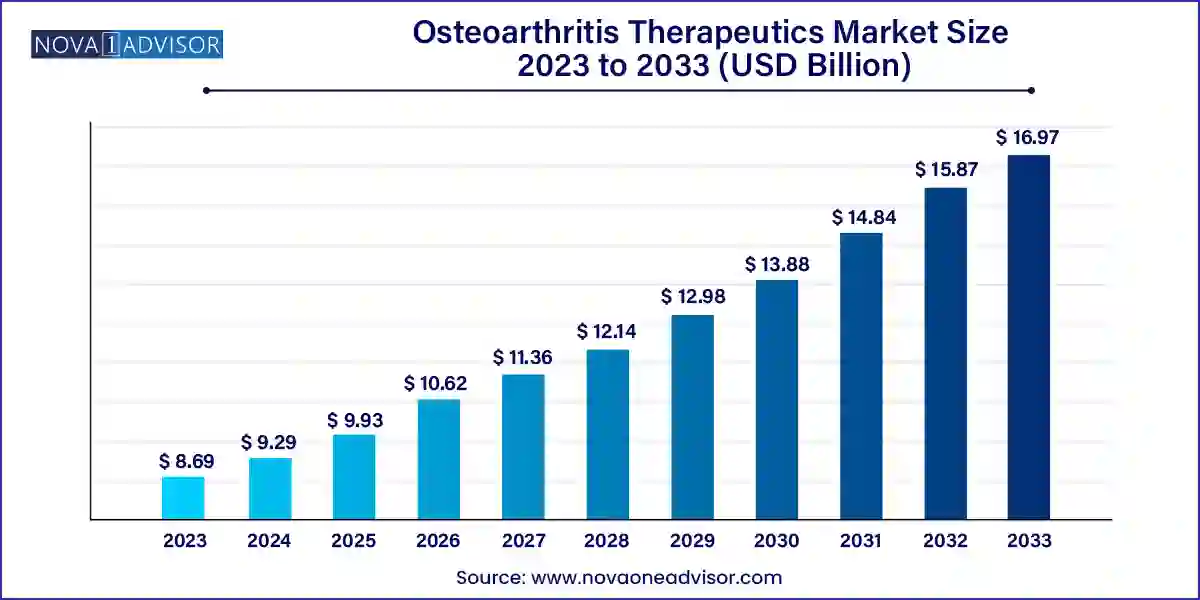

The global osteoarthritis therapeutics market size was exhibited at USD 8.69 billion in 2023 and is projected to hit around USD 16.97 billion by 2033, growing at a CAGR of 6.92% during the forecast period 2024 to 2033.

Key Takeaways:

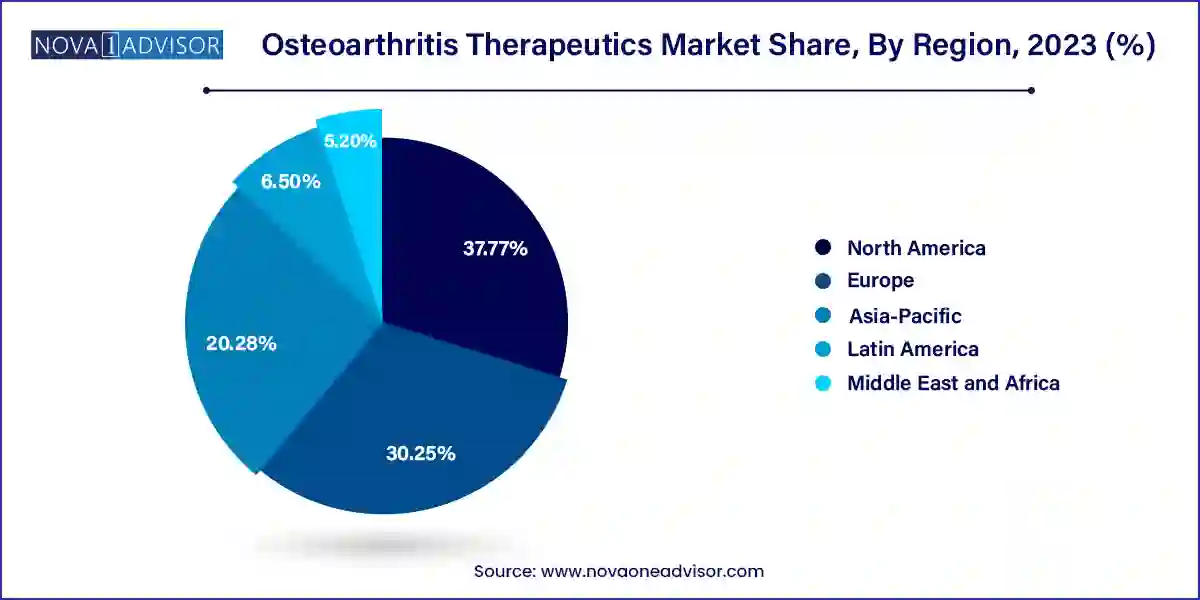

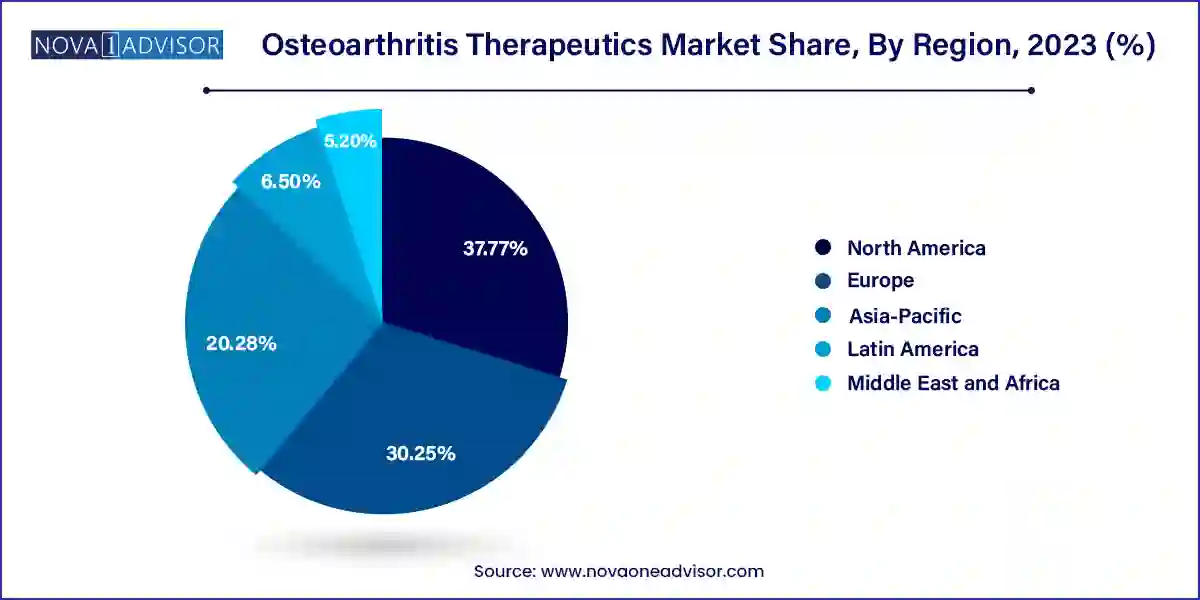

- North America osteoarthritis therapeutics market dominated the market with the revenue share of 37.77% in 2023.

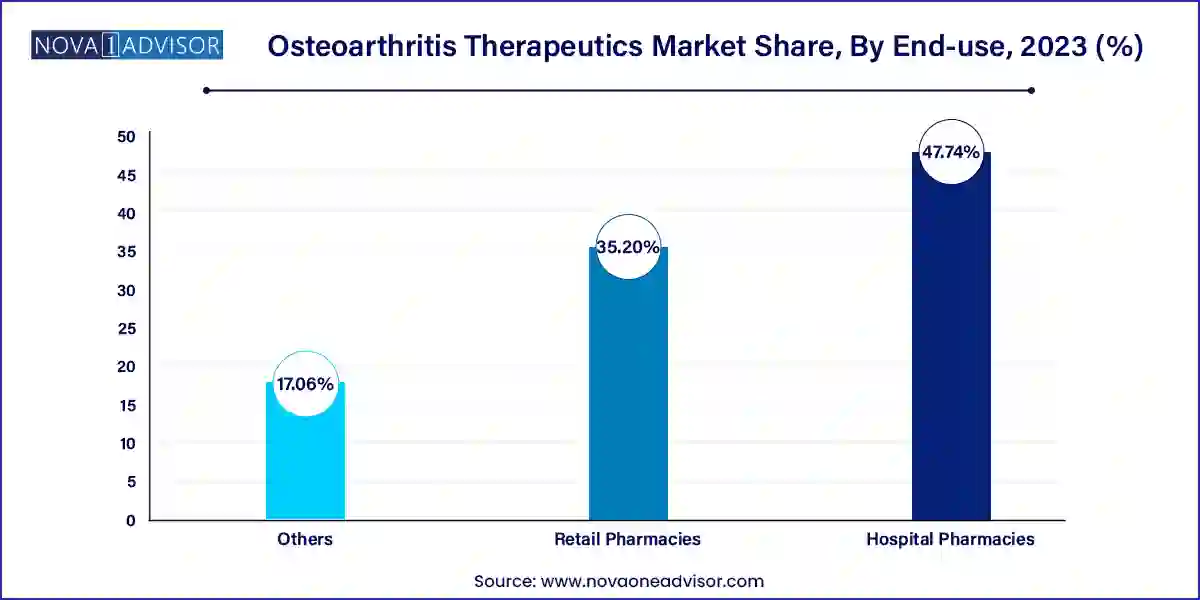

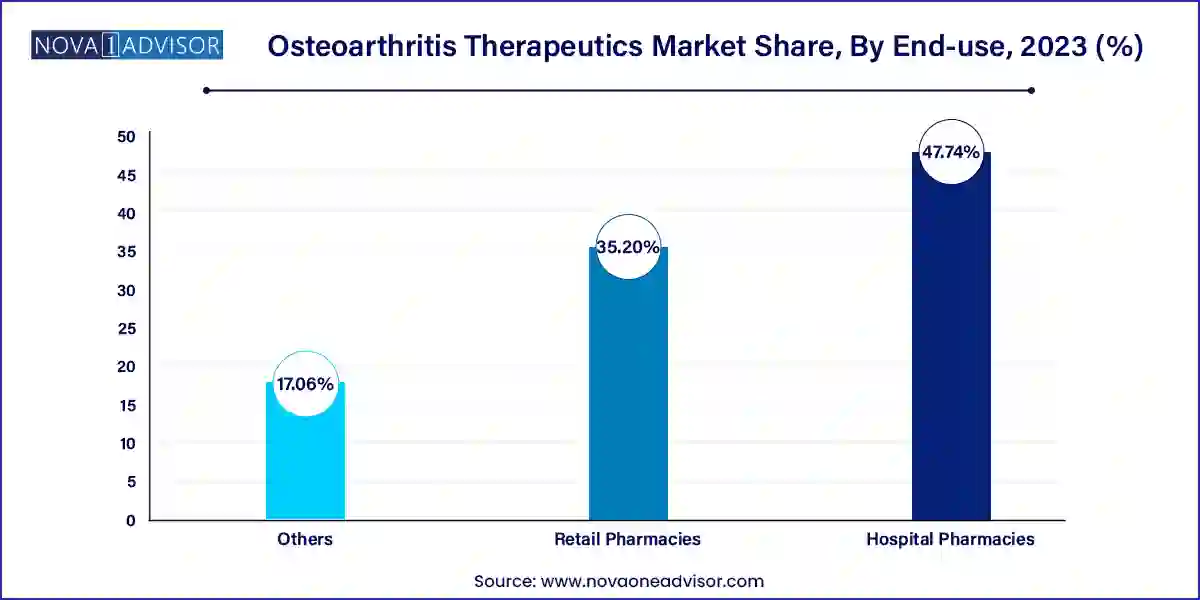

- Based on end-use, the hospital pharmacies segment held the market in 2023 with a largest revenue share of 47.74%.

- Based on drug type, the viscosupplementation agents segment led the market with the largest revenue share of 36.63% in 2023.

- Based on anatomy, the knee osteoarthritis (KOA) segment held a market with the largest revenue share of 41.96% in 2023.

- Based on route of administration, the parenteral route segment held the market with the largest revenue share of 39.94% in 2023 and is expected to grow at a CAGR of 7.50% over the forecast period.

- Based on sales channel, the prescription drugs segment led the market with the largest revenue share of 47.64% in 2023.

Market Overview

The Osteoarthritis (OA) Therapeutics Market is a vital and fast-evolving domain within the musculoskeletal disease treatment landscape. Osteoarthritis, a degenerative joint disease marked by the breakdown of cartilage and underlying bone, is the most common form of arthritis affecting over 300 million people globally. It causes pain, stiffness, decreased range of motion, and significant impairment in quality of life, particularly among aging populations.

Therapeutics for osteoarthritis aim to reduce pain, improve joint function, and slow disease progression. These include a variety of pharmacologic treatments like nonsteroidal anti-inflammatory drugs (NSAIDs), analgesics, corticosteroids, and viscosupplementation agents. In recent years, biologics, gene therapies, and regenerative injections such as platelet-rich plasma (PRP) and placental tissue matrix (PTM) have entered the therapeutic arena, expanding the treatment paradigm.

The increasing prevalence of osteoarthritis, rising geriatric population, sedentary lifestyles, and obesity epidemics are key contributors to market expansion. Alongside, growing awareness, improved diagnostic infrastructure, and expanding access to healthcare in emerging economies are fueling demand for both prescription and over-the-counter (OTC) OA therapies.

Major Trends in the Market

-

Shift Toward Regenerative Therapies

Novel therapies such as PRP, stem cell injections, and PTM are being adopted for long-term joint repair and symptom management.

-

Increased Use of Topical and Oral Combinations

Topical NSAIDs and dual-therapy oral regimens are gaining popularity for reducing systemic side effects.

-

Personalized Pain Management Protocols

Tailored treatment strategies based on patient age, anatomy affected, and comorbidities are improving outcomes.

-

Innovation in Extended-release Injections

Long-acting corticosteroid or hyaluronic acid formulations are enabling fewer doses with prolonged relief.

-

Expansion of Over-the-Counter (OTC) Therapeutics

With rising self-care practices, OTC analgesics and topical treatments are experiencing substantial demand growth.

Report Scope of The Osteoarthritis Therapeutics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.29 Billion |

| Market Size by 2033 |

USD 16.97 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.92% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drug type, Anatomy, Route of Administration, Sales channel, End-use, Sales channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Sanofi SA; GlaxoSmithKline plc; Pfizer Inc; Bayer AG; Zimmer Biomet; Novartis AG; Anika Therapeutics; Assertio Therapeutics, INC.; Bioventus; Ferring Pharmaceuticals Inc. |

Market Driver: Rising Geriatric Population and OA Prevalence

One of the primary drivers of the osteoarthritis therapeutics market is the growing elderly population, which is significantly more susceptible to joint degeneration due to age-related cartilage deterioration. According to the World Health Organization, the global population aged 60 and older is expected to reach 2 billion by 2050, with osteoarthritis projected to be a leading cause of disability among this demographic.

Age-related decline in physical activity, obesity, joint stress from prior injuries, and chronic inflammation contribute to the high OA prevalence. Countries such as Japan, Germany, and Italy, with high median ages, are experiencing the greatest burden, while developing countries are seeing a rise due to changing lifestyles and increasing longevity.

This demographic shift is driving sustained demand for pain relief options, mobility-enhancing medications, and minimally invasive alternatives to surgery such as injections. As OA management shifts toward long-term maintenance, the market for both prescription and non-prescription drugs is expanding.

Market Restraint: Lack of Disease-modifying Osteoarthritis Drugs (DMOADs)

Despite the large patient pool and increasing research funding, a major market restraint is the lack of approved disease-modifying osteoarthritis drugs (DMOADs) that can halt or reverse joint degradation. Current therapies mainly offer symptomatic relief rather than addressing the underlying cause, often leading to long-term dependence on painkillers or eventual surgical intervention.

While corticosteroids and NSAIDs are effective for pain control, prolonged use can result in gastrointestinal, renal, and cardiovascular side effects. Likewise, viscosupplementation agents provide temporary relief but lack consistent clinical efficacy across large populations.

This limitation underscores the unmet medical need for therapies that provide both pain control and cartilage regeneration, which currently remains in clinical development stages. Regulatory barriers, high R&D costs, and variability in patient response also deter companies from aggressively investing in novel DMOAD pipelines.

Market Opportunity: Growth of Intra-articular Biologics and Regenerative Injections

A significant opportunity in the OA therapeutics market lies in the expanding use of intra-articular regenerative therapies such as PRP (platelet-rich plasma), stem cells, and PTM (placental tissue matrix) injections. These biologics offer localized pain relief, reduced inflammation, and potential cartilage regeneration, making them attractive alternatives to conventional corticosteroids or surgery.

Orthobiologics are gaining traction in orthopedic practices, especially for early to moderate OA patients seeking less invasive, regenerative approaches. PRP injections, derived from a patient’s own blood, are increasingly used in sports medicine, outpatient clinics, and pain management centers. Similarly, PTM injections are demonstrating promise in chondroprotection and synovial healing.

As reimbursement structures evolve and clinical trials continue to validate these therapies, the adoption of injectable biologics is expected to rise sharply, especially in the U.S., Japan, South Korea, and EU-5 countries. Companies investing in scalable, standardized delivery platforms and combination therapies will likely benefit most.

Segments:

Osteoarthritis Therapeutics Market By End-use Insights

Based on end-use, the hospital pharmacies segment held the market in 2023 with a largest revenue share of 47.74%. Data from an article published by NCBI in May 2023 highlights the significance of hospital pharmacies in osteoarthritis management, revealing a key 112.1% increase in osteoarthritis-related hospital admissions. This emphasizes hospital pharmacies’ role in effective osteoarthritis treatment monitoring and management. Moreover, direct patient access allows hospital pharmacies to promptly administer injections, which is particularly beneficial for patients requiring immediate symptom relief. In contrast, retail pharmacies’ indirect delivery process may introduce complexities and delays in injection administration, highlighting the critical role of hospital pharmacies in ensuring timely and effective osteoarthritis treatment delivery.

In addition, retail pharmacies serve as intermediaries between manufacturers and healthcare providers, purchasing osteoarthritis therapeutics in bulk and storing them until requested. While they may not handle the volume required for regular purchases, they are crucial in ensuring product availability to healthcare providers. With lower costs than hospital pharmacies, retail pharmacies prioritize accessibility & convenience for patients, offering extended hours and personalized service to enhance satisfaction & adherence. However, they may lack specialized care and monitoring capabilities, posing limitations in comprehensive osteoarthritis management. Despite this, their accessibility and personalized service make them preferred options for several patients seeking convenience in obtaining medications.

Osteoarthritis Therapeutics Market By Drug Type Insights

NSAIDs dominate the osteoarthritis therapeutics market due to their broad accessibility, immediate pain relief, and physician familiarity. Drugs like ibuprofen, diclofenac, celecoxib, and meloxicam are mainstays in both OTC and prescription formats. These medications offer anti-inflammatory effects and rapid symptom relief for mild to moderate OA cases.

They are used across oral, topical, and parenteral routes, and despite their side effects with long-term use, remain first-line therapies recommended in major guidelines like those by the American College of Rheumatology (ACR). Combination therapies and extended-release formulations are further enhancing NSAID efficacy and safety.

Viscosupplementation agents primarily hyaluronic acid (HA) injections are the fastest-growing segment due to their minimally invasive nature and cartilage-supportive properties. These are preferred for patients who are not surgical candidates or want alternatives to corticosteroids.

HA injections restore joint lubrication and may reduce inflammation without the side effects associated with systemic medications. Recent innovations include cross-linked HA, dual-action formulations, and long-acting HA microspheres, supporting their broader adoption in orthopedic and sports medicine clinics.

Osteoarthritis Therapeutics Market By Anatomy Insights

Knee osteoarthritis dominates the anatomical segmentation owing to the weight-bearing and mobility roles of the knee joint, making it most vulnerable to wear and tear. An aging population and obesity prevalence disproportionately affect the knees, leading to early degeneration.

Treatment options for knee OA range from NSAIDs and corticosteroids to HA and PRP injections, with some patients eventually requiring knee arthroplasty. The volume of knee-specific therapeutics, including topical agents and biologics, underscores the segment’s market leadership.

Fastest Growing Segment: Hip Osteoarthritis

Hip OA is the fastest-growing anatomical segment, particularly in regions with high aging populations and active lifestyles. Hip OA is associated with deep joint pain and restricted motion, often requiring early pharmacologic intervention and delayed surgical solutions.

Innovative parenteral therapies and non-opioid pain relievers are being explored to address this growth, particularly in rehabilitation medicine and outpatient pain management.

Osteoarthritis Therapeutics Market By Route of Administration Insights

Oral administration remains the most widely used route due to patient convenience, mass-market penetration, and OTC availability. Most NSAIDs and analgesics are available in oral form, making them the first-line self-management option for osteoarthritis symptoms.

Oral medications are generally prescribed for systemic relief and are suited to managing multiple joints affected by OA. Tablets, capsules, and sustained-release formats dominate this space.

Parenteral administration particularly intra-articular injections is the fastest growing route due to the increasing use of PRP, corticosteroids, HA, PTM, and emerging biologics. These offer localized, long-lasting symptom relief and are increasingly favored by patients avoiding surgery.

The development of ultrasound-guided injection procedures and outpatient delivery models is also accelerating the growth of injectable OA therapeutics.

Osteoarthritis Therapeutics Market By Sales Channel Insights

Prescription drugs dominate the sales channel due to the clinical nature of most OA therapies, especially injections, biologics, and high-dose NSAIDs. Physicians continue to play a central role in diagnosing OA and initiating therapeutic regimens.

Drugs such as celecoxib, duloxetine, and corticosteroid injections are available only via prescription, ensuring medical oversight and insurance coverage, which drives this channel.

OTC drugs are rapidly growing, particularly among younger patients and those with mild to moderate symptoms seeking cost-effective, immediate relief. Topical NSAIDs, acetaminophen, and low-dose ibuprofen are available widely without prescriptions.

Increased consumer education, e-commerce availability, and advertising campaigns are boosting OTC product consumption worldwide.

Osteoarthritis Therapeutics Market By Regional Insights

North America dominates the osteoarthritis therapeutics market, fueled by high disease burden, advanced healthcare infrastructure, and widespread use of both traditional and emerging therapies. The U.S. leads in viscosupplementation and PRP injections, supported by a growing number of orthopedic specialists and pain clinics.

Strong reimbursement models, patient awareness, and a robust pipeline of biopharmaceutical innovations position the region at the forefront of OA treatment adoption. Moreover, presence of major market players and FDA approvals of newer formulations further strengthen this position.

Asia-Pacific is the fastest-growing region, driven by rising aging population, growing obesity rates, and increased access to modern medicine. Countries like China, India, Japan, and South Korea are witnessing a surge in OA prevalence, coupled with infrastructure investments in pain management and rehabilitation clinics.

Increased government funding for elderly care, joint replacement delays, and growing awareness of intra-articular biologics are accelerating therapeutic uptake. Local manufacturers are also contributing with cost-effective generic NSAIDs and HA solutions, broadening treatment accessibility.

Recent Developments

-

March 2025 – Sanofi announced positive Phase III results for its novel oral DMOAD candidate aimed at modifying OA progression rather than symptoms.

-

February 2025 – Flexion Therapeutics launched an extended-release corticosteroid injectable for knee OA, offering 6-month efficacy from a single dose.

-

January 2025 – Bioventus Inc. partnered with a South Korean biotech firm to co-develop a PRP delivery system optimized for outpatient clinics.

-

December 2024 – Teva Pharmaceuticals released a new topical diclofenac gel in Europe, targeting first-line OA pain relief with fewer GI side effects.

Some of the prominent players in the Osteoarthritis therapeutics market include:

- Sanofi SA

- GlaxoSmithKline plc

- Pfizer Inc

- Bayer AG

- Zimmer Biomet

- Novartis AG

- Anika Therapeutics

- Assertio Therapeutics, INC.

- Bioventus

- Ferring Pharmaceuticals Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global osteoarthritis therapeutics market.

Drug Type

- Viscosupplementation Agents

- Nonsteroidal Anti-inflammatory Drugs

-

- Naproxen

- Aspirin

- Diclofenac

- Ibuprofen

- Celecoxib

- Meloxicam

- Piroxicam

- Ketoprofen

- Other NSAIDs

Anatomy

- Knee Osteoarthritis

- Hip Osteoarthritis

- Hand Osteoarthritis

- Others

Route of Administration

-

- Hyaluronic Acid Injections

- Corticosteroid Injections

- Platelet-rich Plasma (PRP) Injections

- Placental Tissue Matrix (PTM) Injections

- Acetylsalicylic Acid (ASA) Injections

- Others

Sales Channel

- Prescription Drugs

- Over-the-Counter Drugs

End-use

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)