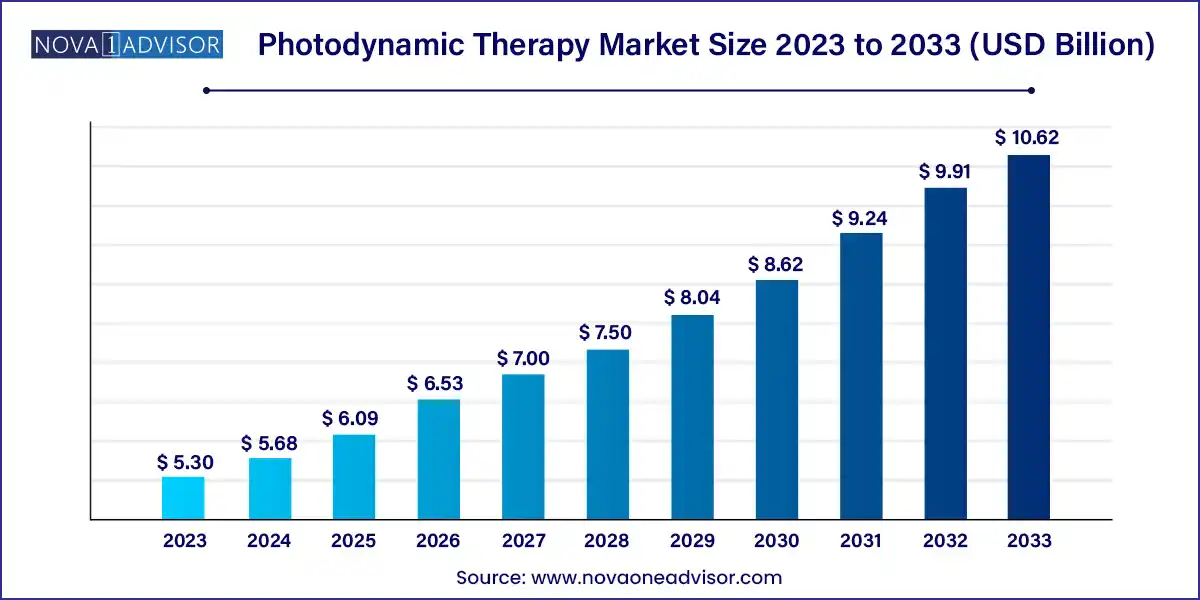

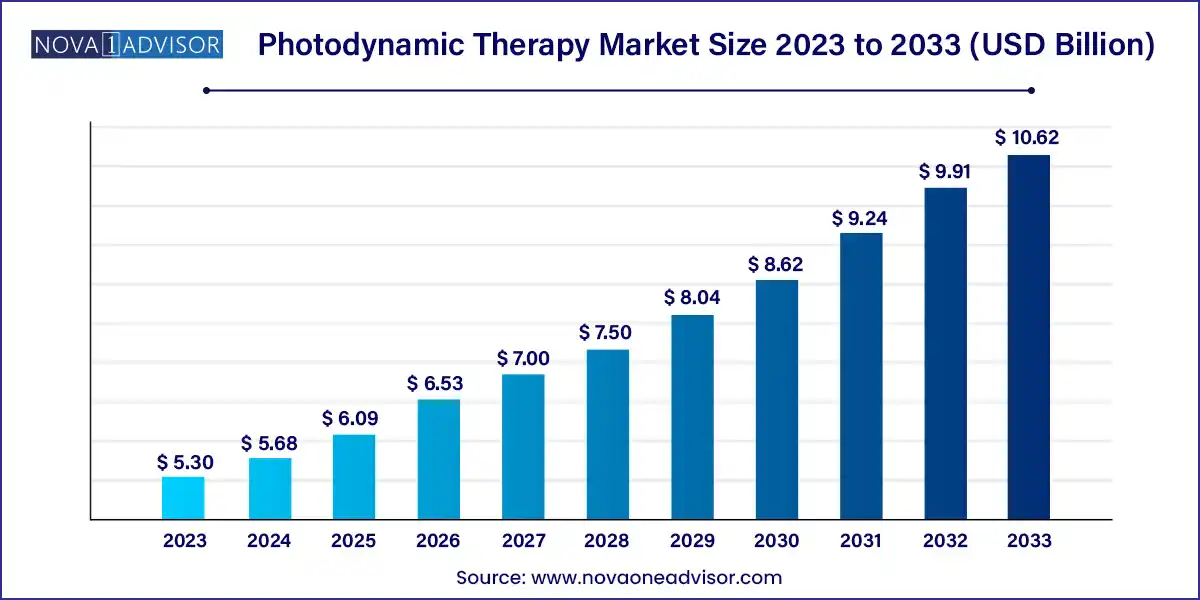

The global photodynamic therapy market size was exhibited at USD 5.30 billion in 2023 and is projected to hit around USD 10.62 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2024 to 2033.

Key Takeaways:

- North America dominated the photodynamic therapy market with the largest share of 31% in 2023.

- By product type, the photosensitizers drugs segment held the largest share of the market in 2023.

- By light source, the lasers segment dominated the market in 2023.

- By application, the cancer segment has the largest share in the photodynamic therapy market in 2023.

- By end-user, the hospitals segment dominated the market in 2023.

Market Overview

The Photodynamic Therapy (PDT) market is emerging as a promising therapeutic frontier that bridges the gap between conventional treatments and precision medicine. PDT is a two-step procedure involving a photosensitizing drug and a specific light source that, upon activation, produces a reactive oxygen species (ROS) that selectively destroys diseased cells. Originally pioneered for cancer treatment, the scope of PDT has expanded dramatically to include dermatological conditions such as acne, actinic keratosis, and psoriasis, as well as ophthalmologic and antimicrobial applications.

The unique advantage of photodynamic therapy lies in its non-invasive nature, minimal systemic toxicity, and the ability to target diseased tissue with high precision, sparing healthy surrounding structures. As healthcare moves toward personalized and less invasive therapies, PDT is gaining traction as an effective alternative or complement to chemotherapy, radiation, and surgical interventions. The rising global cancer burden, increasing prevalence of skin-related conditions, and demand for minimally invasive cosmetic procedures are the key drivers of the market.

Furthermore, advancements in light-based technologies, such as portable and wearable LED devices, and the development of next-generation photosensitizers with improved selectivity and pharmacokinetics are catalyzing PDT’s application across clinical settings. Countries with robust healthcare research ecosystems, such as the U.S., Germany, and Japan, are at the forefront of clinical trials and regulatory approvals, further shaping the commercial and therapeutic landscape of PDT.

Major Trends in the Market

-

Emergence of Targeted Photosensitizers: Research is focused on second- and third-generation photosensitizers with tumor specificity, better tissue penetration, and reduced side effects.

-

Integration of PDT with Immunotherapy: Combining PDT with immunotherapy is an evolving trend aimed at triggering systemic anti-tumor immunity through local photoinduced necrosis.

-

Use of LED and Fiber-Optic Light Sources: The shift from bulky lasers to cost-effective, portable, and wearable LED-based systems is improving treatment flexibility and outpatient applicability.

-

Adoption in Dermatology and Aesthetics: Cosmetic and dermatology clinics are increasingly incorporating PDT for treating acne, actinic keratosis, and sun-damaged skin.

-

AI-Guided PDT Systems: Integration of artificial intelligence for real-time dosimetry, patient monitoring, and outcome prediction is being piloted in advanced clinical settings.

-

Expanding Indications Beyond Oncology: PDT is being researched for bacterial infections, age-related macular degeneration, and even brain tumors, widening its clinical potential.

-

Reimbursement Evolution in Developed Markets: Efforts are being made to standardize CPT codes and insurance coverage for PDT in oncology and dermatology, especially in North America and Europe.

Photodynamic Therapy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.68 Billion |

| Market Size by 2033 |

USD 10.62 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Product Type, By Light Source, By Application, and By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Gladerma S.A., Sun Pharmaceutical Industries Ltd., Biofrontera, Novartis AG, Valeant Pharmaceuticals International, Inc., Quest Pharmatech, Inc., Hologic, Inc., Lumibird (Quantel Medical), Theralase Technologies Inc., Photocure ASA, Biolitec AG, IPG Photonics Corporation, and Others. |

Market Driver: Rising Global Cancer Incidence and Preference for Minimally Invasive Therapies

The primary force accelerating the photodynamic therapy market is the escalating global incidence of cancer, particularly skin, lung, head and neck, and esophageal cancers. According to the World Health Organization, cancer accounted for nearly 10 million deaths in 2022, with skin cancers such as basal cell carcinoma and squamous cell carcinoma among the most common malignancies. PDT offers a non-invasive, outpatient solution with fewer side effects compared to surgery or systemic chemotherapy.

Patients with early-stage cancers, or those who are immunocompromised or not ideal surgical candidates, can benefit significantly from PDT due to its precision and minimal systemic impact. Clinical studies have shown high efficacy of PDT in superficial skin cancers, with excellent cosmetic outcomes and low recurrence rates. With an aging global population and growing preference for day-care procedures, PDT is positioned as a frontline tool in cancer care that aligns with modern patient and provider expectations.

Market Restraint: Limited Tissue Penetration and Accessibility Challenges

Despite its many benefits, limited tissue penetration of activating light sources remains a key constraint in the broader application of PDT. The efficacy of treatment is often limited to superficial or accessible tumors, as traditional photosensitizers and light sources do not penetrate deeply into biological tissues. This makes PDT unsuitable for many deep-seated or highly vascularized tumors, restricting its utility in systemic oncology.

Additionally, the need for specialized infrastructure and trained personnel to administer PDT particularly in oncology settings limits access in low-resource regions. Moreover, some photosensitizers are associated with prolonged skin photosensitivity, leading to post-treatment discomfort and lifestyle restrictions for patients. These factors combined with high upfront equipment costs and inconsistent reimbursement policies in some countries pose challenges to widespread adoption, especially outside major urban healthcare centers.

Market Opportunity: Expansion in Dermatology and Aesthetic Applications

While oncology remains the bedrock of PDT, a major opportunity lies in dermatology and aesthetic medicine. Conditions such as acne vulgaris, actinic keratosis, and rosacea are increasingly being treated using light-activated therapies that reduce inflammation and bacterial load while rejuvenating the skin. The rising consumer demand for non-invasive cosmetic procedures and the growing popularity of medispas and dermatology clinics worldwide are fueling PDT’s role in the aesthetic space.

In acne treatment, for example, PDT has shown notable success in reducing Propionibacterium acnes and shrinking sebaceous glands, offering long-term relief without systemic antibiotics. Moreover, photosensitizers like 5-aminolevulinic acid (ALA) are being packaged into user-friendly, outpatient-friendly kits, opening avenues for large-scale commercialization in dermatology. As the market moves toward personalized skincare and preventive aesthetics, PDT is poised to become a staple in cosmetic dermatology alongside laser and chemical modalities.

Segments Insights:

By Product Type

Photosensitizer drugs dominate the product type segment, as they are the essential activators in the PDT process. Drugs such as porfimer sodium, 5-aminolevulinic acid (ALA), and methyl aminolevulinate are widely used across oncology and dermatology settings. These drugs selectively accumulate in diseased tissues and generate cytotoxic ROS upon light exposure, making them crucial for treatment efficacy. Regulatory approval of newer photosensitizers with enhanced selectivity and faster clearance times has further strengthened their dominance.

Meanwhile, photodynamic therapy devices are the fastest-growing segment, fueled by technological advancements in light delivery systems. Devices now include compact lasers, wearable LED patches, and fiber-optic probes for minimally invasive treatment. Innovations in device ergonomics and precision targeting have broadened the scope of PDT across both hospital and outpatient settings. The demand for portable, clinician-friendly light sources is especially high in dermatology clinics and ambulatory centers.

By Light Source

Lasers have traditionally dominated the light source segment, particularly in cancer treatment and deep-tissue applications where coherent, high-intensity light is required. Lasers such as diode and Nd:YAG systems are favored for their precision and ability to target localized lesions. In hospital oncology departments, laser-based PDT remains a gold standard, especially for esophageal, bladder, and bronchial cancers.

However, LEDs are the fastest-growing light source, owing to their affordability, safety, and portability. LED systems are increasingly being adopted in dermatology and cosmetic clinics due to their broad wavelength options and minimal heat emission. LED-based PDT for acne, sun damage, and skin rejuvenation is particularly popular in Asia and Europe. The ongoing trend toward wearable, home-use LED devices is further amplifying growth in this segment.

By Application

Cancer remains the leading application of PDT, particularly for skin, lung, and esophageal cancers. PDT has become a recognized modality for patients with non-melanoma skin cancer and early-stage internal tumors. Its localized action, cosmetic preservation, and repeatability make it ideal for treating patients with recurrent lesions or contraindications to surgery or radiation. Institutions like MD Anderson Cancer Center and University College London Hospitals are at the forefront of clinical PDT research in oncology.

On the other hand, actinic keratosis (AK) is the fastest-growing application, due to the condition’s high prevalence and the effectiveness of PDT in achieving lesion clearance with minimal scarring. AK is considered a precursor to skin cancer, and PDT offers a preventive, patient-friendly option. The convenience of outpatient delivery, combined with increasing awareness of photoprotection and skin health, is fueling the popularity of PDT for AK, especially among aging populations and fair-skinned demographics in developed countries.

By End User

Hospitals dominate the end-user segment, owing to their comprehensive infrastructure, access to surgical and oncology departments, and ability to manage complex cases. Hospitals routinely use PDT for internal cancers, including bladder and esophageal cancers, requiring fiber-optic laser systems and sedation. They also participate actively in clinical trials and academic research on new PDT protocols and combinations with chemotherapy or immunotherapy.

Meanwhile, cosmetic and dermatology clinics are the fastest-growing end users, driven by growing demand for aesthetic treatments and outpatient skin therapies. Clinics often deploy PDT for acne, rosacea, and photoaging, utilizing portable LED devices and topical photosensitizers. The convenience, affordability, and non-invasiveness of PDT make it attractive to dermatologists aiming to offer results with minimal downtime. As medical aesthetics gain mainstream acceptance, PDT is becoming a staple offering in urban skincare centers.

Regional Analysis

North America dominates the photodynamic therapy market, primarily due to high cancer prevalence, strong research infrastructure, and the presence of leading device manufacturers and biotech firms. The U.S. boasts well-established regulatory frameworks for drug-device combination products, facilitating innovation and market entry. Institutions like Harvard Medical School, Cleveland Clinic, and the University of Pennsylvania are at the forefront of PDT-related clinical research. Moreover, widespread health insurance coverage and the growing cosmetic dermatology sector reinforce the market’s dominance in this region.

Asia-Pacific is the fastest-growing region, driven by rising healthcare spending, growing awareness of skin health, and government-supported cancer screening programs. Countries like Japan and South Korea are investing heavily in minimally invasive cancer treatments, while China is expanding its dermatology services to cater to a rising middle class. The increasing availability of portable PDT devices and growing medical tourism in countries like Thailand and India further boost adoption. Additionally, rising pollution levels and UV exposure in urban Asia are amplifying the demand for preventive dermatology solutions, in which PDT plays a central role.

Recent Developments

-

March 2025 – Biofrontera AG announced FDA approval of its new blue-light PDT system for actinic keratosis, designed for use in dermatology offices and ambulatory surgical centers.

-

January 2025 – Photonamic GmbH & Co. KG initiated a Phase III trial for its new oral photosensitizer drug targeting early-stage head and neck cancers, signaling further expansion of PDT in internal oncology.

-

October 2024 – Theralase Technologies launched a next-generation laser-based photodynamic therapy system optimized for treating bladder cancer, integrating AI-guided light dosimetry.

-

August 2024 – LEONARDO by Biolitec introduced a dual-wavelength PDT system for deeper tumor penetration, aimed at liver metastases and colorectal lesions.

-

May 2024 – BioSyent Inc. entered a strategic partnership to distribute ALA-based photodynamic acne treatment kits across Canadian medispas and dermatology clinics.

Some of the prominent players in the Photodynamic therapy market include:

- Gladerma S.A.

- Sun Pharmaceutical Industries Ltd.

- Biofrontera

- Novartis AG

- Valeant Pharmaceuticals International, Inc.

- Quest Pharmatech, Inc.

- Hologic, Inc.

- Lumibird (Quantel Medical)

- Theralase Technologies Inc.

- Photocure ASA

- Biolitec AG

- IPG Photonics Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global photodynamic therapy market.

By Product Type

- Photosensitizer Drugs

- Photodynamic Therapy Devices

By Light Source

- Lasers

- Light Emitting Diodes (LEDs)

- Lamps

- Others

By Application

- Cancer

- Actinic Keratosis (AK)

- Psoriasis

- Acne

- Others

By End User

- Hospitals

- Cancer Treatment Centers

- Cosmetic and Dermatology Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)