Patient Safety And Risk Management Software Market Size and Trends

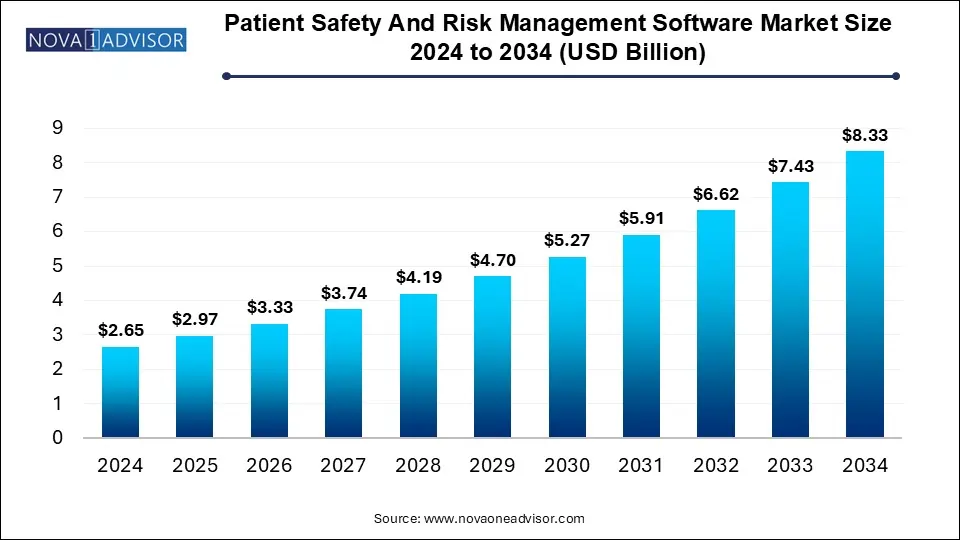

The patient safety and risk management software market size was exhibited at USD 2.65 billion in 2024 and is projected to hit around USD 8.33 billion by 2034, growing at a CAGR of 12.13% during the forecast period 2025 to 2034.

Patient Safety And Risk Management Software Market Key Takeaways:

- The risk management & safety solutions segment dominated the market in 2024, securing the highest revenue share of 68%.

- The cloud segment accounted for the largest portion of the market, generating approximately 59% of total revenue in 2024.

- The hospital segment was the leading sector, holding 42.0% of the market share in 2024.

- North America retained its top position, contributing 49.0% of the total market revenue in 2024.

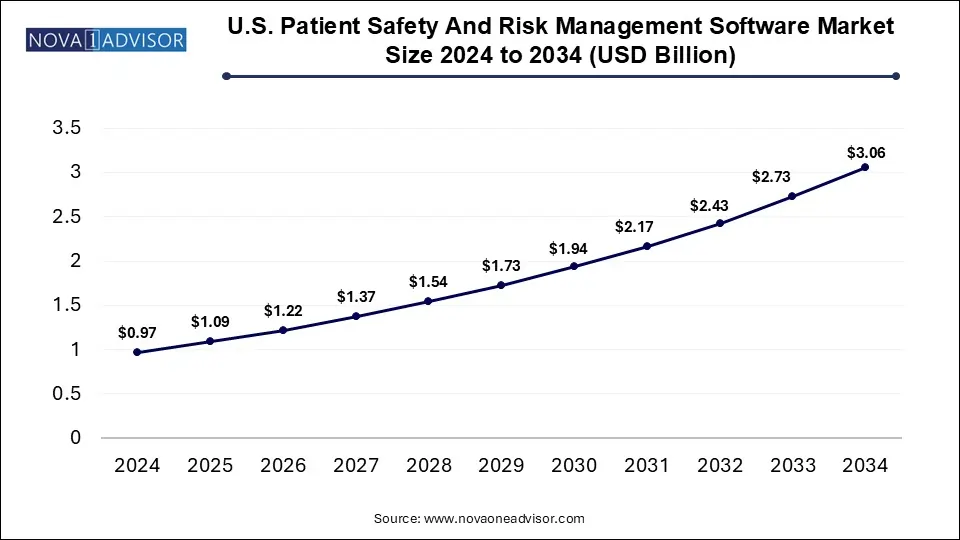

U.S. Patient Safety And Risk Management Software Market Size and Growth 2025 to 2034

The U.S. patient safety and risk management software market size was valued at USD 0.97 billion in 2024 and is expected to reach around USD 3.06 billion by 2034, growing at a CAGR of 11.0% from 2025 to 2034.

In 2024, North America led the market with a 49.0% revenue share. This growth is primarily driven by the widespread adoption of healthcare IT services to enhance workflow efficiency in medical institutions across the U.S. and Canada. Additionally, the presence of an advanced healthcare infrastructure and the shift from on-premise to cloud-based solutions are key factors fueling market expansion. Furthermore, the increasing use of data analytics to improve patient safety and the strong presence of major market players in the U.S. contribute to the region’s continued growth.

U.S. Patient Safety and Risk Management Software Market Trends

In 2024, the U.S. patient safety and risk management software segment held the largest market share, driven by government initiatives aimed at enhancing diagnosis, treatment, and patient care. Approximately 25% of Medicare patients experience adverse events during hospital stays, with over 40% of these incidents being preventable. Hospitals and healthcare systems are continually striving to enhance patient safety standards. In 2023, the American Hospital Association (AHA) introduced a Patient Safety Initiative to reinforce safety protocols and advance healthcare quality across the country.

Europe Patient Safety and Risk Management Software Market Trends

Europe ranked second after North America in terms of market revenue in 2024 and is expected to maintain its position from 2025 to 2034. The European healthcare industry is actively developing solutions to manage rising costs, address an aging population, reduce medical errors, and improve treatment access. The transition toward value-based healthcare is anticipated to boost demand for better patient outcomes at cost-effective rates.

In 2024, Germany led the European patient safety and risk management software market. The increasing adoption of innovative healthcare IT solutions to improve resource utilization and enhance patient-centered care significantly drives the demand for such software in the country.

Meanwhile, the UK market is projected to grow significantly from 2025 to 2034, primarily due to the rising cases of medical errors and hospital-acquired infections. Medical errors pose a serious challenge in healthcare, often resulting in preventable patient harm, extended hospital stays, and increased costs. According to a Policy Research Unit study on Economic Evaluation of Health and Care Interventions, an estimated 237 million medication errors occur annually in England, with 66 million of them having potential clinical consequences.

Asia Pacific Patient Safety and Risk Management Software Market Trends

Asia Pacific is expected to witness the fastest CAGR from 2025 to 2034. Factors such as a growing patient population, increased investments in healthcare infrastructure, and advancements in AI/ML are fueling the demand for patient safety and risk management software. Additionally, the rising need for workflow optimization and demand for customized healthcare solutions in emerging economies like India and China are driving market growth in the region.

In 2024, China held a significant share of the patient safety and risk management software market. The increasing occurrence of medical errors, coupled with a growing emphasis on patient safety and hospital-acquired infections (HAIs), is boosting demand for these solutions. Additionally, high healthcare costs are further accelerating market growth. A 2023 study published by NCBI revealed that the median total medical expenses and hospital stay duration for inpatients with HAIs in China exceed those without HAIs by approximately USD 4000 and 13.89 days, respectively.

Meanwhile, the Indian market for patient safety and risk management software is set for significant growth from 2025 to 2034. The rapid digital transformation in the Indian healthcare sector has encouraged major tech companies to invest in healthcare IT solutions. These solutions help overcome challenges related to early disease detection, diagnostics, decision-making, and treatment while addressing healthcare personnel shortages in a country with a large population. As a result, the adoption of patient safety and risk management software is increasing to enhance care delivery, reduce hospital-acquired infections, and ensure compliance with regulatory standards.

Report Scope of Patient Safety And Risk Management Software Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.97 Billion |

| Market Size by 2034 |

USD 8.33 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.13% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Deployment Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Riskonnect, Inc.; Origami Risk LLC; RLDatix; Health Catalyst; Conduent, Inc.; symplr; Clarity Group, Inc.; Becton, Dickinson and Company (BD); RiskQual Technologies, Inc.; Prista Corporation; Pharmapod (Think Research Corporation) |

Patient Safety And Risk Management Software Market By Type Insights

In 2024, the risk management & safety solutions segment led the market with a 68.0% revenue share. This dominance is driven by the advancement of patient safety software, which enables healthcare administrators to access patient information from a centralized system, ensuring data security and seamless accessibility. These solutions facilitate high-quality and efficient patient care. For instance, in May 2023, DOSIsoft introduced ThinkQA Secondary Dose Check, an innovative software that calculates and verifies patients' secondary doses. This tool is designed to assist Radiation Therapy (RT) departments in ensuring patient safety and quality assurance (QA) by meeting the latest standards for adaptive radiotherapy tools and procedures.

The governance, risk & compliance (GRC) solutions segment is anticipated to experience the fastest CAGR from 2025 to 2034, driven by the increasing occurrence of adverse health events worldwide. A report by the Institute of Medicine (IOM) indicates that nearly 98,000 hospital patients lose their lives annually due to medical errors. In response, organizations such as the WHO and various governments have initiated patient safety programs to raise awareness and mitigate risks.

Additionally, key market players are pursuing strategic mergers & acquisitions to enhance their presence and meet the rising demand. For instance, in July 2023, RLDatix, a leading provider of healthcare GRC solutions, acquired Galen Healthcare Solutions (Galen)—a company specializing in data migration, implementation, optimization, and archival solutions for healthcare IT systems. This acquisition enables healthcare institutions to comply with regulatory data retention mandates while ensuring continuity of patient care. By leveraging RLDatix’s GRC expertise, organizations can efficiently archive, manage, and safeguard legacy data, strengthening patient safety measures.

Patient Safety And Risk Management Software Market By Deployment Type Insights

The cloud-based segment accounted for the largest revenue share of 59% in 2024. Cloud-based patient safety & risk management software operates on cloud servers and is accessible via web browsers. It is specifically designed to support healthcare providers in managing patient safety and mitigating risks. This software utilizes cutting-edge cloud computing and web technologies to offer a secure, scalable, and flexible framework for data storage, incident analysis, and risk assessments.

The on-premise segment is projected to witness substantial CAGR growth from 2025 to 2034. On-premise patient safety & risk management software provides healthcare facilities with greater control over data security and regulatory compliance. It offers customization capabilities, seamless integration, robust performance in low-connectivity areas, and adherence to industry regulations. Furthermore, it enables offline functionality, reliable data backup, potential cost efficiencies, and localized maintenance support, making it a preferred option for healthcare institutions seeking secure and efficient risk management solutions.

Patient Safety And Risk Management Software Market By End-Use Insights

The hospital segment emerged as the dominant market contributor, securing 42.0% of the revenue share in 2024. This growth is driven by the increasing need to reduce medical errors. The adoption of healthcare IT solutions is expanding due to their benefits, including streamlined data collection processes and a single data entry point, which help minimize errors and improve efficiency.

Market players are actively implementing strategic initiatives to promote patient safety software adoption in hospitals. For example, in December 2023, ObservSMART partnered with Mount Sinai Medical Center to enhance patient safety in its three emergency centers across Miami-Dade County. ObservSMART's portable rounding technology, which utilizes Bluetooth proximity and patient wearables, enables real-time monitoring of high-acuity patients, significantly improving behavioral health patient management.

The ambulatory care centers segment is projected to register the fastest CAGR from 2025 to 2034. Ambulatory care refers to outpatient medical services that do not require hospital admission. This includes physician offices, urgent care centers, dialysis and infusion clinics, outpatient hospital departments, and ambulatory surgical centers (ASCs).

To cater to this expanding sector, industry leaders are launching targeted solutions. For instance, in March 2024, Surglogs was selected as the compliance management software provider for one of the largest ASC companies in the U.S.. This collaboration will allow Surglogs to optimize and streamline compliance management across more than 300 ASCs within its network, further strengthening regulatory adherence and operational efficiency in the ambulatory care sector.

Some of The Prominent Players in The Patient Safety And Risk Management Software Market Include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Patient Safety And Risk Management Software Market

By Type

- Risk Management & Safety Solutions

- Claims Management Solutions

- Governance, Risk & Compliance Solutions

By Deployment Type

By End-use

- Hospitals

- Ambulatory Care Centers

- Long-Term Care Centers

- Other End-use

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)