Personalized Cancer Vaccine Market Size and Trends

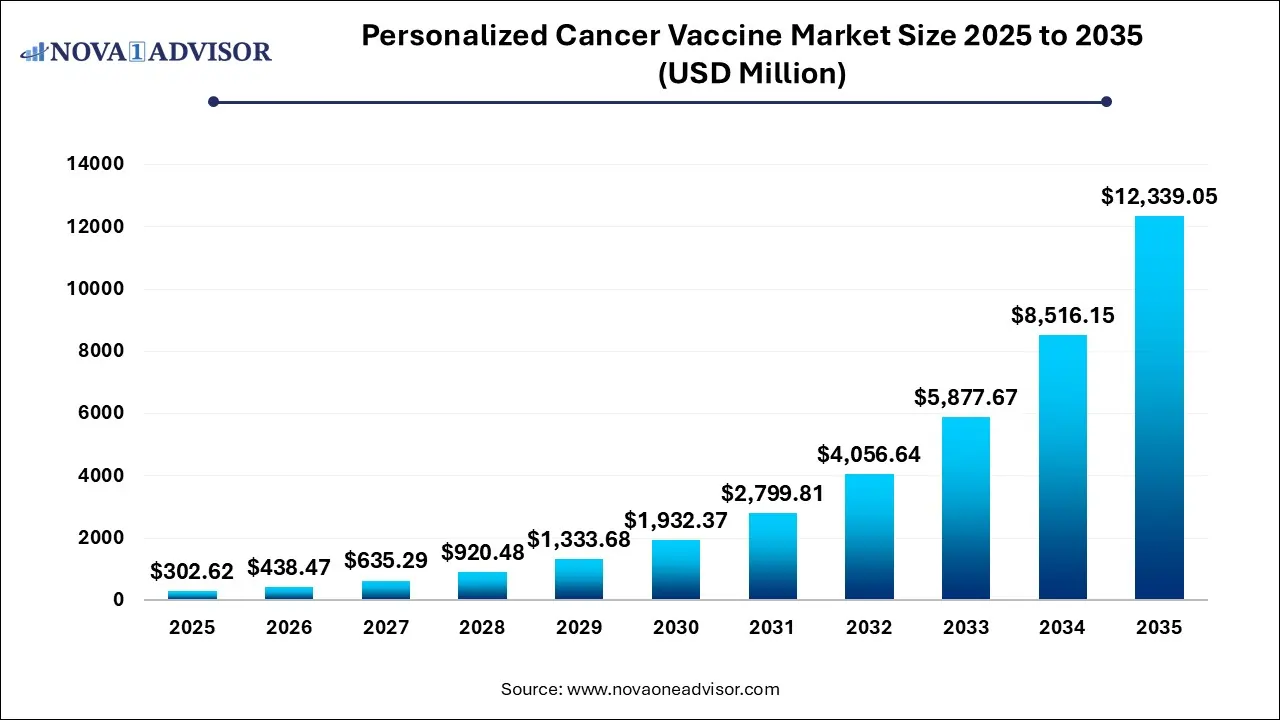

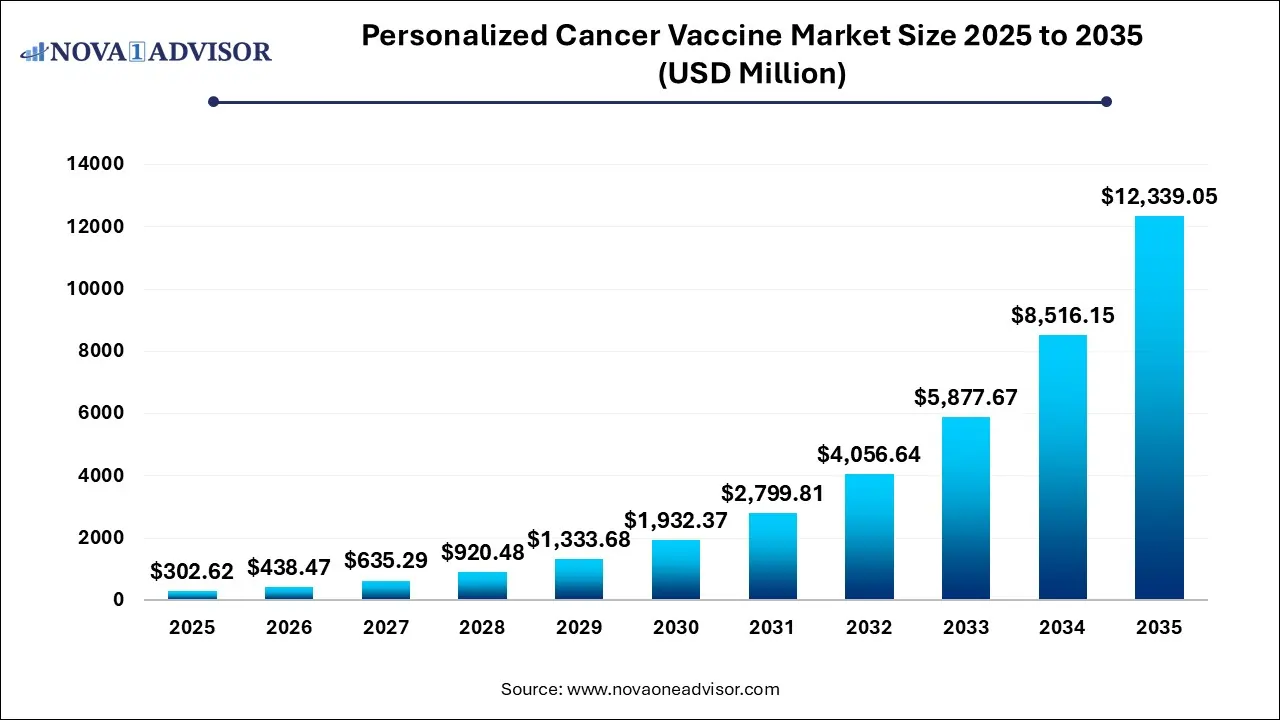

The Personalized cancer vaccine market size was exhibited at USD 302.62 million in 2025 and is projected to hit around USD 12,339.05 million by 2035, growing at a CAGR of 44.89% during the forecast period 2026 to 2035.

Key Takeaways:

- The dendritic cell segment accounted for the largest market share of 100% in 2025.

- The cell-based segment led the market with a 100% revenue share in 2025.

- The hospitals segment dominated the market with a revenue share of 60% in 2025.

- North America dominated the global personalized cancer vaccine market, with a share of 35% in 2025.

Market Overview

The global personalized cancer vaccine (PCV) market represents one of the most dynamic frontiers in oncology and immunotherapy. Unlike traditional vaccines, which are preventive and broadly targeted, personalized cancer vaccines are tailored to the individual’s unique tumor profile, offering a revolutionary approach in the fight against cancer. These vaccines stimulate a patient’s immune system to specifically recognize and destroy cancer cells based on unique tumor antigens, including neoantigens generated by tumor mutations.

Advances in genomics, next-generation sequencing (NGS), and bioinformatics have made the personalization of cancer treatment not just feasible but increasingly accessible. Pharmaceutical giants, biotech startups, and academic institutions are investing heavily in PCV research, making it one of the fastest-evolving segments within immuno-oncology. The potential of PCVs lies not only in their efficacy but also in their reduced side effect profile compared to conventional chemotherapy and radiotherapy. Additionally, personalized vaccines can be used in combination with immune checkpoint inhibitors and other cancer therapies to enhance overall treatment outcomes.

In recent years, several clinical trials have demonstrated the safety and immunogenic potential of PCVs in treating various cancers, including melanoma, non-small cell lung cancer (NSCLC), glioblastoma, and pancreatic cancer. As technological capabilities improve and regulatory pathways become more accommodating, the PCV market is positioned for substantial growth through 2030.

Major Trends in the Market

-

Surge in mRNA Vaccine Platforms: Building on the success of mRNA technology in COVID-19 vaccines, companies are adapting this platform for cancer immunotherapy, especially for personalized neoantigen vaccines.

-

Expansion of Bioinformatics and AI in Vaccine Design: AI algorithms and machine learning are being used to identify optimal neoantigens and streamline PCV development pipelines.

-

Rise of Combination Therapies: Personalized cancer vaccines are increasingly used in conjunction with immune checkpoint inhibitors, targeted therapies, and conventional treatments to improve efficacy.

-

Growing Focus on Solid Tumors: Clinical attention is shifting toward difficult-to-treat solid tumors like glioblastoma and pancreatic cancer, where PCVs show potential for breakthroughs.

-

Decentralization of Vaccine Manufacturing: Advances in decentralized manufacturing models are enabling quicker and localized production of patient-specific vaccines.

-

Increased Government and Philanthropic Funding: Several global initiatives are funding research on individualized oncology treatments, including PCVs.

-

Development of Off-the-Shelf Personalized Approaches: Researchers are investigating semi-personalized vaccines that blend the specificity of PCVs with the scalability of standard vaccines.

Report Scope of Personalized Cancer Vaccine Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 438.47 Million |

| Market Size by 2035 |

USD 12,339.05 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 44.89% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Technology, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Dendreon Pharmaceuticals, LLC; Gritstone Bio; CureVac, NeoCura & Innovent; Stemirna Therapeutics; Elicio Therapeutics; Evaxion Biotech; Imugene; Nouscom |

Key Market Driver

Breakthroughs in Genomics and Tumor Profiling Technologies

The primary driver of the personalized cancer vaccine market is the rapid evolution of genomic sequencing and tumor profiling technologies. High-throughput next-generation sequencing (NGS) enables clinicians and researchers to identify tumor-specific mutations, or neoantigens, within days. These unique markers are then used to design vaccines that direct the immune system specifically toward cancer cells, minimizing harm to healthy tissue.

For instance, Moderna and BioNTech are using mRNA platforms to encode patient-specific tumor antigens, allowing for quick turnaround from biopsy to vaccine synthesis. The precision and speed at which tumor profiles can be analyzed have made it possible to implement real-time, individualized treatment regimens. As the cost of sequencing continues to decline and the accuracy of bioinformatic algorithms improves, the integration of PCVs into mainstream cancer care is becoming a reality.

Key Market Restraint

Complex Manufacturing and High Production Costs

Despite promising clinical results, the commercialization of personalized cancer vaccines faces substantial hurdles, chiefly due to complex manufacturing requirements and high production costs. Each vaccine must be custom-designed based on an individual’s tumor profile, produced in a GMP-compliant facility, and delivered in a narrow therapeutic window. This level of personalization poses logistical and financial challenges, especially when compared to mass-produced biologics.

Moreover, manufacturing PCVs involves sophisticated coordination between sequencing labs, bioinformaticians, manufacturing sites, and clinical centers. Delays or errors at any stage can compromise the vaccine’s efficacy or patient safety. Reimbursement issues further complicate accessibility, as insurance companies may be hesitant to cover expensive, experimental treatments. These challenges necessitate ongoing innovations in decentralized manufacturing, cost optimization, and regulatory reform to realize the full potential of PCVs.

Key Market Opportunity

Expanding Clinical Pipeline and Multi-Cancer Applications

An exciting opportunity lies in the growing breadth of cancer types being targeted by PCV candidates. Initially focused on melanoma and lung cancer, ongoing trials now include breast cancer, pancreatic cancer, glioblastoma, prostate cancer, and even hematologic malignancies. This expansion is supported by increasing collaboration between biotech firms and academic research institutions.

For example, BioNTech is conducting multiple Phase I and II trials across diverse tumor types, while Moderna is collaborating with Merck to evaluate PCVs in NSCLC and melanoma. The success of such trials not only validates the approach but also opens doors to broader applications across the oncology spectrum. As more cancers are mapped genomically and immunogenic antigens are identified, the potential for scalable, platform-based vaccine production rises, allowing for quicker transitions from lab to clinic.

Segmental Analysis

By Type Outlook

RNA-based (mRNA) personalized cancer vaccines dominated the market in 2025, emerging as the most innovative and scalable vaccine platform. The success of mRNA technologies during the COVID-19 pandemic provided proof-of-concept for their speed, safety, and adaptability. In oncology, mRNA vaccines can be engineered to encode multiple patient-specific neoantigens in a single formulation, enhancing immune response diversity. Moderna’s mRNA-4157 and BioNTech’s BNT122 are two of the most prominent candidates currently in advanced clinical trials. These mRNA PCVs have demonstrated strong immunogenicity and favorable safety profiles, making them leading contenders for regulatory approval.

At the same time, neoantigen-based vaccines are expected to be the fastest-growing segment. Neoantigens are unique to an individual’s cancer and are not found in normal tissues, making them ideal targets for personalized therapies. Unlike tumor-associated antigens (TAAs), neoantigens do not risk triggering immune tolerance or autoimmunity. The growing ability to identify, validate, and synthesize neoantigens using AI-powered platforms has created a fertile landscape for biotech innovation. Companies like Gritstone bio and ISA Pharmaceuticals are heavily investing in neoantigen discovery platforms, which will drive segment growth in the years ahead.

By Technology Outlook

Cell-based vaccine technology held the dominant share in 2025 due to its long-standing application in dendritic cell vaccines. These vaccines involve isolating immune cells from the patient, loading them with tumor antigens, and re-administering them to trigger an immune response. Sipuleucel-T (Provenge), the FDA-approved cell-based vaccine for prostate cancer, paved the way for this segment. Despite challenges in scalability, cell-based technologies remain highly relevant, especially for patients with complex or resistant tumors. They also allow for the ex vivo manipulation of immune responses, offering precise control over the vaccine’s therapeutic potential.

mRNA PCV technology is anticipated to grow at the fastest rate, primarily due to its potential for rapid and cost-effective production. Unlike cell-based approaches, mRNA vaccines can be synthesized synthetically and do not require complex biological manufacturing processes. Their modularity allows companies to update vaccine components as new mutations are discovered. Additionally, mRNA vaccines have demonstrated exceptional adaptability in combination therapies, with some trials showing synergistic effects when paired with checkpoint inhibitors or chemotherapy. Their ease of storage and delivery also makes them ideal candidates for scaling across healthcare systems.

By Distribution Channel Outlook

Hospitals accounted for the largest share of the distribution segment in 2025, driven by the fact that most PCVs are administered in conjunction with intensive cancer care regimens. These vaccines often require precise dosing schedules, immune monitoring, and coordination with chemotherapy or immunotherapy cycles services typically centralized in hospital settings. Additionally, hospitals often participate in clinical trials, making them primary sites for PCV administration and data collection. Their infrastructure, multidisciplinary teams, and access to diagnostics further support their central role in vaccine delivery.

In contrast, research and academic institutes represent the fastest-growing distribution channel, as they play a pivotal role in early-stage development, clinical validation, and platform optimization. Institutions such as the Dana-Farber Cancer Institute, MD Anderson Cancer Center, and Memorial Sloan Kettering are not only conducting trials but also collaborating with biopharma companies to develop and test new PCV candidates. Government funding and philanthropic grants continue to support these efforts, encouraging a pipeline of novel PCVs to enter clinical testing. Their contribution is indispensable in transforming personalized cancer vaccines from experimental therapies to clinical realities.

Regional Analysis

North America Dominates the Market

North America leads the global personalized cancer vaccine market, fueled by a strong biotech ecosystem, advanced healthcare infrastructure, and proactive regulatory support. The U.S. houses most of the leading players in the PCV space, including Moderna, Gritstone bio, and BioNTech (via its U.S. operations). The region benefits from rapid adoption of genomics technologies, access to world-class oncology research centers, and high patient awareness. Additionally, the FDA’s willingness to expedite breakthrough therapies through mechanisms like Fast Track and RMAT designation has accelerated development timelines.

The presence of collaborative platforms such as the Cancer Moonshot initiative and the National Cancer Institute’s clinical trial networks further supports innovation and access to experimental treatments. Canada also plays a growing role, with several research institutes and biotech firms entering the space. Reimbursement reforms, investment in AI and digital health, and public-private partnerships continue to strengthen the region's leadership.

Asia Pacific Emerges as the Fastest-Growing Region

Asia Pacific is expected to witness the fastest growth, driven by expanding cancer burdens, rising healthcare investments, and the regional localization of manufacturing capabilities. China, Japan, South Korea, and Australia are emerging hubs for cancer immunotherapy, with multiple players conducting early-stage clinical trials. Chinese biotech firms such as JW Therapeutics and BeiGene are investing in personalized oncology platforms, while South Korea is focusing on mRNA production capabilities.

Government-led initiatives in precision medicine, such as China’s “Healthy China 2030” and Japan’s “Moonshot R&D Program,” are fostering a favorable environment for PCV development. Additionally, Asia Pacific’s diverse genetic landscape provides unique opportunities for population-specific neoantigen research. As regulatory harmonization and international collaborations increase, the region is expected to become a critical player in the global PCV ecosystem.

Some of The Prominent Players in The Personalized cancer vaccine market Include:

- Dendreon Pharmaceuticals, LLC

- Gritstone Bio

- CureVac

- NeoCura & Innovent

- Stemirna Therapeutics

- Elicio Therapeutics

- Evaxion Biotech

- Imugene

- Nouscom

Recent Developments

-

May 2025 – Moderna and Merck reported positive Phase IIb results from their melanoma vaccine candidate mRNA-4157 in combination with Keytruda, showing a 44% reduction in recurrence or death.

-

March 2025 – Gritstone bio announced the initiation of a Phase II trial for its personalized neoantigen vaccine in colorectal cancer, in collaboration with the National Cancer Institute.

-

January 2025 – BioNTech entered a strategic partnership with the UK government to build an mRNA cancer vaccine manufacturing facility in Cambridge, with the goal of treating up to 10,000 patients by 2030.

-

December 2024 – ISA Pharmaceuticals received Orphan Drug Designation from the EMA for its PCV targeting HPV16-positive cancers, paving the way for regulatory acceleration in Europe.

-

October 2024 – NEC Corporation and Transgene expanded their collaboration to develop AI-driven neoantigen prediction engines for personalized vaccine development across Asia and Europe.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Type

- Dendritic Cell

- RNA-Based (mRNA)

- Neoantigen-Based

- Tumor-Associated Antigen (TAA) Vaccines

By Technology

- Cell-based

- mRNA PCV

- Others

By Distribution Channel

- Hospitals

- Clinics

- Research & Academic Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)