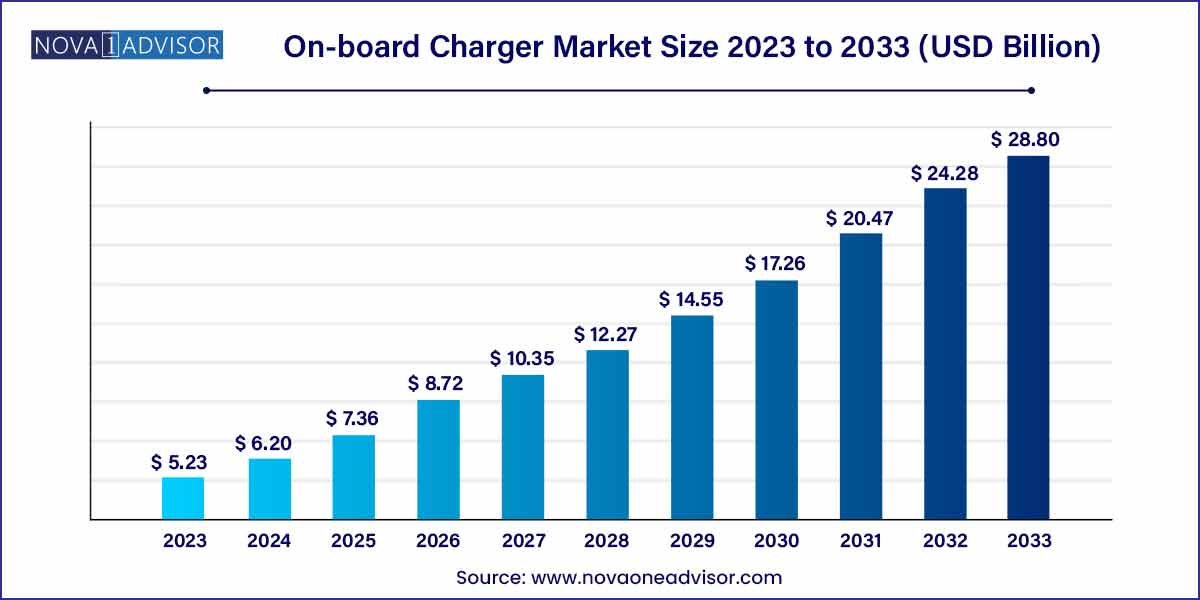

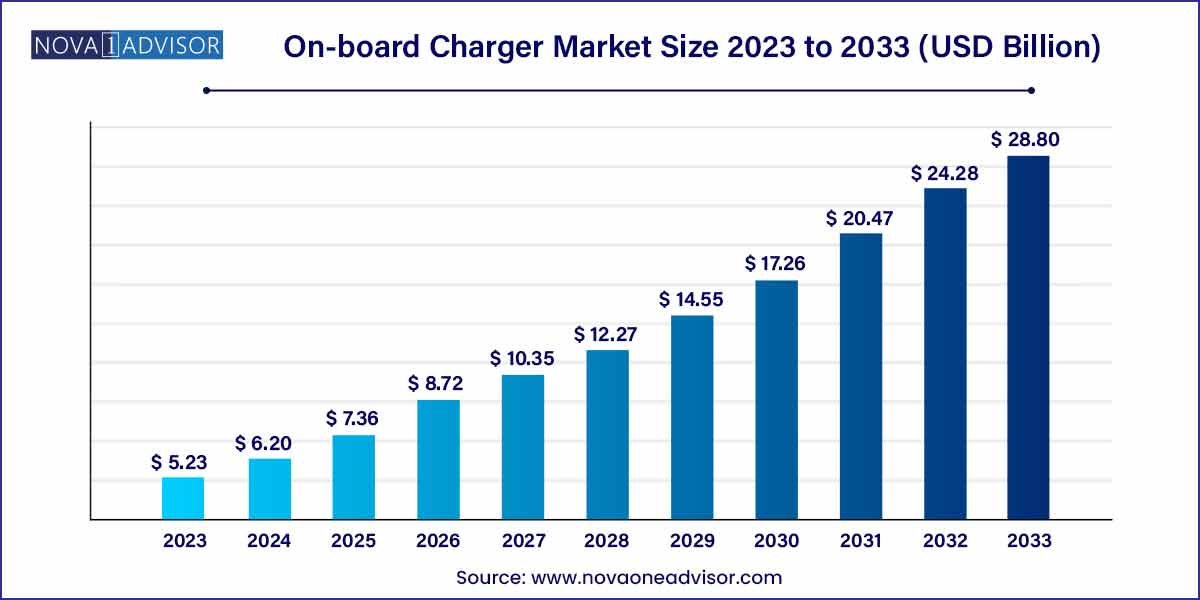

The global on-board charger market size was exhibited at USD 5.23 billion in 2023 and is projected to hit around USD 28.80 billion by 2033, growing at a CAGR of 18.6% during the forecast period of 2024 to 2033.

Key Takeaways:

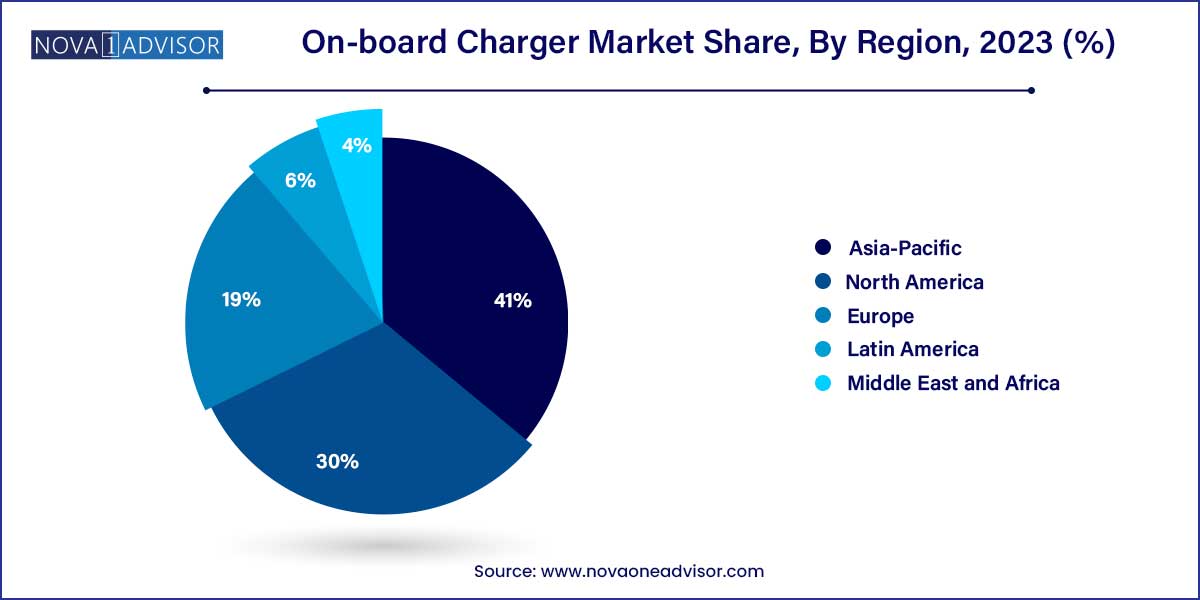

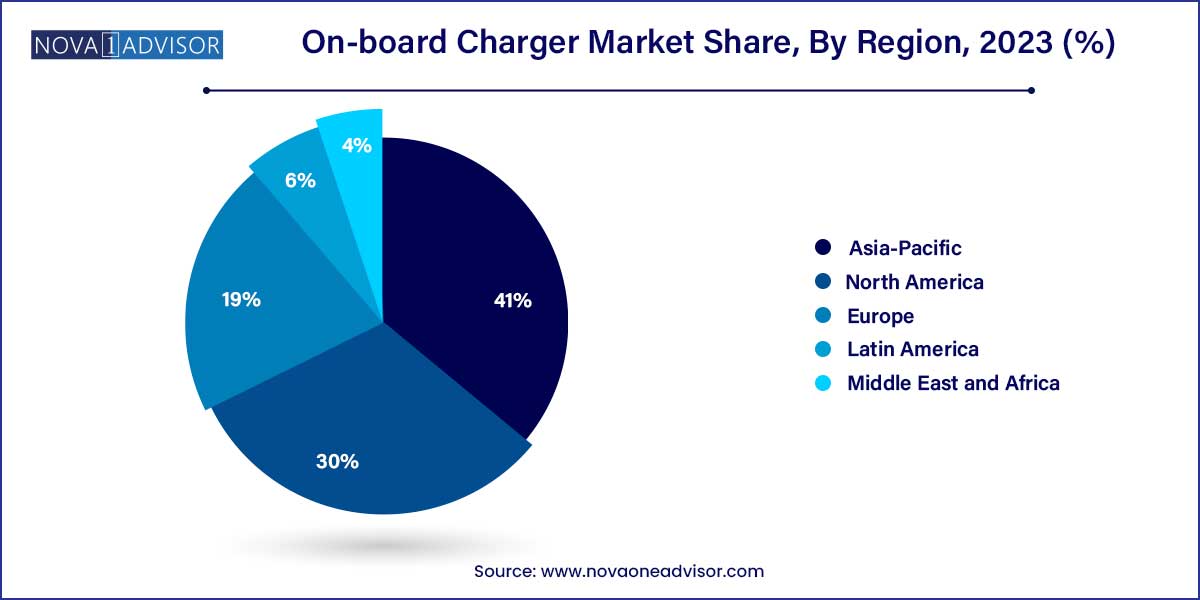

- The Asia Pacific region dominated the on-board charger market and accounted for more than 41.0% of the global revenue in 2023.

- The less than 11 kW segment dominated the market and accounted for more than 40.0% of the global revenue in 2023.

- The passenger cars segment dominated the market and accounted for more than 54.0% of the global revenue in 2023.

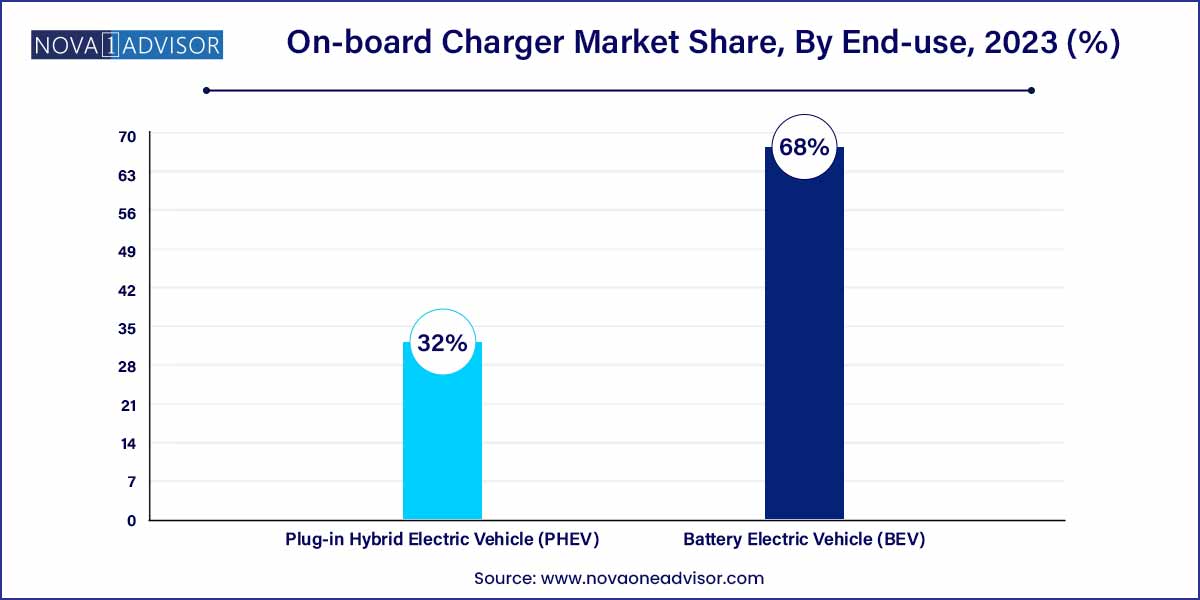

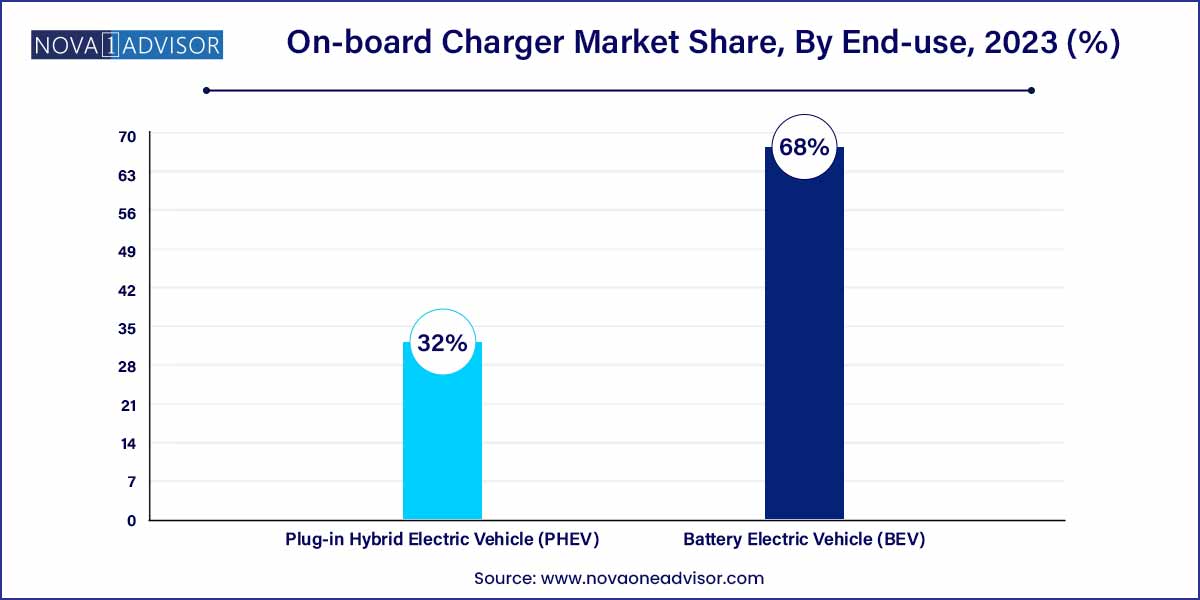

- The BEV segment dominated the market and accounted for more than 68.0% of global revenue in 2023.

On-board Charger Market by Overview

In the realm of electric vehicles (EVs), the on-board charger stands as a pivotal component, dictating the efficiency and convenience of charging solutions. With the burgeoning demand for sustainable transportation options, the on-board charger market witnesses a surge in innovation and competition. This overview delves into the multifaceted landscape of on-board chargers, encompassing market trends, key players, technological advancements, and future prospects.

On-board Charger Market Growth

The growth of the on-board charger market is propelled by several key factors.Firstly, the increasing adoption of electric vehicles (EVs) globally, driven by stringent emission regulations and growing environmental consciousness among consumers, fuels the demand for efficient charging solutions. Secondly, technological advancements in on-board charger technology, including bidirectional charging capabilities, wireless charging solutions, and smart grid integration, contribute to enhanced efficiency and convenience, thereby attracting more consumers. Additionally, declining battery costs and infrastructure investments in charging networks further stimulate market growth by reducing barriers to EV adoption. Moreover, the emergence of electric fleets, autonomous vehicles, and shared mobility models presents new opportunities for market expansion, as on-board chargers become integral components of diverse transportation ecosystems. Overall, these growth factors converge to propel the on-board charger market into a phase of rapid expansion and innovation.

On-board Charger Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.23 Billion |

| Market Size by 2033 |

USD 28.80 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 18.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Power Output, Vehicle Type, Propulsion Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Bel Fuse Inc.; Delta Energy Systems; STMicroelectronics; Toyota Industries Corporation; Eaton; Stercom Power Solutions GmbH; innolectric AG; BRUSA Elektronik AG; AVID Technology Limited; Ficosa Internacional SA. |

On-board Charger Market Dynamics

- Regulatory Environment and Government Initiatives:

The regulatory landscape and government initiatives play a pivotal role in shaping the dynamics of the on-board charger market. With an increasing focus on reducing greenhouse gas emissions and combating climate change, governments worldwide are implementing stringent regulations favoring electric vehicles (EVs). These regulations include mandates for automakers to produce a certain percentage of zero-emission vehicles and stringent emission standards that incentivize the adoption of EVs. Additionally, governments are rolling out various incentives and subsidies to promote EV adoption, such as tax credits, rebates, and grants for purchasing EVs and installing charging infrastructure.

- Technological Advancements and Innovation:

Technological advancements and innovation constitute another significant dynamic shaping the on-board charger market. As the EV industry evolves, there is a continuous emphasis on improving charging efficiency, reducing charging times, and enhancing user experience. Manufacturers are investing heavily in research and development to develop cutting-edge on-board charger technologies that address these objectives. Innovations such as bidirectional charging capabilities, which enable vehicles to both charge and discharge electricity to and from the grid, are gaining traction, especially in the context of vehicle-to-grid (V2G) applications.

On-board Charger Market Restraint

- Charging Infrastructure Challenges:

One of the primary restraints hindering the growth of the on-board charger market is the inadequate charging infrastructure. Despite the increasing popularity of electric vehicles (EVs), the availability of charging stations remains limited, especially in certain regions. This lack of infrastructure poses a significant barrier to EV adoption, as consumers are concerned about range anxiety and the availability of charging facilities during long journeys. Moreover, the slow pace of infrastructure development hampers the market penetration of EVs and subsequently impacts the demand for on-board chargers.

- High Initial Costs and Limited Consumer Awareness:

Another restraint affecting the on-board charger market is the high initial costs associated with electric vehicles and on-board charging solutions. While the long-term operational costs of EVs are lower compared to conventional internal combustion engine vehicles, the upfront purchase price of EVs remains relatively high. Similarly, the cost of installing on-board chargers in EVs contributes to the overall cost of ownership, potentially deterring price-sensitive consumers from embracing electric mobility. Furthermore, limited consumer awareness and misconceptions about EVs, including concerns about range, charging times, and battery longevity, impede market growth.

On-board Charger Market Opportunity

- Rapid Expansion of Electric Vehicle (EV) Market:

The exponential growth of the electric vehicle market presents a significant opportunity for the on-board charger market. As governments worldwide implement stringent emission regulations and incentivize the adoption of electric vehicles to mitigate climate change and reduce air pollution, the demand for on-board chargers is expected to soar. With major automotive manufacturers increasingly investing in electric vehicle development and expanding their EV product portfolios, the market for on-board chargers is poised for rapid expansion. Moreover, the emergence of electric fleets, shared mobility services, and autonomous vehicles further amplifies the demand for on-board charging solutions.

- Advancements in Charging Technology and Infrastructure:

Technological advancements and infrastructure developments in the charging ecosystem present lucrative opportunities for the on-board charger market. Innovations such as faster charging speeds, bidirectional charging capabilities, wireless charging solutions, and smart grid integration are reshaping the landscape of on-board charging technology. These advancements not only enhance the efficiency and convenience of charging but also unlock new revenue streams and business models. Additionally, the expansion of charging infrastructure, including the deployment of fast-charging stations along highways, in urban areas, and at commercial establishments, enhances the accessibility and convenience of EV charging, thereby driving the adoption of electric vehicles and on-board chargers.

On-board Charger Market Challenges

- Range Anxiety and Charging Times:

One of the primary challenges facing the on-board charger market is the issue of range anxiety among electric vehicle (EV) owners and the perception of lengthy charging times. Despite advancements in battery technology and charging infrastructure, concerns about the limited driving range of EVs and the time required to recharge the battery remain prevalent among consumers. This apprehension often dissuades potential EV buyers from making the switch to electric mobility. Additionally, the lack of fast-charging infrastructure in certain regions exacerbates range anxiety and limits the feasibility of long-distance travel in EVs.

- Compatibility and Standardization:

Another challenge confronting the on-board charger market is the lack of compatibility and standardization of charging protocols among different EV models and manufacturers. The absence of uniform standards for on-board charging connectors, communication protocols, and power ratings complicates the charging process and limits interoperability between EVs and charging stations. This lack of compatibility hampers consumer confidence and convenience, as EV owners may encounter difficulties finding compatible charging stations or experience compatibility issues when attempting to charge their vehicles. Moreover, the proliferation of proprietary charging technologies by automakers further exacerbates the fragmentation of the charging ecosystem.

Segments Insights:

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic negatively impacted the sales of electric vehicles in the first half of 2020, which hindered the market growth. According to the statistics provided by the Society of Electric Vehicle Manufacturers, registration of electric vehicles during 2022 declined by 20%, to 236,802 units compared to 295,683 units in 2020. However, efforts are being undertaken by governments, such as the increase in purchase incentives, decline in battery costs, upgrade offers by original equipment manufacturers for EV, during the pandemic provided opportunities for EV adoption. For instance, in Germany, the purchase subsidy provided on BEV, which was to end in 2022, was extended to 2025 due to the pandemic.

Power Output Insights

The less than 11 kW segment dominated the market and accounted for more than 40.0% share of the global revenue in 2023. Most electric vehicles are expected to feature 6 kW to 11 kW on-board chargers in the coming years. According to the statistics published by OpenSystems Media, approximately 98.2% of on-board chargers will be 6 kW to 11 kW, rather than 3 kW to 5 kW, in the upcoming years. At the same time, benefits offered by less than 11 kW on-board chargers, such as increased charging efficiency and maximized performance, are expected to drive the segment growth.

The 11 kW to 22 kW segment is anticipated to register the significant growth over the forecast period. The 11-22 kW chargers are tri-phase AC chargers that charge an electric vehicle in two to four hours. A tri-phase AC charger is commonly used as a public charge point. According to the statistics provided by Transport & Environment, 61% of European public chargers are tri-phase AC chargers.

Vehicle Type Insights

The passenger cars segment dominated the market and accounted for more than 54.0% share of the global revenue in 2023. The increasing sales of electric passenger cars globally are expected to create the demand for on-board chargers. For instance, over 750,000 all-electric cars were registered in the U.S. in 2023, which was 57% higher than 2022.

The buses segment is expected to register the fastest growth over the forecast period. An on-board charger is used in buses for converting the AC to DC for charging the battery. The increase in sales of zero-emission buses globally is expected to accentuate the segment growth. According to the statistics provided by Sustainable Bus, a web magazine focused on the electric buses market, by 2040, the sales of electric buses are expected to rise to 83%.

Propulsion Type Insights

The BEV segment dominated the market and accounted for more than 68.0% share of the global revenue in 2023. In Battery Electric Vehicle (BEV), the propulsion is provided through the plug-in charged battery. The rise in BEV vehicles is driving the segment growth. Various companies such as Tesla, Inc., Volkswagen, Audi, and Mercedes-Benz have accounted for the large share in the BEV segment. In 2023, 484,351 Tesla BEVs were registered in the U.S. which was 41% higher than 343,000 registrations in 2022.

The PHEV segment is expected to register the fastest growth over the forecast period. Various Plug-in Hybrid Electric Vehicle (PHEV) manufacturers are adopting on-board chargers with an output between 3 to 3.7 kW, which is driving the segment growth. Car models such as Hyundai Sonata PHEV, Kia K5 PHEV, and Outlander PHEV use on-board chargers for charging their batteries. PHEVs are witnessing exponential growth across the world. In February 2023, BYD, a China-based electric vehicle manufacturer, sold 191,664 PHEVs, witnessing an increase of 119%, compared to 2022.

Regional Insights

The Asia Pacific region dominated the on-board charger market and accounted for more than 41.0% share of the global revenue in 2023. The growing demand for on-board chargers in Asia Pacific is driven by the increasing adoption of EVs, expanding charging infrastructure, and the availability of renewable energy sources. As the region continues to prioritize sustainability and green technologies, the demand for on-board chargers is likely to continue to grow in the years to come.

The European regional market is expected to register significant growth over the forecast period. The players in Europe are continuously making efforts to expand their EV offerings, which is thereby driving the demand for on-board chargers. According to the BMW vision, the company has planned to electrify its SUVs, sedans, and Mini vehicles in Europe by 2030. At the same time, an increase in subsidies provided on the purchase of electric vehicles is also one of the major factors driving the market growth in the region.

Some of the prominent players in the On-board charger market include:

- Bel Fuse Inc.

- Delta Energy Systems

- STMicroelectronics

- Toyota Industries Corporation

- Eaton

- Stercom Power Solutions GmbH

- innolectric AG

- BRUSA Elektronik AG

- AVID Technology Limited

- Ficosa Internacional SA

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global on-board charger market.

Power Output

- Less than 11 kW

- 11 kW to 22 kW

- More than 22 kW

Vehicle Type

- Passenger Car

- Buses

- Vans

- Medium & Heavy Duty Vehicles

- Boats

- Others

Propulsion Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)