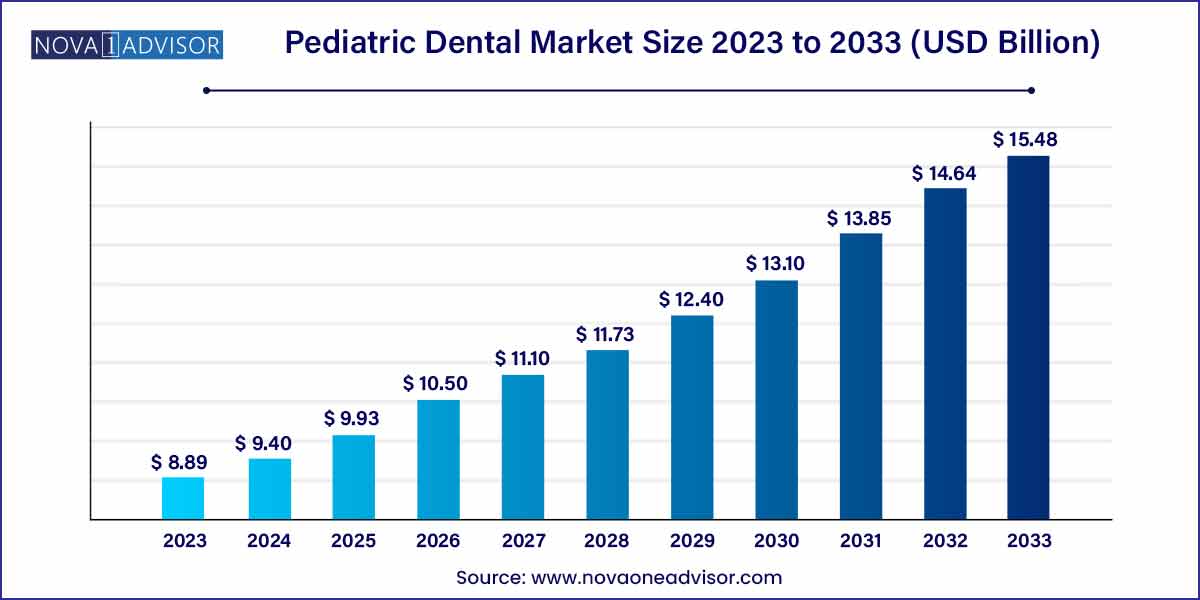

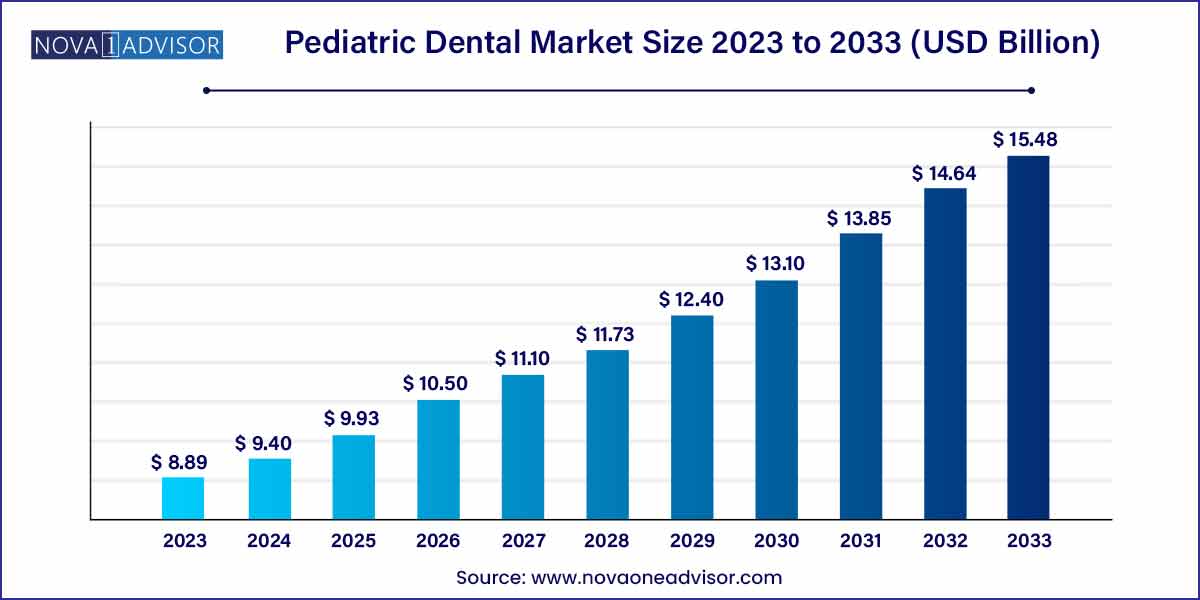

The global pediatric dental market size was exhibited at USD 8.89 billion in 2023 and is projected to hit around USD 15.48 billion by 2033, growing at a CAGR of 5.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- The primary teeth segment held the largest share of more than 50.0% in 2023.

- The dental caries segment dominated the market in 2023, with a revenue share of more than 35.0%.

- The dental cleaning (prophylaxis) segment dominated the market in 2023 with a share of more than 31.0%.

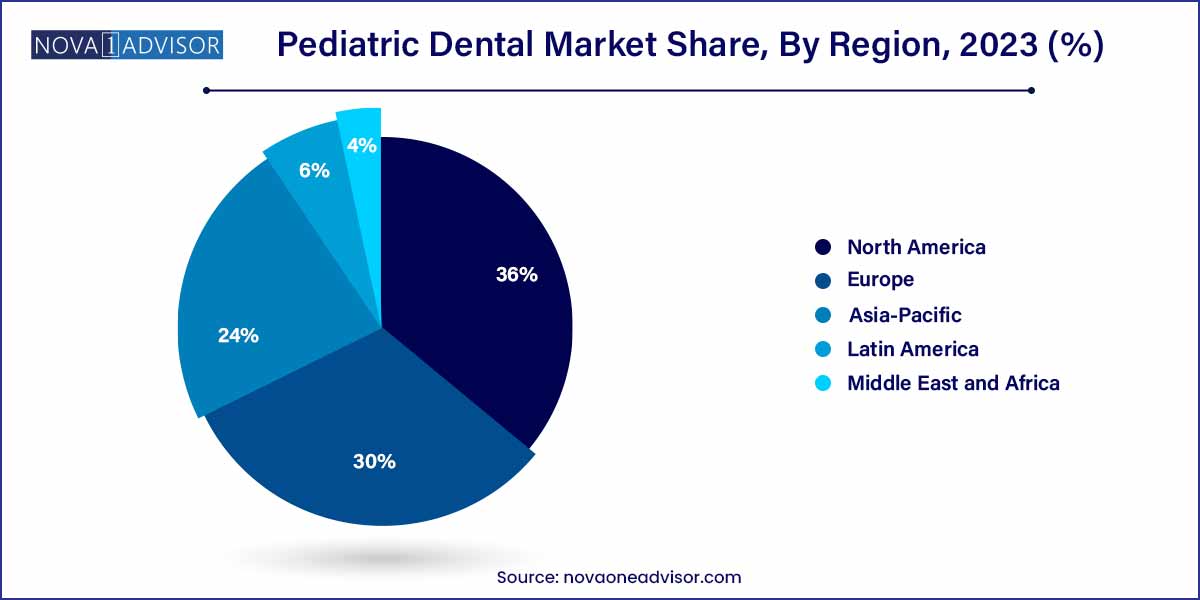

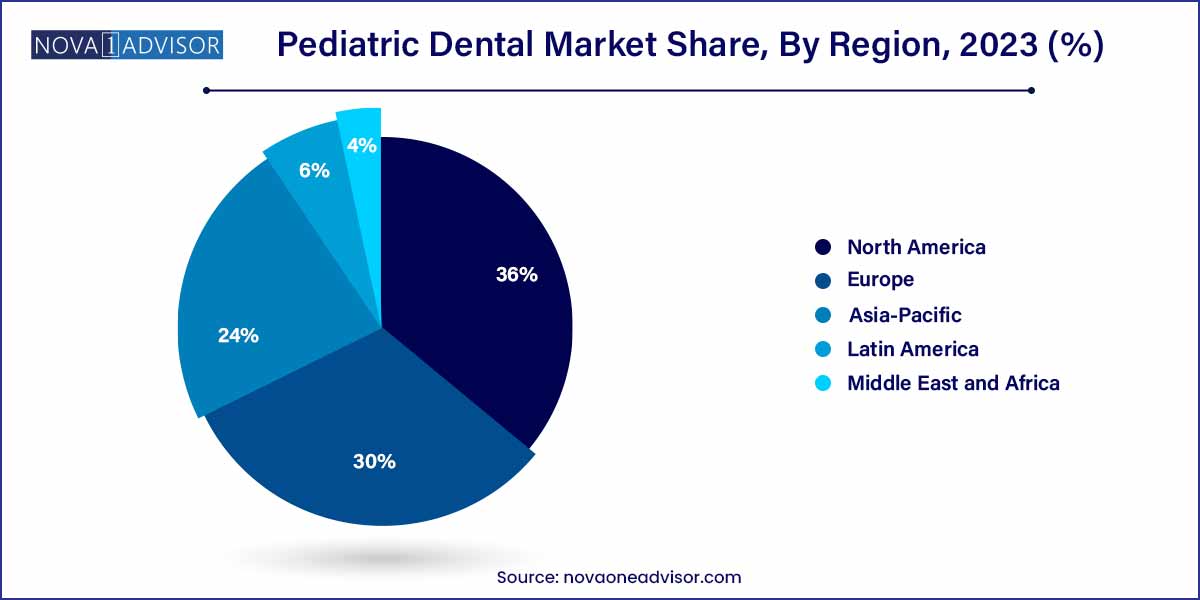

- North America dominated the market in 2023, with a revenue share of more than 36.0%.

Market Overview

The pediatric dental market is a dynamic and critical component of the broader dental care industry, focusing specifically on the oral health of children from infancy through adolescence. Pediatric dentistry is uniquely tailored to address the dental needs, behavior management, preventive strategies, and developmental dental care of younger patients. With the increasing emphasis on early diagnosis and preventive care, the pediatric dental sector has gained prominence among healthcare providers, insurance companies, and parents alike.

The global burden of dental diseases among children, particularly dental caries (tooth decay), remains high. According to the World Health Organization (WHO), dental caries continues to be the most prevalent chronic disease among children worldwide. Early intervention and preventive treatments such as fluoride applications, sealants, and education campaigns are driving growth in the pediatric dental market. Furthermore, growing awareness regarding pediatric oral hygiene, increasing disposable incomes, supportive government initiatives, and advancements in dental technologies are fostering market expansion. As dental clinics, specialty practices, and hospitals increasingly cater to the unique needs of young patients, the pediatric dental market is poised for robust growth over the coming decade.

Major Trends in the Market

-

Growing emphasis on preventive dental care: Fluoride varnish applications, sealants, and early oral hygiene education are becoming primary strategies.

-

Rising adoption of sedation and anesthesia techniques: To manage anxiety and fear among pediatric patients during dental procedures.

-

Increased use of aesthetic, tooth-colored materials: Demand for composite fillings and zirconia crowns over traditional metal options is on the rise.

-

Integration of digital dentistry: CAD/CAM systems and 3D imaging are increasingly used for pediatric dental diagnostics and treatment planning.

-

Emergence of teledentistry: Virtual consultations for pediatric dental issues are gaining traction, especially post-pandemic.

-

Customized pediatric dental insurance plans: Tailored insurance offerings are encouraging early visits and comprehensive dental care for children.

-

Focus on minimally invasive treatments: Techniques like silver diamine fluoride application and laser dentistry are gaining popularity for caries management.

Pediatric Dental Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 8.89 Billion |

| Market Size by 2033 |

USD 15.48 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Disease Type, Procedure, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

3M; Hu-Friedy Mfg. Co., LLC; Kinder Krowns; Figaro Crowns Inc.; Acero Crowns; Sprig Oral Health Technologies, Inc.; Edelweiss Dentistry Products; SML; Cheng Crowns; Dentsply Sirona. |

Type Insights

Primary teeth segment dominated the type segment in 2024. Primary (deciduous) teeth, also known as baby teeth, are particularly vulnerable to caries, trauma, and developmental disorders. Consequently, a significant volume of pediatric dental procedures focuses on managing primary teeth health, including preventive interventions, restorations, and extractions. Ensuring the health of primary teeth is critical as they serve as placeholders for permanent teeth and play a vital role in speech development and nutrition.

Permanent teeth segment is expected to witness the fastest growth. As children transition from primary to permanent dentition, particularly during late childhood and adolescence, the focus shifts to preserving newly erupted permanent teeth. Preventive treatments like sealants, orthodontic evaluations, and management of early caries in permanent molars are growing rapidly. The emphasis on lifelong oral health starting with permanent teeth preservation will continue driving growth in this segment.

Disease Type Insights

Dental caries dominated the disease type segment in 2024. Dental caries remains the most common dental disease affecting pediatric populations globally. Treatments for caries, ranging from simple fillings to more complex pulpotomies and crowns, account for a significant share of pediatric dental services. Governments, public health initiatives, and private practices alike are emphasizing early intervention and preventive strategies to combat caries incidence.

Enamel disorders are anticipated to be the fastest-growing disease segment. Conditions like amelogenesis imperfecta and molar-incisor hypomineralization (MIH) are increasingly recognized, leading to growing demand for specialized pediatric dental care. Awareness of these disorders, coupled with advancements in restorative materials suited for weakened enamel, is contributing to the rising treatment volumes within this category.

Procedure Insights

Tooth-colored fillings dominated the procedure segment in 2024. With increasing parental preference for aesthetically pleasing dental restorations, tooth-colored (composite resin) fillings have overtaken traditional amalgam fillings in pediatric dentistry. Beyond cosmetics, modern composites offer improved adhesion and durability, making them ideal for restoring decayed or fractured teeth in children.

Dental cleaning (prophylaxis) procedures are expected to be the fastest-growing segment. Emphasis on preventive dental care is encouraging more frequent prophylactic cleanings in pediatric patients. Regular dental cleaning helps maintain oral hygiene, detect early signs of caries, and foster good dental habits, all of which are critical components of pediatric preventive care strategies. Schools and community health programs promoting annual dental cleanings are further accelerating growth.

Regional Insights

North America dominated the pediatric dental market in 2024. The region's leadership is attributed to its well-established dental care infrastructure, high awareness among parents regarding pediatric oral health, and favorable insurance policies that often cover preventive and basic dental procedures for children. The United States alone accounts for a significant portion of the market, with the American Academy of Pediatric Dentistry (AAPD) strongly promoting early dental visits starting from the first year of life. Moreover, public health initiatives such as "Give Kids A Smile" Day by the American Dental Association (ADA) have successfully raised awareness and increased dental visits among children, solidifying North America's dominant position.

Asia-Pacific is expected to be the fastest-growing region. Rapid urbanization, rising disposable incomes, and improving healthcare infrastructures are driving increased access to pediatric dental services across countries like China, India, and Japan. Growing awareness campaigns about pediatric oral health, government-led school dental check-up programs, and an emerging middle-class population prioritizing preventive healthcare for their children are all contributing factors. Additionally, increasing numbers of specialized pediatric dentists and expansion of private dental clinics offering child-focused services are further accelerating market growth in the region.

Some of the prominent players in the pediatric dental market include:

- 3M

- Hu-Friedy Mfg. Co., LLC (Subsidiary of Cantel Medical)

- Kinder Krowns

- Figaro Crowns, Inc.

- Acero Crowns

- Sprig Oral Health Technologies, Inc.

- Edelweiss Dentistry Products GmbH

- SML

- Cheng Crowns

- Dentsply Sirona

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pediatric dental market.

Type

Disease Type

- Dental Caries

- Enamel Disorders

- Others

Procedure

- Pulpotomies

- Stainless Steel Crowns (SSCs)

- Tooth Colored Fillings

- Dental Cleaning (Prophylaxis)

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)