The global pessary market size was exhibited at USD 412.80 million in 2023 and is projected to hit around USD 659.71 million by 2033, growing at a CAGR of 4.8% during the forecast period of 2024 to 2033.

Key Takeaways:

- The ring segment dominated the pessary market with a revenue share of 56.9% in 2023.

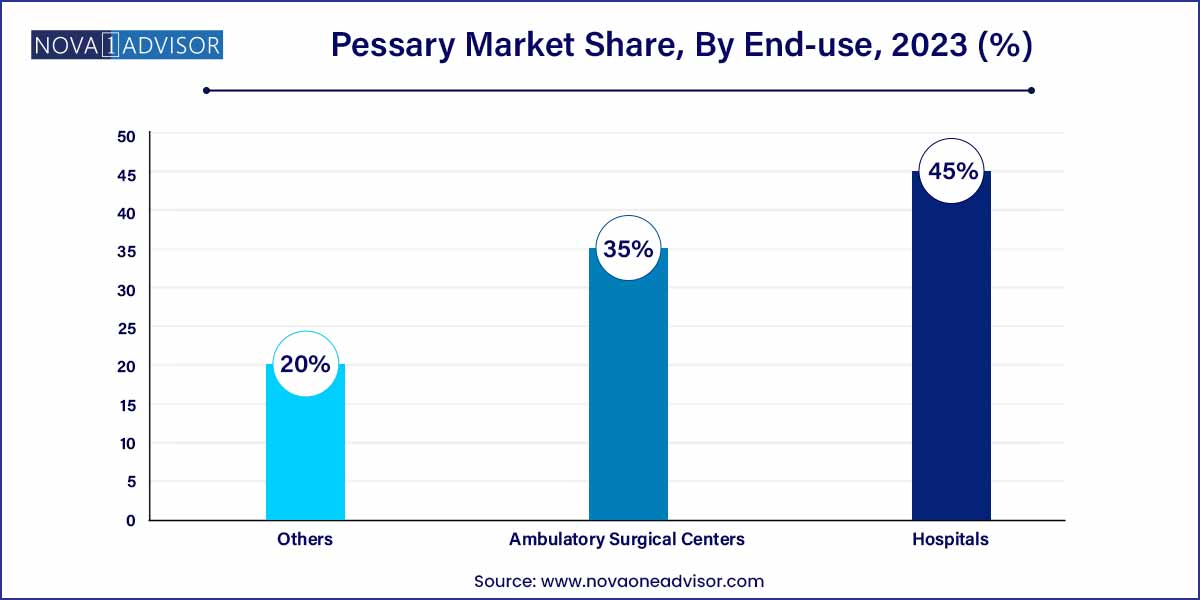

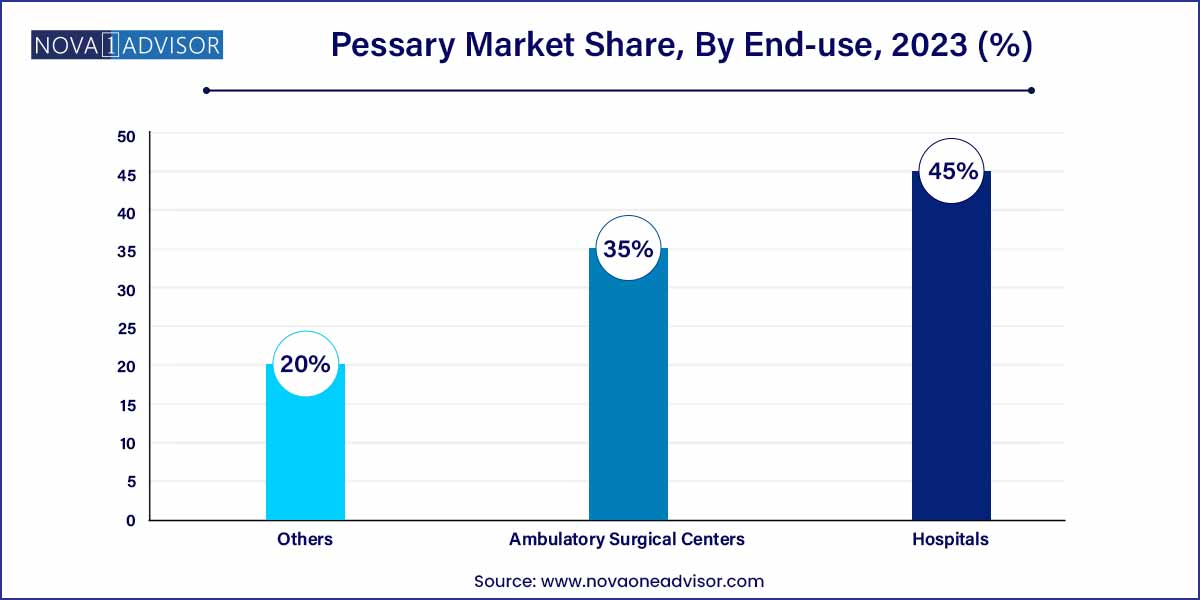

- The hospital segment accounted for the largest market revenue share of 45.0% in 2023.

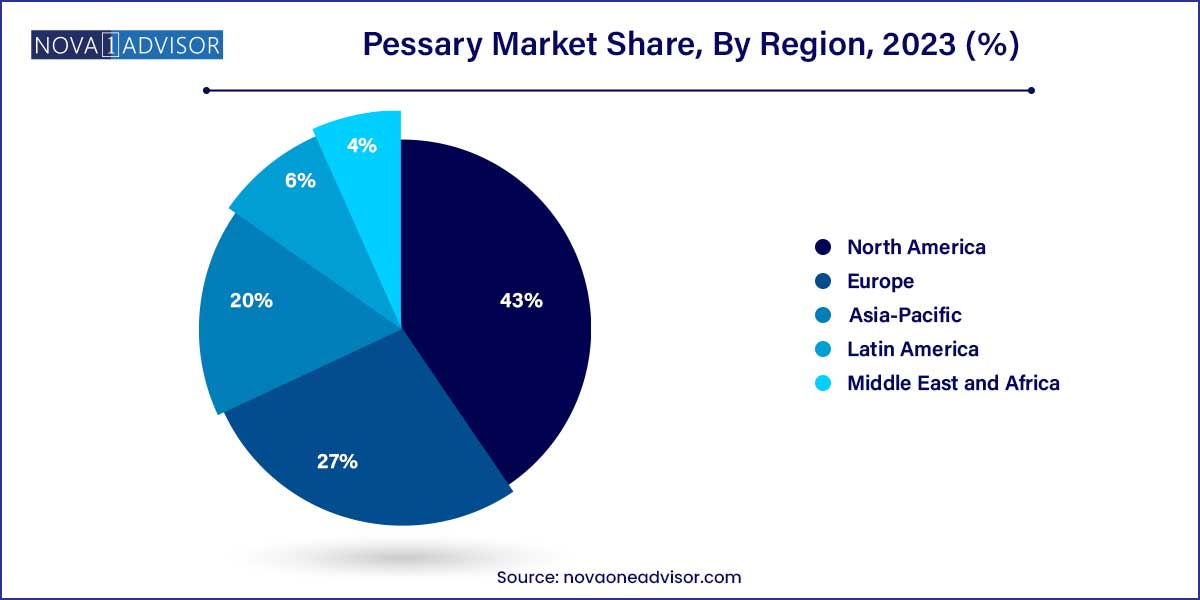

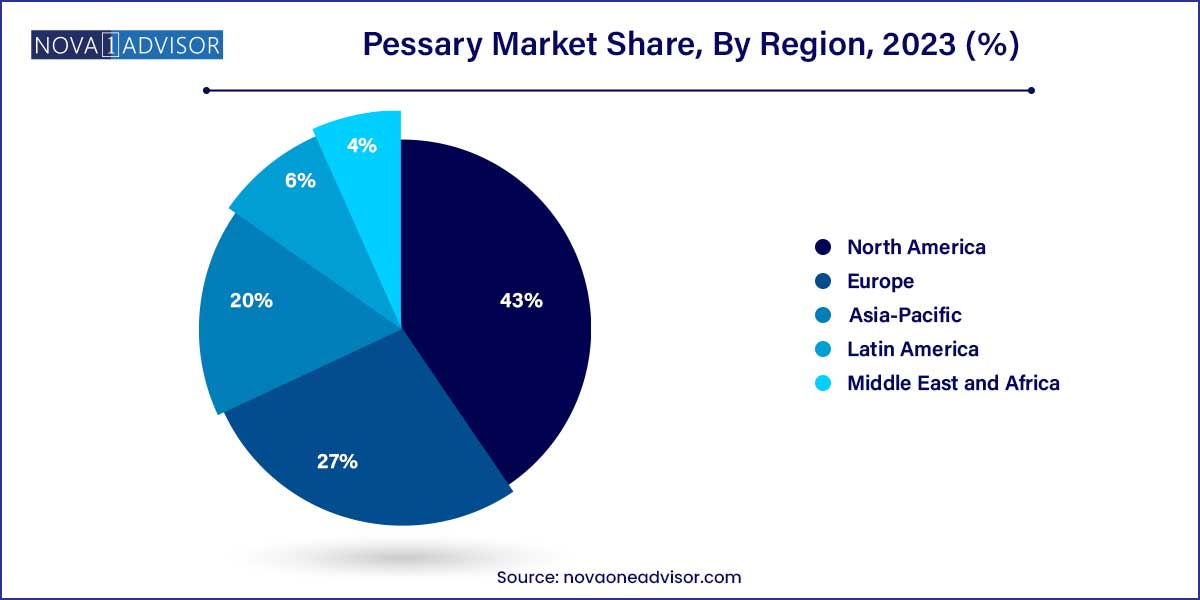

- North America dominated the market and accounted for the largest revenue share of 43.0% in 2023.

Market Overview

The global Pessary Market is steadily expanding, driven by the rising incidence of pelvic organ prolapse (POP) and urinary incontinence among women, particularly in aging populations. Pessaries, non-surgical devices inserted into the vagina to support the uterus, bladder, or rectum, offer an effective, minimally invasive management solution for these conditions. Their cost-effectiveness, reusability, and role in improving quality of life without the need for immediate surgical intervention have made them a preferred option in both developed and developing economies.

Technological advancements have led to the introduction of a wide range of pessaries tailored to different anatomical needs and patient preferences, including Gellhorn, ring, and donut pessaries. Increasing awareness among healthcare providers and patients regarding early diagnosis and non-invasive treatment options is further fueling market growth. In addition, manufacturers are investing in the development of biocompatible materials and more comfortable designs to enhance patient compliance.

However, the market faces certain challenges such as limited access to women's health services in low-resource settings and cultural stigmas associated with POP and incontinence. Despite these barriers, the global trend toward preventive healthcare and non-surgical therapies indicates a positive growth trajectory for the pessary market over the coming years.

Major Trends in the Market

-

Increasing Preference for Non-surgical Treatments: Demand for minimally invasive, cost-effective options is boosting pessary adoption.

-

Product Innovations in Pessary Designs: Development of more comfortable, durable, and easy-to-insert pessaries.

-

Aging Global Population: Higher prevalence of POP and stress urinary incontinence (SUI) among postmenopausal women is expanding the patient pool.

-

Rise in Awareness Campaigns: Initiatives by healthcare organizations promoting pelvic health are increasing patient education.

-

Integration of Telehealth Services: Remote consultations for pessary fitting and management are becoming more common.

-

Focus on Biocompatible and Hypoallergenic Materials: Advances in silicone-based and antimicrobial-coated pessaries are gaining traction.

-

Customized and Size-inclusive Products: Manufacturers are offering a wide range of sizes and types to cater to diverse anatomical needs.

-

Expansion of Ambulatory Care Services: Increasing use of pessaries in outpatient and ambulatory surgical center settings.

Pessary Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 412.80 Million |

| Market Size by 2033 |

USD 659.71 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 4.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

CooperSurgical Inc.; Bliss GVS Pharma; MedGyn; Panpac Medical Corporation; Bioteque America; Personal Medical Corporation; Dr. Arabin GmbH & Co. KG; Integra LifeSciences; Wallach Surgical Devices. |

Driver: Rising Prevalence of Pelvic Organ Prolapse and Urinary Incontinence

One of the primary drivers for the pessary market is the rising prevalence of pelvic organ prolapse (POP) and urinary incontinence, particularly among aging women. According to the International Urogynecological Association, approximately 50% of women over 50 experience some form of pelvic organ prolapse.

Pessaries offer a practical and non-invasive first-line treatment, providing relief from symptoms like vaginal pressure, urinary leakage, and discomfort. Given the growing emphasis on improving women’s quality of life, healthcare providers are increasingly recommending pessaries as a conservative treatment option before considering surgical intervention. As healthcare systems focus more on early intervention and non-invasive solutions, demand for pessaries is expected to rise significantly.

Restraint: Cultural Barriers and Lack of Awareness

Despite growing acceptance in clinical settings, cultural barriers and lack of awareness among patients remain significant challenges. In many regions, discussions around pelvic health issues are still stigmatized, leading women to delay seeking medical advice for symptoms of POP or incontinence.

Moreover, misconceptions regarding pessary use, such as concerns about discomfort, hygiene, or sexual activity, deter some patients from considering this option. Efforts by healthcare providers, advocacy groups, and educational campaigns are crucial in overcoming these barriers and fostering a more informed, open approach toward pelvic health management.

Opportunity: Technological Innovations and Personalized Solutions

An exciting opportunity for the pessary market lies in the advancement of product innovation and personalized fitting solutions. Manufacturers are focusing on designing pessaries with improved ergonomics, biocompatibility, and antimicrobial properties to enhance patient comfort and reduce risks such as vaginal infections.

Customizable and adjustable pessaries, 3D-printed prototypes, and advanced fitting kits are emerging trends that cater to individual anatomical variations, improving treatment outcomes. Companies investing in patient-centered innovations and collaborating with gynecologists and urogynecologists for clinical feedback are poised to capitalize on these growth opportunities.

Type Insights

Gellhorn pessaries dominated the pessary market in 2024. Known for their sturdy structure and effectiveness in treating advanced-stage pelvic organ prolapse, Gellhorn pessaries are widely used by healthcare professionals, particularly for women with significant uterine prolapse or vaginal vault prolapse post-hysterectomy. Their design, featuring a broad base and stem, provides robust support to weakened pelvic structures, enhancing their adoption in both hospital and outpatient settings.

Conversely, Ring pessaries are anticipated to experience the fastest growth during the forecast period. Ring pessaries, especially those with support, are ideal for mild to moderate prolapse cases and stress urinary incontinence. They are easy to insert, remove, and clean, allowing many women to self-manage their care. Their popularity is further boosted by increasing patient education efforts and broader usage in ambulatory settings and primary care clinics.

End-use Insights

Hospitals dominated the pessary market by end-use in 2024. Hospitals serve as primary points of care for women diagnosed with pelvic organ prolapse, offering a range of diagnostic and therapeutic services. Specialized urogynecology and obstetrics departments in hospitals are equipped with trained personnel to fit and manage pessary use, ensuring better clinical outcomes.

However, Ambulatory Surgical Centers (ASCs) are projected to grow at the fastest pace. ASCs offer convenient, efficient, and cost-effective options for pessary fittings and follow-up visits. The expansion of outpatient gynecological services and increasing preference for minimally invasive and outpatient treatments are supporting the adoption of pessary management in ASCs.

Regional Insights

North America accounted for the largest share of the pessary market in 2023. High awareness levels, strong healthcare infrastructure, availability of a wide range of pessary types, and favorable reimbursement policies contribute to the region's leadership. The United States, in particular, has seen significant efforts to destigmatize pelvic health issues, resulting in greater adoption of pessaries for managing prolapse and incontinence.

Moreover, initiatives like the "PFD (Pelvic Floor Disorders) Alliance" and American Urogynecologic Society's educational campaigns are playing a pivotal role in promoting early diagnosis and non-surgical treatment options.

Asia-Pacific is poised to witness the fastest growth in the pessary market over the forecast period. Rapidly aging populations in countries like Japan, China, and South Korea, coupled with improving access to women's healthcare services, are major growth drivers.

Awareness campaigns focusing on women's reproductive health, increasing urbanization, and expanding middle-class populations with greater access to healthcare facilities are contributing to the regional surge. Furthermore, governmental and non-governmental organizations in Asia are increasingly investing in maternal and elderly women's health, creating new opportunities for market penetration.

Recent Developments

-

March 2025: CooperSurgical Inc. launched a new silicone-based self-management Ring Pessary designed for enhanced patient comfort and ease of use.

-

January 2025: Bioteque America announced the release of a Gellhorn pessary with an antimicrobial coating to reduce the risk of vaginal infections during long-term use.

-

November 2024: MedGyn Products, Inc. partnered with leading gynecology clinics in Europe to expand access to a new line of customizable pessary fitting kits.

-

September 2024: Panpac Medical Corporation introduced 3D-printed pessary models to assist clinicians in better sizing and fitting pessaries for individual anatomical variations.

-

August 2024: Dr. Arabin GmbH & Co. KG launched educational webinars for healthcare providers focusing on best practices for pessary fitting and management.

Some of the prominent players in the pessary market include:

- CooperSurgical Inc.

- Bliss GVS Pharma

- MedGyn

- Panpac Medical Corporation

- Bioteque America

- Personal Medical Corporation

- Dr. Arabin GmbH & Co. KG

- Integra LifeSciences

- Wallach Surgical Devices

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pessary market.

Type

- Gellhorn

- Ring

- Donut

- Others

End-use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)