; APS Lighting and Safety; Grote Industries; ECCO Safety Group; Hamsar Diversco Inc.; J.W. Speaker Corporation; WESEM; HELLA GmbH & Co. KGaA; ABL Lights Group; Peterson Manufacturing Co. |

Off-highway Vehicle Lighting Market Dynamics

The off-highway vehicle lighting market is propelled by a combination of significant drivers. One primary factor is the continuous evolution of technology, particularly the integration of advanced lighting solutions such as LED and smart technologies. These innovations not only enhance visibility in challenging off-road conditions but also contribute to energy efficiency, aligning with the industry's sustainability goals. Another crucial driver is the escalating demand for off-highway vehicles, spanning diverse sectors including agriculture, construction, and mining. The surge in recreational and industrial applications has created a robust market, as manufacturers respond to the need for reliable and efficient lighting solutions in these demanding environments.

Despite the promising growth trajectory, the off-highway vehicle lighting market faces certain challenges, with cost considerations being a significant restraint. The initial investment required for the integration of advanced lighting technologies, such as LED systems, can be substantial. Manufacturers must navigate the balance between delivering high-quality, technologically sophisticated lighting solutions and addressing concerns about cost-effectiveness. Additionally, environmental regulations and sustainability concerns present another set of challenges for the market. Meeting stringent environmental standards and ensuring eco-friendly manufacturing processes are imperative, influencing both product development and manufacturing practices. Balancing these considerations while maintaining competitive pricing is a complex task for industry participants.

Off-highway Vehicle Lighting Market Restraint

A significant restraint in the off-highway vehicle lighting market revolves around cost considerations. The integration of advanced lighting technologies, such as LED systems, often entails a higher initial investment. The price sensitivity within the industry, coupled with the competitive market landscape, poses challenges for manufacturers seeking to strike a balance between delivering cutting-edge lighting solutions and ensuring cost-effectiveness. This cost barrier can potentially limit the widespread adoption of advanced lighting technologies, particularly among smaller businesses and price-conscious consumers.

- Environmental Regulations:

Environmental regulations present another significant restraint in the off-highway vehicle lighting market. Stringent norms regarding emissions and manufacturing processes require manufacturers to adhere to eco-friendly practices. While the emphasis on sustainability is commendable, it adds complexity to product development and manufacturing. Compliance with these regulations may necessitate changes in materials, production methods, and disposal processes, impacting the overall manufacturing cost and supply chain. Manufacturers must navigate the intricate landscape of environmental standards, striving to meet regulatory requirements while maintaining competitive pricing.

Off-highway Vehicle Lighting Market Opportunity

- Retrofitting Services Opportunity:

A notable opportunity within the off-highway vehicle lighting market lies in the burgeoning demand for retrofitting services. As technology continues to advance, there is a growing market for aftermarket solutions that allow existing vehicles to be upgraded with the latest lighting technologies. Retrofitting services offer a cost-effective way for owners of older off-highway vehicles to benefit from the advantages of advanced lighting systems without having to invest in an entirely new vehicle. This presents an avenue for manufacturers and service providers to tap into a diverse customer base seeking to enhance the safety and performance of their off-highway vehicles.

- Sustainable Lighting Solutions:

The increasing focus on sustainability opens doors for eco-friendly lighting solutions within the off-highway vehicle market. As environmental consciousness grows, there is a rising demand for lighting systems that are not only energy-efficient but also manufactured with minimal environmental impact. This opportunity extends beyond compliance with regulations and aligns with the broader trend toward sustainable practices. Manufacturers can capitalize on this by developing and promoting off-highway vehicle lighting solutions that utilize eco-friendly materials, reduce energy consumption, and adhere to environmentally conscious manufacturing processes.

Off-highway Vehicle Lighting Market Challenges

- Technological Complexity:

The rapid evolution of off-highway vehicle lighting technologies presents a significant challenge for manufacturers. Integrating advanced features such as LED systems, adaptive lighting, and smart technologies involves a high level of technological complexity. Keeping pace with these advancements and ensuring compatibility with diverse off-highway vehicle models can be demanding. Manufacturers face the challenge of staying ahead in terms of innovation while maintaining reliability and ease of integration. Moreover, the need for continuous research and development to address evolving customer preferences and regulatory requirements adds to the complexity, posing a consistent challenge for industry participants.

- Global Economic Uncertainties:

Off-highway vehicle lighting manufacturers are susceptible to the impact of global economic uncertainties. Fluctuations in economic conditions, trade tensions, and geopolitical factors can influence the purchasing power of consumers and the overall demand for off-highway vehicles. In times of economic downturns, capital-intensive industries such as construction and mining may experience reduced investments, directly affecting the market for off-highway vehicle lighting. The industry's resilience against external economic factors becomes crucial, requiring strategic planning, adaptability, and the ability to diversify offerings or target emerging markets to mitigate the challenges posed by economic uncertainties.

Segments Insights:

Product Insights

LED lighting dominates the off-highway vehicle lighting market, primarily due to its superior efficiency, durability, and resistance to vibration and shock. LED systems offer better illumination, reduced maintenance needs, and lower total cost of ownership over time compared to halogen, HID, or incandescent lighting. OEMs are increasingly offering factory-fitted LED packages, and aftermarket LED upgrades are witnessing high demand.

Halogen lighting, though traditional, remains in use across various cost-sensitive markets due to its low upfront price. However, its share is shrinking as operators realize the long-term cost savings and performance advantages of transitioning to LED. HID and incandescent lighting are also gradually being phased out, although HID lights still find niche usage where very high-intensity beams are temporarily required.

End-use Insights

The construction sector leads in end-use adoption, as a significant proportion of heavy equipment including excavators, loaders, cranes, and dump trucks operate in construction zones requiring reliable illumination for night shifts and tunnel works. Construction companies prioritize rugged, waterproof, and energy-efficient lighting systems to minimize downtime and maintenance.

Agriculture/Farming/Forestry is the fastest-growing end-use segment, driven by global food security demands, expanding farmland operations, and the mechanization of farming activities. Agricultural tractors and harvesters increasingly feature advanced LED lighting arrays to enable long operational hours during planting and harvesting seasons, improving overall productivity.

Vehicle Type Insights

Excavators dominate the vehicle type segment, reflecting their ubiquitous presence across construction and mining activities. Excavators require multiple lighting configurations to ensure safe operation during excavation, material handling, and demolition tasks under varied lighting conditions.

Tractors are the fastest-growing vehicle type, particularly due to the surge in agricultural mechanization globally. Modern tractors are being equipped with sophisticated work lights, cab lights, and field-specific illumination systems that enhance visibility, reduce operator fatigue, and improve precision in farming tasks during extended operational hours.

Application Insights

Work lights dominate the application segment, as they are essential for off-highway vehicles operating in low-light environments such as mining sites, agricultural fields, and nighttime construction projects. High-intensity, wide-beam work lights enable operators to maintain productivity and safety even during nighttime or in poor weather conditions.

Headlamps are the fastest-growing application, owing to increasing safety regulations and the rising integration of advanced headlight technologies such as adaptive beams, cornering lights, and automatic dimming in newer off-highway models. Tail lamps and other auxiliary lights are also evolving, with enhanced designs for visibility and durability.

Regional Insights

North America dominates the off-highway vehicle lighting market, backed by its robust construction sector, large-scale mining activities, and technologically advanced agricultural operations. The U.S. and Canada, in particular, witness high adoption rates of LED and smart lighting solutions, supported by strict workplace safety standards and regulations encouraging operational visibility.

Asia-Pacific is the fastest-growing region, driven by rapid urbanization, expanding infrastructure projects, increasing mechanization of agriculture, and rising investments in mining operations in countries such as China, India, and Australia. As the region witnesses industrial expansion and government initiatives to modernize key sectors, demand for efficient and rugged lighting solutions is surging.

Some of the prominent players in the off-highway vehicle lighting market include:

- Truck-Lite

- APS Lighting and Safety

- Grote Industries

- ECCO Safety Group

- Hamsar Diversco Inc.

- J.W. Speaker Corporation

- WESEM

- HELLA GmbH & Co. KGaA

- ABL Lights Group

- Peterson Manufacturing Co.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global off-highway vehicle lighting market.

Product

- LED

- Halogen

- HID

- Incandescent

Application

- Head Lamp

- Tail Lamp

- Work Light

- Others

End-use

- Construction

- Agriculture/Farming/Forestry

Vehicle Type

- Excavator

- Loader

- Crane

- Dump Truck

- Tractor

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)