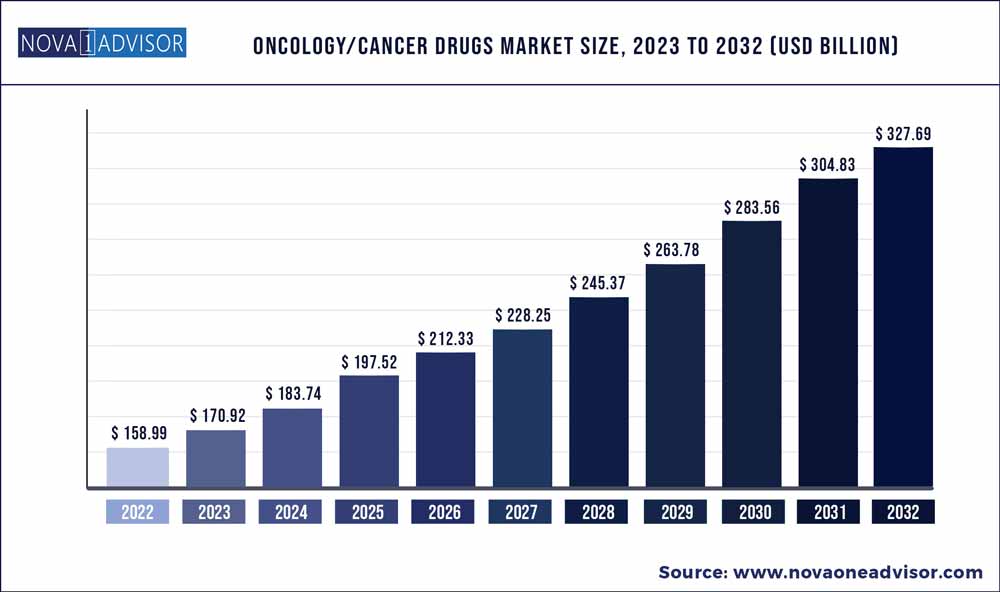

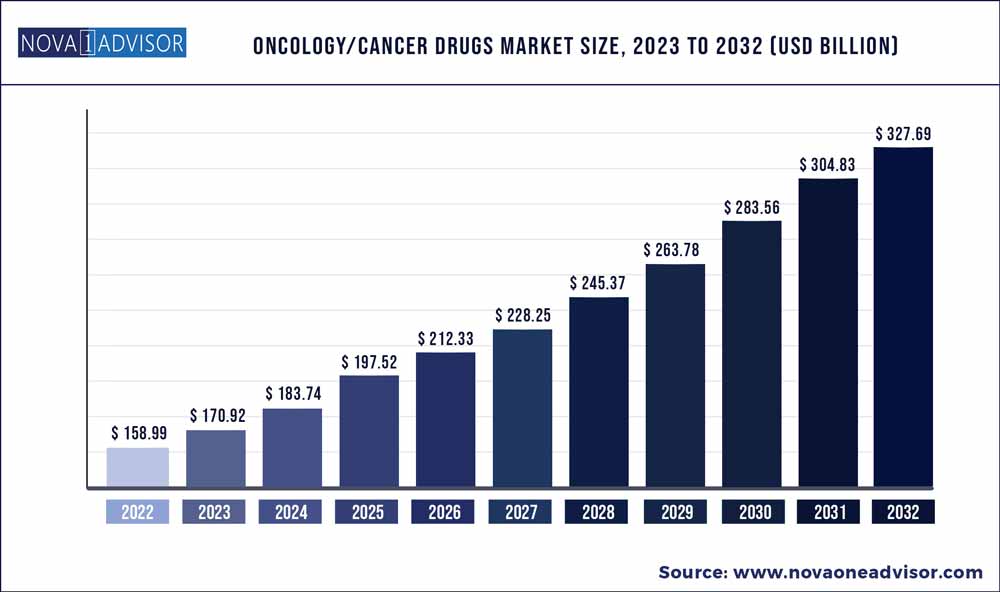

The global Oncology/Cancer Drugs market size was exhibited at USD 158.99 billion in 2022 and is projected to hit around USD 327.69 billion by 2032, growing at a CAGR of 7.5% during the forecast period 2023 to 2032.

Key Pointers:

- North America is the most dominant and is estimated to grow at a CAGR of 6.21%

- Europe is the second-largest contributor to the market and is estimated to reach around USD 66,429.4 million at a CAGR of 7.41%

- The second-largest segment of immunotherapy (biologic therapy) is expected to grow by 2032 at a CAGR of 10.9%

- The breast cancer segment is the highest contributor to the market and is estimated to grow at a CAGR of 8.19% during the forecast period.

- The prostate cancer segment is the second-largest and is estimated to grow at a CAGR of 8.5% during the forecast period.

- The targeted therapy segment is the highest contributor to the market and is estimated to grow at a CAGR of 8.15% during the forecast period.

Oncology/Cancer Drugs Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 170.92 Billion

|

|

Market Size by 2032

|

USD 327.69 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 7.5%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Drug Class Type, Indication

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Key companies profiled

|

ABBVIE INC., AMGEN, INC., ASTELLAS PHARMA INC., ASTRAZENECA PLC, BRISTOL-MYERS SQUIBB COMPANY, F. HOFFMANN-LA ROCHE AG, JOHNSON & JOHNSON, MERCK & CO., INC., NOVARTIS INTERNATIONAL AG, PFIZER, INC.

|

Cancer is characterized by the unchecked proliferation of abnormal cells throughout the body. Cancer develops when the body's normal control system breaks down and cannot stop the growth of abnormal cells. Older cells do not pass away in this condition but continue to divide uncontrollably, creating new aberrant cells.

Chemotherapy, hormonal therapy, immunotherapy, targeted therapy, and targeted therapy are all types of treatment that may be utilized in combating cancer in patients. Biological drugs constructed from monoclonal antibodies (mAbs), abbreviated as an abbreviation for biological drugs, have emerged as a preferred option for treating various types of cancer. Critical factors in the global oncology/cancer drugs market are:

- The rise in the incidence of various cancer conditions.

- The popularity of advanced therapies (such as biological and targeted drug therapies) has increased.

- The surge in the population of older adults around the world.

In addition, an increase in cancer awareness, early cancer screenings, and the availability of cancer drugs are anticipated to boost the market growth.

Market Dynamics

Global Oncology/Cancer Drugs market Drivers

Drugs such as morphine, fentanyl, acetaminophen, nonsteroidal anti-inflammatory drugs (NSAIDs), and others are used extensively in treating cancer pain in patients with lung cancer, bone cancer, and other types of cancer. As a result of the sharp uptick in the number of new cancer cases being diagnosed worldwide, there has been a concomitant increase in the amount of money spent on medications intended to alleviate the suffering caused by cancer. There is an expectation that the market's growth will be fueled by an increase in the prevalence of cancer.

Compared to younger age groups, the global population is expanding at a faster rate than ever before. According to the report titled "Aging in the United States," published by the Population Reference Bureau, "the number of Americans aged 65 and older is projected to increase more than double over 95 million by the year 2060, and it is expected to rise to approximately 23 percent from 16 percent. The American Cancer Society Journal estimates that approximately 140,690 people in the United States are diagnosed with cancer each year and that 103,250 people pass away from cancer each year. In addition, the World Health Organization (WHO) cites cancer as the second leading cause of death worldwide. An increase in the elderly population is anticipated to drive the demand for drugs used in cancer management, which will, in turn, boost the market's growth.

Global Oncology/Cancer Drugs market Restraints

Drugs used in chemotherapy kill rapidly dividing cells, but their use can have unintended consequences because they cannot tell healthy cells from cancerous cells. The most common adverse effect of anti-cancer drugs is damage to blood-forming cells in the bone marrow, which can ultimately result in anemia. The hair follicles become damaged, which eventually results in a loss of hair. Nausea, constipation, problems with fertility, shifts in libido, and other symptoms are some of the more serious adverse reactions resulting from taking these medications. In addition, side effects of drugs used to treat head and neck cancer include rashes, itching, a loss of weight, sores in the mouth, and problems with the nerves and muscles, including numbness, pain, tingling, and other symptoms. As a result, the development of the global market is hampered by the severe adverse effects of consuming cancer medications.

Global Oncology/Cancer Drugs market Opportunities

The United States of America and Europe comprise the most extensive customer base for cancer drugs in the current scenario. Because approximately sixty percent of the world's population resides in Asia and the Pacific, this region holds great potential for expanding the market. In addition, the widespread use of tobacco in Asian countries like India, which contributes to the development of a variety of cancers, including cancer of the oral cavity and cancer of the larynx, amongst others, is a factor in the growth of these diseases in these regions.

In addition, developing countries in Asia-Pacific and LAMEA are forecast to experience significant growth in the not-too-distant future. This is anticipated due to a surge in healthcare infrastructure, an increase in affordability, and a rise in awareness regarding the importance of early cancer diagnosis for various cancers, including oral cancer. As a result, these factors are anticipated to present significant opportunities for expanding the market in developing countries. In addition, the industry of healthcare is growing at a considerable rate in emerging economies. This is a result of an increase in demand for advanced healthcare services, significant investments made by the governments of various countries to improve healthcare infrastructure, and the growth of the medical tourism industry in emerging countries. Thus, it is anticipated that the market for cancer drugs will experience opportunities for potential growth brought about by all of these factors.

By Drug Class Type

Based on the drug class type, the global oncology cancer drugs market has been categorized into chemotherapy, targeted therapy, immunotherapy (biologic therapy), and hormonal therapy.

The targeted therapy segment is the highest contributor to the market and is estimated to grow at a CAGR of 8.15% during the forecast period. The discovery of molecular targets expressed by cancer cells is mainly responsible for the rapid expansion of the use of targeted therapy. There are a variety of targeted therapies that have been given the green light for use in cancer treatment. These treatments include hormone therapies, signal transduction inhibitors, gene expression modulators, apoptosis inducers, angiogenesis inhibitors, immunotherapies, and toxin delivery molecules. Bevacizumab (brand name: Avastin), everolimus (Afinitor), sunitinib (brand name: Sutent), imatinib (brand name: Gleevec), and a few others fall into this category.

In addition, the significant investments made by pharmaceutical companies in the research and development of biologically targeted drugs are fueling the expansion of the market. Recent developments in technology have made it possible for researchers to zero in on the molecular targets that cancer cells use. Because of this increased understanding of how cancer spreads, therapeutic agents have been developed that can specifically target tumor cells while preventing damage to healthy cells. These agents have been successful in treating cancer. Due to antibodies' high target specificity, most research efforts have concentrated on developing mAbs as potential targeted drug therapies.

The second-largest segment of immunotherapy (biologic therapy) is expected to grow by 2032 at a CAGR of 10.9% during the forecast period. Immunotherapy is one of the most recent developments in cancer treatment, and it is one of the factors that has contributed to the overall effectiveness of cancer treatment. This approach to therapy is predicated on the widely held belief that the immune system is one of the essential weapons in the fight against a wide variety of illnesses. Researchers have developed numerous methods to use immunotherapeutics to treat cancer. These strategies include actively stimulating the immune system from the outside to prompt it to take action or destroy tumors with proteins that are specific to the tumors. Immunotherapy is most commonly utilized in conjunction with other cancer treatments such as surgery, radiation therapy, or chemotherapy to maximize the therapeutic efficacy of the cancer treatment. Because immunotherapy is associated with a lower risk of side effects compared to other forms of cancer treatment, it has gained popularity as a viable option for cancer care. The most recent breakthrough in cancer treatment is an immunotherapy-based vaccine currently in development.

By Indication

Based on the indication, the global oncology cancer drug market has been categorized into lung cancer, stomach cancer, colorectal cancer, breast cancer, prostate cancer, liver cancer, esophagus cancer, cervical cancer, kidney cancer, and bladder cancer.

The breast cancer segment is the highest contributor to the market and is estimated to grow at a CAGR of 8.19% during the forecast period. The adoption of an unhealthy lifestyle, the genetic profile of a patient, the growth in the female geriatric population, and exposure to harmful radiation are all contributing factors to this rise in the prevalence rate of breast cancer. The breast cancer segment was the most significant contributor to revenue, and this trend is anticipated to continue during the forecast period. This is because the rise in females diagnosed with breast cancer is the primary factor driving the expansion of the et. In addition, the development of unhealthier lifestyles, the increase in the number of older women, the possibility of being exposed to harmful radiation, and the increasing number of initiatives taken by the government all contributed to the expansion of the market.

The prostate cancer segment is the second-largest and is estimated to grow at a CAGR of 8.5% during the forecast period. Several regional businesses have launched new products to improve their portfolio, further propelling market expansion.

Regional Analysis of Global Oncology/Cancer Drugs market

The global oncology cancer drug market is segmented into four regions, namely North America, Europe, Asia-Pacific, and LAMEA.

North America is the most dominant and is estimated to grow at a CAGR of 6.21% during the forecast period. The availability of top-notch treatment options, a rise in product approvals, and increased public awareness of early cancer detection are just a few factors that will contribute to the market's continued expansion. This is expected to occur shortly. In addition, rapid advancements in tumor biology, genetics, and immunology have led to the creation of several new cancer drugs in this part of the world. North America is anticipated to provide market players in the future with new opportunities. For instance, different companies such as Abbie, Amgen Inc., Johnson & Johnson, and Pfizer Inc. are all examples of companies that offer pipeline products. As a result, the presence of several drugs already in the pipeline, including ideal medications currently in the late stage of development, is anticipated to provide lucrative opportunities for market expansion.

Europe is the second-largest contributor to the market and is estimated to reach around USD 66,429.4 million at a CAGR of 7.41% during the forecast period. A significant number of pharmaceutical companies that focus on the research and development of oncology drugs can be found in Europe. In addition, the high prevalence of cancer, rising demand for targeted medicines, high levels of disposable income, and increased disease awareness due to public and private initiatives are all factors driving the market for cancer therapeutics in Europe. In addition, the rise in the elderly population across the region has been a significant contributor to the expansion of the market, along with the enhancement of treatment facilities and the implementation of highly innovative chemotherapy in clinical environments. During the period being analyzed, these factors are anticipated to contribute to Europe's expansion of the oncology and cancer drug market.

Some of the prominent players in the Oncology/Cancer Drugs Market include:

- AbbVie Inc.

- Amgen

- Astellas Pharma Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Hoffmann-La Roche Ltd.

- Johnson & Johnson (Janssen Global Services, LLC)

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Oncology/Cancer Drugs market.

By Drug Class Type

- Chemotherapy

- Targeted Therapy

- Immunotherapy (Biologic Therapy)

- Hormonal Therapy

By Indication

- Lung Cancer

- Stomach Cancer

- Colorectal Cancer

- Breast Cancer

- Prostate Cancer

- Liver Cancer

- Esophagus Cancer

- Cervical Cancer

- Kidney Cancer

- Bladder Cancer

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)