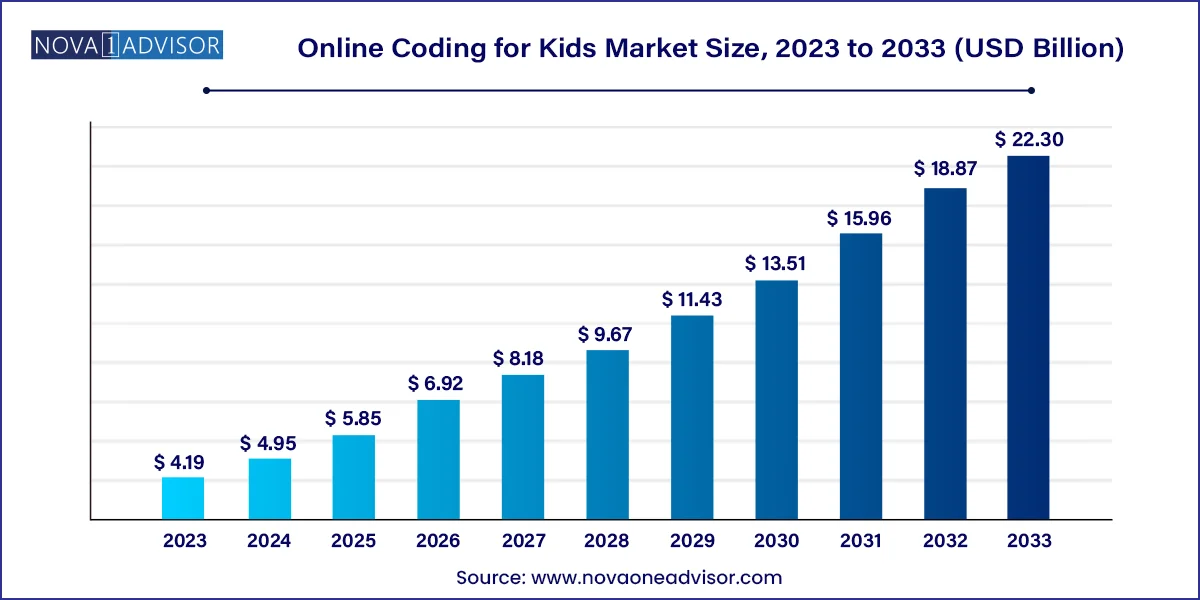

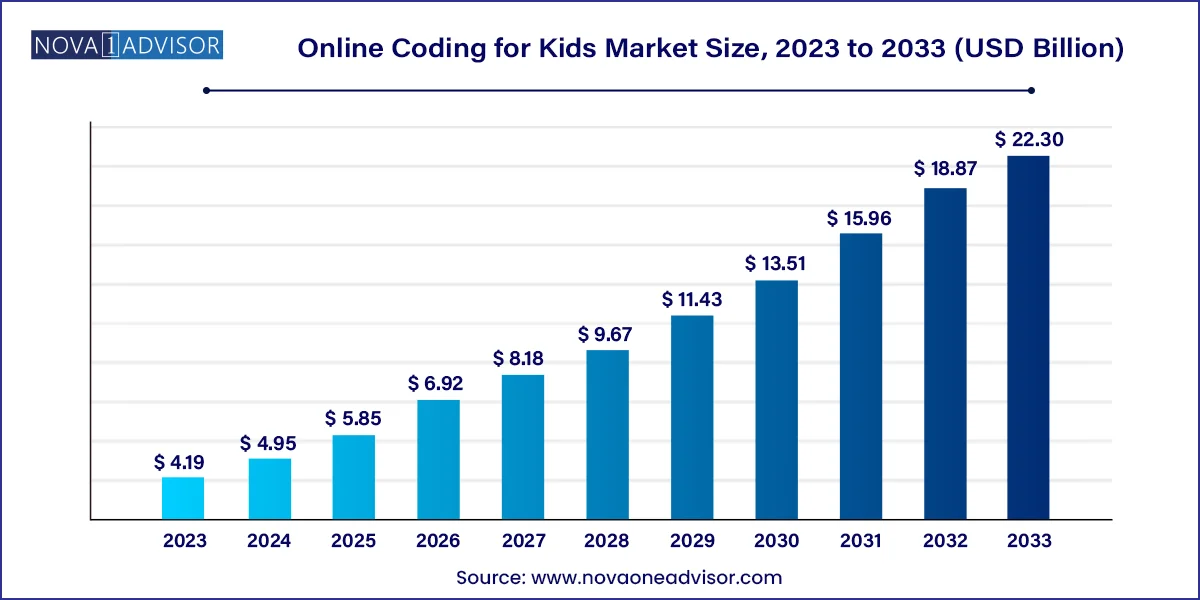

Online Coding for Kids Market Size and Forecast 2024 to 2033

The global online coding for kids market size was USD 4.19 billion in 2023, calculated at USD 4.95 billion in 2024 and is expected to reach around USD 22.30 billion by 2033, expanding at a CAGR of 18.2% from 2024 to 2033.

Online Coding for Kids Market Key Takeaways

- North America dominated the online coding for kids market in 2023.

- Asia- Pacific is observed to be the fastest growing in the online coding for kids market during the forecast period.

- By coding type, the coding apps segment shows significant growth in the online coding for kids market during the forecast period.

- By language, the scratch segment dominated the online coding for kids market in 2023.

- By language, the python segment shows significant growth in the online coding for kids market during the forecast period.

- By end-user, the middle school segment shows significant growth in the online coding for kids market during the forecast period.

- By end-user, the high school segment shows notable growth in the online coding for kids market during the forecast period.

Market Overview

The global Online Coding for Kids Market has witnessed rapid growth over the past decade, driven by the increasing recognition of coding as a critical skill in the digital age. Coding is no longer seen as a niche technical ability but as an essential literacy, much like reading and mathematics. Online platforms offering coding courses for kids are thriving due to growing parental awareness, government initiatives promoting STEM (Science, Technology, Engineering, and Mathematics) education, and the expansion of remote learning opportunities.

These platforms offer a variety of tools, applications, and websites tailored to different age groups and skill levels, covering languages like Scratch, Python, Java, HTML/CSS, and JavaScript. With the rise of gamified learning, project-based instruction, and personalized curricula, online coding education is becoming more accessible and engaging for children worldwide.

Furthermore, the COVID-19 pandemic significantly accelerated the adoption of e-learning platforms, encouraging the development of robust online infrastructures that are expected to continue supporting the market's growth even in a post-pandemic environment. As technological innovation becomes central to economic and social development, coding literacy among young learners is poised to play a crucial role, making the Online Coding for Kids Market an area of intense focus and investment.

Major Trends in the Market

-

Rise of Gamified and Project-Based Learning: Platforms are making coding fun and interactive to retain children's attention.

-

Integration of AI and Machine Learning: Personalized learning paths and adaptive content delivery are becoming more common.

-

Increased Adoption of Subscription Models: Monthly and yearly subscription plans are becoming popular among parents and guardians.

-

Focus on Soft Skills: Coding platforms are increasingly integrating problem-solving, creativity, and critical thinking into their curriculums.

-

Expansion into Emerging Markets: Companies are targeting non-traditional markets, including Southeast Asia, Africa, and Latin America.

-

Introduction of Coding into Traditional School Curricula: Governments are incorporating coding courses in public school education systems.

-

Partnerships with Tech Giants: Coding platforms are collaborating with companies like Google, Microsoft, and Amazon to expand their reach and credibility.

-

Mobile-first Approach: Growing emphasis on developing mobile apps and platforms for greater accessibility.

Online Coding for Kids Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 4.95 Billion |

| Market Size by 2033 |

USD 22.30 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 18.2% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Coding Type, By Language , By End User, By region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Camp K12 (K 12 Innovations Private Limited), CodaKid , Code.org, edX Inc., General Assembly, Kodable, Logiscool Ltd., Mind Champ Teaching Solutions LLP, Neuron Fuel, Inc. (Tynker), Shaw Academy, Pvt. Ltd., Springboard, WhiteHat Education Technology Pvt. Ltd LLP, THINKFUL, Udacity, Inc. , Udemy, Inc., Code Combat Inc. , Codevidhya India (P) Ltd. , Coding Dojo, Inc. , Coding Zen , EduCode Academy

|

Online Coding for Kids Market Dynamics

Driver

- Increasing access to technology

High-speed internet connectivity has increased the number of opportunities for online education. With more homes and schools having dependable internet access, kids can take part in online coding courses from any location. Due to this connectivity, children from all over the world can participate in coding classes. Education is placing more emphasis on digital literacy as technology becomes part of everyday life. Parents and educators understand how critical coding skills are to developing future job markets and cognitive abilities. This understanding fuels the need for online coding classes supporting traditional education.

Restraint

- High costs associated with premium coding programs

Many applications for premium coding rely on subscription structures that demand regular fees. These ongoing expenses can mount over time, making it an expensive long-term commitment for families. This may discourage parents from signing up their kids for these activities or lead them to look for alternatives that don't require ongoing costs. The effects of high costs may be amplified during recessions or other times of financial instability. During these times, families might put more importance on necessities than education, leading them to choose free or less expensive solutions.

Opportunity

- Growing demand for STEM education

Youngsters raised in the digital era are more likely to be exposed to technology and to have an early interest in coding and programming. Online coding platforms provide age-appropriate and entertaining content in response to this growing interest. Coding fosters creativity, reasoning, and problem-solving skills. These abilities enable young people to start initiatives or businesses and are beneficial for technical jobs and entrepreneurial pursuits.

Online Coding for Kids Market Segment Insights

Coding type insights

Coding Websites dominated the Online Coding for Kids Market in 2024. These platforms provide structured, multi-tiered courses ranging from beginner to advanced levels, offering kids the opportunity to learn at their own pace. Websites often feature a rich variety of resources, including tutorials, quizzes, live classes, and peer collaboration tools. Examples include platforms like Code.org, Codecademy Kids, and WhiteHat Jr., which have become household names among tech-savvy families.

On the other hand, Coding Apps are expected to witness the fastest growth. The mobile-first learning trend, especially in emerging markets, is fueling the rise of coding apps tailored for smartphones and tablets. Apps like Tynker, Kodable, and Hopscotch offer gamified, on-the-go coding experiences that appeal to younger audiences and provide flexible learning opportunities, especially where computer access is limited.

Language insights

Coding Websites dominated the Online Coding for Kids Market in 2024. These platforms provide structured, multi-tiered courses ranging from beginner to advanced levels, offering kids the opportunity to learn at their own pace. Websites often feature a rich variety of resources, including tutorials, quizzes, live classes, and peer collaboration tools. Examples include platforms like Code.org, Codecademy Kids, and WhiteHat Jr., which have become household names among tech-savvy families.

On the other hand, Coding Apps are expected to witness the fastest growth. The mobile-first learning trend, especially in emerging markets, is fueling the rise of coding apps tailored for smartphones and tablets. Apps like Tynker, Kodable, and Hopscotch offer gamified, on-the-go coding experiences that appeal to younger audiences and provide flexible learning opportunities, especially where computer access is limited.

End-user Insights

Elementary School students represented the dominant end-user segment in 2024. Early exposure to coding helps children develop logical thinking, creativity, and resilience in problem-solving. Online platforms cater heavily to this demographic with interactive games, storytelling-based coding projects, and visual programming languages.

However, Middle School students are expected to be the fastest-growing end-user segment. As children move into adolescence, their capacity for abstract thinking and complex problem-solving increases, making them ideal candidates for more advanced coding languages like Python, Java, and JavaScript. Online coding platforms are increasingly developing intermediate and advanced courses tailored to this age group.

Regional Insights

North America led the Online Coding for Kids Market in 2024, driven by early adoption of e-learning technologies, strong emphasis on STEM education, and high disposable incomes. The United States and Canada boast extensive internet penetration, a large base of tech-literate parents, and government-backed initiatives promoting coding education, such as "Computer Science for All" in the U.S.

The presence of major EdTech players like Code.org, Tynker, and Outschool further consolidates North America’s leadership. Additionally, collaborations between schools and coding platforms have become increasingly common, integrating coding education into mainstream curricula.

Asia-Pacific Registers the Fastest Growth

Asia-Pacific is poised to register the fastest growth over the next few years. Countries like China, India, South Korea, and Singapore are making significant investments in digital education infrastructure and integrating coding into national curricula.

China’s "New Curriculum Standards" mandate coding education for primary and secondary schools, while India's "National Education Policy 2020" emphasizes computational thinking and coding from grade six onwards. The region's large young population, rising internet penetration, and growing middle class with aspirations for global competitiveness are driving rapid market expansion.

Recent Developments

-

March 2025: WhiteHat Jr. launched "AI & Robotics for Kids" program, integrating coding with hands-on robotics projects to boost STEM engagement among elementary and middle school students.

-

February 2025: Tynker announced a strategic partnership with Amazon Future Engineer to provide free coding courses to underserved schools in North America.

-

January 2025: Code.org introduced "Code Plus," a subscription service offering extended coding challenges, mentorship, and live workshops for advanced learners.

-

December 2024: BYJU’S FutureSchool expanded its coding platform into Latin America, offering Spanish-language coding courses for kids aged 6-16.

-

October 2024: Outschool launched a new AI-driven personalized coding curriculum, adjusting lesson paths based on each learner’s skill progression and learning pace.

Online Coding for Kids Market Top Key Companies:

- Camp K12 (K 12 Innovations Private Limited)

- CodaKid

- Code.org

- edX Inc.

- General Assembly

- Kodable

- Logiscool Ltd.

- Mind Champ Teaching Solutions LLP

- Neuron Fuel, Inc. (Tynker)

- Shaw Academy, Pvt. Ltd.

- Springboard

- WhiteHat Education Technology Pvt. Ltd LLP

- THINKFUL

- Udacity, Inc.

- Udemy, Inc.

- Code Combat Inc.

- Codevidhya India (P) Ltd.

- Coding Dojo, Inc.

- Coding Zen

- EduCode Academy

Online Coding for Kids Market News

| Company name |

Headquarters |

News |

| Physics Wallah Academy |

A-13/5, Sector 62, Noida, India |

In November 2023, Physics Wallah Academy will extend the nursery curriculum to class eight and embark on the AI and Coding Skills Platforms for children. |

| AmaliTech |

Cologne, Germany |

In November 2023, AmaliTech and Access Bank embarked on the" Coding for Kids" initiative to form the future of tech-savvy young minds. |

| WhiteHat Jr |

Mumbai, India |

In May 2022, WhiteHat Jr and EnduroSat collaborated to enable kids to "Code a Satellite" and embarked on the Ayana Satellite to encourage space exploration. |

Online Coding for Kids Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Online Coding for Kids market.

By Coding Type

- Coding Apps

- Coding Websites

By Language

- Scratch

- Python

- Java

- HTML/CSS

- JavaScript

By End User

- Elementary School

- Middle School

- High School

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)