Oncology Biosimilars Market Size and Research

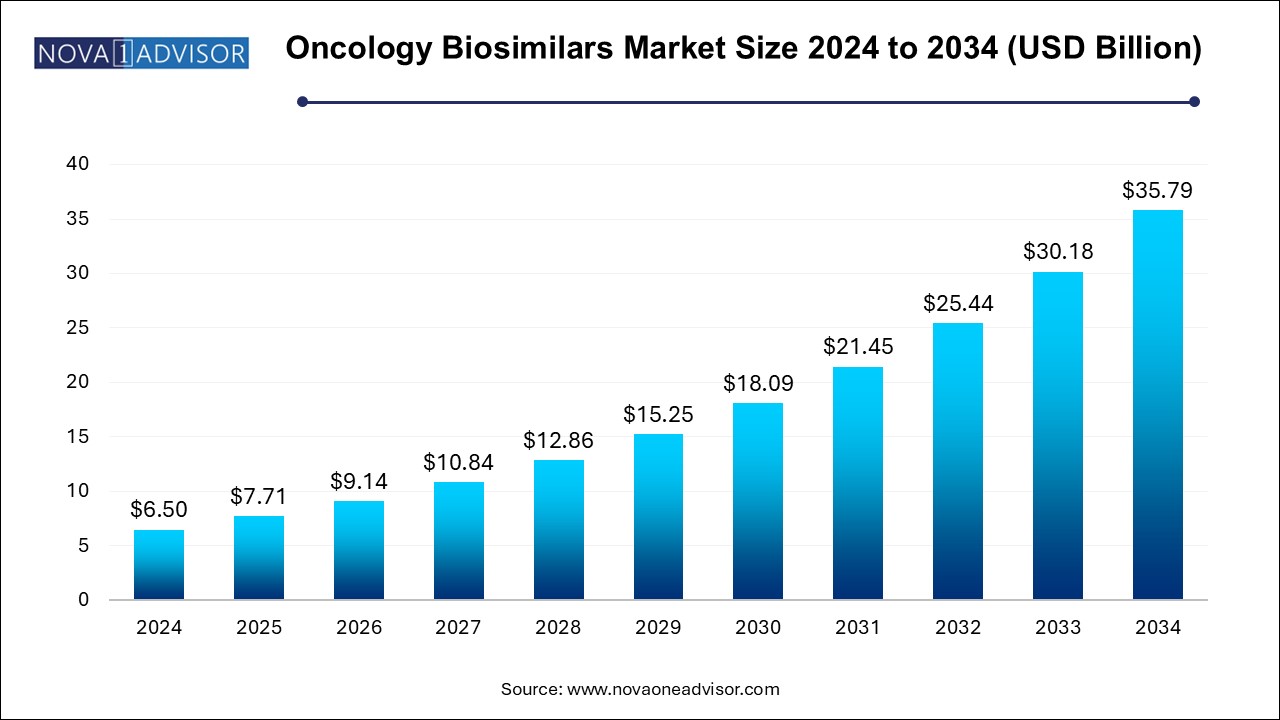

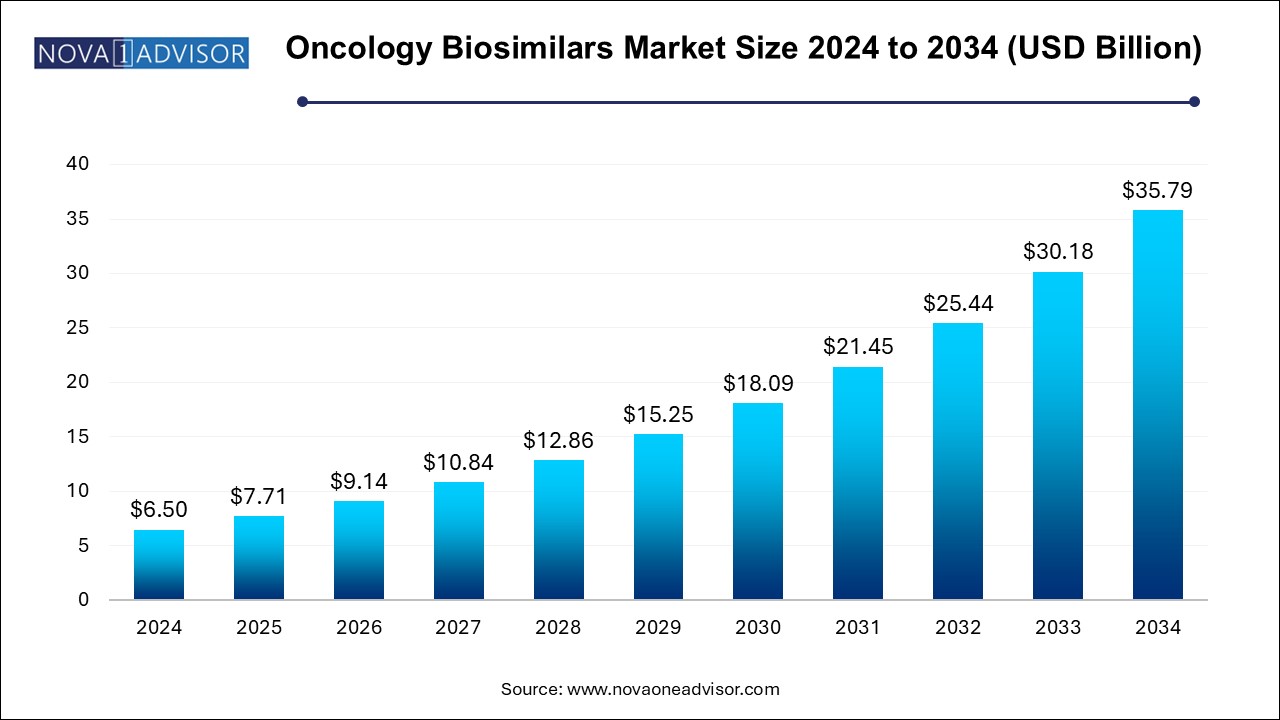

The oncology biosimilars market size was exhibited at USD 6.50 billion in 2024 and is projected to hit around USD 35.79 billion by 2034, growing at a CAGR of 18.6% during the forecast period 2024 to 2034. The growth of the oncology biosimilars market can be linked to increasing incidences of cancer in various regions, need for cost-effective treatments and ongoing advancements in manufacturing processes.

Oncology Biosimilars Key Market Takeaways:

- North America dominated the oncology biosimilars market with the largest share in 2024.

- Asia Pacific is anticipated to witness lucrative growth in the market during the forecast period.

- By indication, breast cancer segment dominated the market with the largest share in 2024.

- By indication, the lung cancer segment is anticipated to witness lucrative growth during the forecast period.

- By drug class, the granulocyte colony-stimulating factor (G-CSF) segment dominated the market in 2024.

- By drug class, the monoclonal antibodies (mAb) segment is expected to show the fastest growth over the forecast period.

- By route of administration, the intravenous segment accounted for the largest share in the market in 2024.

- By end-user, the hospitals segment dominated the market in 2024.

- By end-user, the specialty clinics segment is predicted to grow at the fastest CAGR over the forecast period.

- By distribution channel, the hospital pharmacy segment accounted for the largest market share in 2024.

- By distribution channel, the retail pharmacy segment is anticipated to witness fastest growth in the market over the forecast period.

Cancer is the leading cause of deaths across the globe. According to the International Agency for Research on Cancer, the number of new cancer cases annually is anticipated to rise to 33 million and the number of deaths by cancer to 18.2 million by 2050. Cancer therapies are costly which drives the need for safe and effective biosimilars which are affordable and accessible for everyone.

Factors such as loss of exclusivity for various companies selling reference biologics like trastuzumab and rituximab are creating lucrative opportunities for the market entry of new biosimilars. Development of interchangeability guidelines and streamlined pathways for biosimilar approval by regulatory bodies as well as initiatives like the Biosimilar User Fee Act (BsUFA) in the U.S. are contributing to the market growth. Furthermore, increased emphasis on development of innovative formulations, rising strategic collaborations and growing acceptance based on real-world evidence data are further driving the market expansion.

Integration of artificial intelligence in oncology biosimilars is enabling the development of more accessible and cost-effective cancer therapies. AI algorithms can be applied for analysing large datasets for identifying potential drug targets, designing effective and safe drug molecules, in optimizing clinical trials designs and predicting patient response to treatments leading to accelerated drug discovery and development. Optimization and analysis of data from manufacturing processes with the use of AI can help in the detection of potential issues leading to improved quality control and reduced costs.

Major Trends in the Market

- Favorable regulatory pathways: Stringent regulatory guidelines and development of clear and concise pathways for regulatory approvals by agencies such as the FDA and EMA are encouraging the emergence of new market players and innovations in oncology biosimilars.

- Government initiatives: Several governments across the globe are focused on promoting the development of oncology biosimilars and increasing their access to the public for better healthcare outcomes. Initiatives such as streamlined regulatory approval pathways, stimulating growth through financial aid and conducting public healthcare programs for encouraging the use of biosimilars.

- Patent expirations: The current wave 2 of expiring patents, following the first wave (2010-2020) which introduced biosimilars like infliximab, rituximab and trastuzumab is unlocking lucrative opportunities for competition in the market with the expiration of key monoclonal antibodies patents leading to reduced costs in healthcare.

- Increased access: The development of low cost biosimilars are improving patient access to crucial cancer treatments in regions with financial limitations.

- Emerging new players: The market is witnessing growth in the number of new biosimilar manufacturers with the rising number of expiring patents and increased demand for safe and cost-effective cancer drugs.

Report Scope of Oncology Biosimilars Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.71 Billion |

| Market Size by 2034 |

USD 35.79 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 18.6% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Key Companies Profiled |

Pfizer Inc. (U.S.), GlaxoSmithKline plc (U.K.), Novartis AG (Switzerland), Mylan N.V. (U.S.), Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), F. Hoffmann-La Roche Ltd. (Switzerland), Zydus Cadila (India), Lupin (India), Amneal Pharmaceuticals LLC. (U.S.), Cipla Inc. (U.S.), Aurobindo Pharma (India), Glenmark Pharmaceuticals Limited (India), Eli Lilly and Company (U.S.), Sun Pharmaceutical Industries Ltd. (India), Allergan (Ireland), Bristol-Myers Squibb Company (U.S.), Takeda Pharmaceutical Company Limited (Japan), BIOCAD (Russia), Apotex Inc. (Canada), Endo International plc (Ireland) |

Market Dynamics

Drivers

Cost efficiency of oncology biosimilars

Development of biosimilars in comparison to their reference biologics is driving substantial cost savings and enabling access to affordable cancer treatments benefitting both patients and the healthcare systems. Consumers are increasingly switching to biosimilars for cancer treatments which offer savings in both direct costs such as drug acquisition and indirect costs like reduced utilization of healthcare resources. Furthermore, rising support of payers and Pharmacy Benefit Managers (PBMs) for including biosimilars in their formularies and giving more preference to them over original biologics is leading to cost savings.

Restraints

Complexities and regulatory barriers

Development of oncology biosimilars requires significant investments for research, clinical trials and manufacturing processes which can be expensive and complex. Concerns regarding the safety, efficacy and immunogenicity potential can lead to decreased adoption of these biosimilars among healthcare professionals (HCPs) and patients. Additionally, stringent regulations set by regulatory bodies such as the FDA and EMA can be time-consuming and expensive significantly slowing down the time to market reach.

Opportunities

Increased global demand for cost-effective cancer therapies

Globally rising burden of various types of cancer is creating the need for effective and safe therapies affordable to everyone. Increased adoption of oncology biosimilars by patients and healthcare providers due to their proven efficacy based on real-world data and clinical outcomes is significantly driving the market growth. Growing number of regulatory approvals for biosimilars is leading rise in number of manufacturers and emerging players focused on expanding their biosimilar portfolio. This results in increased market competition creating lucrative opportunities for growth in the upcoming years.

Segment insights

Oncology Biosimilars Market By Indication

By indication, breast cancer segment dominated the market with the largest share in 2024. Rising breast cancer incidences across the globe, scientific innovations facilitating the development of advanced diagnostic procedures and cost-effectiveness of biosimilars are contributing to the market growth. Patent expiration of major biologic drugs such as Herceptin (trastuzumab), Kadcyla (ado-trastuzumab emtansine) and Perjeta (pertuzumab) as well as clear and well-established regulatory pathways for biosimilars is facilitating the emergence of new market players and development of new, cost-effective oncology biosimilars. Furthermore, supportive government initiatives for using biosimilars to reduce healthcare costs, increased patient preference for specialized cancer care, development of interchangeable biosimilars and expanded aces to affordable biosimilars, especially in low- and middle-income countries (LMICs) is driving the market expansion.

By indication, the lung cancer segment is anticipated to witness lucrative growth during the forecast period. The market growth of this segment is driven by the increased prevalence of lung cancer, especially non-small cell lung cancer (NSCLC) and increased consumer demand for safe and effective therapies. Increased R&D activities for assessing the long-term efficacy, safety and side effects of biosimilars as well as rising patent expirations are creating opportunities for biosimilar manufacturers entry into the market.

- For instance, in March 2024, Dr. Reddy’s Laboratories Ltd., an international pharmaceutical company, launched Versavo (bevacizumab) which is a biosimilar of Avastin in the United Kingdom (UK). Versavo is indicated for the treatment iof various types of cancers such as advanced non-squamous non-small cell lung cancer, advanced cervical cancer, ovarian cancer, metastatic breast cancer, metastatic renal cell carcinoma and metastatic colorectal cancer.

Oncology Biosimilars Market By Drug Class

By drug class, the granulocyte colony-stimulating factor (G-CSF) segment dominated the market in 2024. G-CSF biosimilars play an important role in oncology by providing a cost-effective solution for prevention of febrile neutropenia (FN) in cancer patients receiving chemotherapy. Granulocyte colony-stimulating factors such as filgratism and pegfilgratism are used for enhancing white blood cell production in the bone marrow, further mitigating the risk of infections for patients. Rising demand for prophylactic G-CSF, availability of cost-effective biosimilars and increased awareness for neutropenia management are the factors driving the market growth. Moreover, the ongoing advancements such as the development of long-acting G-CSF formulations available with convenient delivery methods such as on-body injectors and subcutaneous injections are leading to enhanced patient compliance with reduced dosing frequency.

By drug class, the monoclonal antibodies (mAb) segment is expected to show the fastest growth over the forecast period. The rising demand for affordable and effective targeted therapies as well as the increasing number of expiring patents for monoclonal antibodies are significantly expanding this market segment. Additionally, the increased biosimilar approvals by regulatory agencies, rising investments, strategic collaborations and expansion of these therapies in emerging economies are the factors contributing to the market growth.

Oncology Biosimilars Market By Route of Administration

By route of administration, the intravenous segment accounted for the largest share in the market in 2024. Intravenous therapies are the most preferred route of administration for oncology therapies owing to their controlled and targeted nature of drug delivery. Rising investments for the adoption of advanced healthcare infrastructure, increased regulatory approvals, government support and growing acceptance of biosimilars by patients as well as oncologists are the factors driving the market growth. Additionally, implementation of robust post-marketing surveillance and pharmacovigilance studies is enabling the evaluation of long-term safety and efficacy of intravenous oncology biosimilars, further promoting their adoption in the market.

Oncology Biosimilars Market By End-Users

By end user, the hospital segment held the largest market share in 2024. Hospitals offer a wide range of services from advanced diagnostic procedures to access to variety of biosimilar options making them the primary choice of patients seeking cancer treatments. Increased healthcare expenditure in developing countries, rising disposable incomes, rising adoption of biosimilar therapies and ongoing advancements in biosimilar development and manufacturing are the factors expanding the market for this segment.

By end user, specialty clinics segment is predicted to show the fastest growth during the predicted timeframe. Specialty clinics are focused providing expertise and building trust of cancer patients through their healthcare professionals such as oncologists and pharmacists for cancer treatments which includes the use of biosimilars. These clinics seamlessly integrate oncology biosimilars in their treatment protocols by swiftly reviewing the financial and clinical benefits of biosimilars. Adoption of value-based care models and generation of real-world evidence by these specialty clinics, further promotes the market growth of this segment.

Oncology Biosimilars Market By Distribution Channel

By distribution channel, the hospital pharmacy segment accounted for the largest market share in 2024. Hospital pharmacies are the primary source of medications for patient undergoing cancer treatments and are anticipated to play a major role in the distribution of oncology biosimilars due to their rising adoption in various regions across the globe. They follow strict quality control measures and are highly regulated, ensuring accuracy and safety in dispensing biosimilars. Increased educational initiatives by regulatory agencies and pharmaceutical companies are driving the adoption of oncology biosimilars among healthcare providers. Furthermore, expertise provided by hospital pharmacists, treatment integration by coordination with oncologist and other healthcare professionals, access to affordable cancer medications are the factors contributing to the market growth.

By distribution channel, the retail pharmacy segment is anticipated to witness fastest growth in the market over the forecast period. Retail pharmacies act as readily available distribution channel for oncology biosimilars, offering patients to receive their medications in a familiar setting with enhanced price transparency which allows them to make informed decisions regarding treatment options. Additionally, rising number of generic stores, increased focus on educating patients on biosimilar efficacy and availability, potential cost savings and management of formularies according to patient needs by retail pharmacies are the factors expected to drive the market growth of this segment in the upcoming years.

Oncology Biosimilars Market By Region

North America dominated the global oncology biosimilars market with the largest share in 2024. The region’s market dominance is driven by the presence of advanced healthcare infrastructure, rising cancer prevalence, increased adoption of biosimilars, supportive government initiatives and growing focus on patient-centric approach for cancer treatments.

U.S. dominates the oncology biosimilars market in North America. The rising approvals of biosimilars by the FDA (Food and Drug Administration), robust research infrastructure, increased strategic collaborations and surging investments for development for effective cancer therapies are the factors promoting the market growth. Furthermore, influence of government through agencies like the National Institutes of Health (NIH) for supporting R&D of biosimilars, initiatives like Cancer Moonshot for reducing cancer mortality, sponsored insurance programs like Medicare Part D as well as the FDA’s Biosimilars Action Plan (BAP) are bolstering the market growth.

Asia Pacific is anticipated to witness lucrative growth in the market over the forecast period. The increased incidences of cancer, rising geriatric population, and surging investments for advancing healthcare infrastructure are driving the market growth of this region. Furthermore, increased presence of emerging pharmaceutical companies, rising disposable incomes and government support are contributing to the market growth.

India plays a major role in contributing to the market growth in Asia Pacific. The country’s booming pharmaceutical industry with a skilled workforce and cost-effective production facilities, rising cancer incidences and increased availability of affordable biosimilar options to original biologic drugs are the factors driving the growth of the oncology biosimilars market. Moreover, active involvement of the Indian government through various bodies and initiatives such as the National BioPharma Mission, development of Biotechnology Industry Partnership Programme (BIPP), stringent regulatory guidelines set by the Central Drugs Standard Control Organization (CDSCO) and the Department of Biotechnology (DBT) focused on adoption of biosimilars in oncology and other fields are strengthening the country’s market growth in Asia Pacific region.

Recently Approved Oncology Biosimilars by FDA

|

Biosimilar Name

|

Company Name

|

FDA Approved Date

|

|

Jobevne

(bevacizumab-nwgd)

|

Biocon Biologics Ltd.

|

9 April, 2025

|

|

Hercessi

(trastuzumab-strf)

|

Accord BioPharma Inc.

|

26 April, 2024

|

|

Nypozi

(filgrastim-txid)

|

Tanvex BioPharma USA, Inc.

|

28 June, 2024

|

|

Conexxence

(denosumab-bnht)

|

Fresenius Kabi USA, LLC

|

25 March, 2025

|

|

Stoboclo

(denosumab-bmwo)

|

Celltrion, Inc.

|

28 February, 2025

|

|

Ospomyv

(denosumab-dssb)

|

Samsung Bioepis Co., Ltd.

|

13 February, 2025

|

Industry Shifts

Shift in Commercialization Strategy

- In May 2025, Celltrion, Inc., a biopharmaceutical company, announced shifting to direct sales model by ending its indirect sales partnership with Ken Pharma, thereby transitioning to direct sales of oncology biosimilars in the European market.Celltrion will continue selling of its oncology drugs which include three biosimilars, namely, Truxima (rituximab) for blood cancer, Herzuma (trastuzumab) for breast cancer, and Vegzelma (bevacizumab) for colorectal and breast cancers through its Spanish subsidiary. The implementation of direct-to-market strategies by manufacturers for gaining greater control of commercialization of their products reflects the potential of the widespread shift in the oncology biosimilars market which result in consequential impacts on competition, pricing and access to market for particular European countries.

Some of the prominent players in the oncology biosimilars market include:

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (U.K.)

- Novartis AG (Switzerland)

- Mylan N.V. (U.S.)

- Teva Pharmaceutical Industries Ltd.(Israel)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Zydus Cadila (India)

- Lupin (India)

- Amneal Pharmaceuticals LLC. (U.S.)

- Cipla Inc. (U.S.)

- Aurobindo Pharma (India)

- Glenmark Pharmaceuticals Limited (India)

- Eli Lilly and Company (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Allergan (Ireland)

- Bristol-Myers Squibb Company (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- BIOCAD (Russia)

- Apotex Inc. (Canada)

- Endo International plc (Ireland)

Oncology Biosimilars Market Recent Development

-

In April 2025, CuraTeQ Biologics, a subsidiary of Aurobindo Pharma, received the marketing authorization by the Committee for Medicinal Products for Human Use of the European Medicines Agency (EMA) for Dazublys, a trastuzumab biosimilar for the treatment of HER2-positive metastatic and early breast cancers.

-

In April 2025, Biocon Biologics Ltd. (BBL), a subsidiary of Biocon Ltd., was granted the U.S. Food and Drug Administration (FDA) approval for its biosimilar Bevacizumab, marketed under the name Jobevne (Bevacizumab-nwgd) which is an intravenous recombinant humanised monoclonal antibody utilized for the treatment of various cancers.

-

In April 2025, Sandoz, a globally leading generic and biosimilar medicines company, entered a global collaboration agreement with Shanghai Henlius Biotech, Inc. for commercialization of ipilimumab, a leading oncology biosimilar therapy used for multiple indications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the oncology biosimilars market

Indication

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Cervical Cancer

- Blood Cancer

- Others

Drug Class

- Monoclonal Antibodies

- Granulocyte Colony-Stimulating Factor

- Others

Route of Administration

- Intravenous

- Subcutaneous

- Others

End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others