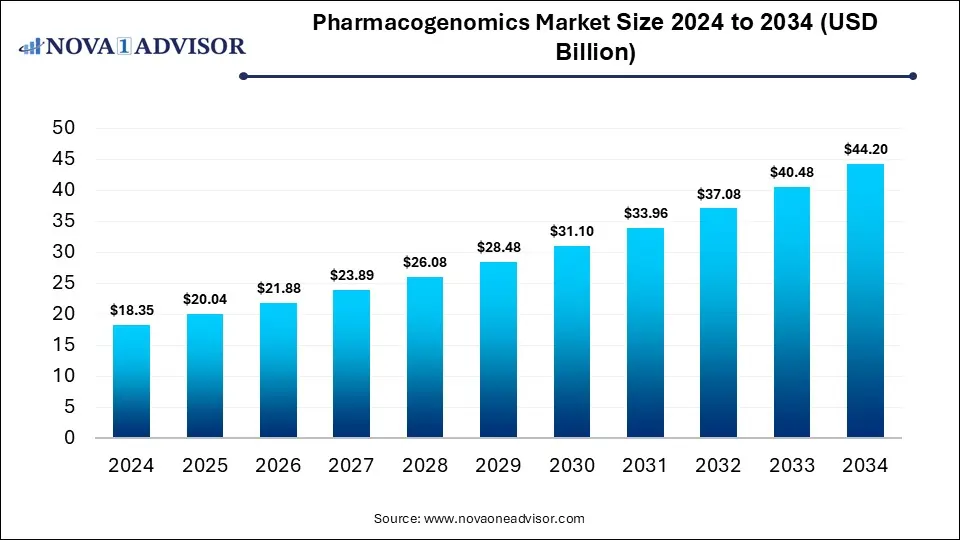

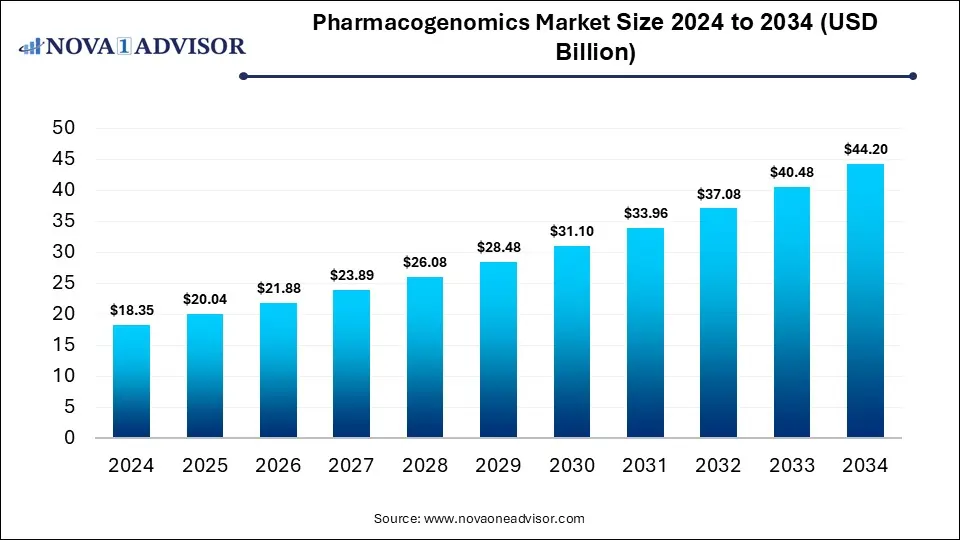

Pharmacogenomics Market Size and Growth 2025 to 2034

The global pharmacogenomics market was valued at USD 18.35 billion in 2024 and is projected to hit around USD 44.2 billion by 2034, growing at a CAGR of 9.19% during the forecast period 2025 to 2034. The growth of the market is attributed to advancements in genomic technologies, rising demand for personalized medicine, and increasing R&D activities.

Pharmacogenomics Market Key Takeaways

- By region, North America dominated the pharmacogenomics market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By technology, the DNA Sequencing segment dominated the market in 2024.

- By technology, the microarray segment is expected to grow at the fastest CAGR in the coming years.

- By application, the oncology segment held the largest market share in 2024.

- By application, the psychiatry segment is likely to grow at the fastest rate during the forecast period.

- By end-user, the hospitals segment dominated the market in 2024.

- By end-user, the research institutes segment is expected to expand at the highest CAGR between 2025 and 2034.

- By distribution channel, the hospital pharmacy segment dominated the market in 2024.

- By distribution channel, the online pharmacy segment is expected to grow at the fastest CAGR in the coming years.

How is AI Impacting the Pharmacogenomics Market

AI is revolutionizing the pharmacogenomics market by enhancing the speed and accuracy of genetic data analysis, enabling more precise and personalized treatment approaches. Through advanced machine learning algorithms, AI can identify patterns and predict how individuals will respond to specific drugs based on their genetic makeup, significantly reducing trial-and-error prescribing. It also accelerates the discovery of pharmacogenomic biomarkers, streamlines drug development, and supports real-time clinical decision-making by integrating genomic data with electronic health records. Overall, AI is making pharmacogenomics more efficient, scalable, and impactful in advancing precision medicine.

Market Overview

The pharmacogenomics market focuses on the study of how an individual's genetic makeup influences their response to drugs, enabling the development of personalized therapies that improve efficacy and reduce adverse effects. This market is experiencing significant growth, driven by the rising demand for precision medicine, increasing prevalence of chronic and genetic diseases, and advancements in genomic technologies such as next-generation sequencing and bioinformatics. Additionally, growing investments in R&D and expanding applications in oncology and psychiatry are further propelling market expansion.

Major Trends in the Pharmacogenomics Market

Rising Adoption of Precision Medicine: Increased focus on tailoring drug therapies to individual genetic profiles is driving the integration of pharmacogenomics into clinical practice, especially in oncology, psychiatry, and cardiology.

Growth of Direct-to-Consumer Genetic Testing: The rise of at-home genetic testing kits is making pharmacogenomic information more accessible to consumers, expanding awareness and fueling market demand.

Expansion of Companion Diagnostics: Pharmaceutical companies are increasingly developing companion diagnostic tests alongside targeted therapies to ensure treatment effectiveness based on a patient’s genetic profile.

Report Scope of Pharmacogenomics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 20.04 Billion |

| Market Size by 2034 |

USD 44.2 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.19% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Technology, By Applications, By End User, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Illumina, Inc., Thermo Fisher Scientific, Inc., Myriad Genetics, Inc., 23andMe, Inc., QIAGEN N.V., Roche Holding AG, Agilent Technologies, Inc., LabCorp (Laboratory Corporation of America), Genetworx , AstraZeneca PLC |

Market Dynamics

Drivers

Increasing Awareness of the Impact of Genetic Variation on Drug Safety

The increasing recognition of how genetic variations influence drug efficacy and safety is a significant driver in the pharmacogenomics market. As scientists and healthcare professionals gain a deeper understanding of the role genes play in drug response, the demand for personalized medicine solutions grows. This awareness leads to a greater need for pharmacogenomic testing to identify individuals who may benefit from specific medications or are at risk of adverse reactions. Consequently, pharmaceutical companies are investing more in research and development to create drugs tailored to specific genetic profiles, fueling the market's expansion. This shift toward personalized medicine, driven by genetic insights, is transforming drug development and clinical practice.

Rising Global Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is also driving the growth of the market. As conditions like cancer, heart disease, and diabetes become more common, the need for effective and personalized treatments increases. Pharmacogenomics offers the potential to tailor drug selection and dosage based on an individual's genetic makeup, optimizing treatment outcomes for these complex diseases. This approach allows healthcare providers to move beyond a one-size-fits-all approach, selecting the most appropriate therapies and minimizing adverse effects. As chronic diseases continue to affect a larger portion of the population, the demand for pharmacogenomic solutions continues to rise, driving market expansion.

Restraint

High Costs and Complexity of Data Interpretation

The high cost of pharmacogenomic testing remains a significant barrier to widespread adoption, limiting accessibility, especially in low- and middle-income regions. Expensive sequencing technologies, coupled with the need for specialized equipment and trained personnel, make these tests less affordable for many healthcare providers and patients. Additionally, the complexity of interpreting vast amounts of genetic data poses challenges for clinicians, who may lack the expertise to translate results into actionable treatment decisions. This complexity can lead to uncertainty or misinterpretation, hindering confidence in pharmacogenomic-guided therapies. The absence of standardized guidelines and variability in test results across laboratories add to the difficulties in clinical implementation.

Opportunities

Expanding Scope of Applications

The expanding scope of pharmacogenomics across various therapeutic areas is creating significant growth opportunities in the market. While oncology has traditionally dominated space, pharmacogenomics is increasingly being applied in fields like psychiatry, cardiology, infectious diseases, and pain management, enabling more precise and effective treatments. This broader application range is encouraging pharmaceutical companies and healthcare providers to adopt pharmacogenomic testing as part of routine clinical care. Additionally, its use in drug discovery and development helps reduce trial-and-errors in clinical trials, saving time and cost.

Increasing Investment in R&D

Increasing investment in research and development (R&D) creates new opportunities in the pharmacogenomics market. These investments enable the discovery of novel gene-drug interactions, development of advanced diagnostic tools, and improvement of sequencing technologies, all of which enhance the precision and applicability of pharmacogenomic testing. Pharmaceutical companies are leveraging R&D to accelerate drug development pipelines, reduce adverse drug reactions, and improve treatment outcomes through personalized therapies. Government and private sector funding also support large-scale genomic studies, data infrastructure, and collaborations between research institutes and industry. As R&D efforts expand, the identification of new biomarkers across diverse disease areas broadens the clinical utility of pharmacogenomics. This not only drives innovation but also encourages integration of genetic testing into mainstream healthcare.

Segment Outlook

By Technology

Why Did the DNA Sequencing Segment Dominate the Pharmacogenomics Market in 2024?

The DNA sequencing segment dominated the market while capturing the largest share in 2024 due to its critical role in accurately identifying genetic variations that influence individual drug responses. Its ability to provide comprehensive and high-resolution genomic data made it the preferred technology for both clinical and research applications. Advancements in next-generation sequencing (NGS) significantly reduced costs and turnaround times, making DNA sequencing more accessible and scalable. Additionally, its widespread adoption in personalized medicine and drug development further solidified its leading position in the market.

The microarray segment is expected to expand at the fastest CAGR in the coming years due to its ability to analyze thousands of genetic variants simultaneously. This technology is particularly useful for large-scale screening studies and population-wide pharmacogenomic research. Its relatively quick turnaround time and compatibility with established lab workflows make it an attractive option for clinical and research settings. As demand for personalized medicine rises, microarrays offer a practical solution for identifying drug-response markers across diverse patient groups, driving their adoption.

By Application

What Made Oncology the Dominant Segment in the Pharmacogenomics Market?

The oncology segment dominated the market with the largest share in 2024. This is mainly due to the high demand for personalized cancer treatments and the critical role of genetic profiling in guiding therapy decisions. Pharmacogenomic testing helps identify mutations and biomarkers that influence how patients respond to targeted therapies, improving treatment efficacy and minimizing adverse effects. With the growing prevalence of cancer and increasing availability of companion diagnostics, pharmacogenomics has become a cornerstone in oncology care. Moreover, substantial investments in cancer genomics research and clinical trials have further accelerated its adoption in this field.

The psychiatry segment is likely to grow at the fastest rate during the forecast period due to increasing awareness of how genetic variations influence individual responses to psychiatric medications. Pharmacogenomic testing helps clinicians select the most effective drugs and dosages for conditions like depression, anxiety, and schizophrenia, reducing trial-and-error prescribing and adverse effects. As mental health disorders become more prevalent, the demand for personalized treatment approaches is rising. Additionally, growing clinical evidence supporting the utility of pharmacogenomics in psychiatry and broader insurance coverage for such tests are driving greater adoption in psychiatric care.

- Recent studies show that genotype-guided prescribing leads to more effective and cost-efficient treatment of depression and schizophrenia compared to standard approaches. Successful clinical implementation requires better strategy prioritization and ongoing education for psychiatrists. Further research is needed to uncover missing genetic factors to enhance pre-emptive genotyping and optimize psychiatric drug therapy.

By End-User

Why Did Hospitals Contribute Most Revenue Share in the Pharmacogenomics Market in 2024.

Hospitals dominated the market by holding a major revenue share in 2024. This is mainly due to the increasing integration of genetic testing into hospital-based diagnostics and treatment planning, especially for complex conditions like cancer, cardiovascular diseases, and mental health disorders. Hospitals offer the infrastructure, clinical expertise, and access to advanced technologies needed to perform and interpret pharmacogenomic tests effectively. Additionally, many hospitals participate in clinical research and precision medicine initiatives, further driving the adoption of pharmacogenomics. The availability of multidisciplinary care teams in hospital settings also supports the application of personalized treatment strategies, contributing to the segment’s leading position.

The research institutes segment is expected to grow at the fastest CAGR over the projection period. The growth of the segment is attributed to the increasing investments in pharmacogenomic research aimed at discovering new gene-drug interactions and biomarkers. These institutes play a critical role in advancing scientific understanding and developing innovative testing methods that support personalized medicine. Government funding and academic-industry collaborations are also fueling growth by enabling large-scale genomic studies.

By Distribution Channel

How Does the Hospital Pharmacy Segment Dominate the Pharmacogenomics Market in 2024?

The hospital pharmacy segment dominated the market in 2024 due to the increasing incorporation of pharmacogenomic testing into hospital-based treatment protocols. Hospital pharmacies play a vital role in dispensing personalized medications based on genetic test results, especially for conditions like cancer and cardiovascular diseases where tailored therapies are critical. Their close collaboration with clinicians and access to patient records enable efficient implementation of precision medicine. Additionally, hospitals are often equipped with advanced diagnostic facilities, making them the primary centers for pharmacogenomic testing and drug management.

The online pharmacy segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing consumer demand for convenient access to genetic testing kits and personalized medications. As awareness of direct-to-consumer pharmacogenomic services rises, more individuals are turning to digital platforms for ordering and managing their treatments. Online pharmacies also offer greater accessibility, especially in remote areas, and often provide competitive pricing and privacy advantages. This trend is supported by the broader shift toward telehealth and digital healthcare solutions, making online channels a key driver of future market growth.

By Regional Insights

What Made North America the Dominant Region in the Pharmacogenomics Market?

North America sustained dominance in the worldwide pharmacogenomics market while capturing the largest share in 2024. The dominance of the region is primarily attributed to its advanced healthcare infrastructure, strong presence of leading biotechnology and pharmaceutical companies, and high adoption of precision medicine. The region benefits from substantial investments in genomic research, particularly in the U.S. Widespread use of electronic health records and integration of pharmacogenomic data into clinical workflows further support market growth. Additionally, favorable regulatory policies and reimbursement frameworks have encouraged both clinicians and patients to adopt pharmacogenomic testing.

- In April 2024, the U.S. FDA finalized a rule to actively regulate all laboratory-developed tests (LDTs), including pharmacogenomic (PGx) tests, as medical devices. Previously overseen mainly by CMS under CLIA, most PGx tests in the U.S. were non-FDA-approved. The rule clarifies that all in vitro diagnostic products (IVDs), including those developed by laboratories, fall under the FDA’s authority per the FD&C Act.

Major Trends in the North America Pharmacogenomics Market

- Rising Adoption of Precision Medicine: North America is witnessing rapid integration of pharmacogenomics into clinical practice, driven by the shift towards precision medicine. Healthcare providers increasingly use genetic testing to tailor drug therapies, improving treatment outcomes and reducing adverse drug reactions.

- Increased Government and Private Funding: Significant investments from both government agencies like the NIH and private sectors are accelerating research and development in pharmacogenomics. These funds support the discovery of new biomarkers and development of advanced testing platforms, fostering innovation and market growth.

- Advancements in Next-Generation Sequencing (NGS) Technologies: The region is at the forefront of adopting cutting-edge NGS technologies, enabling faster, more accurate, and cost-effective genetic analysis. This technological progress enhances the scalability of pharmacogenomic testing and broadens its applications across various diseases.

- Growing Collaborations and Partnerships: Pharmaceutical companies, diagnostic firms, and research institutions in North America are increasingly forming strategic collaborations. These partnerships aim to co-develop companion diagnostics and integrate pharmacogenomic data into drug development pipelines, streamlining personalized therapy approvals.

Country Level Analysis

The U.S. is leading the market in North America due to its strong infrastructure for genomic research, widespread adoption of precision medicine, and significant investments from both government and private sectors. Programs like the NIH’s All of Us Research Program and robust funding for R&D have accelerated innovation in the field. Additionally, the presence of major pharmaceutical companies, advanced healthcare systems, and favorable regulatory and reimbursement frameworks support the integration of pharmacogenomics into clinical practice. This combination of innovation, policy support, and market readiness positions the U.S. at the forefront of the global pharmacogenomics market.

What Makes Asia Pacific the Fastest-Growing Market for Pharmacogenomics?

Asia Pacific is expected to experience rapid growth in the market due to increasing healthcare investments and expanding genomic research initiatives in countries like China, India, and Japan. Growing awareness of personalized medicine and rising prevalence of chronic diseases are driving demand for pharmacogenomic testing. Additionally, improving healthcare infrastructure and government support through favorable policies are encouraging market adoption. The region’s large and genetically diverse population also presents significant opportunities for pharmacogenomic studies and tailored therapies, further boosting growth prospects.

China and India are experiencing strong growth in the pharmacogenomics market in Asia Pacific due to increasing government investments in biotechnology and precision medicine initiatives. Both countries have large, genetically diverse populations that provide valuable data for pharmacogenomic research and the development of personalized therapies. Rising healthcare awareness, expanding healthcare infrastructure, and growing prevalence of chronic and genetic diseases are driving demand for genetic testing. Additionally, collaborations between local research institutions and global pharmaceutical companies are accelerating innovation in these countries.

Region-Wise Market Insights

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 7.6 Bn |

6.53% |

Strong R&D investment, advanced healthcare infrastructure, early adoption of precision medicine |

High testing costs, data privacy concerns |

Mature & innovation-driven growth |

| Asia Pacific |

USD 5.4 Bn |

7.66% |

Expanding genomic research, rising healthcare investments, large patient base |

Limited infrastructure, skilled workforce shortage |

Fastest-growing region |

| Europe |

USD 4.3 Bn |

10.9% |

Government support, growing awareness of personalized medicine, strong academic presence |

Regulatory variability across countries

|

Stable growth with regulatory harmonization |

| Latin America |

USD 1.5 Bn |

5.24% |

Growing demand for personalized treatment, expanding healthcare access |

Lack of awareness, lower adoption of genomic technologies |

High potential, early-stage development |

| MEA |

USD 0.9 Bn |

4.52% |

Rising chronic disease burden, growing investments in diagnostics |

Infrastructure gaps, limited research funding |

Emerging market with gradual growth |

Pharmacogenomics Market Value Chain Analysis

1. Gene Discovery & Biomarker Identification

This stage involves identifying genetic variants and biomarkers that influence drug metabolism, efficacy, and adverse reactions. Research institutions and biotech companies focus on uncovering gene-drug interactions through genomic studies and bioinformatics.

- Key players: Illumina, 23andMe, Thermo Fisher Scientific, BGI Genomics, QIAGEN.

2. Genomic Technology & Tool Development

In this stage, companies develop and refine technologies such as next-generation sequencing (NGS), PCR assays, microarrays, and genotyping tools used to analyze patient genomes. These tools are the backbone of pharmacogenomic testing, enabling high-throughput and accurate genetic analysis.

- Key players: Agilent Technologies, Roche, Bio-Rad, Pacific Biosciences, Thermo Fisher Scientific.

3. Pharmacogenomic Test Development

This phase includes designing and validating diagnostic tests or companion diagnostics that detect specific genetic variants associated with drug response. These tests are often co-developed with pharmaceutical products and are crucial for guiding precision medicine.

- Key players: Myriad Genetics, Foundation Medicine, LabCorp, Genetworx, Invitae.

4. Clinical Trials & Validation

Pharmaceutical and biotech companies conduct clinical trials that incorporate pharmacogenomic data to optimize drug development, stratify patients, and improve efficacy and safety outcomes. The integration of genomic insights allows for targeted therapies and personalized treatment strategies.

- Key players: Pfizer, AstraZeneca, Novartis, GSK, Roche.

5. Regulatory Approval & Compliance

Regulatory agencies oversee the approval of pharmacogenomic-based therapies and tests, ensuring their safety, efficacy, and clinical validity. Companies work closely with regulators to meet data requirements for personalized treatments and companion diagnostics.

- Key players: FDA (U.S.), EMA (Europe), Foundation Medicine, Thermo Fisher, Illumina.

6. Commercialization & Distribution

After approval, pharmacogenomic products are commercialized and distributed to clinical labs, hospitals, and healthcare providers. This stage includes marketing, logistics, training, and integration into clinical workflows.

- Key players: Thermo Fisher, Quest Diagnostics, LabCorp, Eurofins Scientific, Qiagen.

7. End-User Application (Clinical Practice)

At this stage, physicians, hospitals, and diagnostic labs use pharmacogenomic tests to guide treatment decisions, improve drug efficacy, and reduce adverse effects. End users are critical in translating test results into actionable clinical insights for personalized medicine.

- Key players: Hospitals, Academic Medical Centers, Clinical Laboratories, Pharmacists, Genetic Counselors.

Competitive Landscape

1. Illumina, Inc.

Illumina is a global leader in next-generation sequencing (NGS) technologies. It provides the genomic platforms and tools essential for large-scale pharmacogenomic studies, enabling high-throughput analysis of gene-drug interactions.

2. Thermo Fisher Scientific, Inc.

Thermo Fisher offers a wide portfolio of genomic technologies, including sequencing platforms, PCR assays, and reagents. It supports research, diagnostic test development, and clinical implementation of pharmacogenomics across various therapeutic areas.

3. Myriad Genetics, Inc.

Myriad specializes in molecular diagnostic testing, including pharmacogenomic panels used to guide personalized treatment in psychiatry, oncology, and cardiovascular care. It is a key player in making pharmacogenomic testing clinically accessible.

4. 23andMe, Inc.

Known for its direct-to-consumer genetic testing, 23andMe contributes to the market by generating large-scale genomic data sets that can be used in drug development and gene-drug response research.

5. QIAGEN N.V.

QIAGEN provides molecular diagnostics and bioinformatics solutions, including genotyping and sequencing tools used in pharmacogenomic testing and biomarker validation.

6. Roche Holding AG

Roche, through its diagnostics division and Foundation Medicine, is involved in the development of companion diagnostics that link genetic profiles with drug responses, particularly in oncology.

7. Agilent Technologies, Inc.

Agilent supplies high-performance analytical instruments and genomic tools for pharmacogenomics research and diagnostics. Its technologies support gene expression analysis and variant detection.

8. LabCorp (Laboratory Corporation of America)

LabCorp offers a wide range of pharmacogenomic testing services through its diagnostics network. It enables physicians to incorporate genomic data into patient care for better drug selection.

9. Genetworx

Genetworx specializes in pharmacogenomic testing with a focus on helping clinicians optimize medication regimens based on genetic profiles, particularly in psychiatry and pain management.

10. AstraZeneca PLC

AstraZeneca integrates pharmacogenomics in drug development to improve therapeutic efficacy and safety. The company actively invests in personalized medicine and biomarker-driven clinical trials.

These companies are actively involved in developing advanced pharmacogenomic testing technologies, expanding their product portfolios, and forming strategic partnerships to strengthen their market presence globally.

In May 2025, Helix launched a new suite of pharmacogenomic (PGx) tests, including a DPYD test to identify patients at risk of severe side effects from fluoropyrimidine-based chemotherapies, and a first-of-its-kind APOE test relevant to Alzheimer’s treatments. These additions expand Helix’s PGx portfolio into oncology and neurology, supporting more personalized care.

Recent Developments

- In July 2025, Medicover Genetics launched its Pharmacogenomic Preventive and Diagnostic Testing, offering comprehensive PGx solutions to support personalized and safer prescribing. The tests help predict drug response based on genetic factors, enabling healthcare providers to prevent adverse drug reactions and optimize treatment efficacy both before and during therapy.

- In October 2024, Agilus Diagnostics announced the launch of its Pharmacogenomics Testing Service, offering insights into how a patient’s genetic profile affects drug response. The service supports safer, more effective, and personalized treatment decisions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pharmacogenomics market.

By Technology

- DNA Sequencing

- Microarray

- Polymerase Chain Reaction

- Electrophoresis

- Mass Spectrometry

By Applications

- Drug Discovery

- Pain Management

- Neurology

- Oncology

- Cardiovascular Diseases

- Infectious Diseases

- Psychiatry

- Others

By End User

- Hospitals

- Clinics

- Research Institutes

- Medical & Academic Institutes

By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)