Pharmaceutical Contract Packaging Market Size and Research

The pharmaceutical contract packaging market size was exhibited at USD 17.25 billion in 2024 and is projected to hit around USD 34.57 billion by 2034, growing at a CAGR of 7.2% during the forecast period 2024 to 2034.

Pharmaceutical Contract Packaging Market Key Takeaways:

- Primary packaging led segment dominating the market with the largest revenue share of 76.6% in 2024.

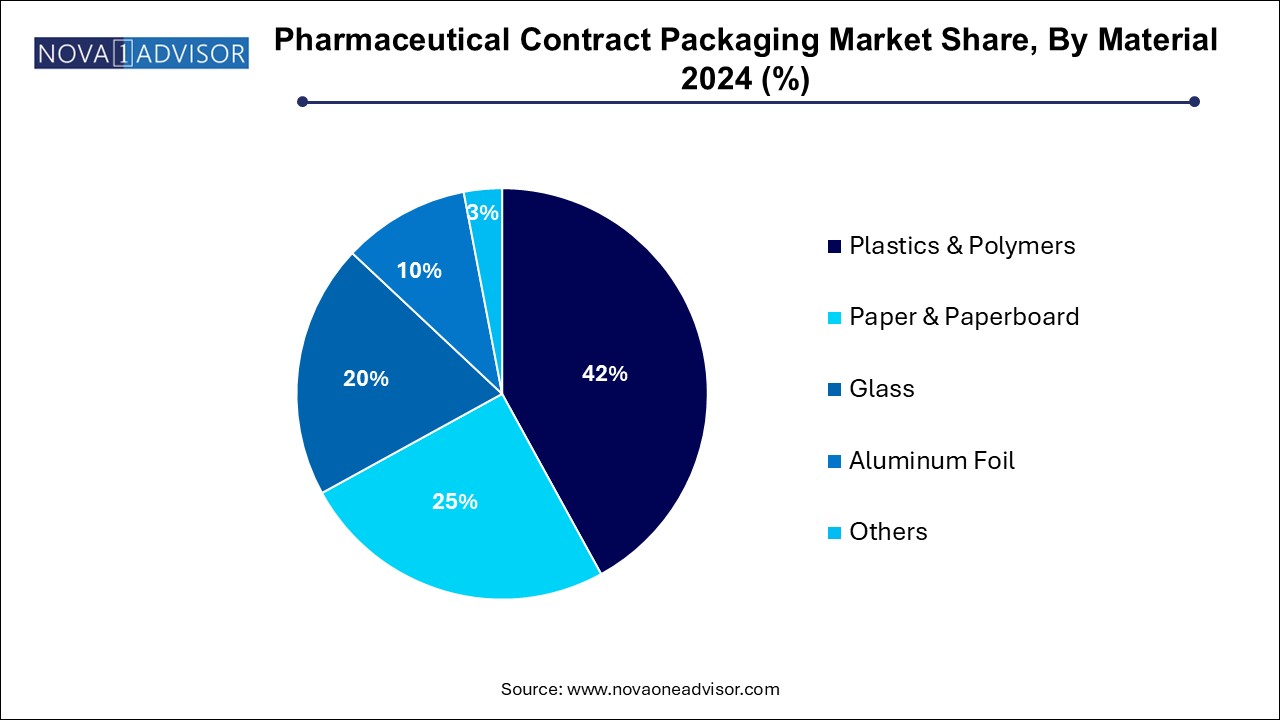

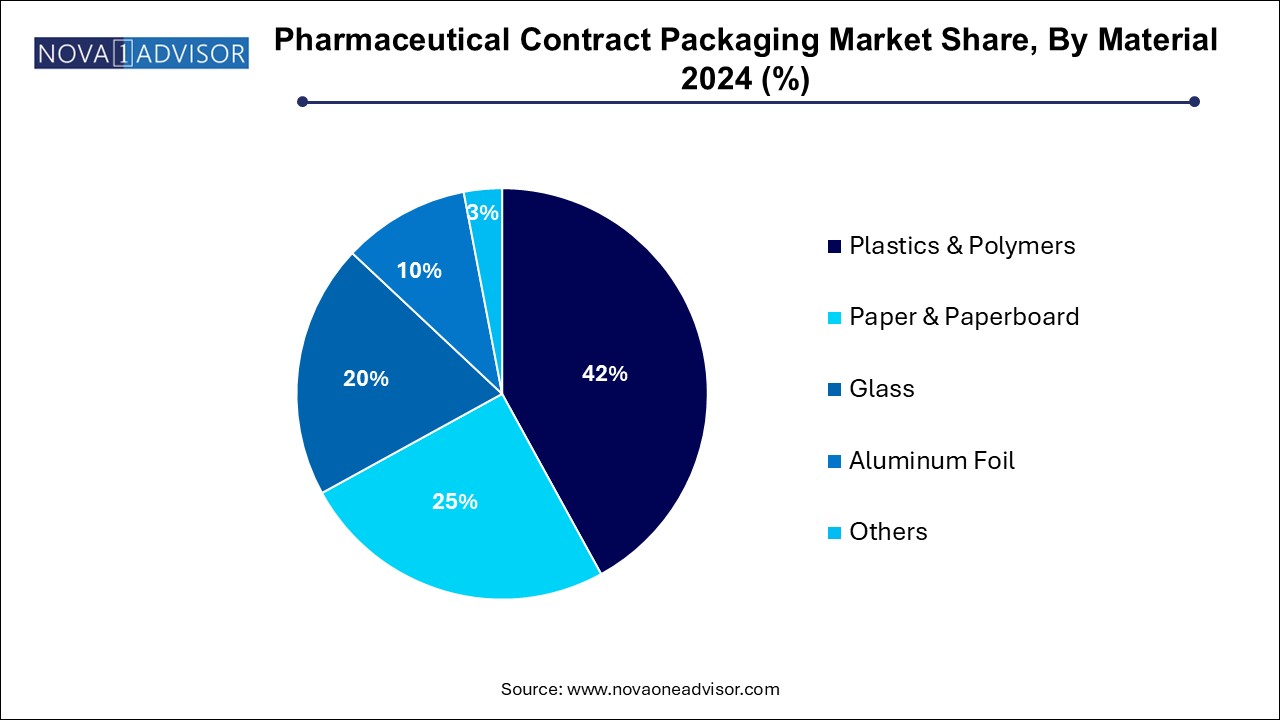

- The plastics and polymers segment contributed the largest revenue share, 42.0%, by 2024

- The paper & page segment is expected to grow at the highest CAGR of 7.65% during the forecast period.

- North America's pharmaceutical contract packaging market has dominated the global market and accounted for the largest revenue share of 36.0% in 2024

Market Overview

The pharmaceutical contract packaging market is a rapidly expanding subset of the global pharmaceutical manufacturing ecosystem, offering outsourced packaging solutions to drug manufacturers. These services encompass the design, engineering, testing, and production of packaging materials for pharmaceuticals ranging from primary, secondary, and tertiary packaging to specialty services such as serialization, cold chain handling, and regulatory labeling. Outsourcing packaging operations allows pharmaceutical companies to focus on their core competencies like R&D and marketing while reducing capital expenditure, maintaining flexibility, and ensuring compliance with increasingly complex regulatory demands.

Pharmaceutical contract packaging firms serve a broad client base, including large multinational pharmaceutical companies, biotechnology firms, generics manufacturers, and nutraceutical companies. The growing demand for customized, patient-friendly, and tamper-proof packaging, alongside technological advancements such as smart packaging and anti-counterfeit features, is reshaping the landscape. Moreover, the increasing emphasis on global supply chain efficiency and sustainability is pushing packaging providers to adopt new materials and digital systems.

The rising complexity of pharmaceutical products such as biologics, injectables, and personalized medicine requires highly specialized packaging formats that ensure product stability, traceability, and user safety. This has led to strategic partnerships between drug manufacturers and contract packaging organizations (CPOs) that possess the technological capabilities and regulatory expertise to meet global quality standards.

Major Trends in the Market

-

Surge in Biologics and Injectables: Biologics require specialized primary packaging such as sterile vials and pre-filled syringes, prompting innovation among contract packagers.

-

Adoption of Serialization and Track-and-Trace Technologies: Regulatory requirements like the U.S. Drug Supply Chain Security Act (DSCSA) and EU Falsified Medicines Directive (FMD) are driving investments in serialization.

-

Rise of Blister Packaging in Oral Solid Dosage Forms: Increasing demand for unit-dose formats and senior-friendly blister packs for better compliance.

-

Growth in Sustainable and Recyclable Packaging Materials: Pharma companies are pushing contract packagers to adopt eco-friendly solutions.

-

Digitalization of Packaging Lines: Integration of IoT, AI, and cloud-based monitoring tools is improving line efficiency and real-time quality assurance.

-

Cold Chain Packaging for Temperature-Sensitive Drugs: Demand is rising for thermally stable packaging, especially for vaccines, insulin, and biologics.

-

Expansion of Contract Packaging Services in Emerging Markets: Companies are setting up operations in Asia and Latin America to reduce costs and support regional market access.

Report Scope of Pharmaceutical Contract Packaging Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.86 Billion |

| Market Size by 2034 |

USD 5.41 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 12.6% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Component, Delivery Model, Function, End-use, Disorder |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Oracle (Cerner Corporation); Core Solutions, Inc.; Epic Systems Corporation; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualifacts; Welligent; SimplePractice, LLC; TherapyNotes, LLC.; TheraNest |

Market Driver: Increasing Demand for Outsourcing and Operational Flexibility

One of the key drivers of the pharmaceutical contract packaging market is the growing inclination of pharmaceutical companies to outsource packaging operations in order to improve flexibility, reduce time-to-market, and focus on core functions like drug development and commercialization. In a highly competitive and regulated industry, outsourcing packaging processes to specialized vendors offers considerable advantages in terms of scalability, compliance, and speed.

CPOs bring with them a wealth of expertise in Good Manufacturing Practices (GMP), FDA and EMA guidelines, and country-specific labeling norms, ensuring that the packaged product meets all regulatory requirements. Moreover, outsourcing allows drug manufacturers to minimize capital investments in high-tech packaging machinery and cleanroom facilities, which can be costly to install and maintain internally.

The increasing product diversity ranging from high-volume generics to low-volume orphan drugs necessitates adaptable packaging capabilities. Contract packagers can quickly scale operations up or down and provide custom solutions such as multi-dose kits, sample packaging, and patient adherence packaging, making them indispensable partners in the modern pharmaceutical value chain.

Market Restraint: Stringent Regulatory Compliance and Integration Challenges

Despite robust growth, the pharmaceutical contract packaging market faces a significant restraint in the form of complex regulatory requirements and integration challenges. As pharmaceutical packaging is directly tied to product efficacy and patient safety, it is subject to stringent validation, traceability, and quality control protocols across all regions.

Every market be it the United States, Europe, or Asia has its own specific regulations related to packaging materials, tamper-evidence, labeling, serialization, and barcode formats. For contract packagers operating in multiple jurisdictions, staying compliant with all evolving norms requires continuous investment in infrastructure, training, and technology.

Additionally, the integration of contract packaging services into pharmaceutical companies’ supply chains can present operational hurdles. Ensuring that the packaging partner aligns with internal timelines, serialization architecture, and product-specific requirements necessitates robust communication and quality agreements. Any lapse can result in recalls, regulatory sanctions, or reputational damage, limiting the appeal of outsourcing for certain segments of the pharmaceutical industry.

Market Opportunity: Expansion of Personalized and Specialty Drug Packaging

A key opportunity area in the market is the emergence of personalized medicine and specialty pharmaceuticals, which demand customized, low-volume, high-precision packaging solutions. As therapies become more targeted and patient-specific such as gene therapies, orphan drugs, and biologics the need for specialized primary packaging and individualized kitting solutions is growing.

These specialty products often have short shelf lives, unique handling requirements (e.g., cold chain logistics), and are delivered through non-traditional channels like home care. Contract packaging firms that can offer flexible batch sizes, rapid changeovers, and integrated logistics support are well-positioned to capitalize on this demand.

Additionally, smart packaging solutions, such as those equipped with sensors, RFID tags, or digital instructions, are increasingly being used for high-value drugs. These features enhance patient engagement, track adherence, and improve safety in decentralized clinical trials. As personalized healthcare continues to evolve, contract packaging organizations capable of agile, compliant, and tech-enabled operations will find ample growth opportunities.

Pharmaceutical Contract Packaging Market By Type Insights

Primary packaging holds the dominant share in the pharmaceutical contract packaging market. This includes direct contact packaging such as bottles, vials, ampoules, blister packs, and prefilled syringes. As the first line of defense for drug products, primary packaging plays a critical role in maintaining sterility, stability, and dosage accuracy. The growth of biologics and injectable therapeutics has particularly fueled demand for sterile vials, ampoules, and ready-to-administer packaging solutions. Contract packaging providers are investing in state-of-the-art filling lines, sterile barrier systems, and isolator technologies to support growing customer needs.

In contrast, tertiary packaging is the fastest-growing segment, especially with the expansion of global supply chains and the increasing need for serialization and cold chain compliance. Tertiary packaging involves bundling of products for storage, shipping, and distribution, and includes crates, pallets, and insulated shippers. With the growing emphasis on logistics optimization and anti-counterfeit protection, tertiary packaging solutions are being enhanced with track-and-trace elements, tamper-evident seals, and temperature indicators. Furthermore, the expansion of e-commerce and direct-to-patient delivery models is contributing to new formats of protective and secure outer packaging.

Pharmaceutical Contract Packaging Market By Material Insights

Plastics and polymers are the most widely used materials in pharmaceutical packaging due to their versatility, durability, and cost-effectiveness. Commonly used in bottles, blister films, caps, and dispensers, plastics such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) offer moisture resistance and adaptability to various drug formulations. Their compatibility with high-speed packaging lines and ability to support features like child-resistance and tamper evidence make them essential for both solid and liquid dosage forms.

Meanwhile, paper and paperboard are gaining popularity as the fastest-growing material segment, driven by sustainability goals and regulatory encouragement to reduce plastic usage. These materials are increasingly being used in secondary and tertiary packaging components such as cartons, leaflets, labels, and shipping boxes. Innovations like coated paperboard for blister backing, fiber-based clamshells, and recyclable labels are allowing paper to encroach on traditional plastic applications. Contract packagers are investing in material R&D and machinery upgrades to accommodate this eco-conscious shift.

Pharmaceutical Contract Packaging Market By Regional Insights

North America holds the largest share of the pharmaceutical contract packaging market, thanks to its mature pharmaceutical industry, strict regulatory oversight, and high R&D intensity. The U.S. alone contributes a substantial portion, with companies outsourcing packaging to meet growing demands for speed, compliance, and quality. Additionally, the enforcement of serialization laws under the Drug Supply Chain Security Act (DSCSA) has led to widespread adoption of track-and-trace-enabled packaging lines.

The region is also witnessing a rise in biologic drug approvals, which require specialized primary packaging solutions and cold chain capabilities. Major contract packagers like PCI Pharma Services, Catalent, and Sharp have expanded their facilities and invested in automation, robotics, and digital inspection technologies to cater to U.S.-based pharma clients. North America’s robust reimbursement framework and technological sophistication further reinforce its leadership in the global market.

Asia-Pacific is the fastest-growing market for pharmaceutical contract packaging, driven by rapid industrialization, increased healthcare access, and the rise of local pharmaceutical manufacturing hubs. Countries like China, India, Japan, and South Korea are seeing strong growth in both domestic demand and export-oriented drug production. The relatively lower operating costs, skilled labor, and improving regulatory standards have made the region attractive to multinational pharmaceutical companies looking to outsource packaging operations.

India, in particular, is emerging as a global contract manufacturing and packaging destination, supported by government initiatives like “Make in India” and the expansion of industrial clusters specializing in life sciences. Local CPOs are upgrading their infrastructure to meet international GMP standards, while global players are setting up joint ventures and facilities across the region. As regulatory harmonization and innovation continue, Asia-Pacific is set to be a vital growth engine in the coming years.

Some of the prominent players in the pharmaceutical contract packaging market include:

- Amcor plc

- BALL CORPORATION

- Nipro Corporation

- Daito Pharmaceutical Co. Ltd.

- Pfizer CentreOne,

- CELESTICA INC.

- West Pharmaceutical Services, Inc.

- WestRock Company

- Patheon

- Baxter BioPharma Solutions.

Pharmaceutical Contract Packaging Market Recent Developments

-

February 2025: Catalent Inc. opened a new high-speed vial packaging line at its Bloomington, Indiana facility to support increased biologics production and contract packaging services for vaccine manufacturers.

-

December 2024: PCI Pharma Services announced the expansion of its biotech center in Philadelphia, adding new isolator-based sterile fill-finish and packaging capabilities for injectable drugs.

-

October 2024: Sharp Packaging Solutions launched a new serialization-enabled secondary packaging line in its Netherlands facility, aligned with EU FMD compliance.

-

August 2024: Gerresheimer AG introduced a recyclable primary plastic packaging line for oral solids aimed at reducing the company’s carbon footprint and improving patient engagement through smart label integration.

-

June 2024: Schott Pharma entered a strategic partnership with an Asian CDMO to expand its prefillable syringe offering in the APAC region, focusing on high-growth biologics markets.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pharmaceutical contract packaging market

By Type

-

- Bottles

- Vials

- Ampoules

- Blister Packs

- Others

- Secondary Packaging

- Tertiary Packaging

By Material

- Plastics & Polymers

- Paper & Paperboard

- Glass

- Aluminum Foil

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)