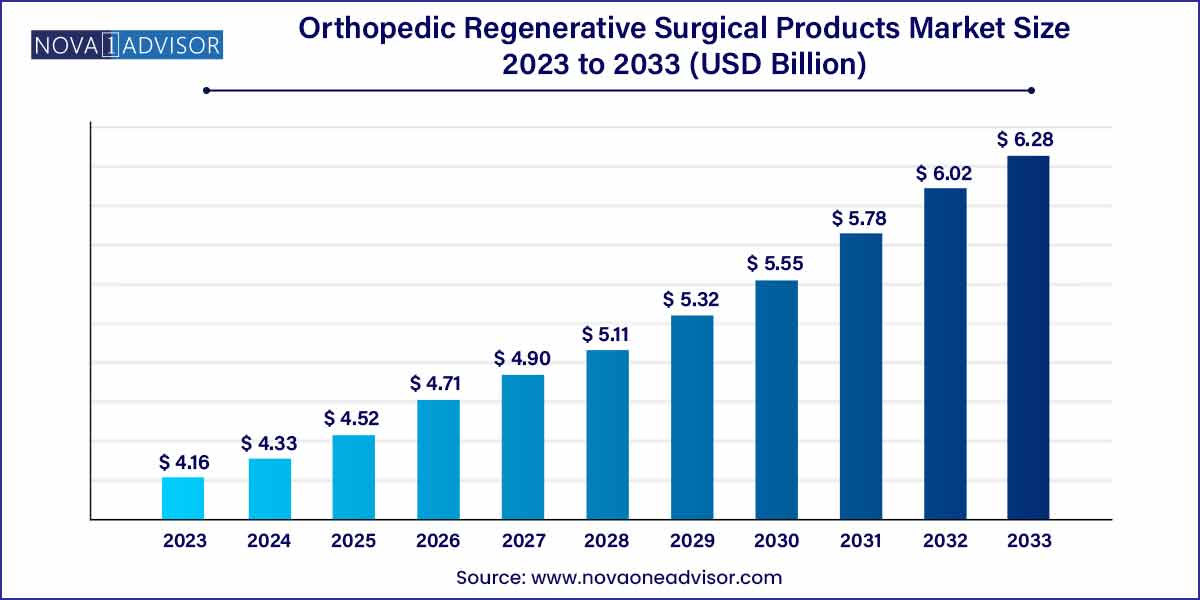

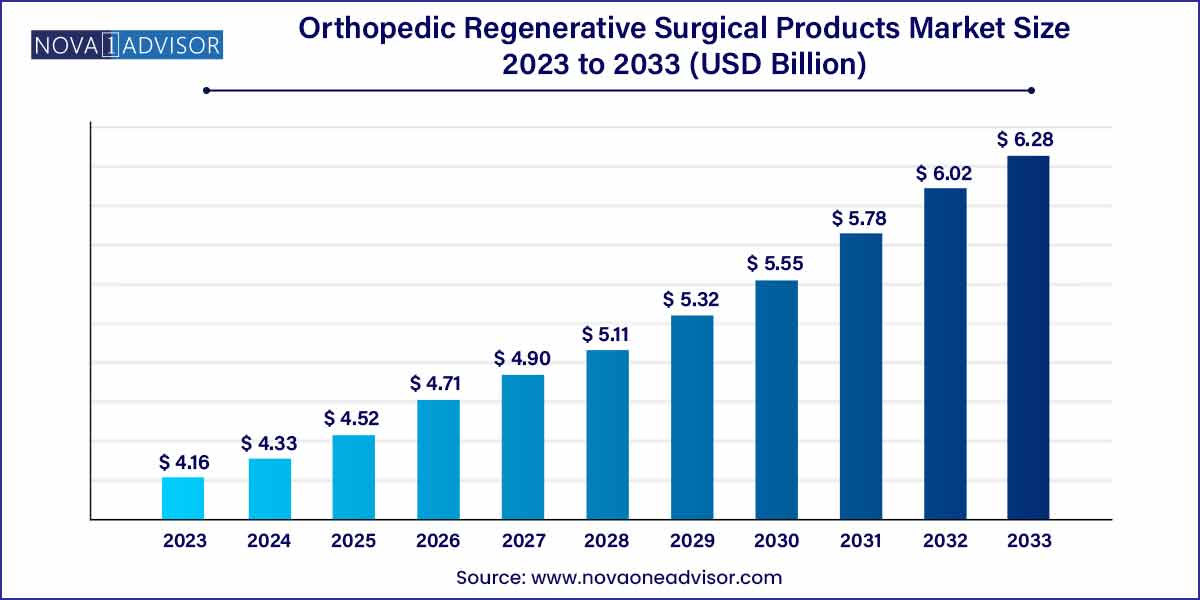

The global orthopedic regenerative surgical products market size was exhibited at USD 4.16 billion in 2023 and is projected to hit around USD 6.28 billion by 2033, growing at a CAGR of 4.2% during the forecast period of 2024 to 2033.

Key Takeaways:

- The viscosupplements segment dominated the market and held the largest revenue share of 42.59% in 2023.

- The joint reconstruction segment dominated the market and held the largest revenue share of 35.66% in 2023.

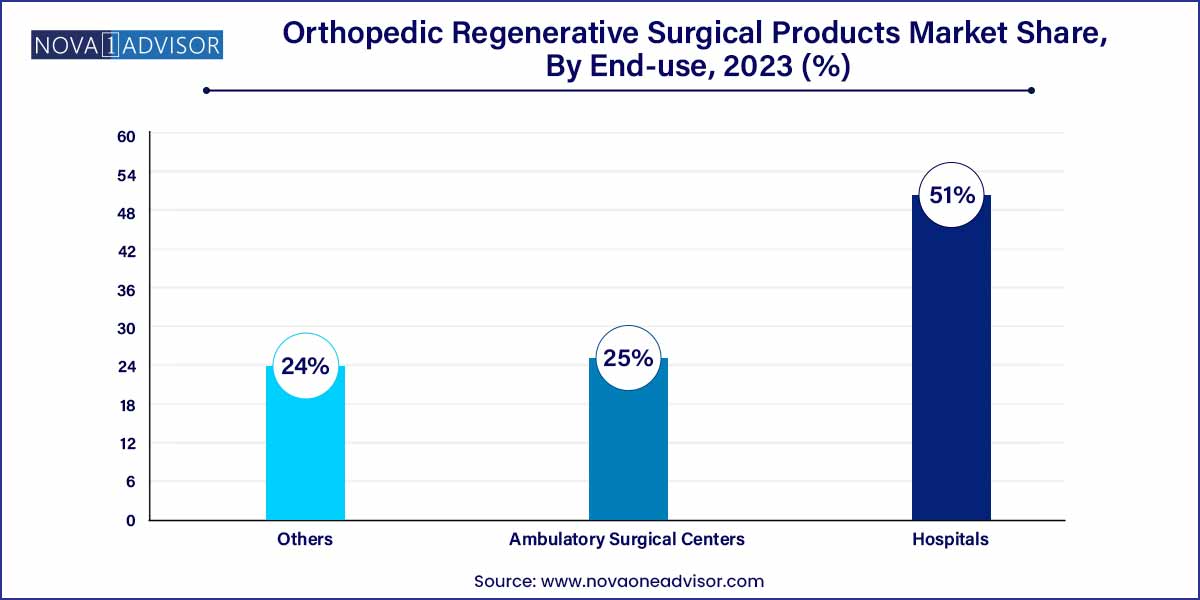

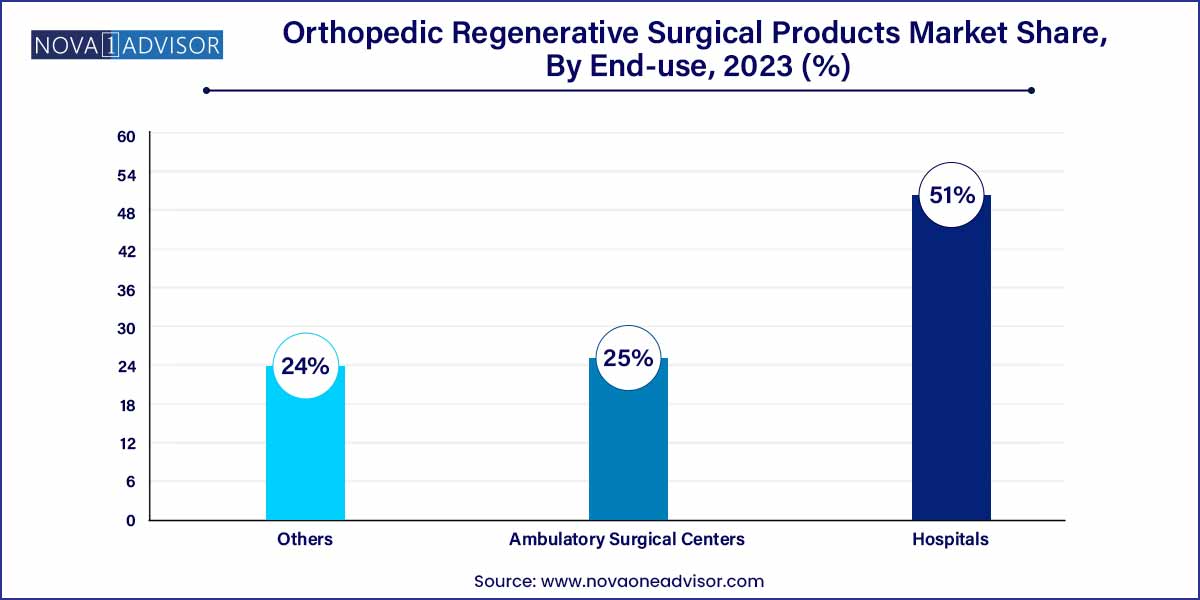

- The hospital segment held the largest revenue share of 51.0% in 2023.

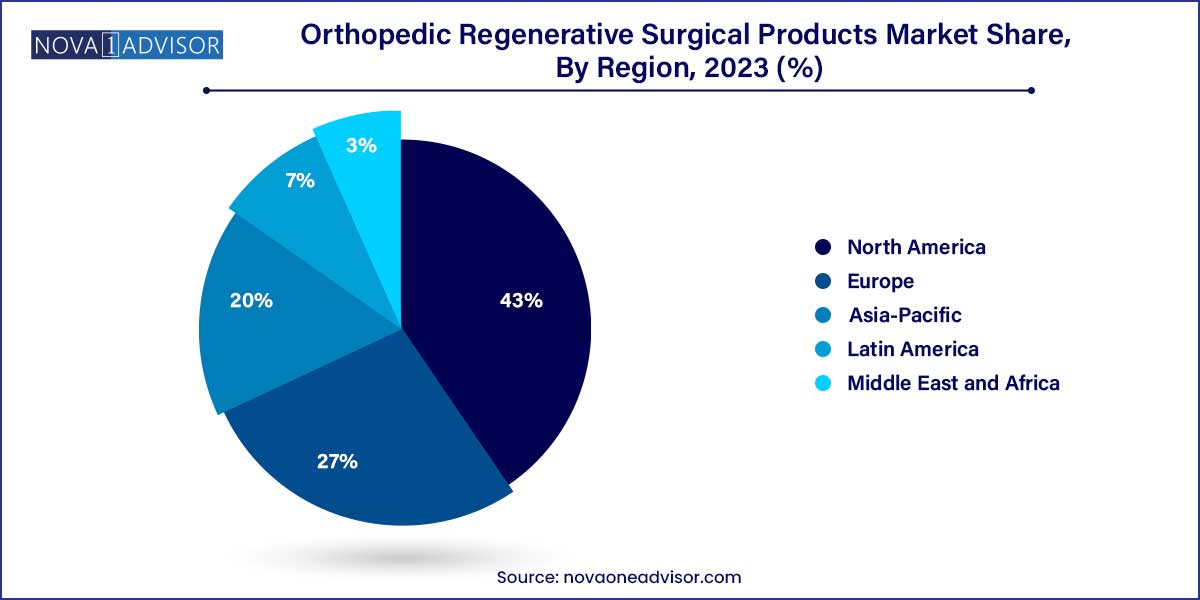

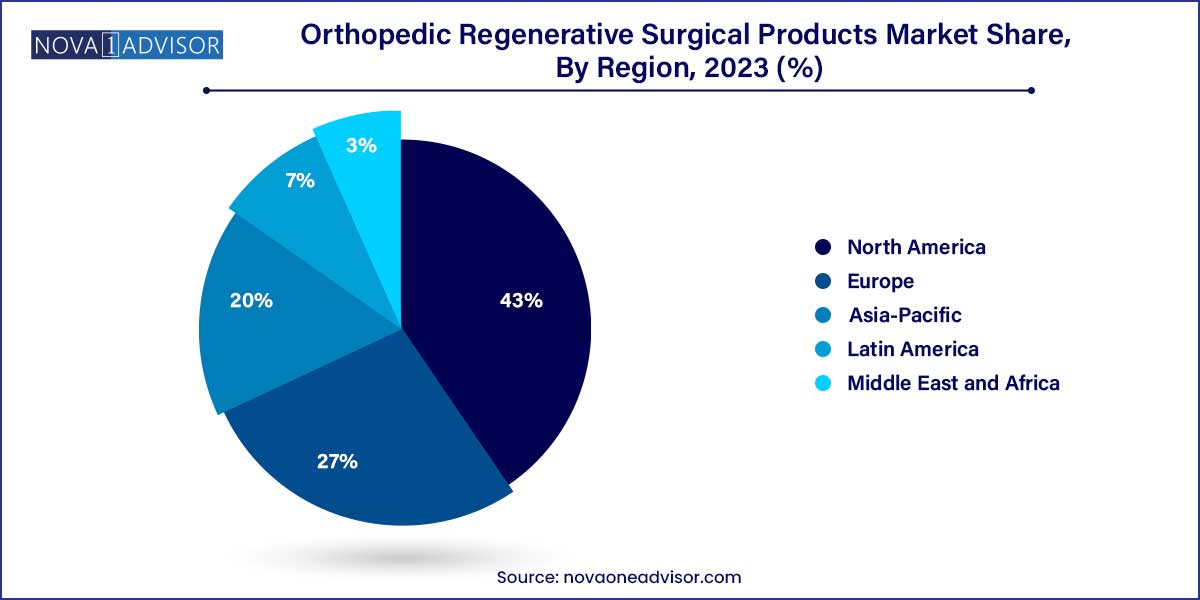

- North America held the largest revenue share of 41.39% in 2023.

Orthopedic Regenerative Surgical Products Market by Overview

The Orthopedic Regenerative Surgical Products market is experiencing dynamic growth, spurred by the increasing demand for innovative, biologically-driven solutions to musculoskeletal disorders and injuries. Orthopedic regenerative surgical products, including allografts, cell-based therapies, synthetic implants, and viscosupplements, are transforming how conditions such as osteoarthritis, cartilage defects, ligament injuries, and bone fractures are treated. These products aim to not only repair but also regenerate damaged tissues, providing superior clinical outcomes compared to traditional surgical interventions.

The market is being fueled by an aging global population, increasing incidence of orthopedic conditions, rising demand for minimally invasive procedures, and advancements in regenerative medicine technologies. The COVID-19 pandemic temporarily disrupted elective orthopedic surgeries; however, it also emphasized the need for faster recovery and less invasive treatment options, further validating the regenerative approach.

With emerging innovations in stem cell therapies, biomaterials, and tissue engineering, the orthopedic regenerative surgical products market is poised to play a pivotal role in shaping the future of orthopedics, offering both clinical and economic benefits by enhancing healing processes and reducing long-term healthcare costs.

Major Trends in the Market

-

Growing Adoption of Biologics in Orthopedic Surgeries: Surgeons are increasingly incorporating allografts, amniotic products, and stem-cell-based therapies.

-

Advancements in Synthetic Implants: New biomaterials and 3D printing are improving implant integration and biocompatibility.

-

Rising Popularity of Viscosupplements for Osteoarthritis: Demand for hyaluronic acid injections is surging due to their effectiveness in pain management.

-

Shift Toward Minimally Invasive Orthopedic Procedures: Regenerative products are being utilized to facilitate faster recovery with less trauma.

-

Expansion of Ambulatory Surgical Centers (ASCs): Outpatient settings are increasingly adopting regenerative orthopedic solutions.

-

Increase in Sports-related Injuries: Growing sports participation globally is driving the need for effective cartilage and tendon repair therapies.

-

Regulatory Support for Regenerative Therapies: Agencies like the FDA are accelerating pathways for orthopedic regenerative products.

-

Strategic Collaborations and Mergers: Partnerships between biotech firms, hospitals, and orthopedic device manufacturers are fueling innovation.

Orthopedic Regenerative Surgical Products Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.16 Billion |

| Market Size by 2033 |

USD 6.28 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Product, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Vericel Corporation; Anika Therapeutics, Inc.; Zimmer Biomet; Baxter; Stryker; AlloSource; Smith+Nephew; Amniox Medical, Inc.; Aptissen S.A; VSY Biotechnology; MiMedx. |

Market Dynamics

- Technological Advancements and Innovation:

The Orthopedic Regenerative Surgical Products market is dynamically influenced by continual technological advancements and innovations in the field of regenerative medicine. Ongoing research and development efforts are focused on enhancing the efficacy and efficiency of surgical products, introducing novel materials, and refining delivery methods. Innovations such as 3D-printed implants, bioactive scaffolds, and growth factor therapies have significantly expanded the scope of regenerative surgical solutions. As companies invest in cutting-edge technologies, the market experiences a positive shift with the introduction of more sophisticated and patient-centric orthopedic regenerative products. This dynamic landscape not only fosters competition but also elevates the overall standard of care within the industry.

- Increasing Emphasis on Minimally Invasive Procedures:

The Orthopedic Regenerative Surgical Products market is witnessing a notable shift towards minimally invasive procedures, driven by the desire to reduce patient trauma, enhance recovery times, and improve overall surgical outcomes. Minimally invasive techniques, such as arthroscopy and laparoscopy, are gaining prominence for orthopedic regenerative interventions. Patients and healthcare providers alike are recognizing the benefits of these procedures, including smaller incisions, reduced postoperative pain, and faster rehabilitation. This growing preference for minimally invasive approaches is reshaping the market dynamics, influencing product development strategies, and prompting manufacturers to create regenerative surgical products that align with the evolving trend toward less invasive orthopedic treatments.

Market Restraint

- High Costs of Orthopedic Regenerative Surgical Products:

A significant restraint in the Orthopedic Regenerative Surgical Products market is the high cost associated with these innovative therapeutic solutions. The development and production of regenerative products involve sophisticated technologies, specialized materials, and rigorous quality control processes, leading to elevated manufacturing expenses. Additionally, the intricate nature of regenerative medicine research and the need for clinical trials contribute to the overall high cost of bringing these products to market. As a result, patients may face financial barriers in accessing these advanced treatments, limiting the widespread adoption of orthopedic regenerative surgical products. Healthcare providers and policymakers grapple with the challenge of balancing the potential benefits of these innovative solutions with the economic considerations and affordability for patients and healthcare systems.

- Regulatory Challenges and Stringent Approval Processes:

Regulatory challenges and stringent approval processes pose a substantial restraint to the Orthopedic Regenerative Surgical Products market. Given the innovative and evolving nature of regenerative medicine, navigating regulatory frameworks can be complex and time-consuming for manufacturers. Meeting the rigorous standards set by health authorities requires extensive clinical evidence, long-term follow-up data, and comprehensive safety profiles. Delays in regulatory approvals can impede the timely market entry of new products, hindering the ability of companies to respond swiftly to emerging healthcare needs. This constraint not only affects the speed of product commercialization but also adds to the overall development costs, influencing the competitive landscape of the orthopedic regenerative surgical products market.

Market Opportunity

- Rising Preference for Outpatient Procedures:

An opportune trend in the Orthopedic Regenerative Surgical Products market is the increasing preference for outpatient procedures. As advancements in regenerative surgical products enable minimally invasive interventions with reduced recovery times, there is a growing shift towards outpatient settings for orthopedic treatments. Outpatient procedures offer cost efficiencies, decreased hospitalization rates, and enhanced patient convenience. This presents a significant opportunity for manufacturers of regenerative surgical products to tailor their offerings to meet the requirements of outpatient settings, thereby expanding their market reach. Streamlining products for outpatient use aligns with the broader healthcare trend towards ambulatory care, unlocking new avenues for growth and market penetration.

- Expanding Applications in Sports Medicine:

The Orthopedic Regenerative Surgical Products market holds promising opportunities with the expanding applications of regenerative solutions in sports medicine. Athletes and active individuals, seeking rapid recovery and optimal performance, increasingly turn to regenerative interventions for the treatment of sports-related injuries. As regenerative products demonstrate efficacy in tissue repair and regeneration, there is a growing demand for these solutions in sports medicine, ranging from ligament and tendon injuries to cartilage repair. Companies specializing in orthopedic regenerative surgical products can capitalize on this trend by developing targeted solutions for sports-related conditions, tapping into a lucrative and expanding market segment. This strategic focus on sports medicine applications positions manufacturers to address a broader spectrum of patient needs and market opportunities.

Market Challenges

- Limited Reimbursement Policies:

A significant challenge in the Orthopedic Regenerative Surgical Products market is the limited availability and variability of reimbursement policies. The innovative nature of regenerative surgical products often leads to uncertainty and inconsistency in reimbursement structures, making it challenging for healthcare providers to recover the costs associated with these advanced treatments. The absence of clear reimbursement pathways may deter healthcare facilities from adopting regenerative surgical products, hindering market growth. Addressing this challenge requires collaboration between industry stakeholders and healthcare policymakers to establish transparent and standardized reimbursement frameworks that incentivize the adoption of orthopedic regenerative solutions.

- Long Development Timelines and Uncertain ROI:

Orthopedic Regenerative Surgical Products face challenges associated with long development timelines and uncertain return on investment (ROI). The intricate research and development processes, coupled with rigorous clinical testing requirements, extend the time it takes to bring these products to market. The prolonged timelines contribute to increased development costs and uncertainties surrounding market acceptance. Additionally, predicting the commercial success of regenerative products can be challenging, given the evolving nature of healthcare trends and competitive landscapes. Companies investing in research and development of orthopedic regenerative surgical products must navigate these uncertainties, making strategic decisions to balance innovation with market demand while managing the financial implications of extended development cycles.

Segments Insights:

Product Insights

Allografts dominated the orthopedic regenerative surgical products market in 2023, accounting for the largest share. Allografts, including bone, tendon, and amniotic membrane grafts, have become the gold standard in orthopedic regenerative surgeries due to their biological compatibility and effectiveness in promoting healing without the need for donor site morbidity. Amniotic products, in particular, are gaining popularity for their anti-inflammatory and regenerative properties, especially in tendon and cartilage repair.

Conversely, cell-based products are anticipated to experience the fastest growth during the forecast period. The increasing focus on stem cell therapies and advancements in cell isolation, expansion, and delivery methods are driving interest in autologous and allogeneic cell therapies. Companies such as Vericel Corporation and Osiris Therapeutics are leading innovation in this space, offering products that enhance tissue regeneration and functional recovery with minimal invasiveness.

Application Insights

Orthopedic pain management was the leading application segment in 2023. The rising burden of osteoarthritis and degenerative joint diseases, coupled with patient preference for non-surgical or minimally invasive pain management options, is boosting the adoption of viscosupplements and biologic injections. These therapies provide symptomatic relief and may delay the need for total joint replacement surgeries.

Meanwhile, cartilage and tendon repair applications are projected to grow at the fastest pace. Sports injuries, occupational injuries, and aging-related degeneration are driving demand for effective regenerative therapies to restore function and mobility. Products such as matrix-induced autologous chondrocyte implantation (MACI) and amniotic membrane-derived scaffolds are revolutionizing treatment paradigms for cartilage lesions and tendon tears.

End-use Insights

Hospitals captured the largest share of the market in 2023. Large hospitals and specialized orthopedic centers possess the resources, infrastructure, and multidisciplinary teams necessary to offer complex regenerative procedures. Institutional investment in cutting-edge technologies and clinical research partnerships also support the dominance of this segment.

Ambulatory Surgical Centers (ASCs) are poised to witness the fastest growth. ASCs are increasingly adopting regenerative orthopedic solutions to cater to patient demand for outpatient, minimally invasive procedures with quicker recovery times. The cost-effectiveness and efficiency of ASCs make them an attractive option for both patients and healthcare providers seeking high-quality regenerative orthopedic care.

Regional Insights

North America led the orthopedic regenerative surgical products market in 2024, driven by strong healthcare infrastructure, high awareness among patients and surgeons, favorable reimbursement policies for select regenerative therapies, and the presence of leading companies such as Stryker, Zimmer Biomet, and Medtronic.

The United States, in particular, is at the forefront of adopting innovative regenerative orthopedic products, supported by robust clinical research, regulatory approvals, and strategic industry-academia collaborations. Initiatives like the 21st Century Cures Act, aimed at accelerating regenerative medicine advancements, have further bolstered market growth in the region.

Asia-Pacific is projected to be the fastest-growing region over the forecast period. Factors such as an aging population, increasing prevalence of osteoarthritis and orthopedic injuries, growing medical tourism, and improving healthcare expenditure are driving demand for advanced orthopedic solutions.

Countries like China, India, Japan, and South Korea are witnessing significant investments in healthcare infrastructure and regenerative medicine research. The expanding middle-class population with rising disposable incomes is also fueling the willingness to adopt premium, regenerative orthopedic treatments.

Some of the prominent players in the Orthopedic regenerative surgical products market include:

- Anika Therapeutics, Inc.

- Vericel Corporation

- Baxter

- Zimmer Biomet

- Stryker

- Smith & Nephew

- AlloSource

- Amniox Medical, Inc.

- VSY Biotechnology

- Aptissen S.A.

- MiMedx

- Arthrex, Inc.

Recent Developments

-

March 2025: Vericel Corporation announced positive Phase 3 results for its NexoBrid® regenerative therapy targeting cartilage repair applications.

-

January 2025: Stryker launched "Biorestor™," a next-generation synthetic bone graft substitute with enhanced osteoinductive properties for trauma repair.

-

November 2024: Smith & Nephew expanded its Regeneten Bioinductive Implant line with a version designed for ACL tendon repairs.

-

September 2024: Zimmer Biomet received FDA clearance for "ZB-Flex™," a flexible, cell-based scaffold designed for cartilage defect treatments.

-

August 2024: Anika Therapeutics completed the acquisition of Parcus Medical to strengthen its sports medicine and regenerative surgical solutions portfolio.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global orthopedic regenerative surgical products market.

Product

- Synthetic

- Cell-based

- Viscosupplements

Application

- Orthopedic Pain Management

- Trauma Repair

- Cartilage & Tendon Repair

- Joint Reconstruction

- Others

End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)