Oral Syringes Market Size and Trends

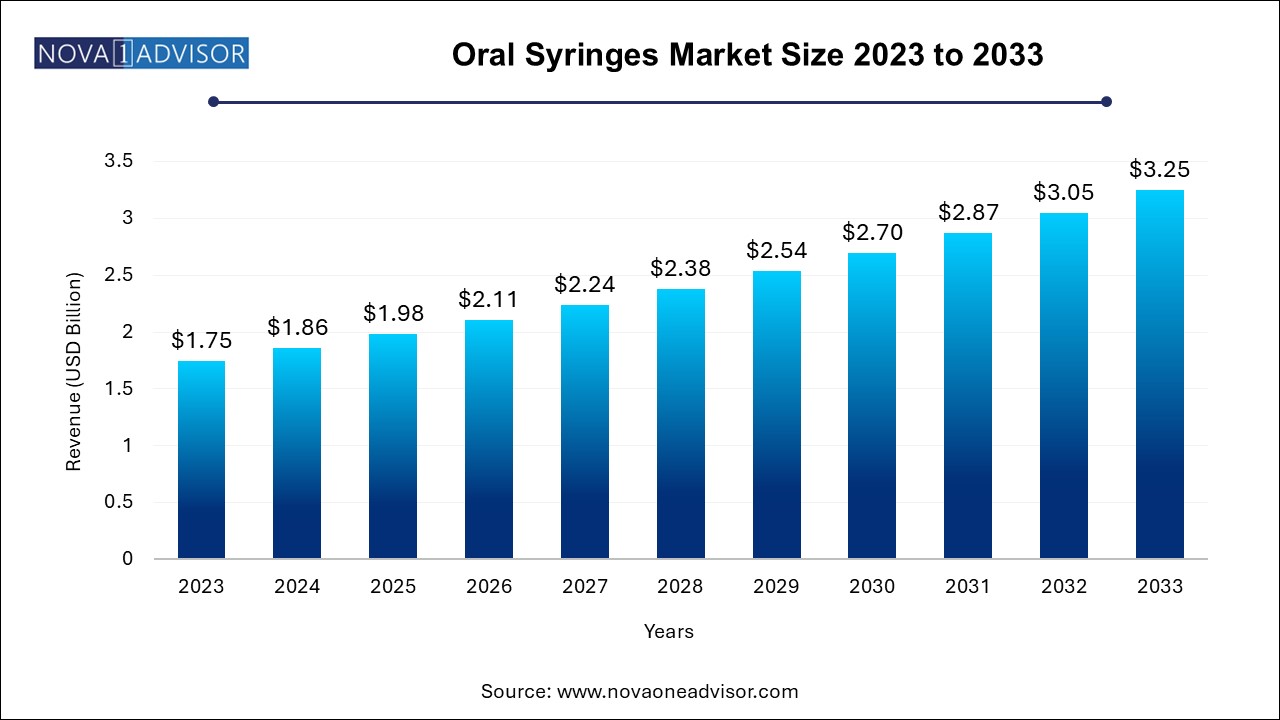

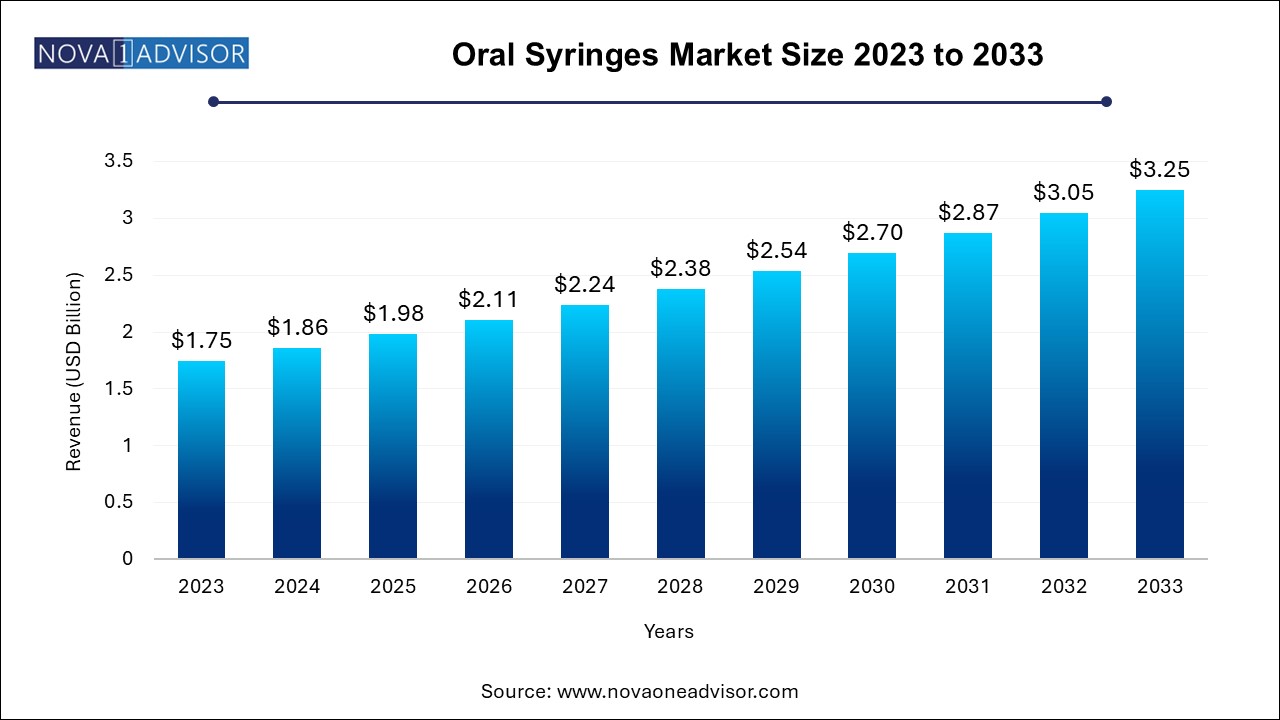

The global oral syringes market size was exhibited at USD 1.75 billion in 2023 and is projected to hit around USD 3.25 billion by 2033, growing at a CAGR of 6.38% during the forecast period 2024 to 2033.

Oral Syringes Market Key Takeaways:

- Clear oral syringes held the largest market share of over 60.0% in 2023.

- The reusable oral syringes segment held the largest market share 50.9% in 2023.

- The disposable oral syringes segment is anticipated to witness the fastest growth rate of 4.3% over the forecast period

- The hospital segment held largest market share of over 50.0% in 2023.

- The home care settings segment is anticipated to witness the fastest growth over the forecast period.

- North America accounted for the highest market share of over 30.0% in 2023.

- In Asia Pacific, the market is anticipated to witness the fastest growth rate over the forecast period.

Market Overview

The oral syringes market is a vital subsegment within the global drug delivery and healthcare consumables industry, primarily used to administer precise doses of liquid medication, especially in pediatric, geriatric, and homecare settings. Oral syringes provide a safer and more accurate alternative to traditional dosing cups and spoons, minimizing dosage errors and improving patient compliance. These devices are designed for ease of use, precision, and hygiene, making them essential in both clinical and home-based healthcare environments.

The market has seen notable growth in recent years, driven by increasing demand for patient-centric drug delivery solutions, the expansion of homecare and ambulatory healthcare models, and regulatory emphasis on accurate medication dosing. Rising incidences of chronic diseases, including diabetes, cardiovascular conditions, and respiratory disorders where oral liquid medications are frequently prescribed have also reinforced demand for oral syringes.

From a manufacturing perspective, innovations in materials, design (e.g., low dead space, color-coded syringes), and packaging integration with pharmaceutical companies have enhanced the utility of oral syringes. Furthermore, as more liquid drugs come to market, particularly pediatric formulations and liquid nutritional supplements, the relevance of precise oral delivery tools continues to grow.

In 2024, major players in the space are investing in sustainable, user-friendly, and regulation-compliant syringes, broadening their offerings to meet evolving demand across various sectors including hospitals, clinics, and homecare.

Major Trends in the Market

-

Rising Use in Pediatric and Geriatric Care: Oral syringes are increasingly adopted for their ease and precision in non-cooperative or dosage-sensitive populations such as infants and the elderly.

-

Increased Demand for Homecare and OTC Medicines: The shift to at-home healthcare services has boosted sales of oral syringes for chronic and routine medication administration.

-

Color-Coded Syringe Innovations: Color differentiation to prevent cross-contamination and ensure correct medication usage is becoming standard in hospital settings.

-

Eco-Friendly and Biodegradable Syringes: Manufacturers are innovating with bio-based plastics and recyclable materials to align with environmental goals.

-

Partnerships with Pharmaceutical Companies: Co-packaging of oral syringes with liquid medications is expanding through partnerships between drug manufacturers and device makers.

-

Regulatory Push for Dosing Accuracy: Stringent guidelines from health agencies like the FDA and EMA are promoting the adoption of precise dosage tools over traditional methods.

-

Tamper-Proof and Child-Safe Designs: Enhanced safety features are being integrated to prevent misuse, especially in pediatric and homecare segments.

Report Scope of Oral Syringes Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.86 Billion |

| Market Size by 2033 |

USD 3.25 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.38% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Usage, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

Becton; Dickinson and Company; Braun Melsungen AG; Medtronic; Amcor Limited; Smiths Medical; NIPRO Corporation; Gerresheimer AG; Terumo Corporation |

Market Driver: Rising Pediatric and Geriatric Population Demands Accurate Liquid Medication Delivery

A central driver propelling the oral syringes market is the growing need for accurate medication dosing in pediatric and geriatric populations. Children and elderly individuals often struggle with swallowing tablets or capsules, making liquid formulations the preferred method of drug administration. However, these formulations require precise dosing to ensure therapeutic effectiveness and avoid overdose.

In this context, oral syringes offer unmatched precision and ease of administration. Their role has been further amplified in pediatric intensive care units and long-term geriatric care facilities where medication regimens can involve multiple drugs with narrow therapeutic windows. Governments and global health organizations continue to push for improved drug delivery methods in these vulnerable groups, creating a consistent demand for high-quality oral syringes in both clinical and homecare settings.

Market Restraint: Environmental Concerns and Plastic Waste Management

Despite their clinical benefits, the environmental impact of disposable plastic oral syringes is a growing concern. Most oral syringes are made from polypropylene or polyethylene, which are not easily biodegradable and contribute to medical waste burdens, especially in large-scale healthcare facilities. With global healthcare sectors increasingly scrutinized for sustainability practices, the disposal and recycling of single-use devices like oral syringes are becoming a regulatory and reputational issue.

Some healthcare systems are re-evaluating usage guidelines to minimize unnecessary disposables, while manufacturers are under pressure to develop greener alternatives. However, the transition to biodegradable or reusable materials comes with challenges in cost, sterility, and compliance, particularly in regions with underdeveloped waste management systems.

Market Opportunity: Growth in Telehealth and At-Home Medication Management

The rise of telehealth and remote medication management presents a major opportunity for the oral syringes market. As more patients are treated outside traditional hospital settings either through online consultations or nurse-supervised home treatments the need for easy-to-use, accurate, and safe medication delivery tools is increasing rapidly.

Oral syringes are ideal for self-administration in homecare settings, offering patients a way to independently manage chronic conditions such as epilepsy, hypothyroidism, or cardiovascular diseases that require liquid medication. Furthermore, e-pharmacies are beginning to bundle oral syringes with home-delivered medications. Companies that innovate in this space by offering child-safe, instruction-friendly syringes, possibly with mobile app-linked dose tracking stand to capitalize on this growing homecare trend.

Oral Syringes Market By Product Type Insights

Clear oral syringes dominate the product type segment due to their widespread clinical acceptance and ability to provide visibility for precise dosing. Their transparent construction enables caregivers and healthcare professionals to visually confirm the volume and any presence of air bubbles before administration. Clear syringes are extensively used in hospitals, clinics, and pharmacy settings where dosage accuracy is critical. Their compatibility with a wide range of medications and standardization in sizes (1 mL to 10 mL) further supports their dominance.

However, colorful oral syringes are the fastest growing segment. These products are especially popular in pediatric hospitals and homecare, where color-coding helps differentiate between medications and times of administration. Colorful syringes also appeal to children by reducing the intimidation often associated with medication intake. With the increasing use of multiple liquid medications in long-term care, color-coded syringes help prevent dosing errors and streamline drug administration schedules. As safety and adherence become key priorities, demand for these specialized syringes is rising in both developed and emerging markets.

Oral Syringes Market By Usage Insights

Disposable oral syringes account for the largest market share due to their convenience, cost-effectiveness, and infection control benefits. These single-use devices are commonly provided by pharmacies, hospitals, and packaged with medications to ensure sterility and minimize contamination risk. They are particularly favored in busy clinical environments where quick turnover and patient safety are paramount. The COVID-19 pandemic further reinforced the use of disposable devices to avoid cross-contamination, boosting their adoption globally.

However, reusable oral syringes are gaining popularity, especially in homecare settings and among environmentally conscious consumers. These products are typically made from durable, medical-grade materials that can be cleaned and sterilized after each use. They are well-suited for patients on long-term medication regimens, reducing overall plastic waste and cost over time. Some manufacturers are offering reusable syringes with color-coded plungers and dosage memory features to support safe reuse. As environmental regulations tighten and sustainability gains importance, reusable syringes are expected to capture increasing market share.

Oral Syringes Market By End-use Insights

Hospitals are the primary end users of oral syringes, reflecting their central role in acute care, pediatric care, and post-surgical recovery. In these settings, nurses frequently administer liquid medications to patients unable to take tablets, making oral syringes a routine consumable. Hospitals also require a wide range of syringe volumes and safety features such as tamper-evident packaging and luer-lock compatibility. Bulk procurement and adherence to medication administration protocols make hospitals the largest contributors to revenue in this segment.

Homecare settings are the fastest growing end-use segment, propelled by the shift toward decentralized healthcare and self-managed therapies. Patients with chronic conditions increasingly receive care at home, either through telemedicine support or regular nurse visits. Oral syringes in these settings offer patients independence, reduced healthcare costs, and greater comfort. The rising number of home births, outpatient surgeries, and infant care programs further supports demand for oral syringes in domestic use. Innovations targeting homecare such as pre-measured syringes, soft-tip designs, and instructional labeling—are accelerating this trend.

Oral Syringes Market By Regional Insights

North America dominates the oral syringes market, driven by its advanced healthcare infrastructure, high adoption of patient safety measures, and strong pharmaceutical industry. The U.S. and Canada collectively contribute the largest share, with hospitals, outpatient clinics, and homecare services routinely using oral syringes. Strict FDA regulations encouraging precise dosage delivery and discouraging medication errors further boost market uptake. Additionally, the presence of industry leaders such as Becton, Dickinson and Company (BD) and Baxter International ensures constant product availability and innovation.

Growth is further supported by rising pediatric medication needs, increasing chronic disease prevalence, and growing awareness about safe drug delivery practices. North American consumers also show greater interest in eco-friendly and ergonomically designed medical devices, encouraging manufacturers to invest in sustainable syringes tailored for retail and homecare.

Asia Pacific is witnessing the fastest growth in the oral syringes market due to expanding healthcare infrastructure, increasing birth rates, and growing pharmaceutical consumption. Countries like China, India, and Indonesia have massive pediatric populations and rising middle-class incomes, making affordable and safe drug delivery tools a public health priority. Government-led vaccination and infant health programs often distribute oral syringes alongside essential liquid formulations.

The market is also benefitting from the rise of regional pharmaceutical manufacturers who co-package oral syringes with syrup-based medications. Additionally, Asia Pacific's emerging telemedicine ecosystem and expanding home healthcare sector are creating a favorable environment for domestic and imported syringe products. Local companies are also investing in biodegradable syringes to address the growing regulatory emphasis on sustainability.

Some of the prominent players in the global oral syringes market include:

- Becton

- Dickinson and Company

- Braun Melsungen AG

- Medtronic

- Amcor Limited

- Smiths Medical

- NIPRO Corporation

- Gerresheimer AG

- Terumo Corporation

Recent Developments

-

February 2025 – Becton, Dickinson and Company (BD) announced a significant expansion to its oral drug delivery portfolio, launching a new range of precision oral syringes with improved dosing accuracy and tamper-evident features. These products are designed for co-packaging with liquid medications and are optimized for pediatric and homecare use. [Source: PR Newswire]

-

November 2024 – Gerresheimer AG introduced a new line of eco-friendly oral syringes, manufactured from recyclable materials, targeting pharmaceutical packaging partnerships in Europe and Asia.

-

August 2024 – Baxter International Inc. unveiled custom dosage oral syringes for hospital and outpatient settings, featuring dual-scale markings and ergonomic designs for elderly patients.

-

May 2024 – Medline Industries LP expanded its presence in Asia by launching low-cost, single-use oral syringes across healthcare chains in India and Southeast Asia, citing growing demand from the pediatric medicine segment.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global oral syringes market

Product Type

- Colorful Oral Syringes

- Clear Oral Syringes

Usage

- Disposable Oral Syringes

- Reusable Oral Syringes

End-use

- Hospitals

- Clinics

- Homecare Settings

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa