Pain Management Drugs Market Size and Research

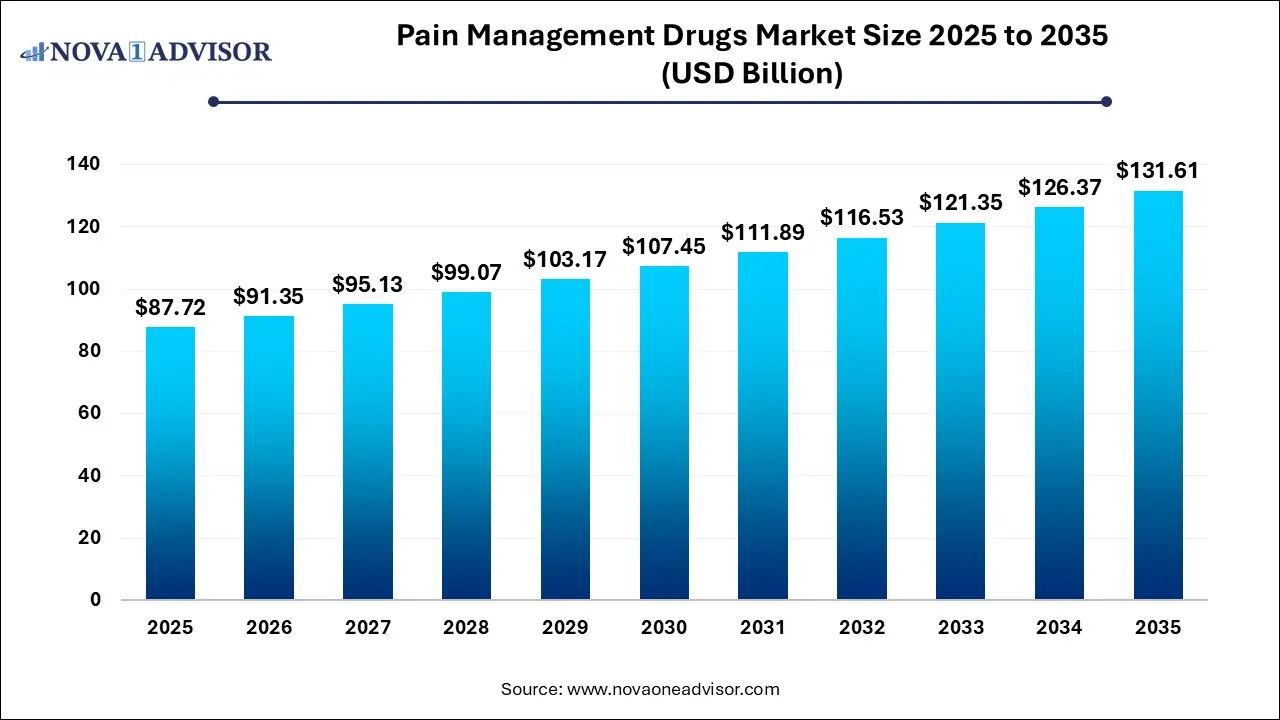

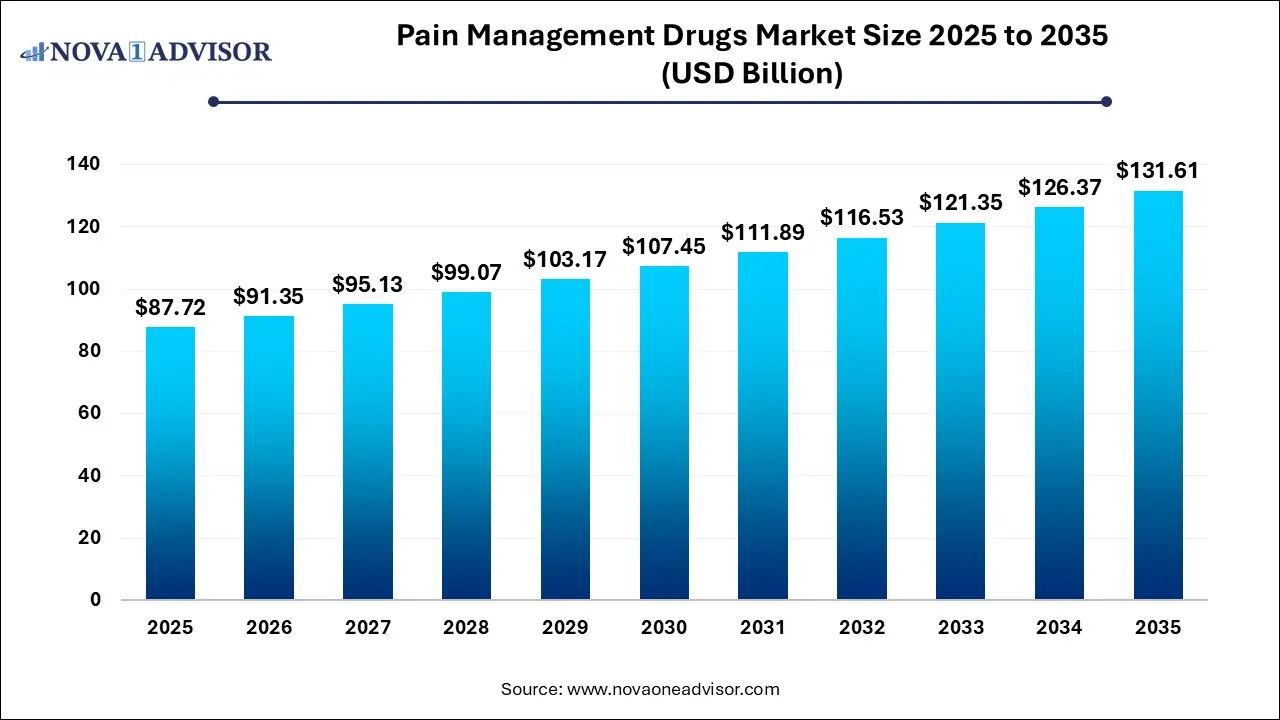

The global pain management drugs market size is calculated at USD 87.72 billion in 2025, grow to USD 91.35 billion in 2026, and is projected to reach around USD 131.61 billion by 2035, representing a CAGR of 4.14% from 2026 to 2035. The market is growing due to the rising prevalence of chronic conditions like arthritis and cancer. The increasing elderly population and post-surgical pain cases also drive demand. Additionally, advancements in drug formulation are enhancing treatment efficacy.

Key Takeaways

- North America dominated the pain management drugs market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By drug class, the NSAIDs segment held the largest revenue market share.

- By drug class, the opioids segment is expected to grow at the fastest CAGR in the market during the studied years.

- By Indication, the neuropathic pain segment dominated the market.

- By Indication, the cancer pain segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the retail pharmacies segment led the market.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is the Pain Management Drugs Market Evolving?

Pain management drugs are medications used to relieve or control different types of pain, including acute, chronic, and neuropathy pain, by targeting the nervous system's pain pathways. The market is evolving rapidly, driven by the rising prevalence of chronic conditions like arthritis, cancer, and neuropathic pain, along with an aging global population requiring long-term pain relief. The opioid crisis has accelerated the development of safer, non-addictive alternatives such as suzetrigine a non-opioid drug approved in 2025 that offers effective pain relief without the risks associated with traditional opioids. Additionally, advancements in drug delivery systems, including transdermal patches and implantable devices, are enhancing treatment efficacy and patient compliance, contributing the market expansion.

- For Instance, In February 2024, Hikma extended its partnership with AFT Pharmaceuticals to introduce the injectable pain reliever Combogesic in Saudi Arabia, Jordan, and Iraq, strengthening its presence in the Middle Eastern pain management market.

What are the Key Trends in the Pain Management Drugs Market in 2025?

- In December 2025, Bausch Health reported encouraging topline results from a global Phase 2 trial of Amiselimod, an S1P antagonist, showing potential effectiveness in treating ulcerative colitis.

- In November 2025, Endo International’s subsidiary, Par Pharmaceutical, started distributing colchicine 0.6 mg capsules, the generic equivalent of Hikma’s MITIGARE, expanding its generic product offerings.

How Can AI Affect the Pain Management Drugs Market?

AI is transforming the market by accelerating drug discovery, optimizing clinical trials, and enabling personalized treatment plans. It helps identify novel drug targets and predict patient responses, reducing development time and costs. AI-driven tools also support real-time pain assessment and monitoring, enhancing treatment accuracy. Additionally, AI aids in analyzing large datasets to track drug efficacy and safety, ultimately improving patient outcomes and driving innovation in pain therapy.

Report Scope of Pain Management Drugs Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 91.35 Billion |

| Market Size by 2035 |

USD 131.61 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.14% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Drug Class, Indication, Distribution Channel, By Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Teva Pharmaceutical, Pfizer, Abbott, Mallinckrodt Pharmaceuticals, Endo International, GlaxoSmithKline, AstraZeneca, Depomed, Merck, Novartis and Others. |

Market Dynamics

Driver

The Rise in Chronic Cases

The rise in chronic cases drives the pain management drugs market because long-term, conditions like arthritis, cancer, and diabetes often lead to persistent pain requiring continuous treatment. As more people live with these conditions, especially among aging populations, the demand for effective and sustained pain relief increases. This trend pushes healthcare providers and pharmaceutical companies to invest in innovative and targeted pain management solutions, fueling steady market expansion and the development of new drug formulations.

- For Instance, According to a 2024 article in Scientific Reports, around 1.5 billion people worldwide experience chronic pain, with its occurrence rising notably among older age groups.

Restraint

Challenges in Opioid Therapy

Opioid therapy poses significant concern due to its potential for dependency, overdose, and long-term health risks, which limit its widespread acceptance. Legal restrictions, public health warnings, and growing awareness of opioids have led to reduced physician confidence in prescribing them. This has shifted focus towards alternative treatments and created a gap in effective yet safe pain relief options, making it difficult for the pain management drugs market to rely on opioids for sustained growth.

Opportunity

Rising Demand for non-opioids Alternatives

As awareness of opioid-related health risks increases, patients and physicians are turning towards safer, more sustainable pain relief options. This shift is creating a strong demand for innovative treatments that offer effective pain control without the dangers of dependency. It opens doors for pharmaceutical companies to develop novel non-opioid drugs, including cannabinoid-based therapies, neuromodulators, and targeted biologics. This evolving preference is reshaping the market landscape and offering long-term growth potential for safer pain management solutions.

For Instance, In January 2025, the FDA approved Journavx (suzetrigine) by Vertex Pharmaceuticals, a groundbreaking non-opioid painkiller. It works by blocking pain signals at the nerve level without affecting the brain, lowering addiction risks. Proven effective in clinical trials for acute pain, it also has fewer side effects than opioids. As the first new class of pain drug in over two decades, it highlights the growing shift toward safer, non-addictive alternatives in pain management.

Segmental Insights

How NSAIDs Segment Dominate the Pain Management Drugs Market in 2025?

The NSAIDs segment dominates the market because of its proven ability to reduce inflammation and relieve mild to moderate pain effectively. Their accessibility and affordability make them popular among patients and healthcare providers alike. Continuous advancements in drug formulations, such as topical and extended-release versions, improve patient compliance and safety profiles. This widespread acceptance and ongoing innovation contribute to market growth.

The opioids segment is projected to experience the fastest compound annual growth rate in the pain management drugs market due to its critical role in addressing severe and chronic pain conditions. Opioids are highly effective for managing pain associated with cancer, post-surgical recovery, and trauma, making them indispensable in clinical settings. The development of extended-release formulations has improved patient compliance by providing sustained pain relief. Additionally, ongoing research and pharmaceutical investments aim to enhance the safety and efficacy of opioid therapies, contributing to the market expansion.

Why Did the Neuropathic Pain Segment Dominate in the Pain Management Drugs Market 2025?

The neuropathic pain segment has emerged as a dominant force in the market, driven by the increasing prevalence of conditions such as diabetic neuropathy, post-herpetic neuralgia, and nerve injuries has led to a higher demand for effective treatments. Neuropathic pain is often chronic and challenging to manage, necessitating the use of specialized medications like anticonvulsants and antidepressants. The rising global diabetic population and advancements in diagnostic techniques have further contributed to the growth of the market.

The rising global incidence of cancer has led to an increased number of patients requiring effective pain management solutions. Advancements in pain management therapies, including the development of new analgesics and targeted treatments, are providing more effective and safer options for cancer patients. Additionally, there is a growing emphasis on personalized medicine and multimodal approaches that combine pharmacological therapies to address the complex nature of cancer pain. These trends, coupled with a focus on improving the quality of life for cancer patients, are driving the demand for innovative pain management solutions in the oncology sector.

- For Instance, In November 2023, AbbVie acquired ImmunoGen, gaining access to its lead cancer drug ELAHERE (mirvetuximab soravtansine-gynx). This move strengthens AbbVie’s position in the oncology space by expanding its portfolio of treatments for solid tumors.

How Does the Retail Pharmacies Segment Dominate the Market?

The retail pharmacy segment leads the pain management drugs market due to its widespread accessibility and convenience for patients seeking both over-the-counter and prescription medication. Retail pharmacies offer a broad range of pain relief options, including NSAIDs and acetaminophen, making them a preferred choice for individuals managing chronic and acute pain conditions. Additionally, the presence of pharmacies provides patients with guidance on medication usage, enhancing treatment adherence. The integration of retail pharmacies into community settings further solidifies their role as the primary distribution channel in pain management.

The online pharmacy segment is poised for rapid growth in the pain management drugs market due to its convenience, especially for patients with chronic pain or mobility challenges. Online platforms offer a wide selection of medications, competitive pricing, and home delivery services, enhancing accessibility. The increasing adoption of digital health solutions, including telemedicine and e-prescriptions, further support this trend. Additionally, advancements in logistics and same-day delivery options by major players are making online pharmacies a preferred choice for pain management therapies.

Regional Insights

How is North America Contributing to the Expansion of the Pain Management Drugs Market?

In 2025, North America led the pain management drugs market due to, the region's advanced healthcare infrastructure, high prevalence of chronic pain conditions, and significant healthcare spending contributed to its dominance. Additionally, the presence of major pharmaceutical companies and a strong focus on research and development facilitated the introduction of innovative pain management therapies. These elements combined to solidify North America's leading position in the global pain management drugs market.

For Instance In May 2023, Zoetis Inc. received FDA approval for Librela™ (bedinvetmab injectable), the first monthly anti-NGF monoclonal antibody designed to treat osteoarthritis (OA) pain in dogs. This innovative therapy is proven to be safe and effective for long-term use, helping improve mobility and overall quality of life in canines suffering from OA-related pain.

How is Asia-Pacific approaching the Pain Management Drugs Market in 2025?

The Asia Pacific region is anticipated to experience the fastest growth in the pain management drugs market during the forecast period due to several key factors. The region's expanding elderly population, which is more susceptible to chronic pain conditions like arthritis and neuropathy, significantly increases the demand for pain management therapies. Additionally, improvements in healthcare infrastructure, rising healthcare expenditures, and increased awareness about pain management contribute to market growth. The prevalence of chronic diseases such as cancer and diabetes, which often lead to chronic pain, further drives the demand for effective pain management solutions in the region.

- For Instance, In January 2024, Guangzhou Fermion gained NMPA approval for FZ008-145, a non-addictive, second-generation Nav1.8 inhibitor for pain relief. The drug showed promising results in multiple pain studies. In October 2023, Fermion licensed Greater China rights to Joincare Pharmaceutical, keeping global rights.

Top Companies in the Pain Management Drugs Market

Recent Developments in the Pain Management Drugs Market

- In April 2025, Baxter International expanded its U.S. pharmaceuticals portfolio by launching five new injectable products. These additions target key therapeutic areas like anti-infective and anti-hypotensive treatments. According to EVP Alok Sonig, the move reflects Baxter’s commitment to offering differentiated solutions that meet critical patient needs and support continued innovation in the injectable drug space.

- In January 2025, Vertex Pharmaceuticals reported successful Phase 3 results for VX-548, a NaV1.8 inhibitor for acute pain. The drug showed significant pain relief after abdominoplasty and bunionectomy surgeries, outperforming placebo. A broader safety study also confirmed its effectiveness.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the pain management drugs market

By Drug Class

- NSAIDs

- Opioids

- Anesthetics

- Antidepressants

- Anticonvulsants

- Others

By Indication

- Arthritic Pain

- Neuropathic Pain

- Chronic Back Pain

- Post-Operative Pain

- Cancer Pain

- Others

By Distribution Channel

- Online Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)