Pharmaceutical Packaging Market Size and Trends

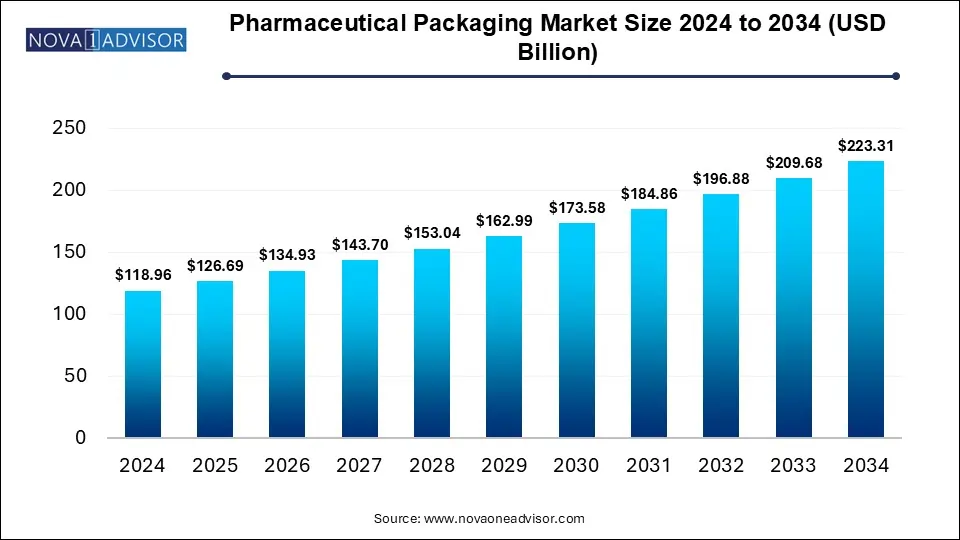

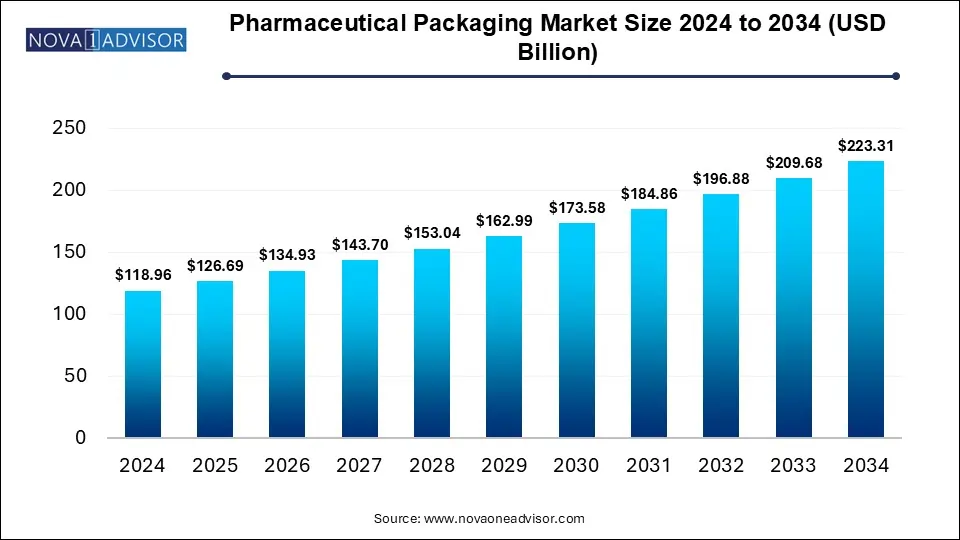

The global pharmaceutical packaging market size is calculated at USD 118.96 billion in 2024, grows to USD 126.69 billion in 2025, and is projected to reach around USD 223.31 billion by 2034, growing at a CAGR of 6.5% from 2025 to 2034. The growth of the pharmaceutical packaging market is driven by the advancements in smart packaging technologies, high demand for user-friendly and sustainable packaging, and rising healthcare expenditure due to increased prevalence of chronic diseases.

Key Takeaways

- North America dominated the pharmaceutical packaging market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market over the forecast period.

- By product, the plastic bottle segment held the major market share in 2024.

- By product, the parenteral container segment is anticipated to witness lucrative growth in the market over the forecast period.

- By material type, the plastics and polymers segment contributed the biggest market share in 2024.

- By material type, the glass is expected to register the fastest growth during the forecast period.

How is the Pharmaceutical Packaging Market Evolving?

Pharmaceutical packaging refers to the use of materials, processes and systems for enclosing and protecting medicinal products from the time of their manufacturing till they reach the consumer. The packaging safeguards pharmaceuticals from light, moisture, physical damage and temperature fluctuations, further ensuring their safety, efficacy and integrity throughout their lifecycle.

Increased demand for pharmaceutical biologics as well as growing adoption of biosimilars, focus on developing patient-centric and user-friendly designs, integration of smart technologies like QR codes and RFID tags, rising popularity of gel capsules and stringent global regulations like the European Union’s Packaging and Packaging Waste Regulation (PPWR) and Corporate Sustainability Reporting Directive (CSRD) are the factors driving the growth of the pharmaceutical packaging market.

What are the Key Trends in the Pharmaceutical Packaging Market in 2025?

- In May 2025, Tjopack, an international contract packaging organization, launched its Customer Collaboration Dashboard which is a breakthrough digital platform developed for streamlining collaboration between Tjoapack and its clients in the pharma supply chain.

- In January 2025, SGD Pharma introduced its Sealian platform at Pharmapack, a European trade show for pharmaceutical packaging. The innovative platform is an internal treatment for glass vials creating a barrier coating for preserving the integrity of sensitive therapeutic products inside the vials, further mitigating any interactions with the packaging and enhancing chemical durability for alkaline solutions.

What Role is AI Playing in the Pharmaceutical Packaging Market?

Integration of artificial intelligence in pharmaceutical packaging can potentially streamline workflows and enhance the efficacy and safety of pharmaceutical goods being transported. AI-powered inspection systems can be applied for identification of defects like empty pockets and broken tablets in blister packs and also for other type packaging, further ensuring only high-quality products will be received by the consumers. Designing and optimization of packaging dimensions can be achieved with AI for minimizing space utilization and maximizing pallet capacity. Furthermore, AI algorithms can be applied for supply chain management, enhancing safety and security of packaged goods, for facilitating the Artwork and Artwork Management Systems (AMS) for labelling as well as standardization and optimization of material specifications.

Report Scope of Pharmaceutical Packaging Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 126.69 Billion |

| Market Size by 2034 |

USD 223.31 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Material type, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Amcor plc., Aptar Group, Inc., Berry Global Group, Inc., BD (Becton, Dickinson and Company), Catalent Inc., CCL Industries Inc., Gerresheimer AG, Nipro Corporation, SCHOTT Pharmaceutical Packaging, West Pharmaceutical Services, Inc. |

Market Dynamics

Drivers

Why is the Growth of the Pharmaceutical Industry Considered the Major Driver for the Packaging Market?

The pharmaceutical packaging market is an essential part of the pharmaceutical industry for meeting the evolving needs of this multifaceted sector. Rising global population and aging demographics leading to increased prevalence of chronic and lifestyle related disorders are creating high demand for medications to extend life expectancy. Increased medical expenditure with advancements in healthcare infrastructure in various regions, especially emerging economies as well as growing adoption of generic drugs is driving the need for cost-effective, compliant and innovative packaging solutions.

Restraints

High Costs of Raw Materials and Manufacturing

Rising costs of related with procurement and production of packaging materials as well as continuous fluctuations in raw material prices can significantly impact the overall costs of packaging solutions for manufacturers focused on maintaining competitive pricing. Geopolitical tensions, cuts in production, energy prices and global demand shifts can lead to price volatility of raw materials such petroleum-based products like plastics and adhesives, metals, glass and specialty materials. Manufacturing of packaging solutions, need for skilled labor as well as adherence to the stringent pharmaceutical regulations like cGMP, serialization and environmental standards requires substantial investments for advanced equipment, quality control and validation procedures which can potentially restrain the market growth for small pharmaceutical companies or budget-conscious companies.

Opportunities

Sustainable and Eco-Friendly Packaging Solutions

Several governments and organizations across the world are imposing stringent regulations for mitigating plastic waste, lowering carbon emissions and promotion of circular economies. High demand from investors, consumers and environment responsibility initiatives by manufacturers themselves is driving the adoption of eco-friendly packaging solutions like use of sustainable materials, increased recycled content and reducing packaging waste. Pharmaceutical packaging suppliers are focused on expanding their product offerings with advanced packaging solutions tailored to consumer needs, reduced costs and usage of innovative materials like biodegradable polymers, plant-based plastics and mono-materials for easy recycling, integration of recycled content and optimization of designs requiring less materials for reducing transport weight is leading to efficient waste management for pharmaceutical companies.

- For instance, in December 2024, the Department of Regulation and Prequalification of the World Health Organization (WHO) issued a call for action through its “Greener pharmaceuticals’ regulatory highway” initiative for driving sustainability in the pharmaceutical manufacturing and distribution sector. The initiative underscores the need for establishing new standards and guidance promoting sustainable manufacturing, packaging, distribution, and use of medical products for reducing the environmental footprint while ensuring adherence to safety and efficacy standards.

Segmental Insights

The Plastic Bottle Segment Dominated

By product, the plastic bottle segment dominated the market with the largest share in 2024. Plastics are remarkably lighter in weight than glass, potentially lowering shipping costs and reducing carbon footprint during transport making them highly desirable for handling massive volumes of products in the global supply chain. Patient-centric features of plastic bottles like easy to use, child-resistant closures (CRCs), tamper-evident seals and enabling dosage accuracy through measuring lines or integrated droppers are enhancing their reliability. Furthermore, rising demand for pharmaceuticals, ongoing advancements in manufacturing technologies as well as high durability and shatter-resistance offered by plastics are the factors fuelling the market expansion of this segment.

The Parenteral Container Segment Fastest CAGR

By product, the parenteral container segment is anticipated to witness lucrative growth in the market over the forecast period. The market growth of this segment is driven by the rising demand for injectable drugs and biologics, growing preference for advanced therapies due to increasing chronic disease prevalence, growth in production of vaccines, stringent regulatory requirements focused on patient safety, and innovations in packaging materials and designs.

The Plastics and Polymers Segment’s Largest Share

By material type, the plastics and polymers segment accounted for the largest market share in 2024. Plastics and polymers offer high versatility and flexibility in designing them in various shapes and sizes such as rigid bottles and blister packs for tailoring packaging solutions for several drug forms like liquids, solids and injectable making them compatible for meeting patient needs, dosing accuracy while maintaining brand aesthetics. Additionally, low production costs, enhanced compatibility with sterilization procedures, continuous innovation in sustainable plastics, and rising demand for biologics, injectable drugs and vaccines are the factors boosting the market growth of this segment.

The Glass Segment: Fastest Growing

By material type, the glass segment is expected to register the fastest growth during the forecast period. Glass packaging is high non-reactive and inert in nature, making it suitable for sensitive drug formulations ensuring their purity, stability and efficacy. Use of clear glass bottles or vials enhances the transparency in visual inspection of drug product. Moreover, rising demand for ready-to-use (RTU) and pre-filled systems for faster drug administration and mitigating medication errors as well as the thermal stability and durability offered by glass for various sterilization methods is further driving their adoption and contributing to the market growth.

- For instance, in October2024, Nipro PharmaPackaging launched its new D2F (Direct-to-Fill) glass vials offering a high-quality ready-to-use (RTU) solution which is powered by Stevanato Group’s advanced EZ-fill technology.

Regional Insights

What Drives North America’s Dominance in the Global Pharmaceutical Packaging Market?

North America dominated the global pharmaceutical packaging market in 2024. The region’s market dominance is primarily driven the presence of large pharmaceutical production base, rising investments in pharmaceutical R&D and increased adoption of biosimilars and generic drugs. Robust healthcare infrastructure, increased spending on healthcare, growing emphasis on patient-centric and convenient packaging, integration of smart technologies and rising focus on sustainable packaging solutions are the factors bolstering the market growth.

Furthermore, strict regulations for drug safety, integrity and traceability imposed by regulatory bodies like the U.S. FDA’s Drug Supply Chain Security Act (DSCSA) which requires strong track-and-trace systems and serialization for pharmaceutical products is enabling the adoption of advanced packaging features like anti-counterfeiting technologies, tamper-evident seals and unique identifiers by packaging manufacturers.

How is Asia Pacific’s Leading Growth Transforming the Pharmaceutical Packaging Market?

Asia Pacific is anticipated to witness lucrative growth in the market over the forecast period. Rising investments in pharmaceutical industry by key regional players like India and China, surge in number of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs), huge population base, increasing disposable incomes and growing chronic disease burden are the factors contributing to the market growth. Moreover, initiatives by various governments for advancing healthcare infrastructure, expansion of distribution channels, integration of smart and sustainable packaging solutions, and evolving regulatory frameworks focused on drug safety and patient compliance are expected to drive the market growth in the upcoming years.

Some of The Prominent Players in The Pharmaceutical Packaging Market Include:

- Amcor plc.

- Aptar Group, Inc.

- Berry Global Group, Inc.

- BD (Becton, Dickinson and Company)

- Catalent Inc.

- CCL Industries Inc.

- Gerresheimer AG

- Nipro Corporation

- SCHOTT Pharmaceutical Packaging

- West Pharmaceutical Services, Inc.

Recent Developments in the Pharmaceutical Packaging Market

- In February 2025, Systech, a subsidiary of Markem-Imaje and Dover, launched UniSecure art AI, an innovative AI-powered, cloud-based SaaS authentication solution designed for securing packaging quality, safeguarding brands and protecting patients. The solution provides real-time results and forensic analysis by leveraging existing packaging artwork and AI applications like machine vision and learning with the aim of helping users to address problems encountered by companies in the life sciences and pharmaceutical industries.

- In January 2025, DS Smith, a British multinational packaging business, launched TailorTemp, an innovative temperature-controlled packaging solution designed for the pharmaceutical industry which was revealed at the PharmaPack Europe 2025. The solution offers strictly controlled temperature environments tailored for supporting the sustainability initiatives of pharmaceutical and biotech businesses, further enabling storage and transport of delicate medicinal products across multiple territories.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Parenteral Container

- Plastic Bottle

- Blister packing

- Specialty Bags

- Closures

- Labels

- Others

By Material type

- Glass

- Aluminum Foils

- Plastics and Polymers

- Paper and Paperboards

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)