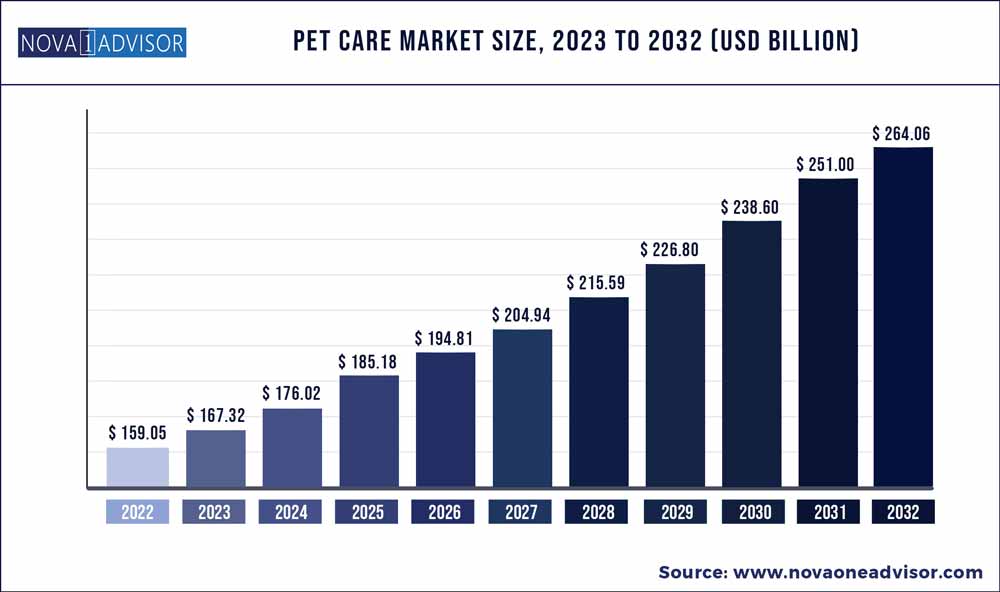

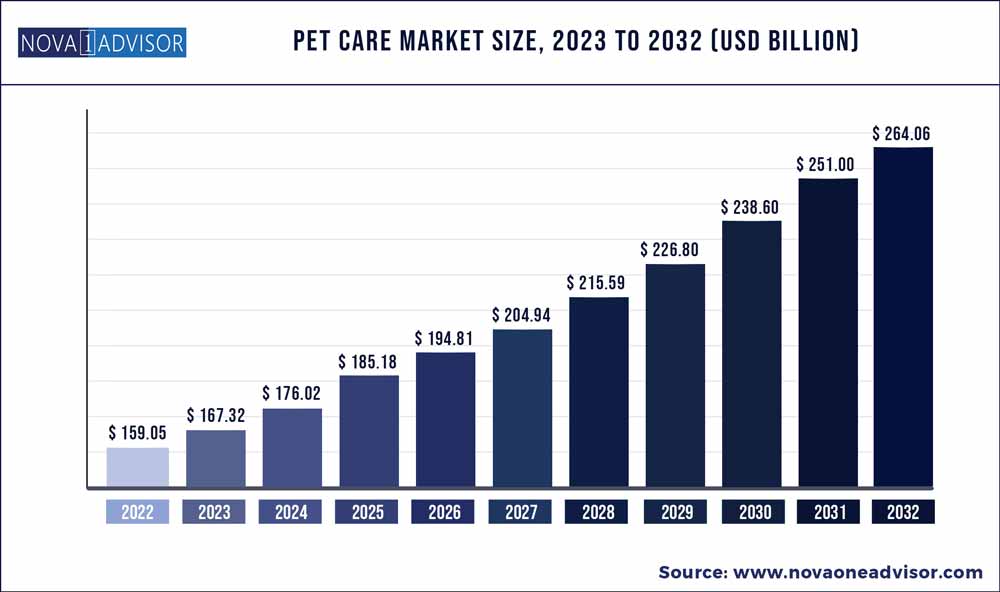

The global pet care market size was exhibited at USD 159.05 billion in 2022 and is projected to hit around USD 264.06 billion by 2032, growing at a CAGR of 5.2% during the forecast period 2023 to 2032.

Key Pointers:

- North America accounted for the largest revenue share of around 44.8% in 2022.

- Asia Pacific is expected to expand at the fastest CAGR of 5.7% during the forecast period.

- The dog segment accounted for over 40.19% of the revenue share in 2021.

- The cat pet type segment is projected to register a CAGR of 5.4% from 2023 to 2032.

- The product type segment accounted for over 55.9% of the revenue share in 2022.

- The pet food type segment is projected to register a CAGR of 5.4% from 2023 to 2032

Pet Care Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 167.32 Billion |

| Market Size by 2032 |

USD 264.06 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 5.2% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Pet type, Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ancol Pet Products Limited; Blue Buffalo Co., Ltd.; Champion Petfoods LP; Hill`s Pet Nutrition, Inc.; Mars, Incorporated; Nestle Purina PetCare; Petmate Holdings Co; Saturn Petcare GmbH; Tail Blazers; The Hartz Mountain Corporation |

The rising trend of pet humanization and increased consumer spending in the household and pet care categories are the major growth drivers. People are also adopting little pets (cats, dogs, etc.) Since they are easier to humanize and indulge than larger pets. As a result, people are willing to spend more to ensure their pets get the best care. Hence, pet care products such as feeders, bowls, and waterers have become more popular.

The pet sector has been exploding in recent years. According to the American Pet Products Association, about 85 million homes own a pet, with pet ownership increasing from 56 % to 68 % in the last 30 years. Technology and the introduction of internet purchases have contributed to some of the changes in pet ownership.

Many people were forced to stay at home for an extended amount of time as a result of COVID-19's impacts, whether owing to shelter-in-place orders or work-from-home advice. Soon after this increased time spent at home, and pet shelters recorded an increase in adoptions and fostering.

However, the majority of the expansion is due to cultural shifts. As millennial and Generation Z consumers have grown into adulthood, they have embraced their pet-owning and pet-loving lives significantly more than their predecessors. In 2020, households headed by the younger generation account for roughly 60% of pet ownership, whilst households headed by baby boomers account for about 30% of pet ownership.

Furthermore, pet owners are demonstrating a strong desire to learn more about pet health issues. They are promoting companion animal preventive care. As a result, responsible pet ownership has been increasingly popular in recent years. This is also a crucial trend that is driving pet care product sales and, as a result, the pet care industry.

Moreover, people are making lifestyle upgrades to mark their share in reducing the ecological footprint in daily lives which includes pet products too. A significant share of pet accessories is made with more sustainable and recyclable materials instead of plastics. For instance, in February 2022, Neo Bites became the first Carbon-negative dog food company in the U.S.

Some of the prominent players in the Pet Care Market include:

- Ancol Pet Products Limited

- Blue Buffalo Co., Ltd.

- Champion Petfoods LP

- Hill`s Pet Nutrition, Inc.

- Mars, Incorporated

- Nestle Purina PetCare

- Petmate Holdings Co

- Saturn Petcare GmbH

- Tail Blazers

- The Hartz Mountain Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Pet Care market.

By Pet Type

By Type

- Products

- Pet Litter

- Pet Grooming Products

- Fashion, Toys, and Accessories

- Food

- Dry Food

- Wet/ Canned

- Treats/ Snacks

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)