Orthodontic Headgear Market Size and Growth 2025 to 2034

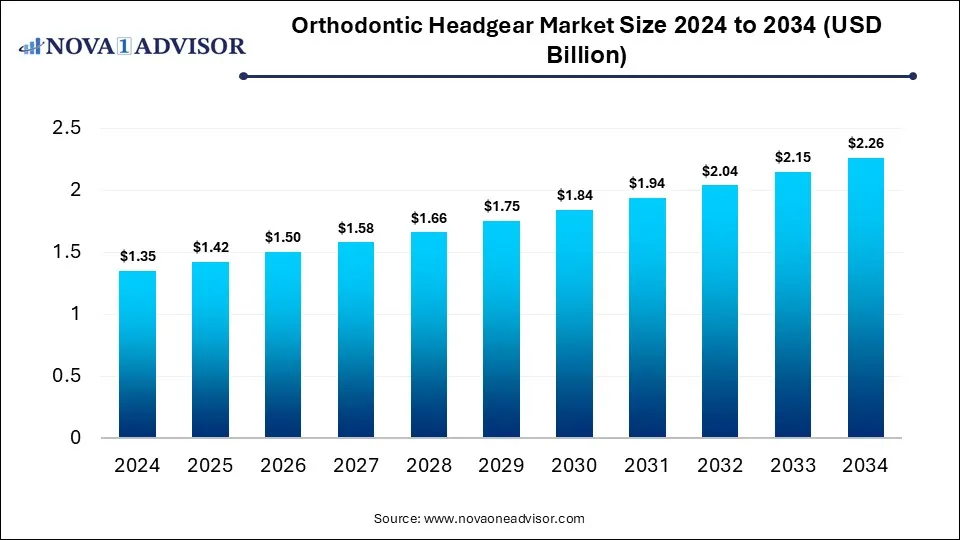

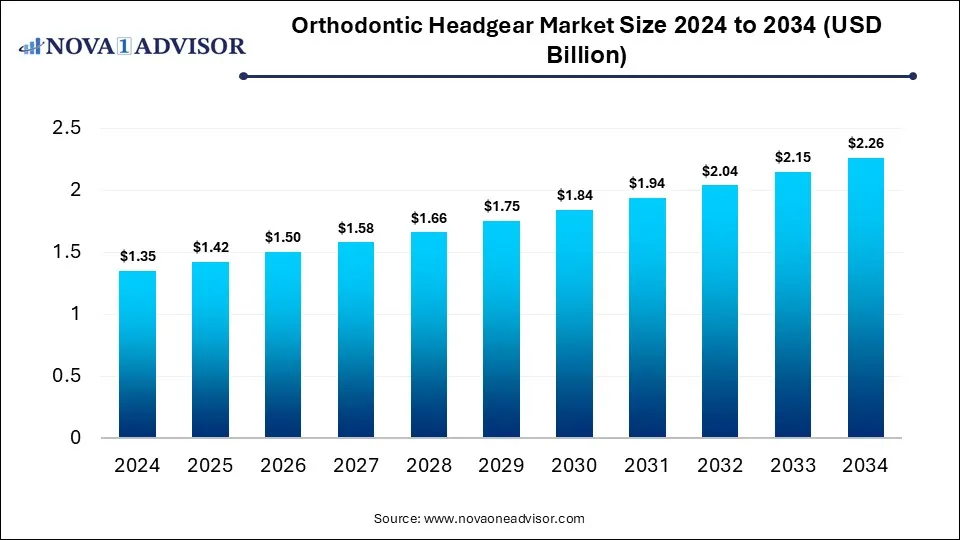

The global orthodontic headgear market size was estimated at USD 1.35 billion in 2024 and is expected to hit USD 2.26 billion in 2034, expanding at a CAGR of 5.3% during the forecast period of 2025-2034. The market growth is driven by rising incidences of dental malocclusions, the increasing adoption of orthodontic treatments among adolescents, technological advancements in headgear design, and growing awareness of oral health and aesthetics.

Orthodontic Headgear Market Key Takeaways

- By region, North America held the largest share of the orthodontic headgear market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By type, the cervical pull headgear segment led the market in 2024.

- By type, the high-pull headgear segment is expected to expand at the highest CAGR over the projected timeframe.

- By application, the Class II malocclusion correction segment led the market in 2024.

- By application, the Class III malocclusion correction segment is expected to expand at the highest CAGR over the projection period.

- By end user, the dental clinics segment led the market in 2024.

- By age group, the children segment led the market in 2024.

Impact of AI on the Orthodontic Headgear Market

AI is transforming the orthodontic headgear market by shifting focus toward more personalized and data-driven treatments. For example, AI algorithms analyze 3D scans and patient history to simulate tooth movement, potentially reducing reliance on bulky appliances like traditional headgear. It improves diagnostic accuracy and treatment planning, which means headgear may be used more selectively and alongside other methods tailored to each patient. Additionally, AI enables remote monitoring and workflow optimization, helping practices increase efficiency and possibly lower the costs of orthodontic appliances and procedures. However, while AI offers many advantages, it is still in early adoption and presents challenges such as data privacy, integration costs, and the need for clinician oversight, which will influence how quickly the headgear market develops.

- In September 2025, female-founded UK healthtech 32Co announced the launch of two proprietary AI tools, 32Coach and AI-Powered Proposals, to help high street dental practices deliver specialist orthodontic care more efficiently. Built in-house and trained on 32Co’s proprietary dataset, these tools tackle the growing gap between rising patient demand and limited specialist availability. 32Coach, the world’s first orthodontic AI education tool and always-on clinical coach, draws from thousands of orthodontist-reviewed cases and expert protocols to provide instant, expert-backed guidance, cutting admin time and expanding access to specialist knowledge in local practices.

Market Overview

The market growth is driven by the increasing prevalence of dental disorders, rising awareness of orthodontic care, and advancements in customizable, comfortable designs. Additionally, the integration of digital orthodontics and 3D printing technologies is further fueling innovation and adoption in this market. The orthodontic headgear market refers to the industry focused on devices used to correct dental and skeletal irregularities by applying external force to guide jaw and tooth alignment. These devices are primarily used in orthodontic treatments for children and adolescents to correct overbites, underbites, and other malocclusions. The key benefits of orthodontic headgear include enhanced facial symmetry, improved bite function, and prevention of more invasive procedures later in life.

What are the Major Trends in the Orthodontic Headgear Market?

- Technological Advancements in Orthodontic Devices

Manufacturers are integrating lightweight materials, smart sensors, and digital tracking technologies to improve comfort and treatment precision. These innovations enhance patient compliance and treatment efficiency.

- Growing Adoption of Customized and 3D-Printed Headgear

3D printing allows orthodontists to design patient-specific headgear for a better fit and effectiveness. Customization reduces discomfort and improves treatment outcomes, driving higher adoption rates.

- Rising Focus on Aesthetic and Comfortable Designs

Patients are increasingly seeking orthodontic solutions that are less visible and more comfortable. This trend is leading to the development of discreet and ergonomically designed headgear products.

- Increasing Use of AI and Digital Orthodontics

AI-driven diagnostic tools and simulation software are helping orthodontists plan and monitor headgear treatments more accurately. These technologies improve decision-making and shorten treatment timelines.

- Expanding Orthodontic Awareness and Pediatric Dental Care Programs

Public health initiatives and educational campaigns are increasing awareness of early orthodontic treatment benefits. As a result, the demand for headgear in pediatric and adolescent orthodontics continues to rise globally.

Report Scope of Orthodontic Headgear Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.42 Billion |

| Market Size by 2034 |

USD 2.26 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Application, By End User, By Age Group, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Prevalence of Malocclusion and Dental Disorders

The rising prevalence of malocclusion and dental issues is a key driver of growth in the orthodontic headgear market. Rising cases of misaligned teeth, overbites, and jaw discrepancies, especially among children and adolescents, are boosting the demand for corrective orthodontic treatments. Headgear devices are essential for guiding facial bone development and aligning the jaws, particularly in growing patients for whom non-surgical options are preferred. Additionally, greater awareness of oral health and early detection of orthodontic problems through school dental programs and routine screenings further accelerates market adoption.

- Malocclusion, one of the most common oral health issues after dental caries and periodontal disease, affects both function and appearance, often causing psychological and social challenges. In a study of 396 students from special needs schools in Ethiopia (mean age 16.55 years), the overall prevalence of malocclusion was 42.9%. It was highest among physically disabled (56.0%) and intellectually disabled students (51.7%). Regression analysis identified intellectual disability (AOR = 3.0), visual impairment (AOR = 1.9), and medical comorbidities (AOR = 2.5) as independent predictors of malocclusion.

Growing Awareness of Preventive Dental Care

The growing awareness of preventive dental care is significantly driving the growth of the orthodontic headgear market. Increasing public understanding of the importance of early orthodontic intervention to prevent severe dental misalignments has led to higher adoption of corrective devices among children and adolescents. Dental professionals and healthcare campaigns emphasize preventive care to avoid costly and invasive treatments later in life, encouraging the timely use of headgear to correct jaw and bite issues. Additionally, the rise in regular dental check-ups and school-based oral health programs has improved early detection of malocclusion, leading to more proactive treatment.

Restraint

Discomfort and Aesthetic Concerns

Traditional headgear devices cause physical discomfort, including pressure on the jaw, teeth, and neck, leading many patients, especially children and teenagers, to avoid or discontinue use. Additionally, the bulky, visible design of headgear leads to self-consciousness and social embarrassment, particularly in public or school settings. These aesthetic drawbacks often prompt patients and orthodontists to choose less noticeable alternatives, such as clear aligners or intraoral appliances, which hampers market growth.

Opportunities

Development of Aesthetic and User-Friendly Headgear

The development of aesthetic and user-friendly orthodontic headgear presents significant opportunities for market growth. Manufacturers are focusing on designing headgear that is lighter, more comfortable, and visually appealing to improve patient compliance and satisfaction. Advances in materials science and ergonomic design are enabling the creation of low-profile, customizable devices that blend functionality with aesthetics. These innovations not only address traditional concerns about discomfort and appearance but also attract a wider patient base, particularly image-conscious adolescents and adults.

Growing Disposable Income

There are immersive opportunities, as consumers gain greater financial stability, they are more willing to invest in advanced dental treatments and orthodontic solutions to improve both oral health and aesthetics. Higher income levels also lead to greater access to private dental care and premium orthodontic products that offer enhanced comfort and design. Additionally, parents are increasingly prioritizing orthodontic treatments for their children, further driving demand. This rising purchasing power is expected to boost market growth by expanding the adoption of both traditional and modern orthodontic headgear systems globally.

How Macroeconomic Variables Influence the Orthodontic Headgear Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. increasing consumer spending on dental and orthodontic treatments. As economies strengthen, individuals have higher disposable incomes, allowing greater access to advanced orthodontic care and aesthetic correction options. Moreover, strong GDP performance encourages healthcare infrastructure investments, supporting wider availability of orthodontic services and boosting overall market demand.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the orthodontic headgear market by increasing the overall cost of materials, manufacturing, and dental treatments. Rising prices make orthodontic care less affordable for patients, particularly in cost-sensitive regions, thereby reducing treatment adoption rates. Additionally, inflation can limit investment by dental clinics in advanced orthodontic technologies, further slowing market expansion.

Exchange Rates

Exchange rate fluctuations can negatively affect, increasing import and export costs for manufacturers and distributors. When local currencies weaken against major trading currencies, the cost of importing orthodontic materials, equipment, and finished products rises, reducing profit margins. Conversely, currency instability can discourage international investment and disrupt global supply chains, leading to price volatility and slower market growth.

Orthodontic Headgear Market By Segment Outlook

By Type Insights

Why Did the Cervical Pull Headgear Segment Dominate the Orthodontic Headgear Market in 2024?

The cervical pull headgear segment dominated the market with the largest share in 2024. This is because of its widespread clinical use in correcting Class II malocclusions, one of the most common orthodontic issues. This type of headgear is highly effective in restraining the forward growth of the upper jaw and aligning teeth, making it a preferred choice among orthodontists for growing children and adolescents. Its cost-effectiveness, ease of use, and proven treatment outcomes have further strengthened its market position.

The high-pull headgear segment is expected to grow at the fastest CAGR during the projection period, owing to the increasing application in treating vertical maxillary excess and open bite conditions, which are becoming more prevalent among adolescents. This type of headgear provides both backward and upward force, allowing precise control over jaw and tooth movement, making it ideal for complex orthodontic cases. The rising demand for customized and minimally invasive orthodontic treatments is also driving their adoption.

Orthodontic Headgear Market By Type, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Cervical Pull Headgear |

0.5 |

0.6 |

0.6 |

0.6 |

0.7 |

0.7 |

0.8 |

0.8 |

0.8 |

0.9 |

1.0 |

| High-Pull Headgear |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.5 |

0.5 |

0.5 |

0.5 |

| Reverse-Pull (Facemask) Headgear |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

| Combination Pull Headgear |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

| Others (Hybrid and Functional Headgears) |

0.1 |

0.1 |

0.1 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

0.2 |

By Application Insights

Why Did the Class II Malocclusion Correction Segment Lead the Market in 2024?

The Class II malocclusion correction segment led the Orthodontic Headgear market in 2024 due to their high global prevalence of Class II malocclusions, particularly among children and adolescents. Orthodontic headgears are widely used as an effective non-surgical solution to correct jaw discrepancies by guiding proper maxillary and mandibular alignment. Increasing awareness about early orthodontic intervention and the growing demand for aesthetic dental correction are further driving the segment’s dominance. Additionally, continuous innovations in adjustable and comfortable headgear designs have improved patient compliance and treatment outcomes, reinforcing this segment’s leading position in the market.

The Class III malocclusion correction segment is expected to expand at the highest CAGR in the coming years. This is mainly due to rising incidence of underbite conditions and increasing awareness about early orthopedic intervention. Advances in reverse-pull and protraction headgear technologies are enabling more effective and comfortable correction of skeletal discrepancies in growing patients. Moreover, parents and orthodontists are showing greater preference for non-surgical treatment alternatives to avoid complex jaw surgeries. The growing adoption of customized and digitally designed headgear systems is further supporting faster and more precise Class III correction, driving this segment’s rapid growth.

Orthodontic Headgear Market By Application, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Class II Malocclusion Correction |

0.47 |

0.50 |

0.53 |

0.56 |

0.59 |

0.62 |

0.66 |

0.69 |

0.73 |

0.77 |

0.81 |

| Class III Malocclusion Correction |

0.34 |

0.35 |

0.37 |

0.39 |

0.41 |

0.43 |

0.45 |

0.47 |

0.49 |

0.52 |

0.54 |

| Bite Alignment and Growth Modification |

0.34 |

0.36 |

0.38 |

0.40 |

0.42 |

0.45 |

0.47 |

0.50 |

0.53 |

0.56 |

0.59 |

| Orthodontic Retention and Post-Treatment Support |

0.20 |

0.21 |

0.22 |

0.23 |

0.24 |

0.25 |

0.27 |

0.28 |

0.29 |

0.30 |

0.32 |

By End User Insights

Why Did the Dental Clinics Segment Lead the Market in 2024?

The dental clinics segment led the orthodontic headgear market in 2024, due to their central role in providing specialized orthodontic care and personalized treatment plans. Most orthodontic headgear fittings, adjustments, and follow-ups are performed in dental clinics, making them the primary end users of these devices. The growing number of private dental practices equipped with advanced diagnostic and imaging technologies has enhanced treatment precision and patient outcomes.

The orthodontic specialty centers segment is expected to expand at the highest CAGR in the coming years. This is primarily due to its increasing demand for advanced and customized orthodontic treatments. These centers focus exclusively on correcting complex dental and jaw alignment issues, making them ideal settings for headgear-based therapies. The adoption of modern diagnostic tools, such as 3D imaging and AI-assisted treatment planning, enhances precision and patient comfort in these facilities. Moreover, the rising preference for specialized care among patients seeking efficient and aesthetically pleasing orthodontic outcomes is fueling rapid growth in this segment.

Orthodontic Headgear Market By End User, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Dental Clinics |

0.61 |

0.64 |

0.68 |

0.71 |

0.75 |

0.80 |

0.84 |

0.89 |

0.93 |

0.99 |

1.04 |

| Hospitals |

0.41 |

0.43 |

0.45 |

0.47 |

0.49 |

0.52 |

0.54 |

0.57 |

0.60 |

0.63 |

0.66 |

| Orthodontic Specialty Centers |

0.20 |

0.21 |

0.23 |

0.24 |

0.26 |

0.27 |

0.29 |

0.30 |

0.32 |

0.34 |

0.36 |

| Academic & Research Institutes |

0.14 |

0.14 |

0.15 |

0.15 |

0.16 |

0.17 |

0.17 |

0.18 |

0.19 |

0.20 |

0.20 |

By Age Group Insights

Why Did the Children Segment Lead the Market in 2024?

The children segment led the orthodontic headgear market in 2024 due to its high prevalence of malocclusion and jaw development issues identified during early growth stages. Orthodontic headgear is most effective in children because their jawbones are still developing, making it easier to correct skeletal and dental misalignments. Pediatric dentists and orthodontists increasingly recommend early intervention to prevent more invasive treatments later in life, which further drives adoption. Additionally, rising awareness among parents about the benefits of early orthodontic care and the availability of more comfortable, child-friendly headgear designs strengthen this segment's dominance.

The teenagers segment is projected to grow at the highest CAGR in the coming years. This is mainly due to increasing awareness of dental aesthetics and the rising demand for orthodontic treatments during adolescence. Teenagers are at an ideal age for orthodontic intervention because their jaw and teeth alignment can still be effectively adjusted, resulting in better long-term results. Additionally, social media influence and the growing focus on appearance among teens are promoting early corrective measures for malocclusion.

Orthodontic Headgear Market By Age Group, 2024-2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Children (6–12 years) |

0.5 |

0.6 |

0.6 |

0.6 |

0.7 |

0.7 |

0.8 |

0.8 |

0.8 |

0.9 |

1.0 |

| Teenagers (13–19 years) |

0.5 |

0.5 |

0.5 |

0.5 |

0.6 |

0.6 |

0.6 |

0.7 |

0.7 |

0.7 |

0.8 |

| Adults (20+ years) |

0.3 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.4 |

0.5 |

0.5 |

0.5 |

0.5 |

By Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the orthodontic headgear market while holding the largest share in 2024. The region’s growth is primarily attributed to its advanced healthcare infrastructure, high adoption of orthodontic treatments, and strong presence of leading dental device manufacturers. The region benefits from widespread awareness of dental aesthetics, supported by high disposable income and insurance coverage for orthodontic care. The increasing prevalence of malocclusion among children and teenagers, coupled with the availability of technologically advanced and comfortable headgear designs, further drives market dominance.

U.S. Orthodontic Headgear Market Trends

The U.S. is a major contributor to the North American orthodontic headgear market, driven by a well-established dental care infrastructure and high oral health expenditure. The country has a large base of orthodontic specialists and clinics that actively adopt advanced headgear technologies for malocclusion correction. Rising awareness of dental aesthetics, supported by insurance coverage for orthodontic procedures and increasing orthodontic treatment among teenagers, further boosts market growth. Moreover, the strong presence of leading manufacturers and continuous product innovation make the U.S. the regional hub for

- In January 2024, Henry Schein Orthodontics launched the Carrier Motion Pro Bite appliance, designed to enhance orthodontic treatments by improving bite correction and tooth movement.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for orthodontic headgear. This is due to rising awareness of dental aesthetics and the increasing prevalence of malocclusion among children and teenagers. Rapid urbanization, coupled with growing disposable incomes, has led to higher spending on advanced orthodontic treatments. Expanding healthcare infrastructure and the availability of affordable orthodontic solutions in countries like China, India, and South Korea are also driving adoption.

China Orthodontic Headgear Market Trends

China is a major player in the Asia Pacific orthodontic headgear market due to its large patient population with dental irregularities and increasing awareness of orthodontic care. The country’s growing middle-class population and rising disposable incomes have significantly boosted the demand for aesthetic dental treatments. Moreover, advancements in dental technology, the expansion of private dental clinics, and the presence of both local and international orthodontic device manufacturers have strengthened China’s market position. Government initiatives to improve oral healthcare services further support this rapid market growth.

Region-Wise Market Outlook

| Region |

Approximate Market Size in 2024 |

Projected CAGR (2025-2034 / similar period) |

Key Growth Factors |

Key Restraints / Challenges |

Growth Overview |

| North America |

USD 0.6 Million |

5.66% |

High prevalence of malocclusion; strong dental care infrastructure. |

Discomfort & aesthetic concerns. |

North America is the dominant market |

| Asia-Pacific |

USD 0.4 Million |

6.5% |

Rising awareness of orthodontic care. |

Affordability issues, less reimbursement or insurance coverage. |

Fastest Growth |

| Europe |

USD 0.3 Million |

10.5% |

Good healthcare infrastructure, high awareness, and strong orthodontic speciality services. |

Cost and discomfort; strong competition from alternatives. |

Steady growth |

| Latin America |

USD 0.1 Million |

6.5% |

Increasing dental clinics, a growing urban population, and rising income. |

Lower disposable incomes, poor insurance coverage. |

Emerging Growth |

| Middle East & Africa (MEA) |

USD 0.1 Million |

0% |

Rising healthcare investment, improving clinic penetration. |

Affordability issues; fewer orthodontic specialists. |

Grow faster |

Orthodontic Headgear Market Value Chain Analysis

1. Raw Material Procurement and Component Manufacturing

This stage involves sourcing high-quality materials like stainless steel, medical-grade plastics, elastics, and composites that are essential for manufacturing orthodontic headgear components such as facebows, straps, and brackets. Manufacturers emphasize biocompatibility, durability, and safety of materials to ensure patient comfort and clinical effectiveness.

- Key Players Involved: 3M Company, TP Orthodontics Inc., and American Orthodontics.

2. Product Design and Development

In this stage, companies design and prototype new headgear systems using advanced digital tools such as CAD/CAM, 3D scanning, and AI-based customization software. The focus is on creating headgear that provides precise force control, better aesthetics, and improved patient comfort.

- Key Players Involved: Dentsply Sirona, Ormco Corporation, and Henry Schein Inc.

3. Manufacturing and Assembly

This stage includes large-scale production of orthodontic headgear systems under stringent quality and safety standards, including ISO 13485 and FDA regulations. Manufacturers use automated production lines and precision engineering to ensure consistency in performance and fit.

- Key Players Involved: 3M Unitek, G&H Orthodontics, and Orthodynamic Supplies Ltd.

4. Distribution and Supply Chain Management

Once manufactured, products are distributed through both direct sales channels and third-party distributors to hospitals, dental clinics, and orthodontic specialty centers. Efficient logistics and global distribution networks ensure the timely availability of products worldwide.

- Key Players Involved: Henry Schein Inc., Patterson Dental Supply, and Ortho-Care (UK) Ltd.

5. End-Use Application (Dental Clinics & Orthodontic Centers)

This stage represents the practical use of orthodontic headgear in patient care. Orthodontists and dental professionals use these devices to correct malocclusion, jaw alignment, and other dental irregularities, often in children and teenagers.

- Key Players Involved: Private Dental Clinics, Orthodontic Specialty Centers, and academic institutions

Orthodontic Headgear Market Companies

- 3M Company (3M Oral Care)

3M is a global leader in orthodontic solutions, offering a wide range of high-quality headgear, brackets, and dental materials designed for precision and patient comfort. The company’s continuous innovation in advanced materials and digital orthodontics strengthens its dominance in the global market.

Dentsply Sirona contributes significantly through its cutting-edge orthodontic equipment and integrated digital solutions that improve treatment outcomes. Its focus on combining AI-driven diagnostics and patient-specific devices enhances the precision and efficiency of orthodontic care.

Ormco specializes in advanced orthodontic appliances, including headgear systems, and provides customized treatment solutions to orthodontists worldwide. The company is known for its innovation in force management technologies and aesthetic product lines, making treatments more patient-friendly.

American Orthodontics is one of the largest privately held manufacturers of orthodontic products, offering durable and high-performance headgear components. Its strong focus on clinician support and global distribution ensures accessibility and reliability in orthodontic care.

Henry Schein acts as a major distributor of orthodontic products, including headgear systems, to dental clinics and hospitals globally. The company’s strong logistics network and digital sales platforms make it a vital link in the orthodontic supply chain.

TP Orthodontics is known for its extensive range of orthodontic devices and accessories that enhance treatment comfort and efficiency. The company’s continuous investment in research ensures improved material performance and adaptability to modern dental needs.

G&H Orthodontics manufactures precision-engineered orthodontic appliances and accessories, including facebows and traction systems used in headgear. The company’s commitment to quality manufacturing and customer-focused service reinforces its strong market position.

- Orthodynamic Supplies Ltd.

Orthodynamic Supplies Ltd. provides a wide selection of orthodontic headgear products designed for both performance and comfort. The company focuses on affordable yet high-quality solutions, catering to the needs of orthodontic clinics across Europe and Asia.

- Patterson Dental Supply, Inc.

Patterson Dental is a key distributor offering comprehensive orthodontic product portfolios, including headgear systems, to clinics and hospitals. Its robust digital ordering systems and strong supplier partnerships streamline product accessibility and customer service.

- Rocky Mountain Orthodontics (RMO)

RMO designs and produces innovative orthodontic systems, including high-precision headgear and force modules. The company’s focus on research-driven design and practitioner collaboration helps advance orthodontic treatment effectiveness globally.

Recent Developments

- In June 2024, LM-Dental™ launched My LM-Activator™, an enhanced version of its clinically proven early orthodontic appliance with over two decades of success. The prefabricated silicone aligner supports natural facial and jaw growth in early mixed dentition, helping prevent the progression of malocclusions and reducing the need for later treatment. Developed with clinicians, the new line features optimized dimensions and improved comfort, advancing LM-Dental’s commitment to high-quality orthodontic care for growing patients.

- In January 2024, LightForce updated its product line, which includes better digital treatment planning features like CBCT integration into its LightPlan software, as well as enhancements in packaging and bracket components to improve clinical and patient satisfaction.

Exclusive Analysis on the Orthodontic Headgear Market

The global orthodontic headgear market is poised for a sustained growth trajectory, underpinned by the convergence of demographic expansion, aesthetic awareness, and the proliferation of advanced orthodontic modalities. While historically perceived as a mature segment, the market is entering a transformative phase driven by technological refinement, digital integration, and emerging economies’ healthcare modernization.

From an analytical standpoint, the sector’s evolution is characterized by the integration of smart sensor technologies, AI-driven diagnostic interfaces, and custom-fabricated appliances via 3D printing, collectively redefining patient compliance and clinical precision. The migration from conventional metallic frameworks to lightweight, biocompatible, and ergonomically optimized materials further amplifies adoption rates, particularly among adolescent and young adult cohorts.

Emerging markets in Asia-Pacific and Latin America exhibit robust demand elasticity, catalyzed by a rapidly expanding middle class and heightened investment in dental infrastructure. Meanwhile, strategic alliances between device manufacturers, digital dentistry startups, and academic institutions are fostering innovation pipelines and expanding product differentiation opportunities.

Overall, the orthodontic headgear market presents a nuanced yet lucrative investment landscape, with mid-term opportunities concentrated around product personalization, smart compliance monitoring, and minimally invasive orthodontic adjuncts. For stakeholders with technological foresight and operational agility, the market’s upward momentum signals a compelling frontier for sustainable value creation.

Segments Covered in the Report

By Type

- Cervical Pull Headgear

- High-Pull Headgear

- Reverse-Pull (Facemask) Headgear

- Combination Pull Headgear

- Others (Hybrid and Functional Headgears)

By Application

- Class II Malocclusion Correction

- Class III Malocclusion Correction

- Bite Alignment and Growth Modification

- Orthodontic Retention and Post-Treatment Support

By End User

- Dental Clinics

- Hospitals

- Orthodontic Specialty Centers

- Academic & Research Institutes

By Age Group

- Children (6–12 years)

- Teenagers (13–19 years)

- Adults (20+ years)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa