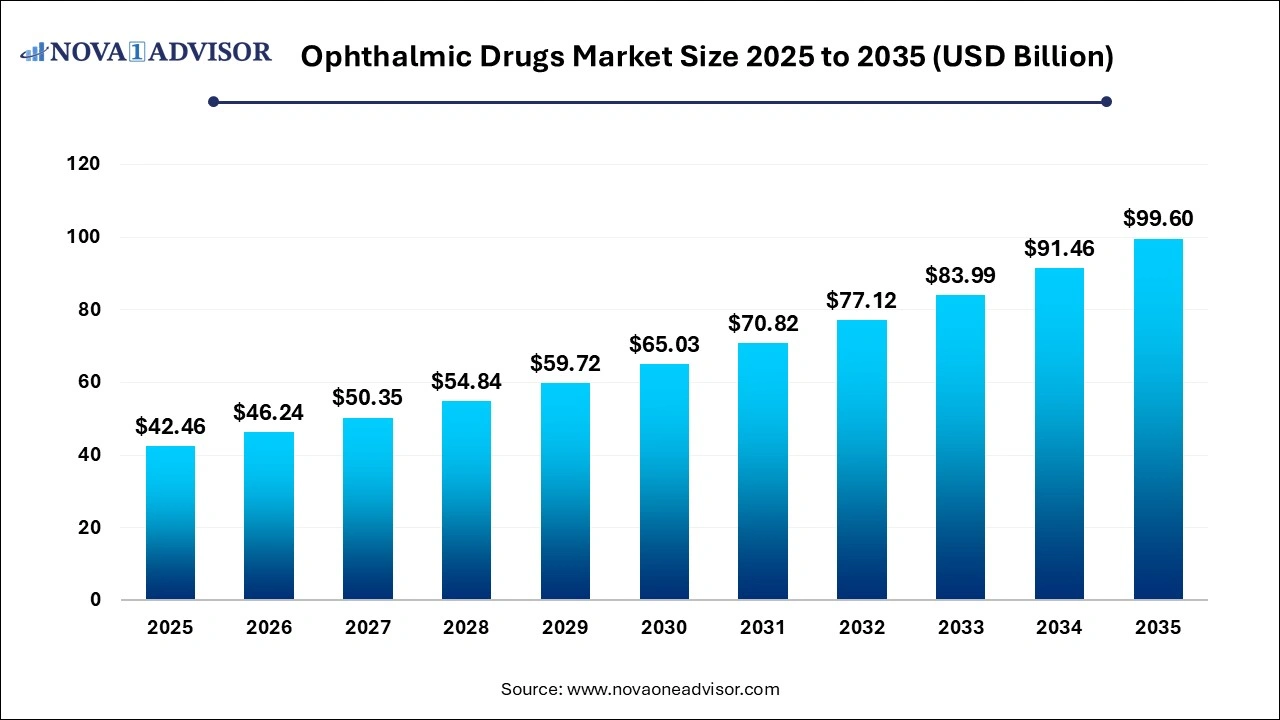

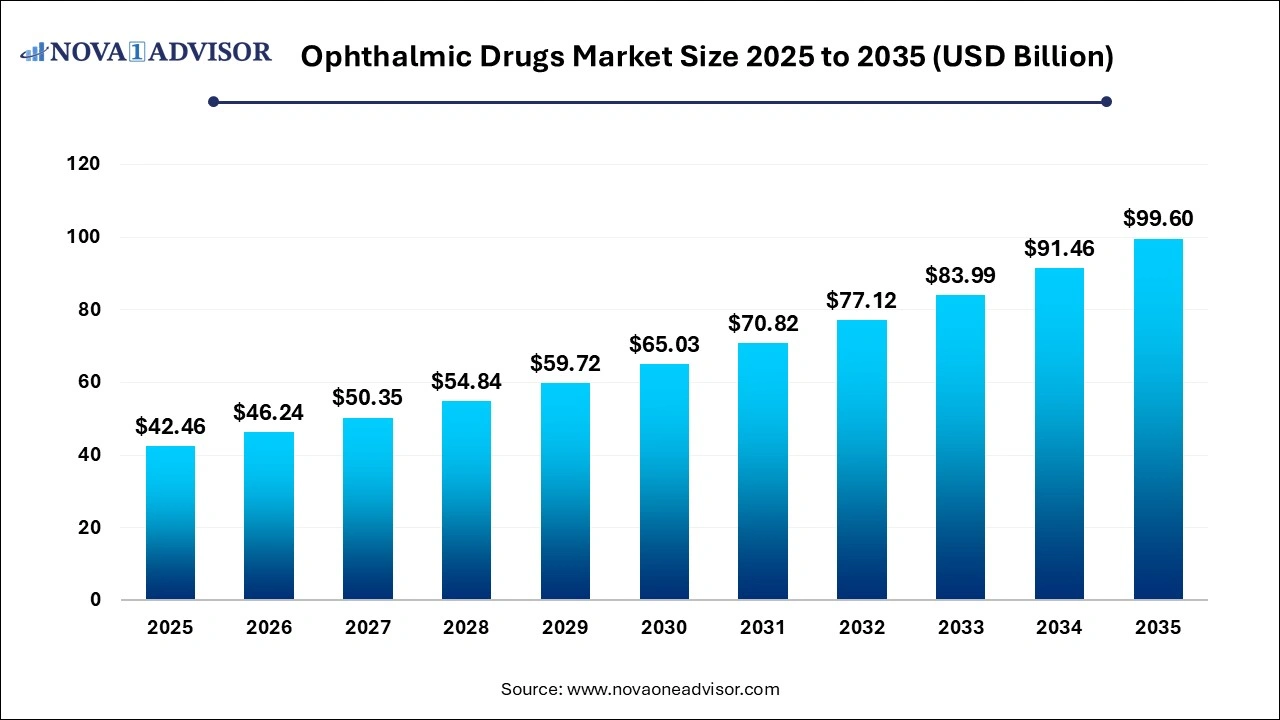

Ophthalmic Drugs Market Size and Growth 2026 to 2035

The global ophthalmic drugs market size is calculated at USD 42.46 billion in 2025, grow to USD 46.24 billion in 2026, and is projected to reach around USD 99.6 billion by 2035, growing at a CAGR of 8.9% from 2026 to 2035. The market is growing due to the growing prevalence of eye disorders like cataracts and glaucoma, especially in the aging population. Technological advancements in diagnostics and treatments are driving demand.

Ophthalmic Drugs Market Key Takeaways

- North America dominated the ophthalmic drugs market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By indication, the dry eye segment held the largest revenue market share.

- By indication, the glaucoma segment is expected to grow at the fastest CAGR in the market during the coming years.

- By type, the prescription segment dominated the market.

- By type, the over-the-counter segment is expected to grow at a notable CAGR in the market during the forecast period.

- By dosage form, the liquid ophthalmic segment led the market in 2025.

- By dosage form, the semisolid ophthalmic segment is expected to grow at the fastest CAGR in the market during the studied years.

- By distribution channel, the hospital pharmacies segment held the largest revenue market share.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the

- forecast period.

Which Factors Driven the Growth of the Ophthalmic Drugs Market?

An ophthalmic drug is a medication designed for the diagnosis, treatment, or prevention of eye diseases and conditions. These drugs are specially formulated to be applied directly to the eye, typically as drops, ointments, gels, or inserts, ensuring localized and effective action with minimal systemic side effects. The ophthalmic market is growing due to the rising prevalence of eye disorders such as glaucoma, cataracts, and age-related macular degeneration. An aging global population and increased screen time contribute to higher demand for eye care. Technological advancements. Drug delivery systems and diagnostic tools also support market expansion. Additionally, greater awareness, improved access to healthcare, and increased investment in research and development are boosting the market demand.

- For Instance, In July 2023, the National Eye Institute committed USD 2.5 million in funding over five years to support glaucoma treatment research at the Missouri University of Science and Technology. This investment aims to advance innovative approaches in managing glaucoma and reflects the growing emphasis on eye disease research and development.

What are the Major Trends Influencing Ophthalmic Drugs Market in 2024?

In December 2024, Santen announced that south korea and vietnam began reviewing its new drug application for STN1013001, a preservative-free cationic emulsion of latanoprost (50μg/mL) aimed at treating open-angle glaucoma and ocular hypertension. This drug not only reduces intraocular pressure but also enhances eye surface health. The application is backed by Phase III trial results showing it is as effective as standard latanoprost while offering better improvement in ocular surface conditions.

- In August 2023, Regeneron Pharmaceuticals, Inc. received regulatory approval for EYLEA HD (aflibercept), a treatment for wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and diabetic retinopathy.

How is AI enhancing advancements in the Ophthalmic Drugs Market?

Artificial intelligence is significantly advancing the market by improving disease diagnosis, patient screening, and treatment personalization. AI-powered imaging tools enable early detection of conditions like glaucoma and diabetic retinopathy, allowing timely intervention. It also accelerates drug discovery by analyzing vast datasets to identify potential compounds and predict outcomes. Furthermore, AI supports clinical trials by enhancing patient selection and monitoring. These innovations collectively streamline development processes and improve patient outcomes in ophthalmic care.

Ophthalmic Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 46.24 Billion |

| Market Size by 2035 |

USD 99.6 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.9% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By indication, By Type, By Dosage Form, By Distribution Channel, By Therapeutic Class, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Alcon, Novartis AG, Bausch Health Companies, Inc., Merck & Co., Inc., Regeneron Pharmaceuticals, Inc., Coherus BioSciences, Inc., AbbVie, Inc. (Allergan), Pfizer, Inc., Bayer AG, Santen Pharmaceutical Co., Ltd., Roche (Genentech, Inc.), Nicox |

Market Dynamics

Driver

Rising Prevalence of Eye Diseases

The rising prevalence of eye diseases boosts the ophthalmic drugs market by creating a consistent and expanding patient base requiring long-term treatment. This surge increases healthcare spending on vision care and encourages governments and organizations to prioritize eye health. Additionally, it prompts pharmaceutical companies to accelerate the development of novel therapies and improve drug accessibility. The growing demand also supports collaboration, clinical trials, and approvals, further propelling market growth and innovation in ophthalmic solutions.

For Instance, The World Health Organization (WHO) reports that over 2.2 billion people globally experience some form of near or distant vision impairment each year. Of these, at least 1 billion cases are either preventable or have not yet been addressed, highlighting a significant gap in global eye care and the urgent need for timely intervention and treatment.

Restraint

Side-Effects Associated with Ophthalmic Drugs

Side effects linked to ophthalmic drugs act as a major restraint in the market, as they can reduce patient compliance and limit widespread adoption. Common issues such as eye irritation, redness, blurred vision, or allergic reactions may discourage continued use. In some cases, long-term use of certain medications can lead to serious complications like increased intraocular pressure or systemic absorption effects. These safety concerns often prompt caution among healthcare providers and patients, impacting market growth.

Opportunity

The Growing Adoption of Advanced Drug Delivery Systems

The growing adoption of advanced drug delivery systems presents a significant future opportunity in the ophthalmic drugs market. Innovations such as sustained-release implants, nanoparticles, and ocular inserts enhance drug effectiveness, minimize side effects, and reduce the frequency of administration. These technologies improve patient compliance and provide targeted, long-lasting treatment for chronic eye conditions. As the demand for more convenient and efficient therapies increases, advanced delivery methods are expected to drive growth and transform ophthalmic care in the coming years.

Segmental Insights

How dry eye Segment Dominate the Ophthalmic Drugs Market in 2025?

The dry eye segment led the ophthalmic drugs market due to the growing number of individuals affected by lifestyle-related factors such as prolonged digital device use, air-conditioned environments, and reduced blink rates. In addition, increased awareness campaigns and improved diagnostics tools have led to higher detection rates. The availability of a wider range of over-the-counter and prescription treatments has further fueled demand, making dry eye dominant ophthalmic drugs market.

The aging global population significantly increases the prevalence of glaucoma, particularly among individuals over 60 years old. Advancements in diagnostic technologies, such as optical coherence tomography (OCT), facilitate early detection and intervention-enhancing treatment outcomes. Furthermore, the development of innovative therapies, including sustained-released drug delivery systems and neuroprotective agents, improves patient adherence and efficacy. These combined factors drive the expansion of the market.

Why Did the Prescription Segment Dominate the Ophthalmic Drugs Market in 2025?

The market is largely attributed to the growing prevalence of severe eye disorders requiring specialized treatment. These medications often undergo rigorous clinical testing, ensuring high efficacy and safety standards. Physicians prefer prescription-based drugs for tailored dosing and monitoring, especially in long-term therapies. Additionally, increased access to healthcare services and insurance coverage has made prescribed treatments more accessible, contributing to the market leadership.

- For Instance, In May 2023, the U.S. FDA approved Miebo, developed by Bausch & Lomb and Novaliq, as the first and only prescription eye drop for treating dry eye disease (DED), marking a significant advancement in DED therapy.

The over-the-counter segment is anticipated to grow at a significant rate in the ophthalmic drugs market due to its affordability and accessibility, especially for treating mild eye conditions like dryness, allergies, and irritation. The availability of various OTC formulations such as eye drops, gel, and ointments allows consumers to manage minor ocular issues without prescriptions. Additionally, the expansion of retail and online pharmacies has made these products more accessible, further driving the market growth.

- For Instance, In July 2023, Bausch + Lomb purchased the Blink OTC eye drop brand from Johnson & Johnson Vision for $106.5 million, strengthening its position in the over-the-counter eye care market.

What Made the Liquid Ophthalmic Suites the Dominant Segment in 2025?

In 2024, the liquid ophthalmic segment led the market due to its ease of application and rapid therapeutic action. Liquid forms, such as eye drops and solutions, allow for direct drug delivery to the eye, ensuring quick relief and high patient compliance. Their widespread use in treating various ocular conditions, including dry eye and glaucoma, along with advancements in preservative-free formulations and multi-dose packaging, have further solidified the market dominance.

For Instance, In December 2024, Santen submitted an application in Japan seeking approval for STN1013800, an eye drop designed to treat acquired blepharoptosis. This move highlights the company’s focus on expanding treatment options for eyelid drooping conditions with innovative ophthalmic solutions.

The increasing number of product approvals and launches, such as ointments, suspensions, and gels, are gaining popularity due to their enhanced effectiveness in treating conditions like inflammation, infection, and dry eye. Unlike liquid formulations, semi-solid ophthalmic drugs offer the advantage of prolonged corneal residence time, leading to sustained drug release and improved therapeutic outcomes. Additionally, the growing focus on obtaining approvals and introducing innovative products is further propelling market growth.

How Does the Hospital Pharmacies Segment Dominate the Market?

The hospital pharmacy segment holds the largest revenue share in the ophthalmic drugs market due to its pivotal role in managing complex and severe eye conditions. Hospitals are equipped with specialized facilities and healthcare professionals capable of administering advanced treatments, including injectable therapies and surgical interventions. This setting ensures precise dosing, patient monitoring, and access to a comprehensive range of ophthalmic medications. Consequently, hospital pharmacies cater to a substantial portion of the market, particularly for conditions requiring specialized care.

The online pharmacy segment in the ophthalmic drugs market is projected to experience rapid growth due to the increasing prevalence of eye conditions, such as dry eye syndrome and glaucoma, which has heightened the demand for accessible treatment options. Online platforms offer the convenience of home delivery, enabling patients to obtain medications without visiting physical pharmacies. Additionally, the growing adoption of digital health solutions and e-prescriptions has streamlined the process, further driving the segment's expansion.

Regional Insights

How is North America Contributing to the Expansion of the Ophthalmic Drugs Market?

In 2025, North America dominated the market due to a high prevalence of eye diseases like glaucoma and diabetic retinopathy, driven by an aging population. The region’s advanced healthcare infrastructure and strong focus on research and development have facilitated the introduction of innovative treatments. Additionally, increased awareness and access to quality eye care have boosted demand. These combined factors have firmly positioned North America as the leading market for ophthalmic drugs.

How is Asia-Pacific approaching the Ophthalmic Drugs Market in 2025?

The Asia-Pacific market is expected to grow at the highest CAGR during the forecast period, driven by a rapidly aging population and rising cases of eye disorders like glaucoma and diabetic retinopathy. Improved healthcare infrastructure and increasing awareness about eye health are boosting demand for effective treatments. Additionally, advancements in pharmaceutical technology and expanding access to healthcare in emerging countries are fueling market growth, making Asia-Pacific a key region for ophthalmic drug development and sales.

- For Instance, In January 2025, Vyluma revealed that China’s National Medical Products Administration accepted its application for NVK002, a drug designed to slow down myopia progression in children, marking a significant step toward addressing childhood vision problems.

Ophthalmic Drugs Market Top Key Companies:

- Alcon

- Novartis AG

- Bausch Health Companies, Inc.

- Merck & Co., Inc.

- Regeneron Pharmaceuticals, Inc.

- Coherus BioSciences, Inc.

- AbbVie, Inc. (Allergan)

- Pfizer, Inc.

- Bayer AG

- Santen Pharmaceutical Co., Ltd.

- Roche (Genentech, Inc.)

- Nicox

Recent Developments in the Ophthalmic Drugs Market

- In July 2024, Novaliq announced that the European Medicines Agency’s CHMP gave a positive opinion recommending EU marketing approval for Vevizye. This drug targets moderate to severe dry eye disease in adults, especially for patients who have not responded well to conventional tear substitutes.

- In April 2024, Viatris Inc. introduced RYZUMVI (phentolamine ophthalmic solution) 0.75% in the U.S. to treat drug-induced pupil dilation caused by adrenergic agonists like phenylephrine or parasympatholytic agents such as tropicamide.

Ophthalmic Drugs Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Ophthalmic Drugs market.

By indication

- Dry EyeGlaucoma

- Infection/Inflammation/Allergy

- Retinal Disorders

-

- Wet Age-related Macular Degeneration

- Dry Age-related Macular Degeneration

- Diabetic Retinopathy

- Others

By Type

- Prescription Drugs

- Over-the-counter Drugs

By Dosage Form

- Liquid Ophthalmic Drug Forms

- Solid Ophthalmic Drug Forms

- Semisolid Ophthalmic Drug Forms

- Multicompartment Drug Delivery Systems

- Other Ophthalmic Drug Forms

By Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Online Pharmacies

- Others

By Therapeutic Class

- Anti-glaucoma

- Anti-infection

- Anti-inflammation

- Anti-allergy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)