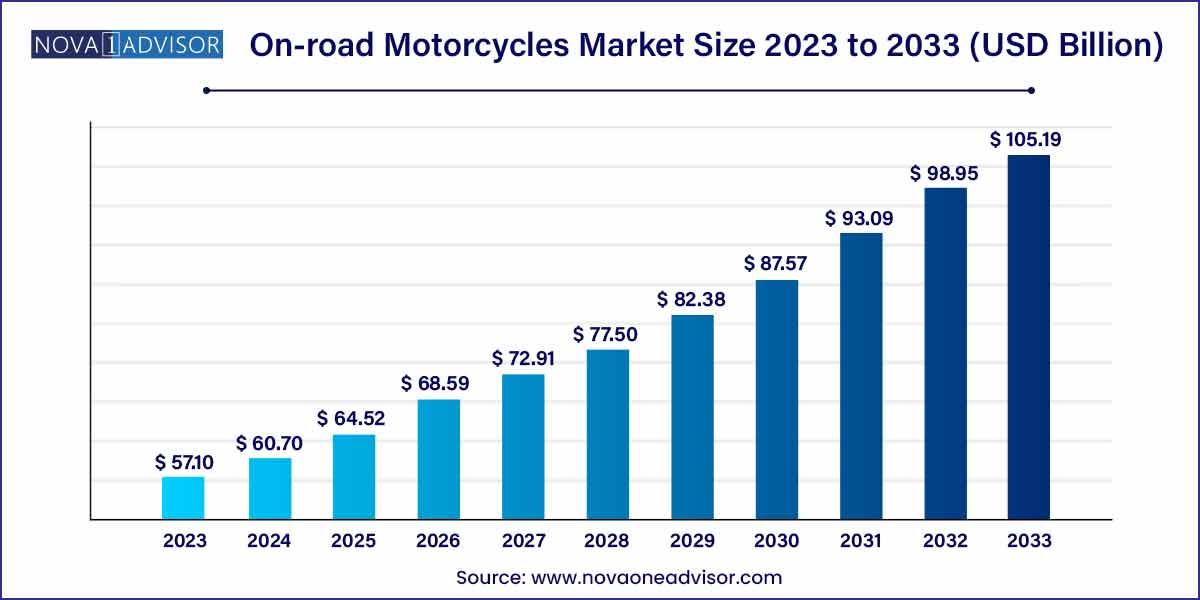

The global on-road motorcycles market size was exhibited at USD 57.10 billion in 2023 and is projected to hit around USD 105.19 billion by 2033, growing at a CAGR of 6.3% during the forecast period of 2024 to 2033.

Key Takeaways:

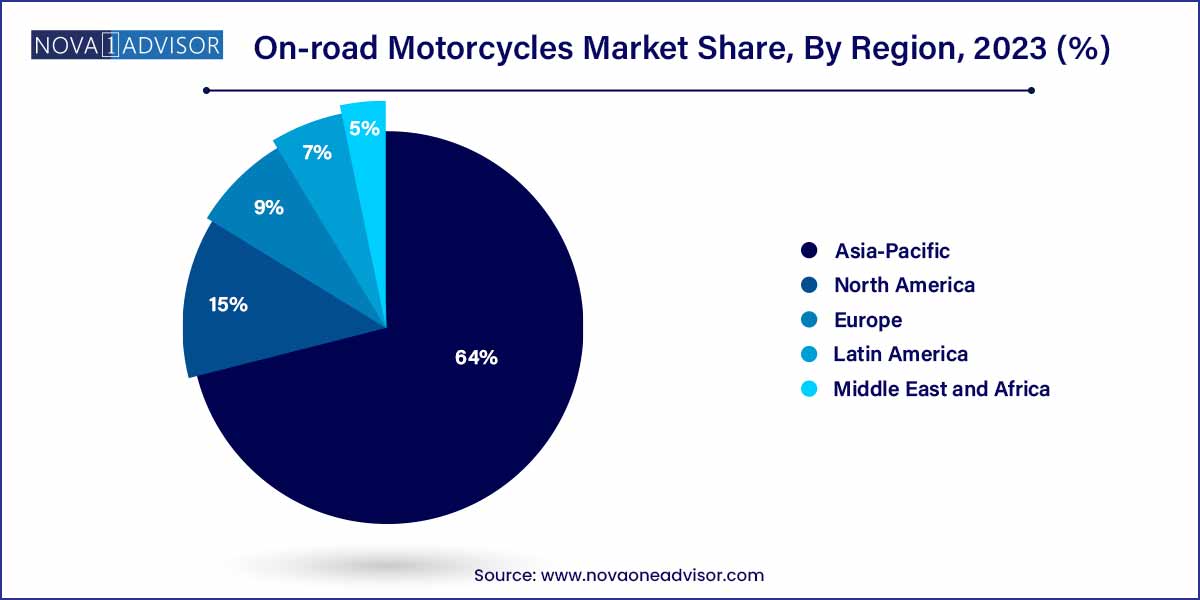

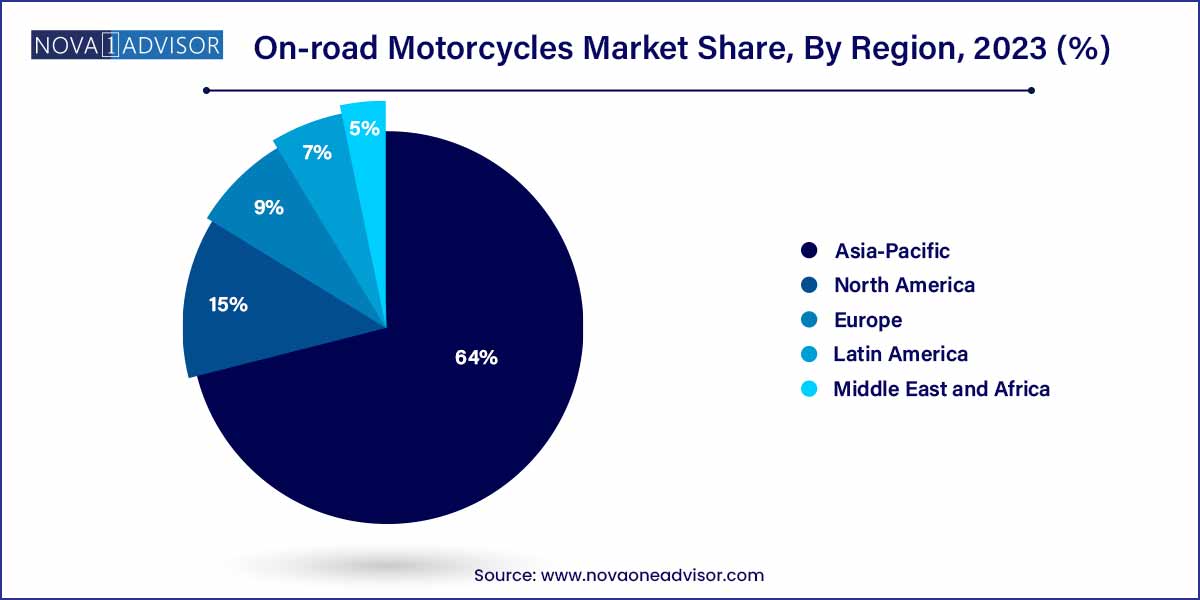

- Asia Pacific accounted for a significant revenue share of more than 64.0% in 2023.

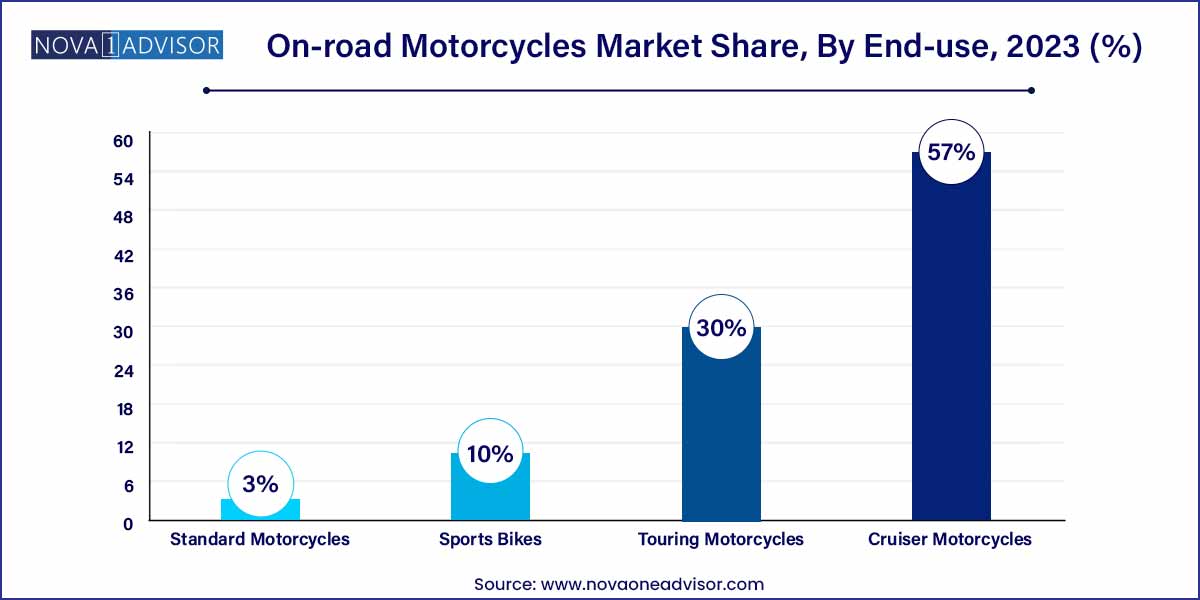

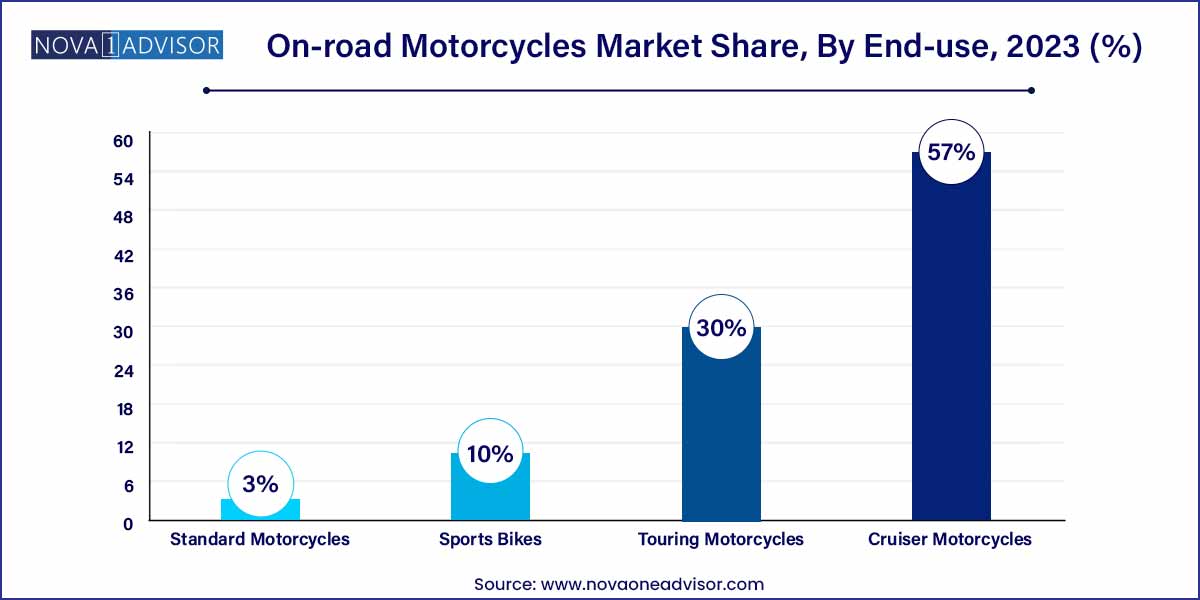

- The cruiser motorcycles segment dominated the market and contributed a revenue share of more than 57.0% in 2023.

On-road Motorcycles Market: Overview

The global on-road motorcycles market has evolved significantly over the past decade, fueled by an amalgamation of technological advancements, consumer lifestyle changes, and economic growth in emerging markets. Encompassing a wide array of two-wheeled motor vehicles designed primarily for paved surfaces, this market segment includes sports bikes, cruisers, touring motorcycles, and standard motorcycles. Motorcycles offer a cost-effective, fuel-efficient, and versatile mode of transportation, which makes them particularly attractive in urban centers grappling with congestion and rising commuting times.

The market is characterized by a high degree of innovation, with manufacturers consistently introducing advanced safety features, electric models, and connectivity solutions. Simultaneously, motorcycle culture has flourished, fostering a passionate community of enthusiasts globally. Whether for daily commuting, leisure touring, or competitive racing, motorcycles hold a unique position that bridges practical necessity with lifestyle aspirations.

The future outlook remains optimistic, with market players focusing on expanding electric motorcycle portfolios, improving safety features, and capitalizing on the emerging middle class in developing economies. Additionally, increasing adoption among women riders and younger demographics presents a fresh wave of growth potential.

On-road Motorcycles Market Growth

The growth of the on-road motorcycles market is fueled by several key factors. Technological advancements play a crucial role, with innovations in engine technology, materials, and design leading to more efficient and powerful motorcycles. Urbanization and increasing traffic congestion also drive market growth, as consumers seek agile and maneuverable two-wheelers for convenient mobility in crowded cities. Cultural shifts towards recreational and alternative modes of transportation further contribute to the market's expansion. Additionally, growing environmental concerns prompt manufacturers to develop electric and hybrid motorcycles, catering to environmentally conscious consumers. These factors collectively propel the growth of the on-road motorcycles market, shaping its trajectory in the automotive industry.

On-road Motorcycles Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 57.10 Billion |

| Market Size by 2033 |

USD 105.19 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Harley-Davidson Incorporation; Yamaha Motor Co., Ltd.; Ducati Motor Holding S.p.A.; Honda Motor Co., Ltd.; Kawasaki Heavy Industries, Ltd.; BMW AG; Suzuki Motor Corporation; Hero MotoCorp Limited; Bajaj Auto Ltd.; TVS Motor Company. |

On-road Motorcycles Market Dynamics

The dynamics of the on-road motorcycles market are shaped by a multitude of factors, two of the most significant being technological innovation and urbanization. Technological advancements drive market evolution, with continuous improvements in engine technology, materials, and design enhancing the performance, efficiency, and safety of motorcycles. These innovations not only attract consumers seeking cutting-edge features but also address regulatory requirements and environmental concerns, fostering sustainable growth in the market. Concurrently, urbanization and increasing traffic congestion propel the demand for on-road motorcycles as viable solutions for navigating crowded city streets. With their agility, maneuverability, and space-saving advantages, motorcycles offer commuters a practical and efficient means of transportation, driving market expansion in urban areas.

On-road Motorcycles Market Restraint

Despite its growth potential, the on-road motorcycles market faces notable restraints, with regulatory challenges and safety concerns standing out as significant barriers to growth. Stringent emission regulations and safety standards impose compliance burdens on manufacturers, leading to increased production costs and potential market entry barriers for smaller players. Additionally, safety concerns surrounding motorcycle accidents and fatalities contribute to consumer hesitancy and regulatory scrutiny, impacting market demand and public perception. Addressing these restraints requires collaborative efforts from industry stakeholders, policymakers, and safety advocates to implement effective regulations, promote safety initiatives, and enhance public awareness, ultimately fostering a safer and more sustainable environment for on-road motorcycle usage.

On-road Motorcycles Market Opportunity

In the on-road motorcycles market, opportunities abound, particularly in the realm of electrification and expanding demographic reach. The shift towards electric motorcycles presents a significant opportunity for manufacturers to capitalize on growing consumer interest in sustainable transportation solutions. With advancements in battery technology and infrastructure, electric motorcycles offer zero-emission alternatives that appeal to environmentally conscious consumers and align with global efforts to combat climate change. Moreover, expanding the demographic reach of on-road motorcycles presents another promising opportunity. By targeting underrepresented segments such as women, younger riders, and urban commuters, manufacturers can tap into new markets and diversify their customer base.

On-road Motorcycles Market Challenges

Within the on-road motorcycles market, two significant challenges stand out: intensifying competition and shifting consumer preferences. As the market becomes increasingly saturated with established players and new entrants, competition intensifies, placing pressure on manufacturers to differentiate their offerings through innovation, branding, and value-added services. This heightened competition not only squeezes profit margins but also necessitates ongoing investments in research and development to stay ahead of rivals.

Moreover, shifting consumer preferences present another formidable challenge for the on-road motorcycles market. Rapid changes in lifestyle trends, socio-economic dynamics, and cultural influences can lead to fluctuations in demand and preferences among motorcycle buyers. Manufacturers must remain vigilant and adaptable, continuously monitoring consumer insights and market trends to anticipate shifts in demand and adjust their product portfolios and marketing strategies accordingly. Failure to address these challenges effectively can result in market share erosion and missed opportunities for growth in an increasingly dynamic and competitive landscape.

Segments Insights:

Type Insights

Standard Motorcycles dominated the type segment of the on-road motorcycles market. Standard motorcycles, known for their versatile design and user-friendly ergonomics, appeal to a broad consumer base, from beginners to seasoned riders. Their affordability, ease of handling, and adaptability for city commuting, weekend rides, or even minor touring make them a staple choice across global markets. Models like the Honda CB500 and Yamaha MT-07 exemplify the enduring popularity of standard bikes. Their simplistic yet effective design continues to resonate strongly, particularly in price-sensitive emerging economies where first-time motorcycle ownership is high.

Meanwhile, Sports Bikes are witnessing the fastest growth rate within the type segment. Rising disposable incomes, the allure of speed, performance, and stylish designs have spurred the demand for sports motorcycles. Youth and young professionals in regions like Southeast Asia and Latin America are particularly enthusiastic adopters. The launch of accessible mid-range sports bikes, such as the Kawasaki Ninja 400 and Yamaha YZF-R3, has broadened the segment’s appeal beyond niche racing enthusiasts. Manufacturers are also innovating with lightweight, high-powered options to cater to urban riders seeking an adrenaline rush on their daily commutes.

Regional Insights

Asia-Pacific dominated the on-road motorcycles market in terms of volume and revenue. The region accounts for a substantial portion of global motorcycle sales, with countries like India, China, Indonesia, and Vietnam leading the charge. In India, two-wheelers represent a primary mode of transportation for millions, with motorcycles preferred for their affordability, fuel efficiency, and maneuverability. The presence of major manufacturers like Hero MotoCorp, Bajaj Auto, Honda, and Yamaha underpins the region's leadership. Government policies promoting electric two-wheelers, rapid urbanization, and increasing middle-class incomes are further stimulating demand.

Latin America is emerging as the fastest-growing region for the on-road motorcycles market. Brazil, Colombia, and Argentina have shown remarkable growth in motorcycle ownership, driven by economic shifts, high automobile costs, and urban congestion. In particular, Brazil witnessed a spike in motorcycle registrations in 2024, as motorcycles became a popular solution for last-mile delivery and personal transport amid rising inflation and vehicle costs. Motorcycle taxi services are also proliferating across Latin American cities, creating a new commercial avenue for the market's expansion.

Some of the prominent players in the On-road motorcycles market include:

- Harley-Davidson Incorporation

- Yamaha Motor Co., Ltd.

- Ducati Motor Holding S.p.A.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- BMW AG

- Suzuki Motor Corporation

- Hero MotoCorp Limited

- Bajaj Auto Ltd.

- TVS Motor Company

Recent Developments

-

April 2025: Harley-Davidson announced the launch of its lightweight electric motorcycle model "LiveWire S2 Mulholland," aimed at urban commuters, offering a 150-mile range per charge.

-

March 2025: Honda revealed its all-new 500cc "CB500 Hornet" model, featuring a lightweight frame, enhanced connectivity, and improved fuel efficiency.

-

February 2025: BMW Motorrad inaugurated a new manufacturing facility in Thailand to expand production of mid-range touring and adventure motorcycles for Southeast Asia.

-

January 2025: Yamaha Motor Company collaborated with Gogoro to develop battery-swapping solutions for electric motorcycles in urban Asian markets.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global on-road motorcycles market.

Type

- Sports Bikes

- Cruiser Motorcycles

- Touring Motorcycles

- Standard Motorcycles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)