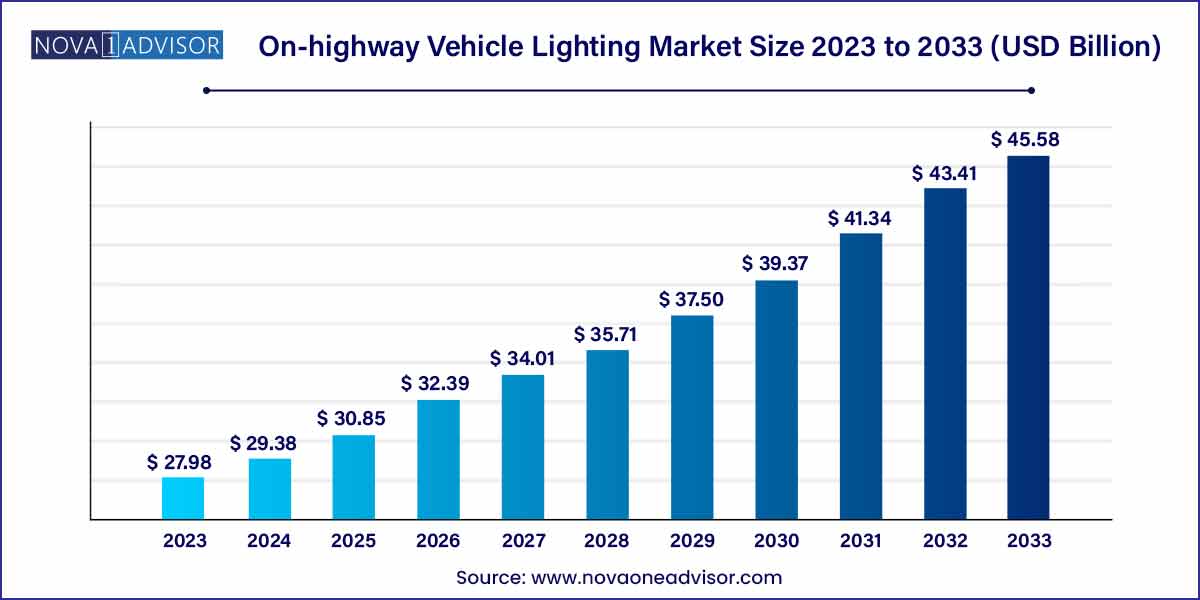

The global on-highway vehicle lighting market size was exhibited at USD 27.98 billion in 2023 and is projected to hit around USD 45.58 billion by 2033, growing at a CAGR of 5.0% during the forecast period of 2024 to 2033.

Key Takeaways:

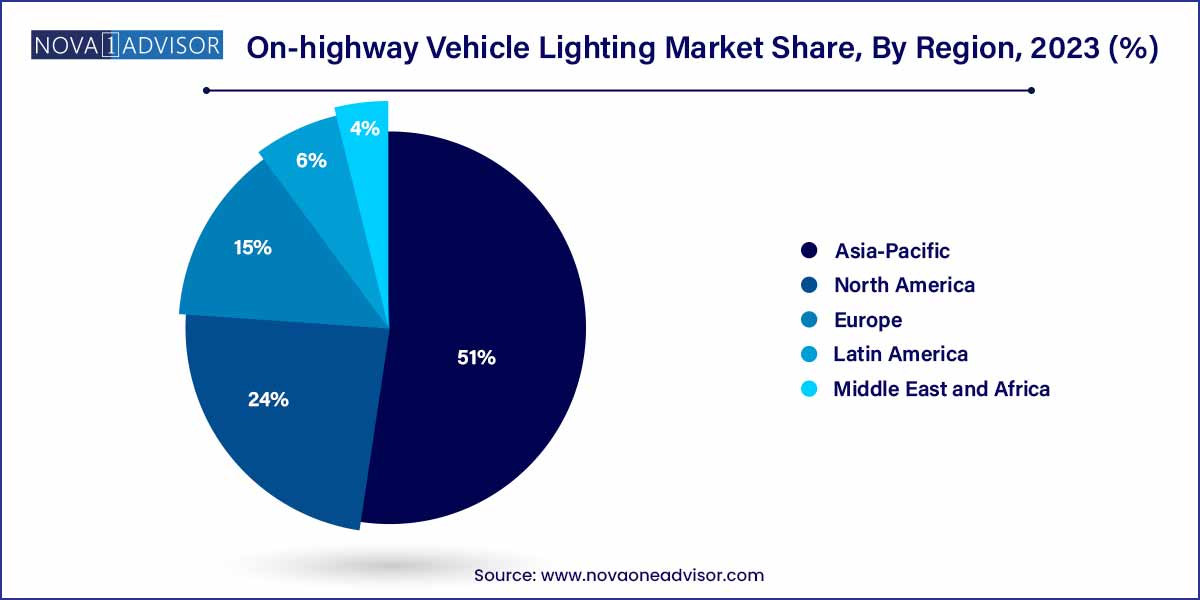

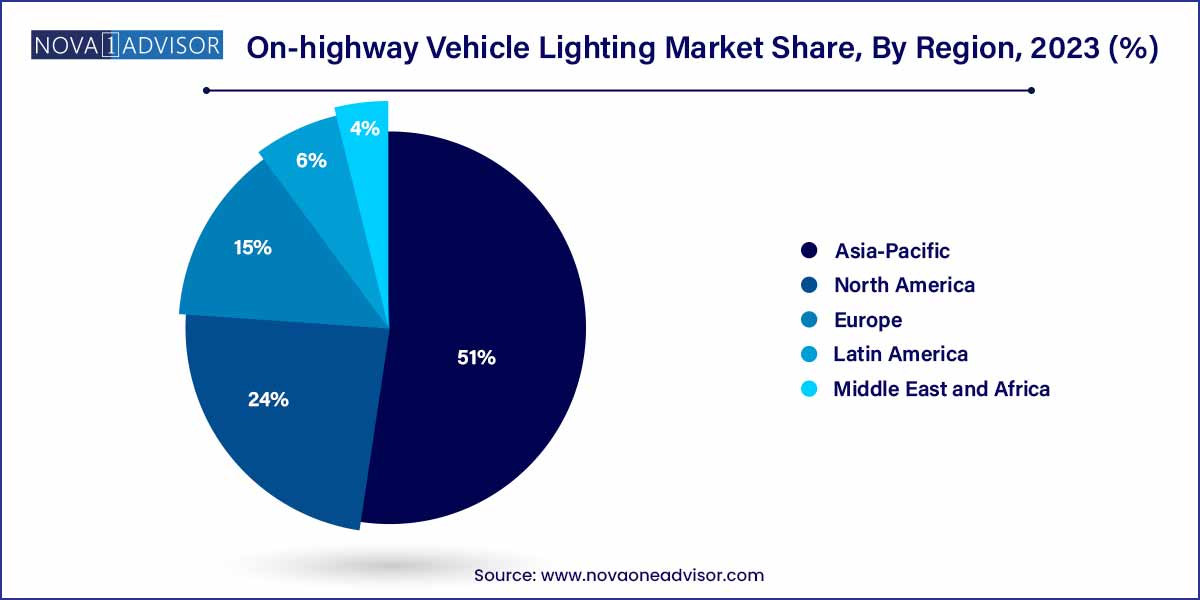

- Asia Pacific accounted for the largest revenue share of over 51% in 2023.

- The LED segment dominated the market and captured around 40% of the on-highway vehicle lighting demand in 2023.

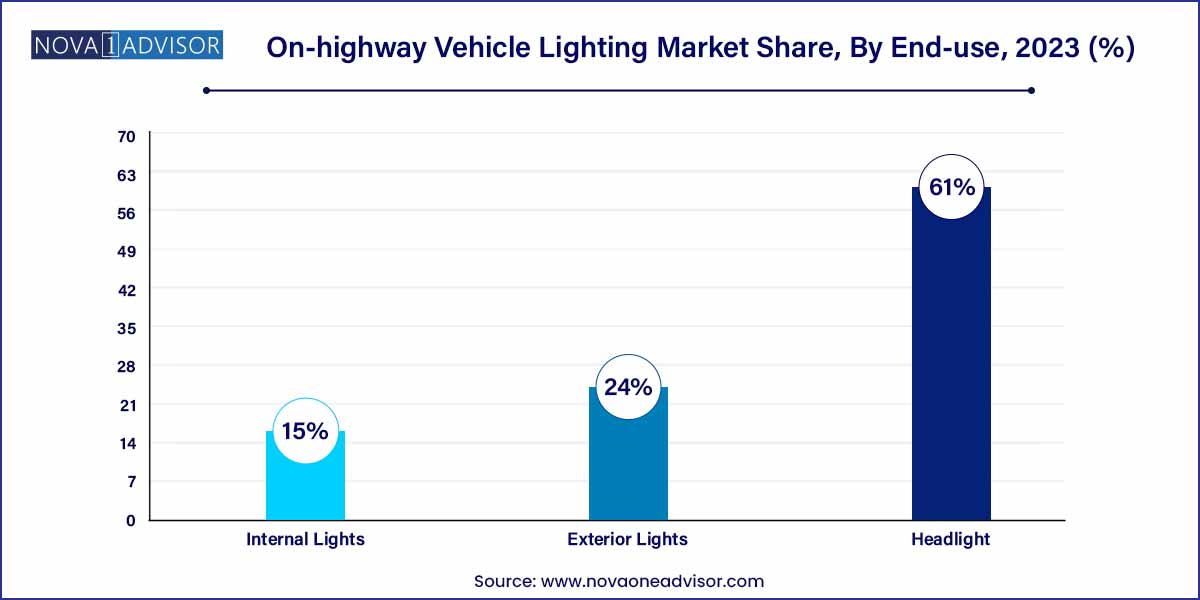

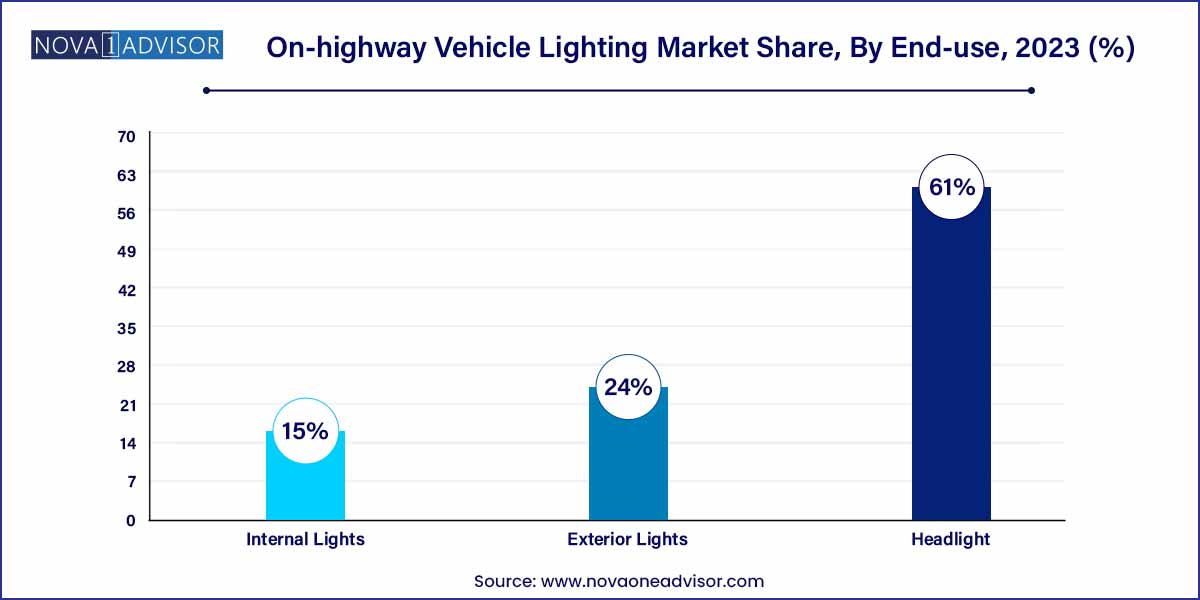

- The headlight application segment captured over 61% of the on-highway vehicle lighting market share in 2023.

- Considering the type of vehicle, the passenger car segment accounted for the largest revenue share of over 40% in 2023 and is expected to maintain its dominance over the projected period.

Market Overview

The on-highway vehicle lighting market forms a crucial segment of the global automotive lighting industry, encompassing all lighting systems specifically designed for vehicles that operate on public roadways—ranging from passenger cars and motorcycles to commercial vehicles such as light, medium, and heavy trucks. These lighting systems are not only essential for visibility and driver safety, but also play a growing role in vehicle aesthetics, energy efficiency, and autonomous driving functionality.

Modern vehicle lighting has evolved beyond basic illumination to include advanced driver-assistance system (ADAS) integration, adaptive beam control, and energy-efficient technologies. The shift toward electric and smart vehicles has further catalyzed innovation in this sector, with demand for LED, laser, and organic light-emitting diode (OLED) technologies rising rapidly. These innovations aim to improve visibility, reduce glare, and enable better vehicle-to-vehicle and vehicle-to-infrastructure communication.

Driven by safety regulations, consumer expectations for high-end aesthetics, and the ongoing transformation of the automotive industry, the on-highway vehicle lighting market is witnessing unprecedented growth. As lighting systems evolve to meet both functional and regulatory demands, OEMs and suppliers are focused on delivering intelligent, energy-efficient, and customizable lighting solutions.

On-highway Vehicle Lighting Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 27.98 Billion |

| Market Size by 2033 |

USD 45.58 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Marelli Automotive Lighting; KOITO MANUFACTURING CO. Ltd.; Valeo; Koninklijke Philips N.V.; Zizala Lichtsysteme GmbH; TYC Genera; Spyder Auto; Maxxima; Optronics International LLC. |

On-highway Vehicle Lighting Market Dynamics

The dynamics of the on-highway vehicle lighting market are intricately shaped by two primary factors: technological advancements and the evolving regulatory landscape. Firstly, the industry is experiencing a paradigm shift with the widespread adoption of advanced lighting technologies, notably LED and OLED solutions. These technologies not only enhance visibility and energy efficiency but also provide manufacturers with greater design flexibility. The integration of adaptive lighting systems, capable of adjusting light beams based on driving conditions, exemplifies this technological progression, contributing to heightened safety standards.

Secondly, the regulatory landscape plays a pivotal role in steering the on-highway vehicle lighting market. Stringent regulations, such as FMVSS 108 in the United States and ECE regulations in Europe, impose compliance requirements on manufacturers, pushing them to continually innovate. These regulations are focused on bolstering vehicle safety and reducing emissions, fostering a climate of innovation in the development of lighting systems. Manufacturers must navigate these regulatory frameworks adeptly, ensuring their products meet or exceed mandated standards while staying attuned to evolving requirements.

On-highway Vehicle Lighting Market Restraint

The on-highway vehicle lighting market faces notable restraints, with two key factors impacting its growth and development. Firstly, cost constraints pose a significant challenge for manufacturers and consumers alike. The integration of advanced lighting technologies, such as LED and OLED solutions, often comes with a higher initial cost. Manufacturers must strike a delicate balance between incorporating cutting-edge technologies and maintaining competitive pricing to cater to a broad consumer base. Additionally, consumers may be hesitant to adopt vehicles equipped with these advanced lighting systems due to concerns about potential repair and replacement costs.

Secondly, supply chain disruptions and global economic conditions represent another significant restraint for the on-highway vehicle lighting market. The industry relies on a complex network of suppliers and manufacturers across different regions. Disruptions in the supply chain, whether caused by geopolitical events, natural disasters, or global economic downturns, can lead to delays in production and increased costs. These uncertainties create challenges for market players in maintaining a stable and efficient supply chain, impacting their ability to meet demand consistently.

On-highway Vehicle Lighting Market Opportunity

The on-highway vehicle lighting market presents compelling opportunities, primarily driven by the increasing focus on electric vehicles (EVs) and the rise of autonomous driving technology. Firstly, the surge in the adoption of electric vehicles creates a significant opportunity for innovation in lighting solutions tailored to the unique requirements of these platforms. As EVs gain traction, manufacturers have the chance to develop lighting systems that are energy-efficient, lightweight, and complement the distinct design features of electric vehicles. This shift toward electrification opens up a new avenue for market players to differentiate their offerings and cater to the evolving needs of the automotive landscape.

Secondly, the ongoing development of autonomous vehicles represents a noteworthy opportunity for the on-highway vehicle lighting market. As vehicles become more autonomous, there is an increased emphasis on communication between the vehicle and its surroundings. Lighting systems play a crucial role in conveying information to pedestrians, cyclists, and other drivers. Innovations such as smart lighting, which can dynamically adjust based on the vehicle's status and surroundings, become integral in enhancing safety in autonomous driving scenarios. The demand for advanced lighting technologies to support the visual communication requirements of autonomous vehicles presents a lucrative opportunity for manufacturers to pioneer cutting-edge solutions in this rapidly evolving segment.

On-highway Vehicle Lighting Market Challenges

The on-highway vehicle lighting market faces notable challenges that impact its trajectory and development. Firstly, stringent regulatory requirements represent a significant hurdle for manufacturers. Compliance with various safety standards such as FMVSS 108 and ECE regulations necessitates continuous adaptation and innovation in lighting systems. The challenge lies in meeting these regulatory standards while simultaneously addressing the evolving demands of consumers for advanced features, aesthetics, and energy efficiency. Manufacturers must navigate this complex landscape to ensure their products not only comply with safety regulations but also align with market expectations.

Secondly, the industry contends with the constant pressure of balancing cost considerations with the integration of advanced lighting technologies. The implementation of cutting-edge solutions like LED and OLED comes with an inherent cost, impacting both manufacturing expenses and the final retail price of vehicles. Striking a balance between providing technologically advanced lighting systems and keeping products cost-competitive is a persistent challenge. Consumers may be hesitant to embrace vehicles equipped with these advanced technologies if perceived costs, including potential repair and replacement expenses, are perceived as prohibitive.

Segments Insights:

Product Insights

LED lighting dominates the product segment, thanks to its high energy efficiency, long operational lifespan, compact design, and design versatility. LED systems offer rapid illumination, excellent thermal management, and aesthetic flexibility, which have made them the lighting standard across most new vehicle platforms. Automakers are integrating LEDs not only in headlights but also in DRLs, taillights, fog lamps, and ambient lighting features. Their adaptability supports dynamic lighting functions like animation, signaling, and adaptive beam control.

Laser lighting is the fastest-growing product type, driven by premium vehicle adoption and technological enhancements in beam distance and accuracy. Laser systems are primarily used in high-end vehicles from brands like BMW and Audi but are expected to trickle down as production costs decrease. With exceptional range and brightness, laser lights are ideal for highway driving and rural areas with minimal lighting infrastructure.

Application Insights

Headlights are the dominant application, as they are the most critical safety lighting components and are highly regulated. Automakers have invested heavily in improving headlight functionality, visibility, and aesthetic design. The rise of adaptive driving beam (ADB) and matrix lighting has transformed headlights into intelligent systems that enhance both safety and comfort for drivers and pedestrians.

Interior lighting is the fastest-growing application, largely due to the increasing demand for customization, user comfort, and brand differentiation. Ambient lighting in vehicle cabins is no longer a luxury feature but a mainstream trend across vehicle classes. Manufacturers are using ambient lighting to create immersive driving experiences, integrate infotainment feedback, and enhance perceived vehicle quality.

Vehicle Type Insights

Passenger cars hold the largest share of the vehicle type segment, driven by their high production volumes and rapid adoption of advanced lighting technologies. Consumer demand for stylish, safe, and high-tech features has compelled automakers to integrate LED DRLs, matrix headlights, and customizable taillights as standard or optional offerings. The segment benefits from continuous innovation and early adoption of premium technologies.

Light trucks (Class 1–3) are the fastest-growing category, due to rising popularity of SUVs and pickup trucks in North America and parts of Asia. These vehicles are increasingly fitted with rugged, high-intensity lighting systems for off-road and utility use. Additionally, automakers are enhancing exterior and interior lighting features in trucks to appeal to lifestyle buyers and professional users alike.

Regional Insights

Europe dominates the on-highway vehicle lighting market, supported by strict road safety laws, strong OEM presence, and consumer preference for technologically advanced vehicles. European automakers were early adopters of LED and matrix lighting technologies and have led the push for legalizing adaptive high-beam systems. The region also emphasizes aesthetic design and sustainability, fueling innovation in energy-efficient lighting.

Asia-Pacific is the fastest-growing region, with China, India, Japan, and South Korea driving vehicle production and adoption of advanced technologies. The growing middle class, expanding automotive industry, and increasing demand for electric and connected vehicles are boosting lighting upgrades. Local OEMs are collaborating with global lighting suppliers to bring advanced features into mainstream models at affordable price points.

Some of the prominent players in the on-highway vehicle lighting market include:

- KOITO MANUFACTURING CO., LTD.

- Koninklijke Philips N.V.

- Marelli Automotive Lighting

- Valeo

- Zizala Lichtsysteme GmbH (LG Electronics)

- TYC Genera

- Spyder Auto

- Maxxima

- Optronics International LLC

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global on-highway vehicle lighting market.

Product

- Halogen

- HID

- LED

- Incandescent

- LASER

Application

- Headlight

- Exterior Lights

- Internal Lights

Vehicle Type

- Motorcycle

- Passenger Cars

- Buses

- Light Trucks (Class 1-3)

- Medium Trucks (Class 4-6)

- Heavy Trucks (Class 7 & 8)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)