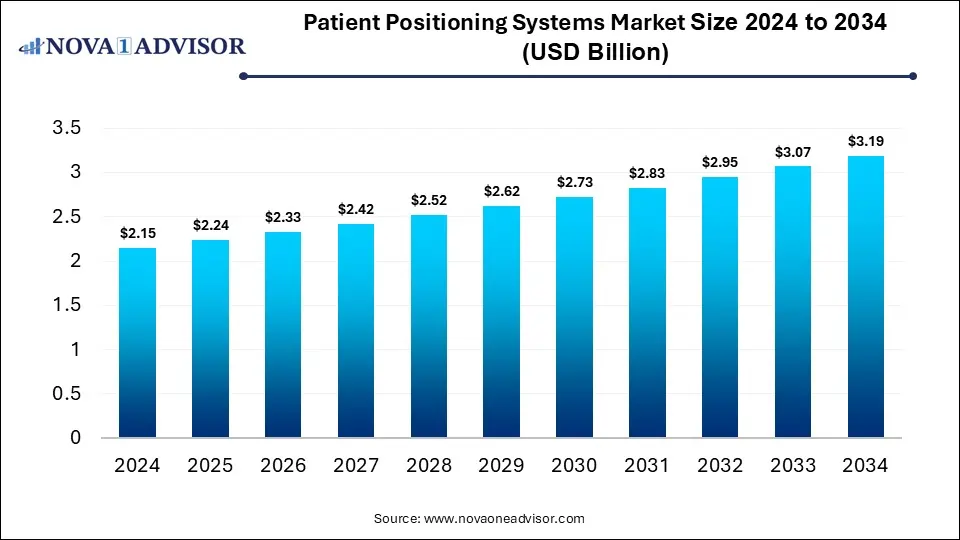

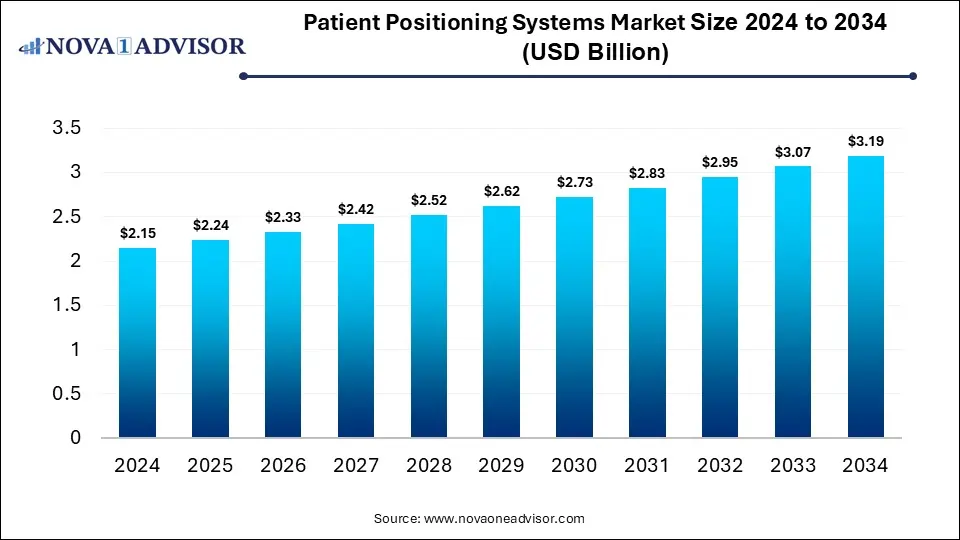

Patient Positioning Systems Market Size and Trends

The global Patient Positioning Systems market gathered revenue around USD 2.15 Billion in 2024 and market is set to grow USD 3.19 Billion by the end of 2034 and is estimated to expand at a modest CAGR of 4.03% during the prediction period 2025 to 2034.

Growth Factors:

This market is expected to witness lucrative growth during through 2025 owing to rising awareness about and surging expenditure on diagnostic procedures. In addition, increasing prevalence of cancer and rising geriatric population are expected to assist in market growth.

According to the National Cancer Institute, in 2024, there were 1,685,210 new cases of cancer diagnosed in U.S. and 60.1 million cases globally. The most common types of cancer are breast cancer, prostate cancer, and colon and rectum cancer. This steady increase in disease prevalence acts as a driver for R&D investments in the industry. Increase in innovation has resulted in improved efficiency and accuracy of these systems in cancer therapy. These products keep patients immobile yet comfortable during radiotherapy. This is anticipated to supplement industry growth.

Rising expenditure on diagnostics procedures has been a strong force driving demand in the market. According to a research published by NCBI, majority oncologists and cardiologists in U.S. and Germany prescribe diagnostics tests and choose a treatment plan only after studying test results. Thus, demand for diagnostics tests is increasing globally.

This research report purposes at stressing the most lucrative growth prospects. The aim of the research report is to provide an inclusive valuation of the Patient Positioning Systems market and it encompasses thoughtful visions, actualities, industry-validated market findings, historic data, and prognoses by means of appropriate set of assumptions and practice. Global Patient Positioning Systems market report aids in comprehending market structure and dynamics by recognizing and scrutinizing the market sectors and predicted the global market outlook.

COVID-19 Impact Assessment on Market Landscape

The report comprises the scrutiny of COVID-19 lock-down impact on the income of market leaders, disrupters and followers. Since lock down was instigated differently in diverse regions and nations, influence of same is also dissimilar across various industry verticals. The research report offers present short-term and long-term influence on the market to assist market participants across value chain makers to formulate the framework for short term and long-lasting tactics for recovery and by region.

Patient Positioning Systems market Report empowers readers with all-inclusive market intelligence and offers a granular outline of the market they are operational in. Further this research study delivers exceptional combination of tangible perceptions and qualitative scrutiny to aid companies accomplishes sustainable growth. This report employs industry-leading research practices and tools to assemble all-inclusive market studies, intermingled with pertinent data. Additionally, this report also emphases on the competitive examination of crucial players by analyzing their product portfolio, pricing, gross margins, financial position, growth approaches, and regional occurrence.

Report Scope of Patient Positioning Systems Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.24 Billion |

| Market Size by 2034 |

USD 3.19 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.03% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Segments covered analysis

By Product analysis:

The products analyzed in this study include tables and accessories. The tables segment is expected to dominate the market owing to increased demand and a rising number of hospitals, ambulatory centers, and other settings such as specialty centers and diagnostics centers.

The tables segment is expected to retain its lead over the forecast period due to rising demand for efficient and accurate diagnostic imaging, which is creating growth opportunities for the segment.

The accessories segment is expected to witness the fastest growth in the market, owing to the increasing number of patients undergoing different types of surgeries and diagnoses. There is a greater demand for diagnosis in developing countries such as India and China, which may drive sales of patient positioning systems over the forecast period.

Patient Positioning Systems Market Size By Service Provider, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Tables |

1.33 |

1.38 |

1.42 |

1.47 |

1.52 |

1.57 |

1.62 |

1.68 |

1.73 |

1.79 |

1.85 |

| Accessories |

0.82 |

0.86 |

0.90 |

0.95 |

1.00 |

1.05 |

1.10 |

1.16 |

1.22 |

1.28 |

1.34 |

By Application analysis:

Based on application, patient positioning systems are segmented into diagnostics/imaging, surgery, and others. The surgery segment held the largest share owing to the increasing prevalence of chronic diseases such as cancer. Additionally, there is an increase in healthcare expenditure globally. This is anticipated to further supplement the growth of this application.

The diagnostics segment is estimated to grow at a lucrative rate over the forecast period, due to increasing expenditure on diagnostics/imaging, globally. Diagnostics tests represent more than 3.2% of total healthcare spending. These tests also play a major role in a doctor’s decision-making process. Almost all cancer diagnoses are based on laboratory tests and their results.

Patient Positioning Systems Market Size By Application, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Surgery |

1.20 |

1.25 |

1.31 |

1.36 |

1.42 |

1.48 |

1.54 |

1.61 |

1.68 |

1.75 |

1.82 |

| Diagnostics |

0.60 |

0.62 |

0.65 |

0.67 |

0.69 |

0.72 |

0.75 |

0.77 |

0.80 |

0.83 |

0.86 |

| Other |

0.34 |

0.36 |

0.37 |

0.39 |

0.40 |

0.42 |

0.44 |

0.45 |

0.47 |

0.49 |

0.51 |

By End-use anlysis

By end-use, the market for patient positioning systems is categorized into hospitals, ambulatory centers, and others. Hospitals are identified as the largest segment owing to increasing healthcare expenditure globally. Additionally, increasing the number of hospitals across the globe is anticipated to drive demand in this market.However, the ambulatory segment is expected to grow at a faster rate. As the number of these centers soars in developed as well as developing countries, they help alleviate the pressure on hospitals and clinics. There are approximately 5,229 Ambulatory Surgical Centers (ASCs) certified by Medicare in the U.S.

Patient Positioning Systems Market Size By End-use, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospital |

1.46 |

1.52 |

1.57 |

1.63 |

1.69 |

1.76 |

1.82 |

1.89 |

1.96 |

2.03 |

2.11 |

| Ambulatory Centers |

0.47 |

0.50 |

0.52 |

0.55 |

0.57 |

0.60 |

0.63 |

0.66 |

0.70 |

0.73 |

0.77 |

| Other |

0.22 |

0.22 |

0.23 |

0.24 |

0.25 |

0.26 |

0.27 |

0.28 |

0.29 |

0.31 |

0.32 |

By Regional analysis:

North America held a dominant share of 36.1% in 2024 owing to the rising prevalence of chronic and lifestyle-related diseases and the presence of sophisticated healthcare infrastructure. In addition, the local presence of major market players in the U.S., such as Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; and SchureMed, is expected to boost the growth of the market for patient positioning systems in North America.

Europe is also expected to hold a lucrative share during the forecast period due to a flourishing medical device industry in U.K., France, and Germany, in addition to rising avenues for market participants in this region. Asia Pacific is expected to register a higher CAGR as compared to other regions over the forecast period, which can be attributed to the increasing geriatric population and increasing healthcare expenditure in this region.

Patient Positioning Systems Market Size By Regional, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

0.73 |

0.76 |

0.78 |

0.81 |

0.84 |

0.86 |

0.89 |

0.92 |

0.96 |

0.99 |

1.02 |

| Europe |

0.58 |

0.60 |

0.62 |

0.65 |

0.67 |

0.69 |

0.72 |

0.75 |

0.77 |

0.80 |

0.83 |

| Asia Pacific |

0.49 |

0.52 |

0.55 |

0.59 |

0.62 |

0.65 |

0.69 |

0.73 |

0.77 |

0.82 |

0.86 |

| Latin America |

0.17 |

0.18 |

0.18 |

0.19 |

0.19 |

0.20 |

0.20 |

0.21 |

0.21 |

0.22 |

0.22 |

| Middle East and Africa (MEA) |

0.17 |

0.18 |

0.19 |

0.19 |

0.20 |

0.21 |

0.22 |

0.23 |

0.24 |

0.25 |

0.26 |

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Patient Positioning Systems Market include: Medtronic; Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; OPT SurgiSystems Srl; SchureMed; Smith & Nephew; STERIS plc; Leoni

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2021 to 2034 and covers subsequent region in its scope:

By Product

By Application

- Surgery

- Diagnostics

- Other

By End-use

- Hospital

- Ambulatory Centers

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)