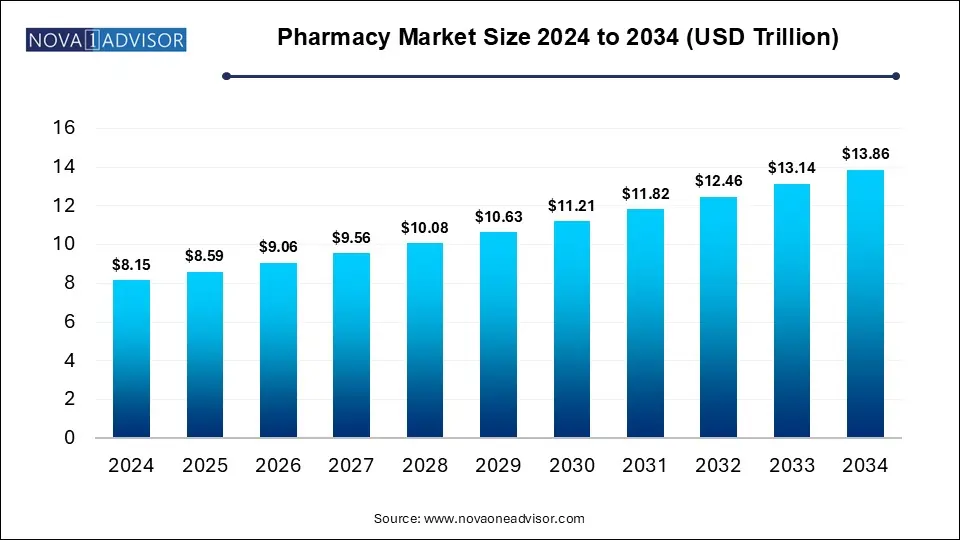

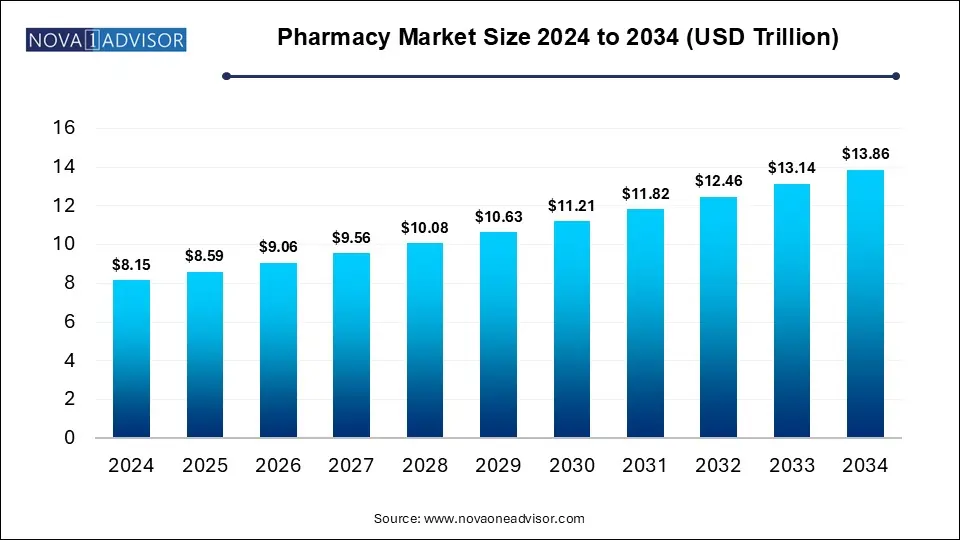

Pharmacy Market Size and Forecast 2025 to 2034

The global Pharmacy market size was valued at USD 1.85 trillion in 2024 and is anticipated to reach around USD 3.81 trillion by 2034, growing at a CAGR of 7.5% from 2025 to 2034.

Pharmacy Market Key Takeaways

- The prescription segment dominated the global pharmacy market with a revenue share of 82% in 2024.

- Retail pharmacy held the largest revenue share of 55.0% the global pharmacy industry in 2024.

- North America dominated the global pharmacy market with revenue share of 54% in 2024.

Market Overview

The global pharmacy market is a pivotal segment of the healthcare ecosystem, serving as the primary distribution and access point for medications and healthcare products. It spans a broad array of outlets including hospital-based dispensaries, retail pharmacy chains, independent community drugstores, and rapidly growing online or ePharmacy platforms. From prescription drugs to over-the-counter (OTC) medicines, vitamins, health supplements, and personal care items, pharmacies play a central role in patient care, disease management, and health maintenance.

The increasing global burden of chronic diseases, rising awareness around preventive health, and enhanced healthcare access across developing economies are all contributing to the expansion of pharmacy services. Aging populations in many regions, combined with digitalization trends, have further stimulated innovation in pharmacy operations. Pharmacists are no longer solely dispensing medicines they now offer services like vaccination, diagnostics, medication therapy management, and health screenings.

The pharmacy market has also witnessed profound transformations in its structure and service delivery models. The COVID-19 pandemic was a major inflection point, pushing both consumers and providers to embrace digital solutions. The emergence of ePharmacy platforms has redefined convenience, offering doorstep delivery, automated refills, teleconsultations, and even AI-driven health advice. Despite regulatory hurdles in some regions, the long-term outlook for pharmacy services remains robust, fueled by consumer-centric innovation, evolving healthcare demands, and strategic retail-healthcare integrations.

Pharmacy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 1.85 Trillion |

| Market Size by 2034 |

USD 3.81 Trillion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.29% |

| Base Year |

2024

|

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

CVS Health; Boots Walgreens; Cigna; Walmart; Kroger; Rite Aid Corp.; Lloyd Pharmacy; Well Pharmacy; Humana Pharmacy Solutions; Matsumoto Kiyoshi; Apollo Pharmacy; MedPlusMart.com. |

Market Driver – Growing Burden of Chronic Diseases and Polypharmacy

One of the primary drivers propelling the pharmacy market is the rising prevalence of chronic diseases such as diabetes, hypertension, cardiovascular disorders, asthma, and arthritis. These conditions often require long-term, multi-drug regimens, contributing to the phenomenon known as polypharmacy. Pharmacies act as essential mediators in managing such treatments, providing patient counseling, tracking medication adherence, and mitigating drug-drug interactions. For instance, a patient with comorbid diabetes and hypertension may rely on the pharmacist for managing blood glucose monitors, lifestyle supplements, insulin delivery, and therapeutic guidance. As chronic conditions become more widespread globally, pharmacies are evolving to become community-centered hubs for integrated chronic care support.

Market Restraint – Regulatory Complexities and Prescription Fraud Risks

Despite its growth potential, the pharmacy market faces several challenges, chief among them being the complexity of regulatory frameworks. Dispensing practices vary significantly across regions, and maintaining compliance with licensing, prescription validation, controlled substances management, and data protection can be cumbersome. In addition, the digitalization of prescriptions and expansion of ePharmacy services have opened up new vulnerabilities to fraudulent prescriptions, counterfeit drugs, and cyber threats. For example, in some countries, the sale of prescription medications through online platforms is tightly controlled or even prohibited without government-issued e-prescriptions. These constraints increase operational risks and can delay the scalability of pharmacy services, especially in cross-border operations.

Market Opportunity – Growth of ePharmacy and Home Healthcare Integration

The expansion of ePharmacy platforms represents a transformative opportunity in the global pharmacy market. With internet penetration and smartphone usage rising, especially in Asia-Pacific and Latin America, consumers are increasingly turning to digital channels for convenience and discretion. Online pharmacies not only offer 24/7 ordering and home delivery, but also facilitate personalized health tracking, subscription-based refills, and integration with wearables. Moreover, partnerships between ePharmacies and home healthcare providers are enabling seamless transitions from hospitals to home care, especially for post-surgical recovery and palliative care. This synergy is reshaping healthcare delivery by reducing hospital burden and enhancing patient satisfaction.

Pharmacy Market By Product Insights

Prescription drugs continue to dominate the pharmacy market in terms of revenue, reflecting the essential nature of these medications in treating acute and chronic conditions. Hospitals, clinics, and primary care centers generate consistent demand for prescriptions that are filled by both retail and hospital pharmacies. These include antibiotics, cardiovascular drugs, antidiabetics, antidepressants, and biologics. In developed economies, strict regulations ensure that prescriptions are carefully dispensed, often with pharmacist consultations. In contrast, many emerging markets are adopting more rigorous prescription validation systems to combat misuse and ensure appropriate use.

Conversely, over-the-counter (OTC) medicines are the fastest-growing segment, especially in the context of self-care and preventive health. The global consumer shift towards immunity boosters, pain relievers, antacids, and vitamins has accelerated post-pandemic. Pharmacies now stock a wide range of wellness products, including herbal remedies and functional foods. In countries like India and Brazil, OTC sales are growing as health literacy improves and accessibility increases. The trend is further supported by aggressive promotional strategies and product bundling in retail outlets and e-commerce platforms.

Pharmacy Market By Type Insights

Retail pharmacies, both chain and independent outlets, dominate the market due to their widespread accessibility, especially in urban and suburban settings. These pharmacies offer personalized consultation, prescription filling, minor ailment management, and health monitoring. Chains like Walgreens (U.S.), Boots (UK), and Apollo Pharmacy (India) have built strong brand equity, integrating point-of-sale technology, loyalty programs, and in-store diagnostics to attract footfall. Independent pharmacies also maintain strong community ties and often serve rural or underdeveloped regions where larger chains have limited presence.

However, ePharmacies are growing at an unprecedented rate, transforming the pharmaceutical landscape. Digital platforms like 1mg, Netmeds, and Amazon Pharmacy are leveraging logistics, data analytics, and user interfaces to streamline operations and enhance user experience. Particularly during COVID-19 lockdowns, ePharmacies became vital channels for safe medicine access. Their ability to aggregate demand, offer competitive pricing, and provide value-added services such as teleconsultations makes them an attractive option for tech-savvy consumers. As regulatory clarity improves, especially in developing countries, ePharmacies are expected to rival traditional formats in reach and revenue.

Pharmacy Market By Regional Insights

North America, particularly the United States, leads the global pharmacy market in both innovation and volume. A well-established insurance infrastructure, high healthcare spending, and a mature pharmaceutical industry support the region’s dominance. The U.S. is home to major pharmacy retail chains such as CVS Health, Walgreens, and Rite Aid, which operate thousands of outlets and integrated services including vaccinations, chronic disease clinics, and wellness programs. The region has also seen rapid uptake of ePharmacy platforms, especially Amazon Pharmacy, which officially launched in November 2020 and continues to expand aggressively.

Asia-Pacific is emerging as the fastest-growing pharmacy market, driven by rising incomes, expanding urbanization, and increased healthcare digitization. Countries like India, China, Indonesia, and Vietnam are investing in retail infrastructure and digital platforms to enhance medicine accessibility. In India, for example, Tata Group’s acquisition of 1mg and Reliance’s investment in Netmeds demonstrate growing corporate interest in healthcare retail. Meanwhile, government initiatives such as China’s Healthy China 2030 plan are catalyzing pharmacy sector modernization, including regulatory reforms for ePharmacy. With a young population, high mobile usage, and improving health awareness, the region is poised to lead the next phase of pharmacy innovation.

Pharmacy Market Top Key Companies:

The following are the leading companies in the pharmacy market. These companies collectively hold the largest market share and dictate industry trends.

- CVS Health

- Boots Walgreens

- Cigna

- Walmart

- Kroger

- Rite Aid Corp.

- Lloyd Pharmacy

- Well Pharmacy

- Humana Pharmacy Solutions

- Matsumoto Kiyoshi

- Apollo Pharmacy

- MedPlusMart.com

Recent Developments

-

April 2025 – CVS Health launched an AI-powered health advisory chatbot integrated into its mobile pharmacy app.

-

March 2025 – Tata 1mg introduced personalized supplement subscriptions in India based on diagnostic insights.

-

February 2025 – Boots UK expanded its rapid diagnostic testing services across 500 retail locations.

-

January 2025 – Amazon Pharmacy entered into a strategic distribution agreement with major insurance providers in the U.S.

-

December 2024 – Medlife merged with PharmEasy to create one of India’s largest digital pharmacy platforms.

Pharmacy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmacy market.

By Product

By Type

- Hospital Pharmacy

- Retail Pharmacy

- Chain

- Independent

- Others

- ePharmacy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)