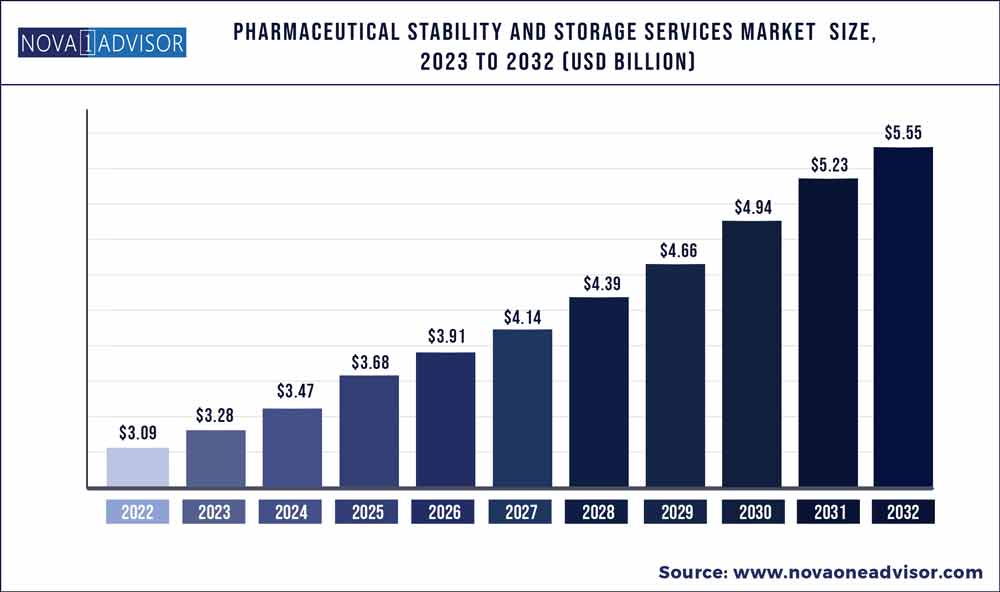

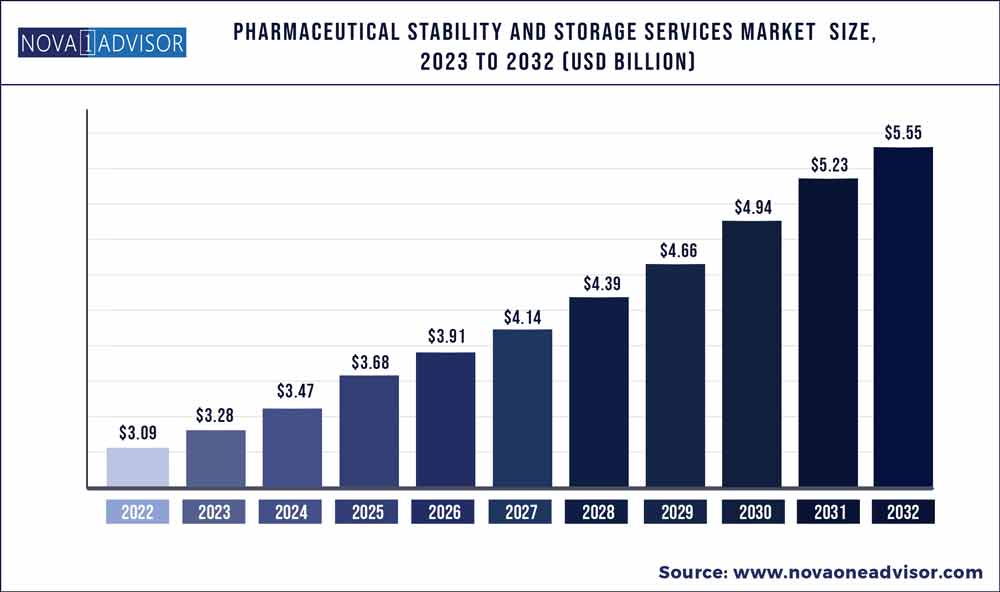

The global pharmaceutical stability and storage services market size was exhibited at USD 3.09 billion in 2022 and is projected to hit around USD 5.55 billion by 2032, growing at a CAGR of 6.03% during the forecast period 2023 to 2032.

Key Pointers:

- North America generated more than 54.9% of the revenue share.

- Asia Pacific is expected to expand at the biggest CAGR of around 7.1% between 2023 and 2032.

- The stability services segment captured more than 73.8% of the revenue share in 2022.

- The storage services segment is projected to grow at the fastest rate between 2023 and 2032.

- The small molecule segment generated the highest revenue share of around 64.5% in 2022.

- The large molecule segment is predicted to expand at the fastest rate between 2023 and 2032.

- The in-house mode segment contributed the highest share of around 61.2% in 2022.

- The outsourcing mode segment is expected to grow at the fastest rate between 2023 and 2032.

Pharmaceutical Stability and Storage Services Market Report Scope

The global market has noticed critical growth on account of the rising R&D investments by pharmaceutical companies owing to the high burden of chronic and infectious diseases. Pharmaceutical organizations are increasingly focusing on their R&D activities to stay competitive & flexible. As per the estimates of Evaluate Pharma, the pharmaceutical R&D spending accounted for USD 183 billion, in 2018, whereas in 2021 it increased by 16.6% and accounted for USD 213 billion.

The COVID-19 pandemic has significantly impacted the storage and stability market. During the crisis, global pharmaceutical stability and storage services providers played a predominant role in meeting the needs of pharmaceutical companies, biotech companies, contract research organizations, and other end users. These organizations have been actively working towards the development of pharmaceutical samples, APIs, small & large molecules, and other pharmaceutical products.

In recent years the demand for biosimilar has improved significantly, as they are highly similar to biologics and are generally cheaper than biologics. Biosimilar has gained significant popularity in treating cancer, autoimmune diseases, and other chronic diseases. The high burden of these diseases globally is expected to fuel the demand for biosimilars and thus promote the demand for stability and storage of biosimilars. Different regulatory authorities have different data requirements and testing rules for testing stability, which makes it difficult to market products, especially across different markets. This is expected to boost the demand for outsourcing services in the market.

The COVID-19 pandemic has significantly increased demand for biological medicines like vaccines, as of 15th April 2022, over 349 vaccines were under development as per the WHO. This is expected to improve the demand for stability and storage of COVID-19 vaccines in clinical trials. Owing to the high burden of COVID-19, many COVID-19 vaccines received emergency approval. Such actions are likely to contribute to the demand for stability and storage of commercial vaccines.

Market Dynamics

Global Pharmaceutical Stability and Storage Services Market Drivers

Rapid Demand for Vaccines

Demand for commercial COVID-19 vaccines that are stable and can be stored for an extended period is likely to increase as the government authorities ramp up their vaccination efforts. The amount spent on research and development in the pharmaceutical industry has seen significant growth in recent years. It is anticipated that the rising spending on research and development will increase the number of drugs. To receive approval for each phase of a clinical trial, one must first conduct stability testing, another factor driving the market growth. Additionally, compared to biological drugs, the cost of biosimilar drugs is much lower because they are nearly identical copies of biological drugs.

Increasing Demand for Biosimilar

Due to their close resemblance to biologics and typically lower cost, the demand for biosimilars has significantly increased in recent years. Biosimilar has gained considerable traction in treating cancer, autoimmune diseases, and other chronic conditions. The demand for biosimilars is expected to rise along with the need for their stability and storage due to these diseases' widespread prevalence worldwide. Marketing products across markets is challenging because various regulatory authorities have different data requirements and testing guidelines for determining a product's stability. This is anticipated to increase market demand for outsourcing services.

Global Pharmaceutical Stability and Storage Services Market Restraint

Rare Highly Skilled Workers

Providers of pharmaceutical stability and storage services face difficulties attracting and retaining highly skilled personnel. These companies compete for qualified and experienced scientists in pharmaceutical, biotechnology, medical device, contract research, and academic and research institutions. The expansion of the pharmaceutical industry toward novel molecular structures and mechanisms of action contributes to the shortage of skilled specialists in this field. To create training programs tailored to the healthcare industry, pharmaceutical companies, CROs, and healthcare analytical testing companies must work together.

Some of the prominent players in the Pharmaceutical Stability and Storage Services Market include:

- Catalent, Inc.

- Charles River Laboratories International, Inc

- Almac Group

- Eurofins Scientific

- Lucideon Limited

- Intertek Group Plc

- Alcami Corporation

- Element Materials Technology

- Q1 Scientific

- BioLife Solutions

- Masy BioServices

- Roylance Stability Storage Limited

- Reading Scientific Services Ltd.

- Als Ltd.

- Auriga Research Private Limited

- Q Laboratories

- Precision Stability Storage

- PD Partners

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Pharmaceutical Stability and Storage Services market.

By Services

- Stability

- Drug Substance

- Stability indicating method validation.

- Accelerated stability testing.

- Photostability Testing

- Other stability testing methods

- Storage

- Cold

- Non-cold

By Molecule

- Small Molecule

- Research Products

- Commercial Products

- Large Molecule

- Research Products

- Commercial Products

By Mode

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)