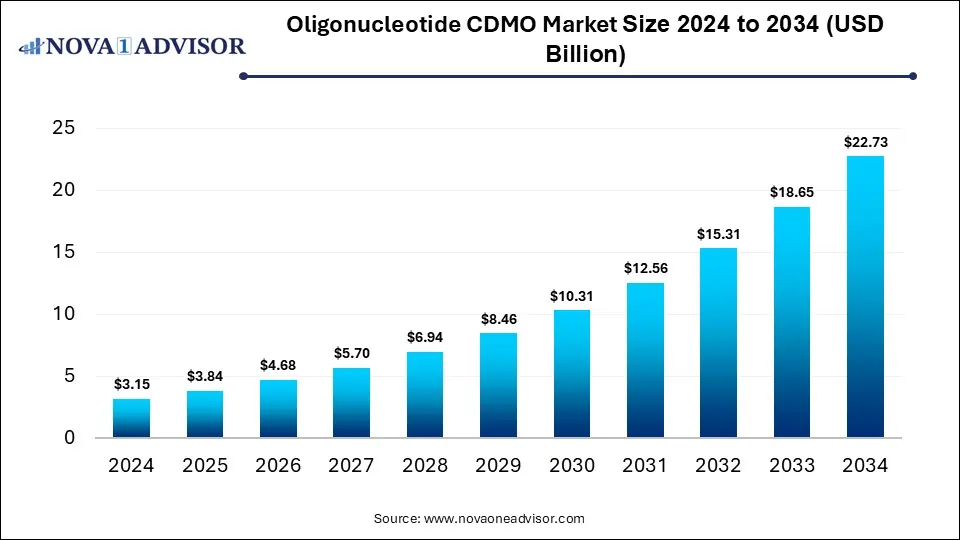

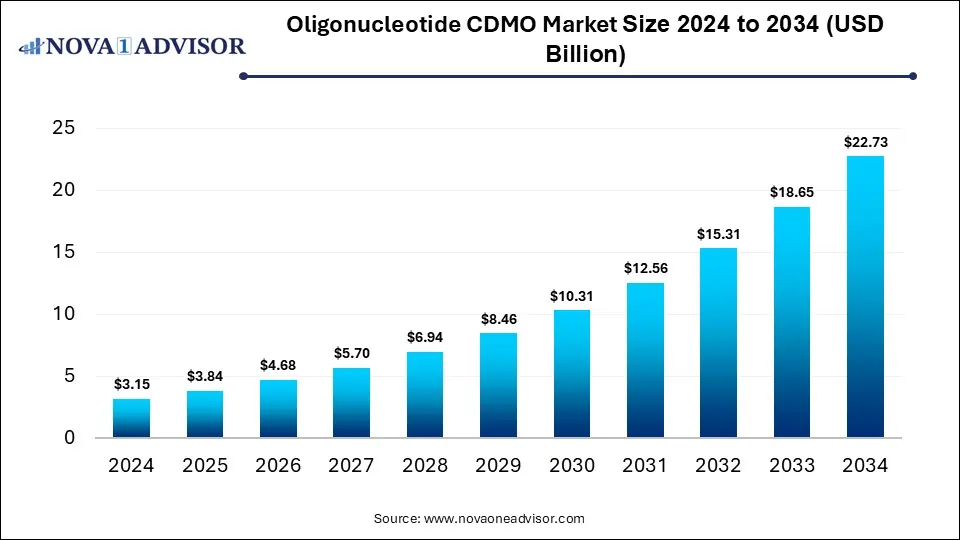

Oligonucleotide CDMO Market Size and Forecast 2025 to 2034

The global oligonucleotide CDMO market size is calculated at USD 3.15 billion in 2024, grows to USD 3.84 billion in 2025, and is projected to reach around USD 22.73 billion by 2034, at a compound annual growth rate (CAGR) of 21.85% from 2024 to 2034. The market is growing due to rising demand for RNA-based therapies and gene-targeted drugs. Increasing outsourcing by pharma and biotech companies to CDMOs for specialized manufacturing and regulatory expertise further drives growth.

Key Takeaways

- North America dominated the oligonucleotide CDMO market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By service, the contract manufacturing segment held the largest market share in 2024.

- By service, the contract development segment is expected to grow at a significant rate in the market during the forecast period.

- By type, the ASO segment dominated the market with a major revenue share in 2024.

- By type, the siRNA segment is expected to grow at a significant rate in the market during the forecast period.

- By application, the therapeutic segment held the highest market share in 2024.

- By application, the research segment is expected to grow at a significant rate in the market during the forecast period.

- By end-use, the pharma segment held the largest market share in 2024.

- By end-use, the biotech segment is expected to grow at a significant rate in the market during the forecast period.

Which Factors are Driving the Growth of the Oligonucleotide CDMO Market?

An oligonucleotide CDMO is a contract development and manufacturing organization that provides specialized services for the development, synthesis, scale-up, and commercial production of oligonucleotide-based therapeutics. The oligonucleotide CDMO market is expanding due to increasing demand for personalized medicine, as these molecules enable targeted and patient-specific treatments. Rising collaborations between CDMOs and biotech firms to accelerate time-to-market also boost growth. Moreover, the need for high-purity and scalable production processes, advancements in solid-phase synthesis, and scalable production processes, advancements in solid-phase synthesis, and growing interest in therapeutic areas like oncology and rare genetic disorders are encouraging pharmaceutical companies to rely more on specialized CDMOs, driving sustained market momentum.

What are the Key trends in the Oligonucleotide CDMO Market in 2024?

- In January 2025, India-based CDMO Aragen secured a $100 million investment from Singapore’s Quadria Capital, a private equity firm, to boost its capacity and broaden its multi-modality service offerings. (Source: https://www.aragen.com)

- In June 2024, Suven Pharmaceuticals’ stock rose 4.59% to ₹697.85 after completing the acquisition of all equity shares of Sapala Organics, a Hyderabad-based CDMO focused on nucleic acid building blocks and oligonucleotide medicines.(Source: https://www.business-standard.com/)

How Can AI Affect the Oligonucleotide CDMO Market?

AI is transforming the market by enabling virtual simulations of production processes, reducing the need for extensive trial-and-error experiments. It supports advanced modeling for scale-up, ensuring consistent yields and purity in large batches. AI-powered forecasting tools help CDMOs anticipate demand trends and manage resources more efficiently. Additionally, AI enhances risk management by detecting anomalies in complex synthesis pathways early, while also accelerating innovation through integration with bioinformatics and genomics for novel therapeutic discovery.

Report Scope of Oligonucleotide CDMO Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.84 Billion |

| Market Size by 2034 |

USD 22.73 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 21.85% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service, By Type, By Application, By End-User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bachem, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., EUROAPI, ST Pharm, Kaneka Eurogentec S.A., Ajinomoto Co., Inc., Syngene International Limited, PolyPeptide Group, Eurofins Scientific, GenScript, Lonza |

Market Dynamics

Driver

Growing Pipeline of Nucleic Acid-based Therapies

The rise in nucleic acid-based therapies fuels the oligonucleotide CDMO market because it increases the demand for flexible manufacturing platforms that can handle multiple modalities under one roof. As therapies advance from research to late-stage trials, companies need rapid scale adjustments and seamless tech transfers, which CDMOs are well-positioned to provide. Additionally, growing regulatory scrutiny on complex nucleic acid products drives firms to partner with CDMOs that already possess compliance-ready facilities and global quality certifications.

- For Instance, In August 2024, ST Pharm signed a USD 63.4 million contract with a European pharmaceutical company to supply APIs for a newly commercialized oligonucleotide therapy for hyperlipidemia, showcasing how the growing nucleic acid pipeline boosts CDMO demand. (Source: https://www.koreabiomed.com)

Restraint

High Cost and Complexity of Large-Scale Manufacturing

The high cost and complexity act as a restraint in the oligonucleotide CDMO market because unexpected scalability issues often lead to production delays and higher failure risks. The need for specialized facilities and limited global capacity creates supply bottlenecks, while frequent process adjustments increase time and resource requirements. Moreover, dependence on niche raw materials with volatile pricing adds financial pressure. These factors together restrict smooth project execution and discourage widespread adoption of oligonucleotide-based therapies.

Opportunity

Growing demand for Personalized and RNA-based Therapies

The increasing focus on personalized and RNA-based therapies offers future growth opportunities for oligonucleotide CDMOs by driving demand for advanced formulation technologies and innovative delivery methods. As therapies become more patient-specific, companies require flexible manufacturing platforms capable of handling require flexible manufacturing platforms capable of handling diverse molecular modifications. Additionally, the rise of global clinical trials and expansion into emerging markets encourages CDMOs to provide end-to-end solutions, from synthesis to quality control, positioning them as key players in accelerating the development and commercialization of next-generation nucleic acid therapeutics.

- For Instance, In June 2024, Roche partnered with Ascidian Therapeutics to develop gene therapies for neurological diseases using RNA exon editing technology. This collaboration highlights the increasing demand for specialized manufacturing capabilities in the oligonucleotide CDMO market, as companies seek to advance personalized RNA-based therapies. (Source: https://www.pharmtech.com/)

Segmental Insights

How does the Contract Manufacturing Segment dominate the Oligonucleotide CDMO Market in 2024?

In 2024, the contract manufacturing segment dominated the market because it allows companies to focus on R&D and commercialization while outsourcing complex production processes. The rise in multi-modality oligonucleotide therapies and the need for scalable, high-purity manufacturing further strengthened demand. Additionally, contract manufacturing offers flexibility in batch sizes, faster response to market fluctuations, and access to CDMOs' established supply chains, making it the preferred choice over in-house production for many pharma and biotech firms.

The contract development segment is projected to grow rapidly because there is increasing demand for tailored solutions in formulation, analytical testing, and process optimization of oligonucleotides. Emerging biotech firms, to CDMOs for expertise in innovative delivery methods and stability improvements. Furthermore, regulatory complexities and the push for faster clinical trial readiness make outsourcing development a strategic choice, enabling companies to accelerate their product pipeline and reduce development bottlenecks, driving growth in this segment.

Oligonucleotide CDMO Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Contract Manufacturing |

2.21 |

2.71 |

3.33 |

4.09 |

5.02 |

6.18 |

7.59 |

9.32 |

11.45 |

14.06 |

17.28 |

| Contract Development |

0.94 |

1.13 |

1.35 |

1.61 |

1.92 |

2.28 |

2.72 |

3.24 |

3.86 |

4.59 |

5.45 |

Why Did the ASO Segment Dominate the Market in 2024?

The ASO segment led the market in 2024 because of its versatility in modulating gene expression and treating a broad range of diseases, including metabolic and cardiovascular disorders. Increased collaborations between biotech firms and CDMOs for ASO developments, coupled with advancements in chemical modifications that enhance stability and efficacy, further fueled demand. Moreover, the relatively faster development timeliness and growing clinical success of ASO therapeutics compared to other oligonucleotide types contributed to its dominant revenue share in the market.

The siRNA segment is projected to grow rapidly because of the increasing focus on precision medicine and targeted therapies that require highly specific gene silencing. Growing awareness of siRNA potential in treating rare and hard-to-treat diseases is driving R&D investments. Furthermore, advancements in scalable manufacturing processes and improved regulatory pathways make outsourcing to CDMOs more attractive. These factors collectively create strong demand for siRNA development and production, positioning the segment for significant market growth during the forecast period.

Oligonucleotide CDMO Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| ASO |

1.25 |

1.52 |

1.83 |

2.21 |

2.66 |

3.22 |

3.87 |

4.67 |

5.63 |

6.78 |

8.18 |

| siRNA |

1.01 |

1.23 |

1.51 |

1.84 |

2.25 |

2.75 |

3.36 |

4.11 |

5.02 |

6.14 |

7.5 |

| CPG Oligos |

0.32 |

0.38 |

0.45 |

0.54 |

0.64 |

0.76 |

0.91 |

1.08 |

1.29 |

1.53 |

1.82 |

| gRNA |

0.57 |

0.71 |

0.89 |

1.11 |

1.39 |

1.73 |

2.17 |

2.7 |

3.37 |

4.2 |

5.23 |

How does the Therapeutic Segment Dominate the Oligonucleotide CDMO Market?

The therapeutic segment led the market in 2024 because of the rising emphasis on innovative treatments addressing unmet medical needs, including personalized and gene-targeted therapies. Increasing collaborations between pharma companies and CDMOs for large-scale production of therapeutic oligonucleotides, coupled with advancements in delivery systems that improve efficacy and safety, further drove demand. Moreover, growing investment in large-scale clinical trials and the expanding adoption of oligonucleotide therapeutics in multiple disease areas reinforced the segment's dominant market share.

The research segment is poised for strong growth as demand rises for specialized oligonucleotides in drug discovery, assay development, and diagnostic tool creation. Increasing funding in life sciences research, expansion of biotech startups, and the need for rapid prototyping of novel nucleic acid sequences encourage outsourcing to CDMOs. Furthermore, advances in high-throughput synthesis and analytical technologies make it easier for researchers to access custom oligonucleotides, boosting the segment's adoption and driving significant market growth during the forecast period.

Oligonucleotide CDMO Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Therapeutic |

2.36 |

2.9 |

3.56 |

4.36 |

5.34 |

6.56 |

8.04 |

9.86 |

12.09 |

14.83 |

18.18 |

| Research |

0.47 |

0.56 |

0.67 |

0.8 |

0.96 |

1.14 |

1.36 |

1.62 |

1.93 |

2.29 |

2.73 |

| Diagnostics |

0.32 |

0.38 |

0.45 |

0.54 |

0.64 |

0.76 |

0.91 |

1.08 |

1.29 |

1.53 |

1.82 |

Why Did the Pharma Segment Dominate the Market in 2024?

The pharma segment dominated the market in 2024 because pharma companies are increasingly partnering with CDMOs to access advanced technologies, high-quality manufacturing, and a global supply chain network. The rising demand for novel oligonucleotide therapeutics, coupled with the need to efficiently manage production costs and minimize operational risks, makes outsourcing attractive. Additionally, regulatory complexities and gene-based drugs further strengthen the pharma sector's position as the largest end-user in the oligonucleotides CDMO market.

The biotech segment is projected to grow rapidly because emerging biotech companies are increasingly investing in novel oligonucleotide therapies, including siRNA, ASO, and mRNA-based treatments. These firms often rely on CDMOs for cost-effective access to cutting-edge manufacturing technologies, analytical services, and faster scale-up solutions. Additionally, the rise of collaborative research, venture funding in biotech startups, and the push for innovative, targeted therapeutics are driving outsourcing demand, positioning the biotech end-use segment for significant growth during the forecast period.

Oligonucleotide CDMO Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Pharma |

1.83 |

2.21 |

2.68 |

3.24 |

3.91 |

4.74 |

5.73 |

6.93 |

8.39 |

10.14 |

12.28 |

| Biotech |

1.32 |

1.63 |

2 |

2.46 |

3.03 |

3.72 |

4.58 |

5.63 |

6.92 |

8.51 |

10.45 |

Regional Insights

How is North America contributing to the Expansion of the Oligonucleotide CDMO Market?

North America led the oligonucleotides CDMO market in 2024 due to early adoption of advanced oligonucleotide technologies and a strong pipeline of personalized and RNA-based therapeutics. Well-established research centers, high healthcare expenditure, and strategic partnerships between CDMOs and biotech firms enhanced the region’s production capabilities. Additionally, supportive government initiatives, increasing FDA approvals for oligonucleotide drugs, and the concentration of key market players further strengthened North America’s dominance in revenue generation within the global oligonucleotides CDMO market.

How is Asia-Pacific Accelerating the Oligonucleotide CDMO Market?

The Asia-Pacific oligonucleotides CDMO market is projected to grow fastest because of the region’s increasing focus on localized drug development and manufacturing to serve both domestic and international markets. Rising collaborations between global pharma companies and regional CDMOs, coupled with lower operational costs and government incentives for biotech innovation, drive growth. Furthermore, expanding clinical trials, growing healthcare infrastructure, and the surge in demand for novel oligonucleotide therapeutics position Asia-Pacific as a key growth hub during the forecast period.

Oligonucleotide CDMO Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

1.43 |

1.7 |

2.06 |

2.48 |

2.99 |

3.6 |

4.33 |

5.22 |

6.29 |

7.55 |

9.09 |

| Europe |

0.88 |

1.07 |

1.29 |

1.56 |

1.89 |

2.28 |

2.76 |

3.34 |

4.04 |

4.89 |

5.91 |

| Asia Pacific |

0.69 |

0.87 |

1.09 |

1.36 |

1.69 |

2.12 |

2.64 |

3.29 |

4.1 |

5.11 |

6.36 |

| Latin America |

0.09 |

0.12 |

0.14 |

0.17 |

0.21 |

0.26 |

0.32 |

0.39 |

0.48 |

0.59 |

0.73 |

| Middle East & Africa (MEA) |

0.06 |

0.08 |

0.1 |

0.13 |

0.16 |

0.2 |

0.26 |

0.32 |

0.4 |

0.51 |

0.64 |

Top Companies in the Oligonucleotide CDMO Market

- Bachem

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- EUROAPI

- ST Pharm

- Kaneka Eurogentec S.A.

- Ajinomoto Co., Inc.

- Syngene International Limited

- PolyPeptide Group

- Eurofins Scientific

- GenScript

- Lonza

Recent Developments in the Oligonucleotide CDMO Market

- In April 2025, Sumitomo Chemical launched Sumitomo Chemical Advanced Medical Solutions America LLC in Massachusetts to operate its oligonucleotide CDMO business, with plans to supply gRNA samples to clients by August 2025. (Source: https://www.outsourcedpharma.com/)

- In July 2024, Agilent Technologies entered a strategic deal to acquire specialized CDMO BioVectra for $925 million, aiming to strengthen its oligonucleotide and CRISPR therapeutics capabilities. The acquisition expands Agilent’s service portfolio and enhances its expertise in supporting advanced gene-editing technologies. (Source: https://www.investor.agilent.com/)

Segments Covered in the Report

By Service

- Contract Manufacturing

- Clinical

- Commercial

- Contract Development

By Type

- ASO

- siRNA

- CPG Oligos

- gRNA

By Application

- Therapeutic

- Research

- Diagnostics

By End-User

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)