Organoids And Spheroids Market Size and Trends

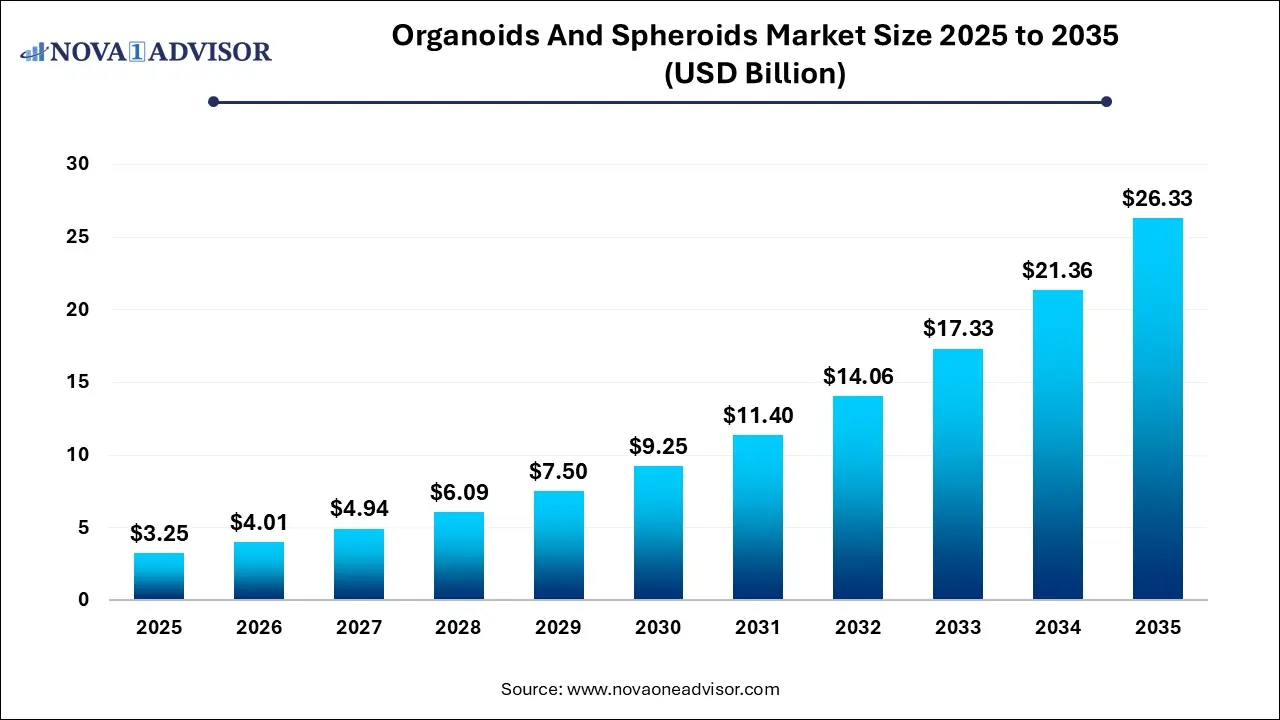

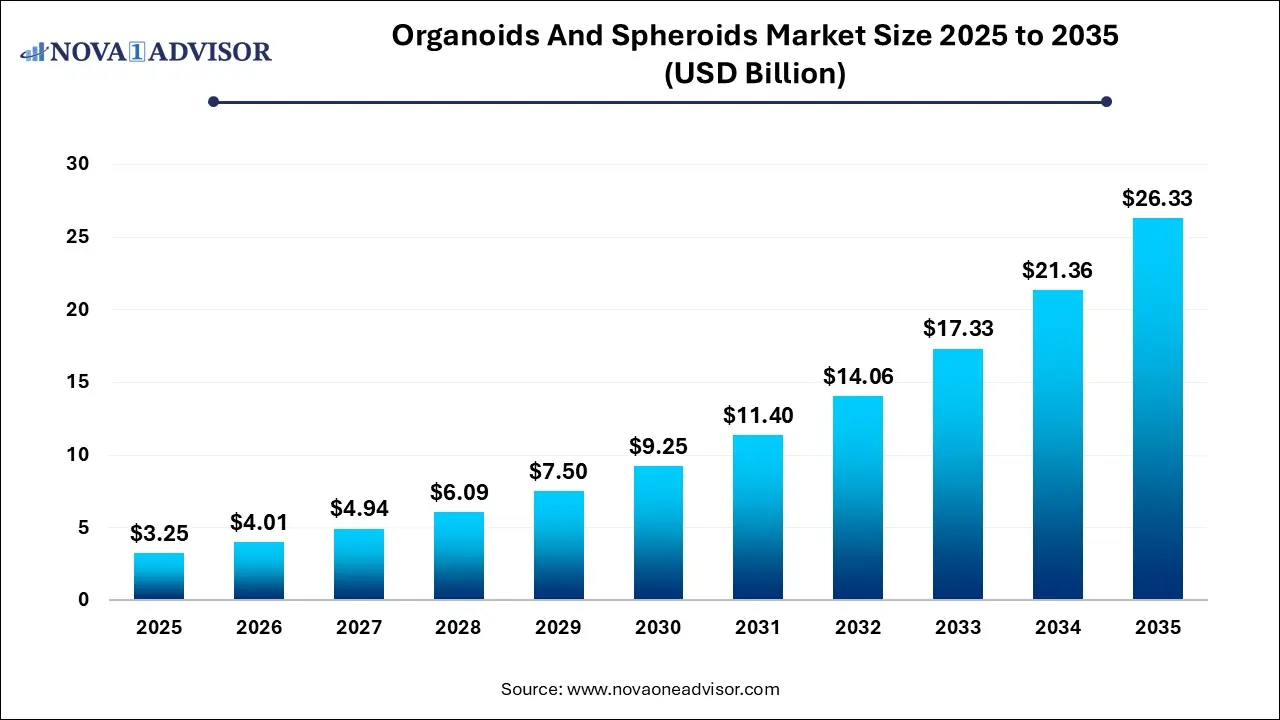

The Organoids and spheroids market size was exhibited at USD 3.25 billion in 2025 and is projected to hit around USD 26.33 billion by 2035, growing at a CAGR of 23.27% during the forecast period 2026 to 2035.

Key Takeaways:

- Based on type, the organoids segment led the market with the largest revenue share of 60% in 2025.

- Based on application, the developmental biology segment led the market with the largest revenue share of 31% in 2025

- Based on end use, the biotechnology and pharmaceutical industries segment led the market with the largest revenue share of 48% in 2025.

- North America dominated the organoids and spheroids market with the largest revenue share of 35% in 2025.

Market Overview

The Organoids and Spheroids Market has emerged as a transformative force in biomedical research and precision medicine, offering unprecedented opportunities to model human physiology and pathology in vitro. Organoids and spheroids are three-dimensional (3D) cell culture systems derived from stem cells or primary cells that self-organize into structures mimicking the functionality and architecture of real human tissues or organs. These platforms offer superior biological relevance compared to traditional 2D cell cultures, enabling researchers to study disease mechanisms, test drugs, and explore regenerative therapies in ways previously unattainable.

Organoids, often developed from adult stem cells or induced pluripotent stem cells (iPSCs), can form miniaturized versions of organs such as the liver, brain, kidney, and intestine. Spheroids, on the other hand, are typically simpler multicellular aggregates derived from tumor cells, neurons, or hepatocytes, commonly used in cancer and toxicity studies. The use of these 3D models in drug screening, developmental biology, disease modeling, and personalized medicine is expanding rapidly.

Fueled by increased interest in reducing animal testing, the growing need for personalized therapies, and the limitations of traditional preclinical models, the organoids and spheroids market is seeing accelerating growth. As of 2025, both academic institutions and pharmaceutical companies are investing heavily in developing standardized, scalable, and reproducible organoid and spheroid systems to bridge the translational gap between in vitro testing and human clinical trials.

Major Trends in the Market

-

Adoption of Organoids in Precision Oncology

Organoids derived from patient tumor samples are increasingly used to predict individual drug responses and guide personalized treatment plans.

-

Integration of Microfluidics and Organoid-on-a-Chip Platforms

Combining organoids with lab-on-a-chip technologies is enabling dynamic, multi-organ simulation for high-fidelity testing.

-

CRISPR-Engineered Organoids for Disease Modeling

Gene editing tools are being applied to develop organoids that accurately recapitulate genetic diseases and support functional genomics.

-

Expansion of Organoid Biobanks and Commercial Kits

Companies and research consortia are establishing standardized biobanks and offering ready-to-use organoid culture kits to streamline research.

-

Shift Toward GMP-Compliant Organoid Production for Therapeutics

Regulatory pathways are evolving to support the use of organoids in regenerative medicine and transplantation.

-

Use of Spheroids in High-Throughput Drug Screening

Spheroid cultures are now integrated into automated screening platforms for evaluating drug toxicity and efficacy with higher predictive accuracy.

Report Scope of Organoids And Spheroids Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.01 Billion |

| Market Size by 2035 |

USD 26.33 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 23.27% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

3D Biomatrix; 3D Biotek LLC; AMS Biotechnology (Europe) Limited; Cellesce Ltd; Corning Incorporated; Greiner Bio-One; Hubrecht Organoid Technology (HUB); InSphero: Lonza; Merck KGaA; Prellis Biologics; STEMCELL Technologies Inc.; Thermo Fisher Scientific, Inc. |

Market Driver: Growing Demand for Predictive Preclinical Models

A primary driver of growth in the organoids and spheroids market is the rising demand for more predictive and physiologically relevant preclinical models. Traditional 2D cell cultures fail to replicate the complexity of in vivo tissue environments, often leading to poor translation of experimental findings to clinical outcomes. Animal models, while more biologically complex, suffer from interspecies differences that limit their predictive value and ethical concerns that restrict their use.

Organoids and spheroids offer a bridge by closely mimicking human tissue behavior and function. For instance, intestinal organoids derived from patients with cystic fibrosis have been used to test drug efficacy, enabling personalized therapy decisions. In cancer research, tumor-derived spheroids better replicate the tumor microenvironment, including gradients of oxygen and nutrients, thereby providing realistic platforms for drug screening. The need for improved translational fidelity is making 3D cell culture technologies essential in pharmaceutical R&D.

Market Restraint: High Cost and Technical Complexity

Despite their advantages, a significant restraint in the organoids and spheroids market is the high cost of production and technical complexity associated with culture, maintenance, and analysis. Establishing organoid cultures requires specialized growth media, extracellular matrix components (like Matrigel), and stem cell expertise, often making them resource-intensive for small labs and early-stage biotech firms.

In addition, standardization and reproducibility remain challenges due to batch variability, inconsistencies in organoid formation, and complex handling procedures. Spheroids, though easier to generate, often suffer from lack of uniformity and central necrosis in larger aggregates. These limitations hinder scalability and limit adoption in high-throughput industrial applications, slowing down their full commercialization potential.

Market Opportunity: Personalized Drug Testing and Precision Medicine

A key opportunity for the market lies in the expanding application of organoids and spheroids in personalized medicine, particularly for drug testing and therapy response prediction. By generating patient-derived organoids or tumor spheroids, researchers can test the efficacy of different treatments in vitro before administering them to the patient, thereby tailoring therapy to individual biological profiles.

This approach has gained traction in precision oncology, where tumor organoids can predict response to chemotherapeutics, targeted therapies, or immunotherapies. Companies such as Hubrecht Organoid Technology and SEngine Precision Medicine are commercializing such platforms for clinical use. As sequencing technologies and bioinformatics tools become more accessible, the integration of patient genomic data with 3D cell cultures is expected to revolutionize individualized treatment strategies.

Segmental Analysis

By Type Outlook

Organoids dominated the overall type segment, owing to their complex architecture and close physiological resemblance to real human tissues. Among organoids, intestinal and hepatic organoids hold a major share due to their application in drug metabolism studies, toxicity testing, and gastrointestinal disease modeling. For instance, hepatic organoids are increasingly used to study liver fibrosis and hepatotoxicity, especially in preclinical drug testing pipelines. Neural organoids are gaining momentum in neurodevelopmental studies, autism research, and neurodegenerative disease modeling, offering a dynamic in vitro tool that surpasses traditional neuronal cultures.

Spheroids are expected to witness faster growth, particularly in oncology and pharmacology research. Multicellular tumor spheroids (MCTS) replicate 3D tumor microenvironments, supporting applications in drug penetration studies and screening of cytotoxic agents. Additionally, techniques such as hanging drop and low-attachment plates make spheroid formation cost-effective and suitable for high-throughput screening. Innovations in scalable spheroid formation platforms are accelerating their adoption in industrial drug discovery workflows.

By Application Outlook

Drug toxicity and efficacy testing led the application segment, as pharmaceutical companies increasingly adopt 3D models for screening compounds and reducing late-stage trial failures. Organoids and spheroids provide more accurate toxicity profiles compared to 2D cultures, reducing the reliance on animal testing. Hepatotoxicity testing using liver spheroids and cardiotoxicity screening with cardiac organoids are becoming industry standards. The ability to simulate human physiological responses enables early detection of adverse reactions, saving billions in R&D costs.

Personalized medicine is the fastest growing application, driven by the emergence of patient-derived models and companion diagnostics. Oncology is the leading field where patient-specific tumor organoids are used to assess responsiveness to various chemotherapy regimens. Beyond cancer, this personalized approach is now being explored in cystic fibrosis, inflammatory bowel disease, and rare genetic disorders. With regulatory agencies showing interest in integrating such models into clinical decision-making, the personalized medicine segment is poised for substantial expansion.

By End-Use Outlook

Biotechnology and pharmaceutical industries were the largest end-users, accounting for the lion’s share of the revenue. These sectors utilize 3D cultures for drug discovery, toxicity testing, and disease modeling. Large biopharma firms are increasingly investing in partnerships with organoid platform companies to integrate these models into preclinical workflows. The cost of failed drug trials, combined with pressure for better animal alternatives, has made these tools indispensable in modern R&D.

Academic and research institutes are projected to be the fastest growing segment, supported by public funding for regenerative medicine and basic disease research. Universities and government research centers are using organoids and spheroids to understand organ development, stem cell differentiation, and gene function. The ease of genetic manipulation and imaging compatibility makes them ideal for high-resolution studies and functional genomics.

By Regional Analysis

North America dominated the organoids and spheroids market, led by the U.S. due to strong biomedical research infrastructure, extensive funding from the NIH and NSF, and widespread adoption by pharmaceutical companies. Prestigious institutions like MIT, Harvard, and Johns Hopkins have pioneered organoid-based research, further bolstering regional leadership. Moreover, the U.S. FDA has actively promoted alternative models to reduce animal testing, encouraging 3D culture adoption across both academia and industry.

Asia Pacific is the fastest growing region, driven by increasing investments in life sciences research, regenerative medicine, and academic innovation in countries like China, Japan, and South Korea. China’s 14th Five-Year Plan highlights stem cell and tissue engineering as national priorities, supporting rapid expansion of related research infrastructure. Japanese companies are commercializing organoid technologies for regenerative therapy applications, and Korean biotech startups are gaining attention for exosome and 3D culture innovations.

Some of The Prominent Players in The Organoids and spheroids market Include:

Recent Developments

-

April 2025 – STEMCELL Technologies launched a new range of human intestinal organoid culture kits designed for high-throughput drug screening and enteric disease modeling.

-

February 2025 – Hubrecht Organoid Technology (HUB) announced a licensing partnership with Roche to utilize HUB’s patient-derived organoids for oncology drug screening and companion diagnostic development.

-

January 2025 – Cellesce Ltd. expanded its GMP-compliant organoid production facility in the UK to support commercial-grade manufacturing for pharmaceutical clients.

-

November 2024 – Corning Inc. introduced advanced ultra-low attachment spheroid plates compatible with robotic screening systems to support industrial-scale cancer research.

-

September 2024 – InSphero AG collaborated with AstraZeneca to evaluate liver spheroids in predicting drug-induced liver injury across diverse compound classes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Organoids and spheroids market

Type

-

-

-

- Neural Organoids

- Hepatic Organoids

- Intestinal Organoids

- Other Organoids

-

-

-

- General Submerged Method for Organoid Culture

- Crypt Organoid Culture Techniques

- Air Liquid Interface (ALI) Method for Organoid Culture

- Clonal Organoids from Lgr5+ Cells

- Brain and Retina Organoid Formation Protocol

- Others

-

-

-

- Primary Tissues

- Stem Cells

-

-

-

- Multicellular Tumor Spheroids (MCTS)

- Neurospheres

- Mammospheres

- Hepatospheres

- Embryoid bodies

-

-

-

- Micropatterned Plates

- Low Cell Attachment Plates

- Hanging Drop Method

- Others

-

-

-

- Cell Line

- Primary Cell

- iPSCs Derived Cells

Application

- Developmental Biology

- Personalized Medicine

- Regenerative Medicine

- Disease Pathology Studies

- Drug Toxicity & Efficacy Testing

End-use

- Biotechnology and Pharmaceutical Industries

- Academic & Research Institutes

- Hospitals and Diagnostic Centers

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)