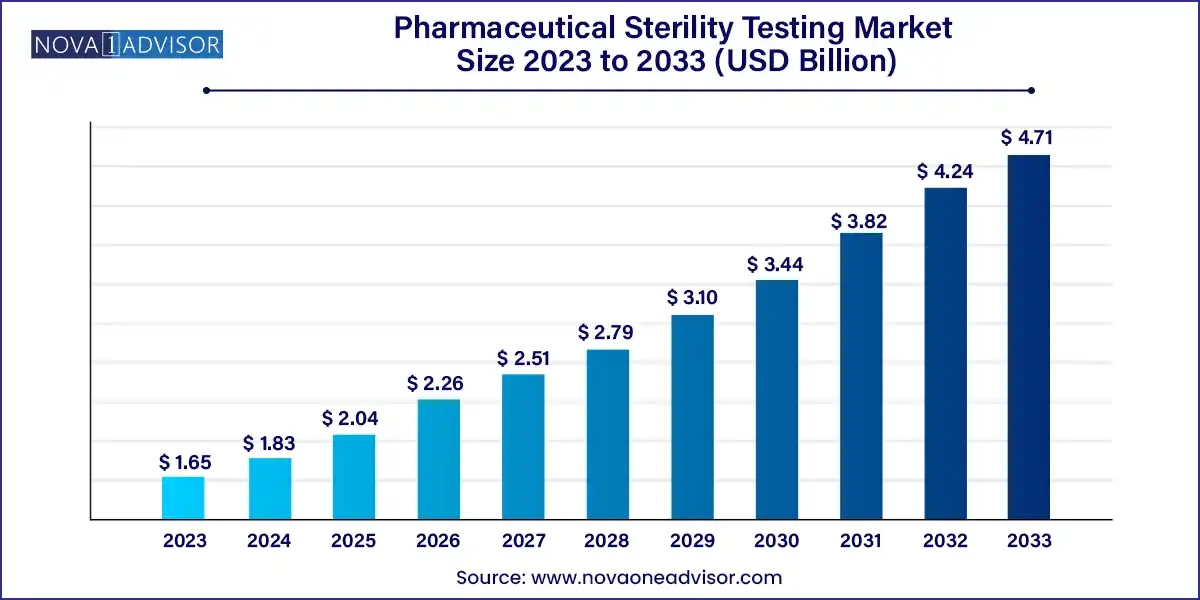

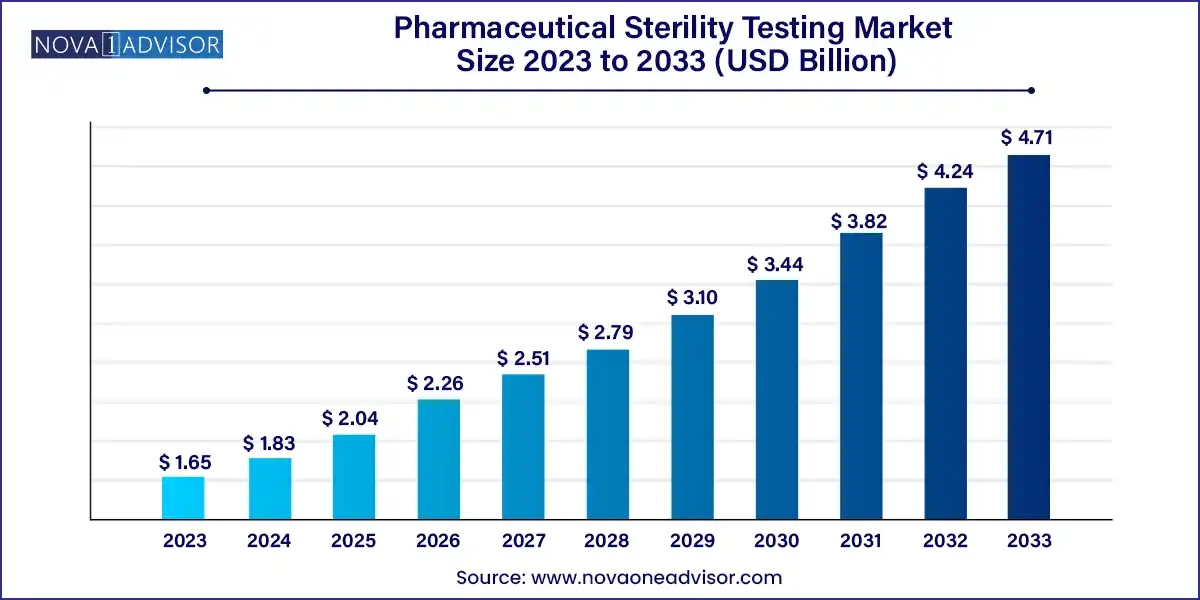

The global pharmaceutical sterility testing market size was exhibited at USD 1.65 billion in 2023 and is projected to hit around USD 4.71 billion by 2033, growing at a CAGR of 11.06% during the forecast period 2024 to 2033.

Key Takeaways:

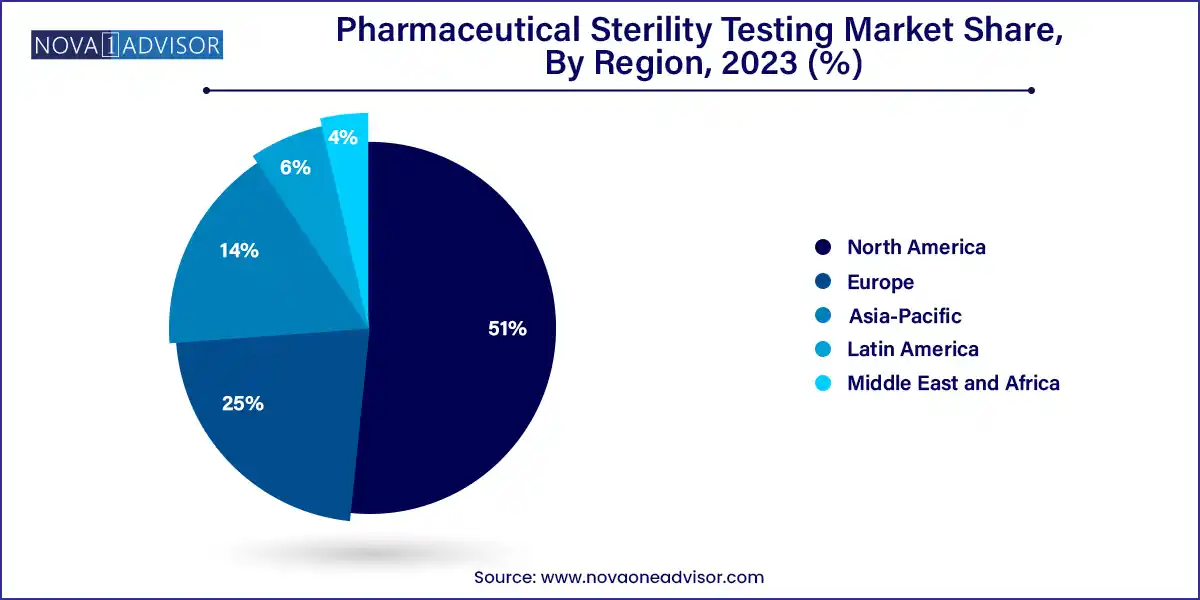

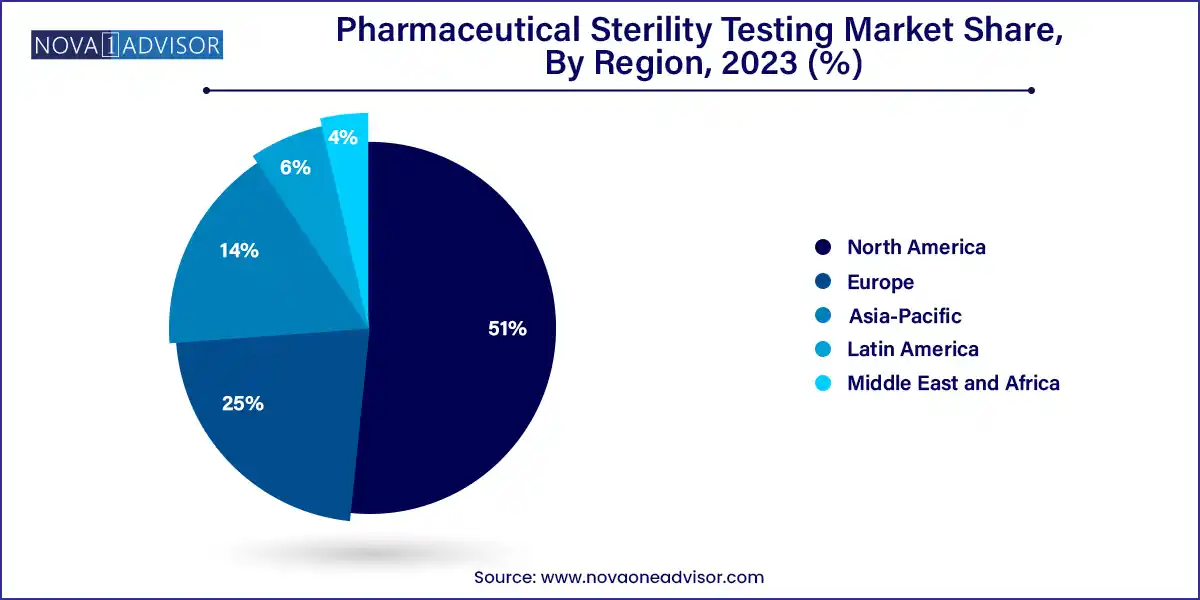

- North America dominated the market with the revenue share of 51.0% in 2023.

- Based on type, the outsourcing segment led the market with the largest revenue share of 59.25% in 2023.

- Based on product type, the kits & reagents segment held the market with the largest revenue share of 60.30% in 2023.

- Based on test-type, the bioburden testing segment held a market with the largest revenue share of 41.71% in 2023.

- Based on sample, thepharmaceuticals companies segment held the market with the largest revenue share of 45.0% in 2023.

- Based on end-use, the pharmaceutical companiessegment held a market with the largest revenue share of 42.45% in 2023.

Market Overview

The Pharmaceutical Sterility Testing Market has become a critical segment within the global pharmaceutical quality assurance framework. Sterility testing is a fundamental process in ensuring that pharmaceutical and biopharmaceutical products, as well as medical devices, are free from viable contaminating microorganisms. It is particularly crucial for injectable drugs, ophthalmic solutions, tissue-based products, and other sterile formulations, where contamination can result in severe consequences for patient safety and regulatory compliance.

The increasing complexity of pharmaceutical manufacturing, rising global demand for biologics, personalized medicines, and advanced medical devices, along with evolving regulatory standards, is driving the demand for precise, rapid, and reliable sterility testing solutions. The market spans a range of products and services, including membrane filtration systems, direct inoculation techniques, bacterial endotoxin tests, bioburden tests, and analytical kits and reagents. It also includes both in-house testing setups and outsourced services, catering to pharmaceutical companies, contract manufacturers, and compounding pharmacies.

As pharmaceutical supply chains globalize, sterility testing is becoming more rigorous and standardized. Regulatory bodies such as the U.S. FDA, EMA, WHO, and USP are tightening sterility requirements, especially for sterile injectables, biosimilars, and cell and gene therapies. In this high-stakes environment, sterility testing is no longer seen as a post-production step but an integrated component of Good Manufacturing Practices (GMP), quality control, and product lifecycle management.

Technological innovations such as rapid microbial methods, closed-system transfer devices (CSTDs), and real-time monitoring tools are redefining traditional sterility protocols. With the rise of outsourcing trends, particularly among small-to-mid-sized companies, third-party sterility testing labs and CROs (Contract Research Organizations) are experiencing significant growth. As the industry evolves toward automation, digitization, and regulatory harmonization, the pharmaceutical sterility testing market is poised for robust and sustained expansion.

Major Trends in the Market

-

Shift Toward Rapid Sterility Testing: Companies are investing in rapid microbial detection techniques to reduce turnaround time from 14 days to under 7 days.

-

Rise in Outsourced Sterility Services: Pharmaceutical and biopharmaceutical firms increasingly outsource sterility testing to specialized labs and CROs to reduce cost and improve compliance.

-

Integration with Digital QC Platforms: Sterility testing data is being integrated with LIMS (Laboratory Information Management Systems) for real-time reporting, traceability, and audit readiness.

-

Increased Testing for Biologics and ATMPs: The expansion of advanced therapy medicinal products (ATMPs), including cell and gene therapies, requires novel sterility strategies due to small batch sizes and rapid delivery cycles.

-

Adoption of Closed and Isolator Systems: Modern isolators and cleanroom systems are replacing open-system testing to minimize contamination and manual error.

-

Regulatory Emphasis on Endotoxin Testing: The FDA and USP have updated guidelines to emphasize bacterial endotoxin testing in parenteral formulations and medical devices.

-

Automation of Sample Preparation and Processing: Robotics and automated filtration/inoculation systems are reducing human intervention and standardizing outcomes.

Pharmaceutical Sterility Testing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.83 Billion |

| Market Size by 2033 |

USD 4.71 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.06% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Product Type, Test Type, Sample, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Pacific Biolabs; Steris Plc; Boston Analytical; Nelson Laboratories; LLC (Sotera Health); Sartorius AG; SOLVIAS AG; SGS SA; Labcorp; Pace Analytical; Charles River Laboratories; Thermo Fisher Scientific, Inc.; Rapid Micro Biosystems; Almac Group;Labor LS SE & Co; KG. |

Market Driver: Increasing Demand for Biologics and Sterile Injectables

The rising global demand for biologics and sterile injectables is a key driver accelerating the pharmaceutical sterility testing market. Biologics, including monoclonal antibodies, recombinant proteins, vaccines, and cell-based therapies, are highly sensitive to microbial contamination and require stringent sterility standards throughout manufacturing, packaging, and delivery.

Unlike traditional small-molecule drugs, biologics often involve complex manufacturing environments including cleanrooms, single-use technologies, and aseptic fill-finish lines. These products are frequently delivered via injection or infusion, making them particularly vulnerable to endotoxins and microbial contamination. Any lapse in sterility can render the product unusable and pose life-threatening risks to patients.

As a result, pharmaceutical companies are investing heavily in both in-house sterility testing infrastructure and outsourced services to comply with GMP and regulatory requirements. The FDA’s scrutiny of contamination events in injectable manufacturing plants has led to product recalls, warning letters, and facility shutdowns, making sterility testing not only a scientific necessity but a legal and financial imperative.

Market Restraint: High Cost and Time Consumption of Traditional Testing Methods

One of the primary restraints in this market is the high cost, labor intensity, and long turnaround time associated with traditional sterility testing methods. Techniques like membrane filtration and direct inoculation are manually intensive, requiring cleanroom environments, trained personnel, and incubation periods of 14 days to detect microbial growth.

Such long timelines can delay product release, impact supply chains, and increase inventory holding costs. Additionally, setting up in-house sterility testing requires significant capital investment in infrastructure, qualified staff, validation protocols, and routine maintenance. Smaller pharmaceutical companies and startups often lack the resources to build and maintain such systems, especially when facing regulatory audits.

Furthermore, traditional methods are susceptible to human error and cross-contamination, which can result in false positives or inconclusive results. These factors create both operational and reputational risks for companies, making the case for transitioning to more rapid, automated, and error-resistant systems.

Market Opportunity: Emergence of Rapid Microbial Testing and Real-Time Monitoring

The development and regulatory acceptance of rapid microbial detection systems present a significant opportunity for the pharmaceutical sterility testing market. These novel platforms reduce detection time from the traditional 14-day incubation to as little as 3 to 7 days, using technologies such as ATP bioluminescence, nucleic acid amplification (PCR), microfluidics, and flow cytometry.

Rapid methods are especially useful for short shelf-life products, such as cell therapies, compounded sterile preparations, and autologous transplants, which cannot wait for conventional sterility results. These systems enable faster batch release, reduce warehousing requirements, and improve responsiveness to market demands.

In addition, real-time environmental and in-process sterility monitoring using integrated sensors, cloud-based dashboards, and AI-driven data analytics is becoming a value-added service for manufacturers. Regulatory bodies are beginning to recognize and validate these new approaches, paving the way for their wider adoption and integration into aseptic processing workflows.

Segmental Analysis

By Type

In-house testing dominated the market, especially among large pharmaceutical manufacturers with established quality control systems. These firms maintain dedicated microbiology labs equipped for sterility, bioburden, and endotoxin testing. In-house testing offers full control over sample handling, data integrity, and turnaround time, making it the preferred choice for critical product lines like biologics and vaccines. Companies like Pfizer, Roche, and Novartis have multi-tiered testing infrastructure integrated into their GMP compliance and batch release processes.

However, outsourcing is the fastest-growing segment, particularly favored by mid-sized pharma companies, compounding pharmacies, and biotech startups. Outsourcing reduces the burden of infrastructure investment and compliance documentation while allowing firms to access specialized expertise and advanced analytical platforms. Leading CROs like Eurofins, Charles River, and SGS provide full-service sterility testing under GMP conditions, including method development, validation, and regulatory support. Outsourcing also offers flexibility during scale-up, new product launches, and global supply chain expansion.

By Product Type

Kits and reagents dominate the product category, as they are essential for all types of sterility and endotoxin testing procedures. These include culture media, buffers, filters, gel clot reagents, and LAL (Limulus Amebocyte Lysate) kits for endotoxin detection. Companies like Merck KGaA and Thermo Fisher Scientific supply a wide range of validated kits that conform to global pharmacopeial standards. These consumables form the backbone of daily sterility testing in QC labs, with recurring purchase cycles driving steady revenue.

Meanwhile, services are the fastest-growing product category, aligned with the growth of outsourcing. Services encompass everything from method development and routine batch testing to consultation on regulatory compliance and data documentation. The shift toward contract manufacturing and external QC auditing is expanding the role of service providers, who offer flexibility, faster turnaround, and multi-geography certifications.

By Regional Insights

North America remains the dominant region in the pharmaceutical sterility testing market, driven by its highly regulated pharmaceutical industry, advanced manufacturing infrastructure, and proactive regulatory oversight. The U.S. Food and Drug Administration (FDA) has established strict sterility guidelines for parenteral drugs, compounded sterile preparations, and biologics. Moreover, the region has a high concentration of biotech startups, CDMOs, and established pharma giants, all of which rely on stringent sterility protocols. Companies like Charles River, Thermo Fisher Scientific, and Nelson Labs have their largest sterility operations based in North America.

In contrast, Asia-Pacific is the fastest-growing region, owing to the rapid expansion of pharmaceutical manufacturing in India, China, South Korea, and Japan. The rise in biosimilar production, generics, and API exports is necessitating stronger sterility and quality control systems. Regulatory bodies such as India’s CDSCO and China’s NMPA are aligning more closely with ICH and WHO GMP standards, creating new demand for testing infrastructure and expertise. Moreover, international players are setting up regional testing hubs in Asia-Pacific to cater to local and export-oriented clients, accelerating market growth.

Recent Developments

-

March 2025 – Merck KGaA announced the launch of a next-generation Endosafe® Endotoxin Test Kit, featuring real-time data capture and cloud integration to comply with FDA 21 CFR Part 11 requirements.

-

January 2025 – Charles River Laboratories opened a new microbiological testing facility in Singapore to expand its sterility testing services for regional biopharma clients in Asia-Pacific.

-

November 2024 – Thermo Fisher Scientific introduced its SmartSterile Platform, combining automated filtration hardware with AI-powered analytics to accelerate sterility testing workflows for injectable drugs.

-

October 2024 – Eurofins Scientific acquired EAG Laboratories' microbiology division, expanding its global capabilities in endotoxin and bioburden testing across the U.S. and Europe.

-

August 2024 – Lonza Bioscience launched an updated PDA-compliant media line for bacterial and fungal sterility testing in cell and gene therapy production environments.

Some of the prominent players in the Pharmaceutical sterility testing market include:

- Pacific Biolabs

- Steris Plc

- Boston Analytical

- Sotera Health Company (Nelson Labs)

- Sartorius Ag

- Solvias Ag

- SGS SA

- Labcorp

- Pace Analytical

- Charles River Laboratories

- Thermo Fisher Scientific, Inc.

- Rapid Micro Biosystems, Inc.

- Almac Group

- Labor LS SE & Co. KG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pharmaceutical sterility testing market.

Type

Product Type

- Kits & Reagents

- Instruments

- Services

Test Type

-

- Membrane Filtration

- Direct Inoculation

- Product Flush

- Bioburden Testing

- Bacterial Endotoxin Testing

Sample

- Pharmaceuticals

- Medical Devices

- Biopharmaceuticals

End-use

- Compounding Pharmacies

- Medical Device Companies

- Pharmaceutical Companies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)