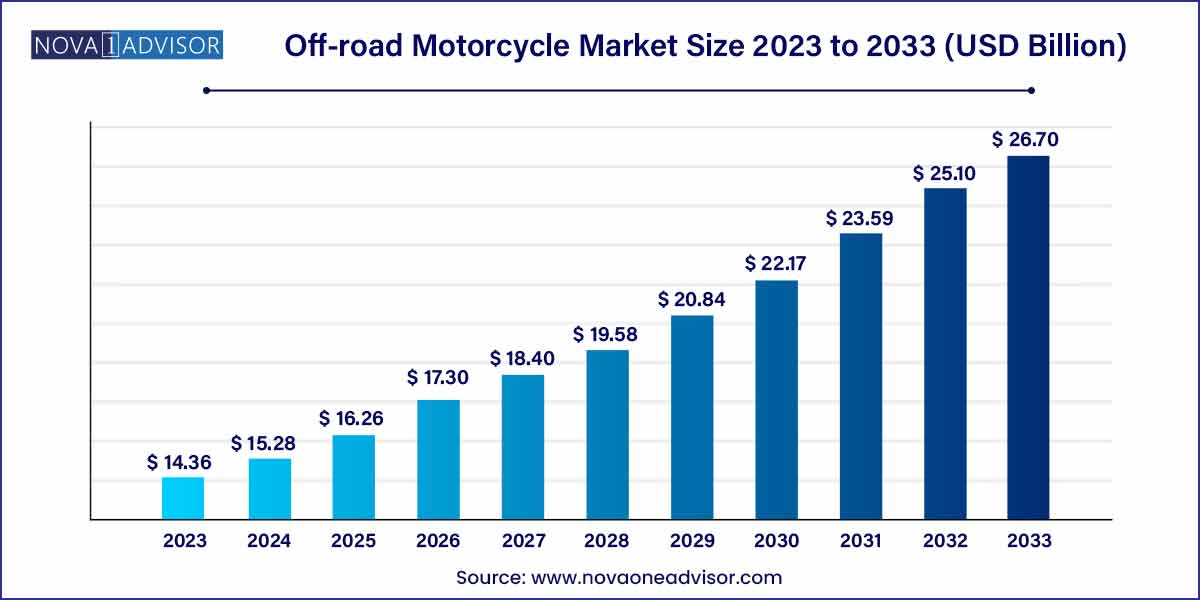

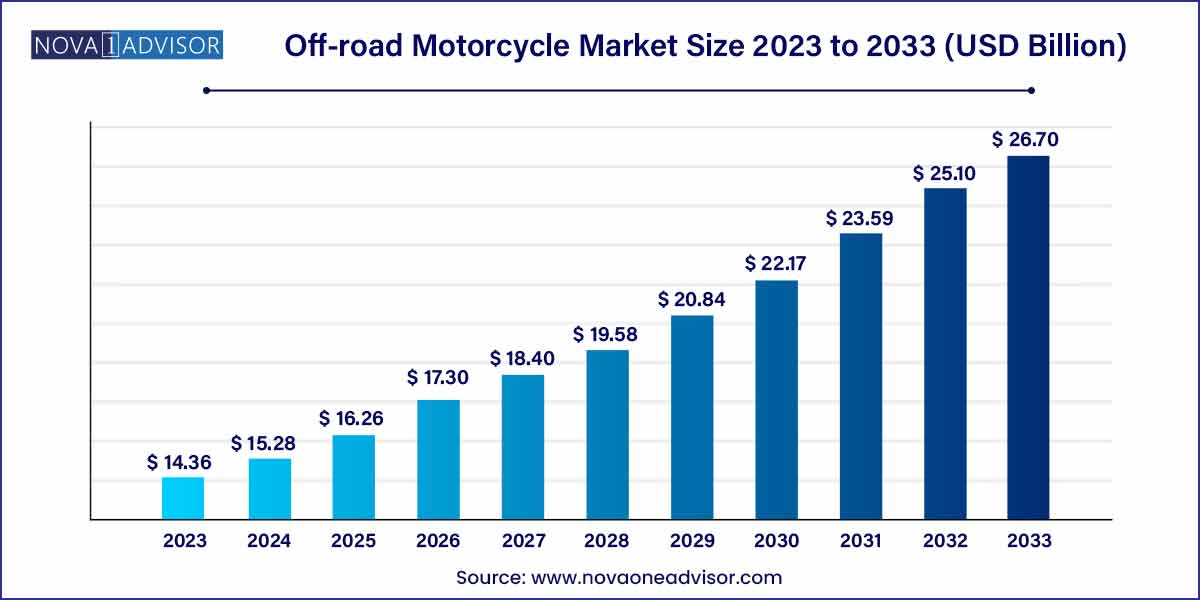

The global off-road motorcycle market size was exhibited at USD 14.36 billion in 2023 and is projected to hit around USD 26.70 billion by 2033, growing at a CAGR of 6.4% during the forecast period of 2024 to 2033.

Key Takeaways:

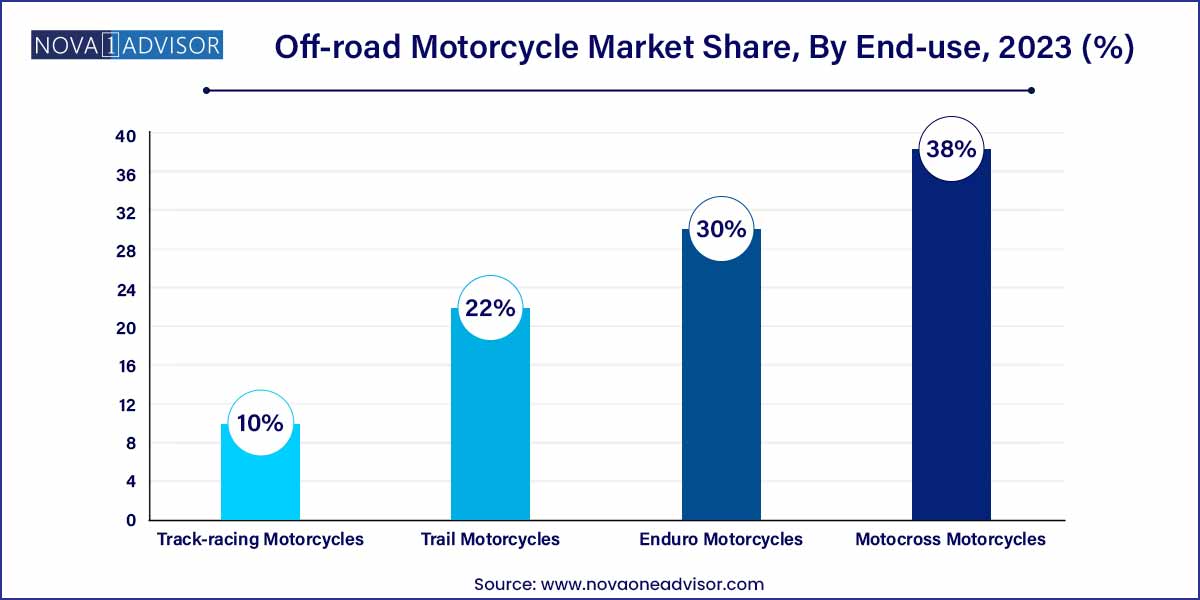

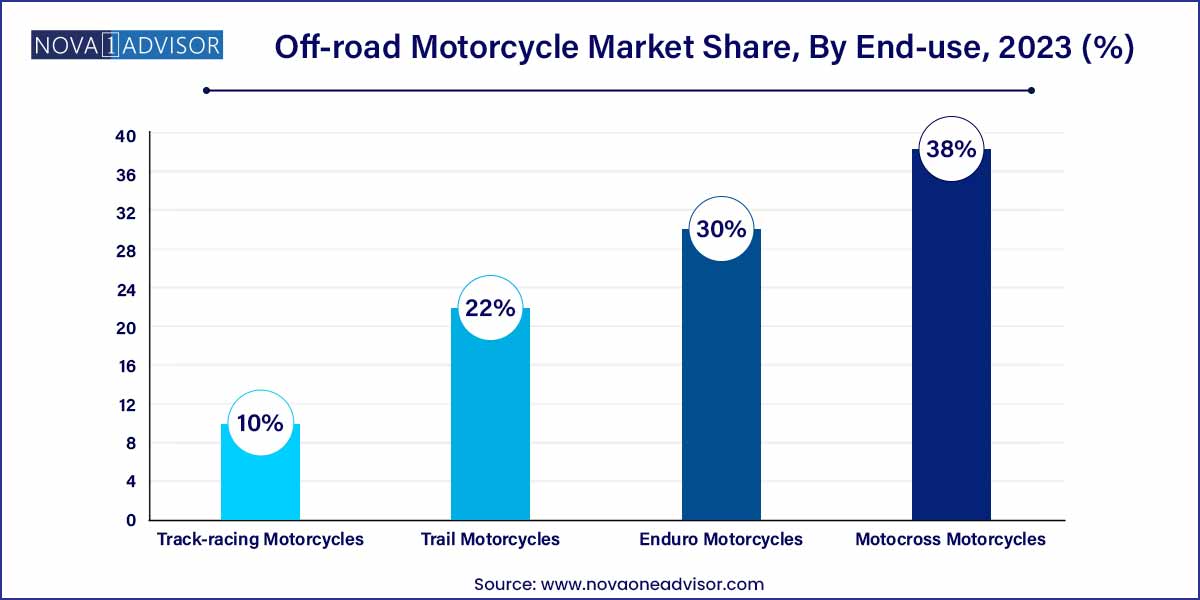

- The enduro motorcycles segment dominated the market and contributed a revenue share of more than 38.00% in 2023.

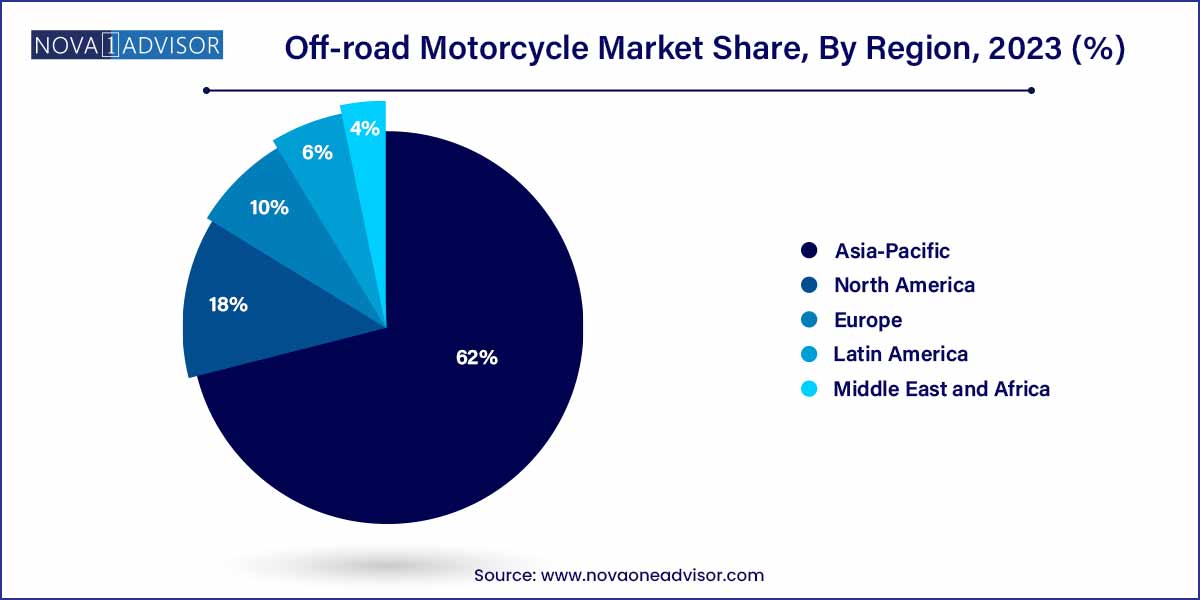

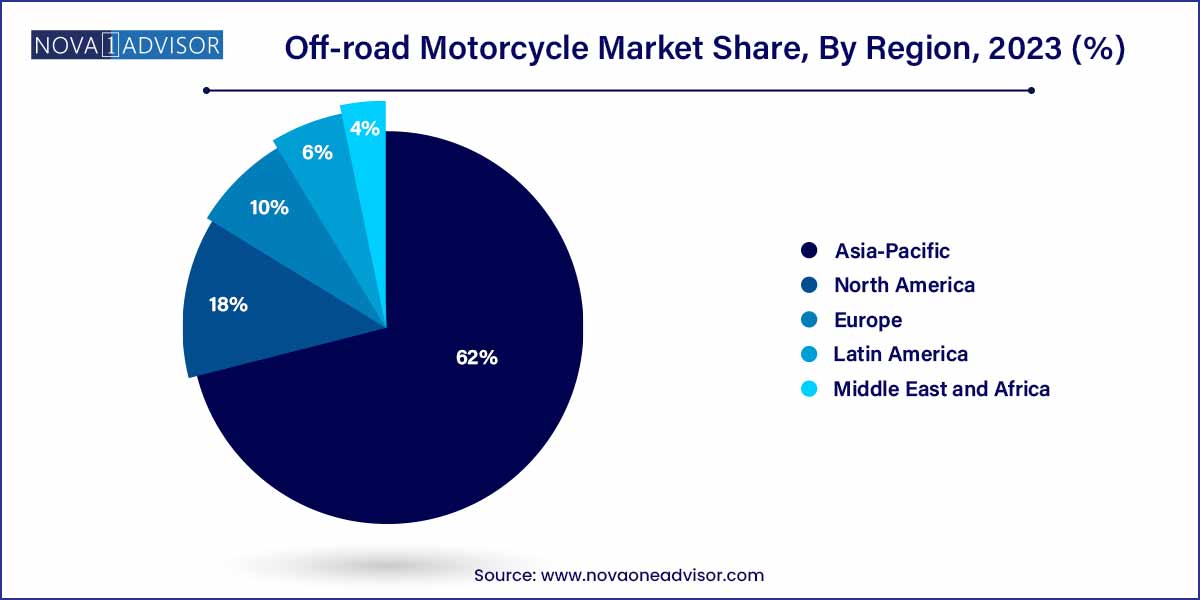

- Regional analysis revealed that Asia Pacific accounted for a significant market revenue share of more than 62% in 2023.

Off-road Motorcycle Market: Overview

The global off-road motorcycle market has carved out a strong niche within the broader powersports industry, characterized by a robust culture of adventure, competition, and leisure. Off-road motorcycles, designed for use on rugged terrains, include motocross bikes, enduro motorcycles, trail bikes, and track-racing motorcycles. These vehicles emphasize lightweight construction, high suspension travel, and durable designs capable of handling challenging landscapes.

Over the past decade, the market has seen impressive growth fueled by increasing recreational activities, the expansion of adventure tourism, and the popularity of competitive events like motocross championships and enduro rallies. Enthusiasts across all age groups are drawn to the thrill and versatility that off-road motorcycles provide. Simultaneously, technological innovations have improved performance, safety, and durability, making off-road motorcycles more accessible to both amateur and professional riders.

Factors such as the rising disposable incomes in emerging markets, growth of motorsports culture, and the development of purpose-built off-road tracks and parks are further augmenting the market. However, regulatory restrictions related to emissions, environmental concerns, and land usage may pose challenges. Nevertheless, with manufacturers introducing electric off-road models and expanding their global footprint, the future of the off-road motorcycle market appears promising.

Off-road Motorcycle Market Growth

The off-road motorcycle market is experiencing robust growth driven by several key factors. Firstly, the rising popularity of adventure tourism has significantly contributed to increased demand for off-road motorcycles. Enthusiasts are drawn to the thrill of exploring rugged terrains and remote landscapes, fueling the need for durable and high-performance off-road bikes. Additionally, evolving consumer preferences favor vehicles that offer versatility and off-road capability, spurring interest in off-road motorcycles as a means of outdoor recreation. Furthermore, continuous technological advancements in off-road motorcycle technology, such as improved suspension systems and lightweight materials, have enhanced performance and safety, attracting enthusiasts seeking the latest features and capabilities. These growth factors combined underscore a promising outlook for the off-road motorcycle market, with manufacturers poised to capitalize on the expanding consumer base and evolving preferences within this dynamic segment.

Off-road Motorcycle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 14.36 Billion |

| Market Size by 2033 |

USD 26.70 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Harley-Davidson Inc.; Yamaha Motor Co., Ltd.; Ducati Motor Holding S.p.A.; Honda Motor Co., Ltd.; Kawasaki Heavy Industries, Ltd.; BMW AG; Suzuki Motor Corp.; Hero MotoCorp Ltd.; Bajaj Auto Ltd.; TVS Motor Company. |

Off-road Motorcycle Market Dynamics

- Growing Adventure Tourism:

One of the primary dynamics propelling the off-road motorcycle market is the surge in adventure tourism activities. Enthusiasts increasingly seek adrenaline-fueled experiences in challenging terrains, driving the demand for off-road motorcycles designed to conquer rugged landscapes. Adventure riders are drawn to the versatility and agility offered by off-road bikes, which enable them to explore remote destinations and navigate off-road trails with confidence.

- Technological Advancements:

Continuous technological advancements play a pivotal role in shaping the off-road motorcycle market dynamics. Manufacturers are constantly innovating to enhance performance, safety, and rider comfort, thereby attracting enthusiasts seeking the latest features and capabilities. Advanced suspension systems, lightweight materials, and electronic rider aids are among the key technological innovations driving the evolution of off-road motorcycles. These advancements not only improve off-road handling and maneuverability but also elevate the overall riding experience, catering to the demands of discerning consumers who prioritize innovation and performance.

Off-road Motorcycle Market Restraint

One significant restraint affecting the off-road motorcycle market is growing environmental awareness and concerns. Off-road riding, particularly in sensitive ecosystems such as forests, deserts, and wetlands, can have detrimental impacts on natural habitats and wildlife. Increased off-road motorcycle activity may lead to soil erosion, habitat destruction, noise pollution, and disturbance to wildlife populations. As environmental regulations become stricter and conservation efforts intensify, off-road riders and manufacturers face pressure to adopt sustainable practices and minimize their ecological footprint.

- Safety Concerns and Regulatory Compliance:

Another key restraint impacting the off-road motorcycle market is growing concerns regarding rider safety and regulatory compliance. Off-road riding inherently involves greater risks compared to on-road riding, with riders facing hazards such as uneven terrain, obstacles, and unpredictable weather conditions. Inadequate safety measures and irresponsible riding behavior can lead to accidents, injuries, and even fatalities, raising concerns among riders, regulators, and the general public. Furthermore, regulatory requirements governing off-road motorcycle use, such as age restrictions, licensing, and trail access regulations, vary significantly across different regions and jurisdictions.

Off-road Motorcycle Market Opportunity

- Expanding Urbanization and Recreational Spaces:

An opportunity in the off-road motorcycle market lies in the expanding urbanization and development of recreational spaces. As urban populations grow and cities expand, there is a corresponding demand for outdoor recreational activities closer to urban centers. Off-road motorcycle riding offers an exhilarating escape from the urban hustle, providing enthusiasts with opportunities to explore nearby trails, parks, and off-road riding areas. Manufacturers and retailers can capitalize on this trend by promoting off-road motorcycles as accessible and convenient means of outdoor recreation for urban dwellers.

- Rising Interest in Motorsports and Extreme Sports:

Another significant opportunity for the off-road motorcycle market is the rising interest in motorsports and extreme sports. Off-road motorcycle racing events, such as motocross, enduro, and desert racing, continue to attract large audiences and garner media attention worldwide. The adrenaline-fueled excitement and competitive spirit of off-road racing appeal to a broad demographic of enthusiasts, ranging from amateur riders to professional athletes. Moreover, the growing popularity of extreme sports and adventure activities has led to increased participation in off-road motorcycle adventures, tours, and rallies. Manufacturers and event organizers can leverage this trend by sponsoring racing events, organizing off-road riding tours, and promoting off-road motorcycle experiences as thrilling and aspirational pursuits.

Off-road Motorcycle Market Challenges

- Access to Riding Areas and Trail Preservation:

One of the foremost challenges facing the off-road motorcycle market is limited access to riding areas and the preservation of off-road trails. As urbanization and land development continue to encroach upon natural habitats and open spaces, off-road riders face dwindling opportunities to ride in traditional off-road areas. Additionally, environmental conservation efforts and concerns about habitat destruction have led to increased restrictions on off-road riding in sensitive ecosystems. This challenge is compounded by the lack of designated off-road riding areas and the closure of existing trails due to land-use conflicts, liability issues, and regulatory pressures. As a result, off-road riders often struggle to find legal and accessible riding areas, leading to frustration and dissatisfaction within the off-road motorcycle community.

- Cost of Ownership and Maintenance:

Another significant challenge in the off-road motorcycle market is the cost of ownership and maintenance associated with off-road motorcycles. Compared to their on-road counterparts, off-road motorcycles typically require more frequent maintenance and replacement of consumable parts due to the harsh operating conditions encountered off-road. This includes regular servicing of suspension components, frequent oil changes, and periodic replacement of tires, chains, and sprockets. Additionally, the rugged terrain and demanding riding conditions can result in accelerated wear and tear on off-road motorcycles, leading to higher repair and maintenance costs over time.

Segments Insights:

Type Insights

Motocross motorcycles dominated the type segment of the off-road motorcycle market. Motocross bikes, designed for racing on closed circuits with varied terrain, have remained a mainstay of the off-road segment. Their lightweight frames, powerful engines, and rugged suspension systems make them the preferred choice for competitive riders. Events such as AMA Supercross and MXGP championships have amplified the popularity of motocross motorcycles globally. Major manufacturers like Honda, Yamaha, and Kawasaki have invested heavily in developing high-performance motocross models, further strengthening their dominance.

Meanwhile, Enduro motorcycles are experiencing the fastest growth within the type segment. Enduro bikes, known for their long-distance off-road capabilities, are gaining traction among adventure enthusiasts who seek both competitive and recreational experiences. These motorcycles are designed to handle rough terrain for extended periods, featuring larger fuel tanks, lighting systems, and versatile gearing. The increasing number of endurance races and trail-riding adventures, especially in Europe and North America, has bolstered the demand for enduro motorcycles. Brands like KTM and Husqvarna are setting benchmarks in this rapidly growing sub-segment.

Regional Insights

North America dominated the global off-road motorcycle market in terms of revenue and participation rates. The United States, in particular, boasts a rich culture of motocross racing, desert rallying, and trail riding. Organizations such as the American Motorcyclist Association (AMA) actively promote off-road racing events and youth development programs. States like California, Texas, and Arizona offer a wealth of off-road trails and motorsports parks, supporting both recreational and competitive markets. Additionally, a strong aftermarket for performance parts, apparel, and safety gear complements the region's thriving off-road ecosystem.

Asia-Pacific is poised to be the fastest-growing region in the off-road motorcycle market. Countries like Australia, India, Indonesia, and Thailand are witnessing a surge in off-road biking activities. Rising disposable incomes, expanding youth populations, and government initiatives to promote adventure tourism are key drivers. For example, Australia's Simpson Desert and Thailand's rugged northern provinces offer ideal terrains for off-road motorcycling. Moreover, the increasing penetration of global brands and the rise of domestic manufacturers offering affordable off-road models are accelerating market growth in the Asia-Pacific region.

Recent Developments

-

April 2025: KTM announced the launch of its latest electric enduro bike, the "Freeride E-XC 2025," with enhanced battery capacity and lighter frame design.

-

March 2025: Yamaha Motor Company introduced the "YZ450F GYTR Edition," a factory-prepped motocross bike aimed at competitive riders seeking race-ready features.

-

February 2025: Honda unveiled its "CRF450RL" dual-sport motorcycle in India, expanding its off-road product portfolio in emerging markets.

-

January 2025: Swedish electric motorcycle manufacturer Cake partnered with REI Co-op to make its electric off-road bikes available in select U.S. retail outlets.

Some of the prominent players in the Off-road motorcycle market include:

- Harley-Davidson, Inc.

- Yamaha Motor Co., Ltd.

- Ducati Motor Holding S.p.A.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BMW AG

- Suzuki Motor Corp.

- Hero MotoCorp Ltd.

- Bajaj Auto Ltd.

- TVS Motor Company

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global off-road motorcycle market.

Type

- Motocross Motorcycles

- Enduro Motorcycles

- Trail Motorcycles

- Track-racing Motorcycles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)