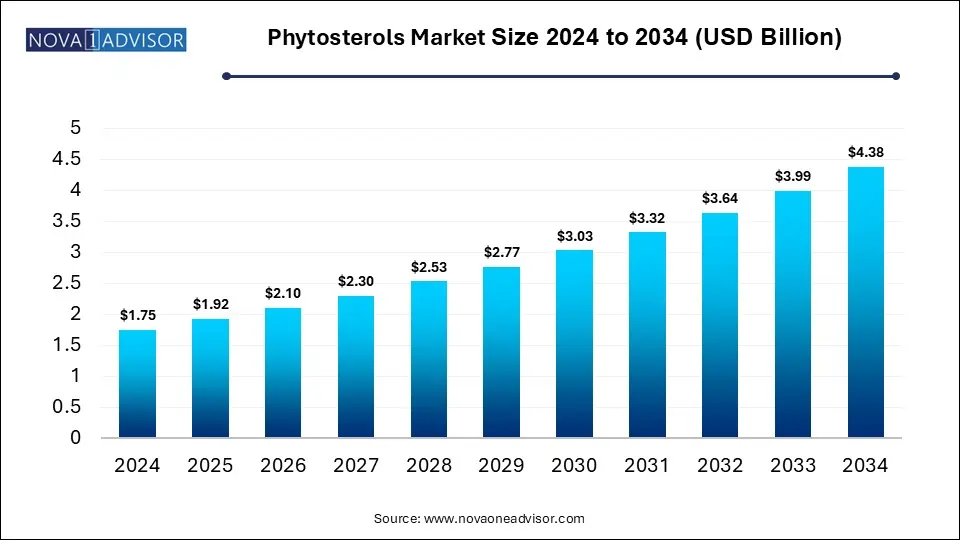

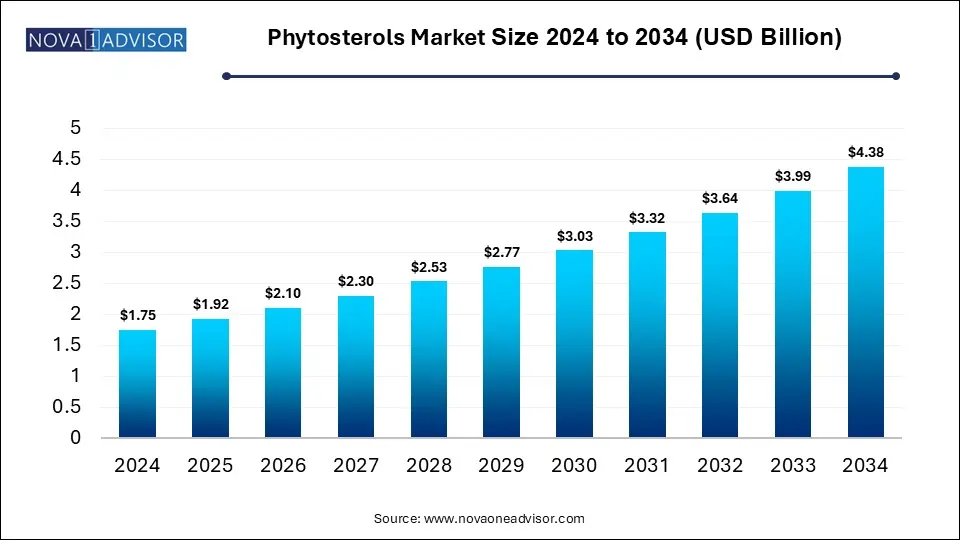

Phytosterols Market Size and Growth

The global phytosterols market size is calculated at USD 1.75 billion in 2024, grow to USD 1.92 billion in 2025, and is projected to reach around USD 4.38 billion by 2034, growing at a CAGR of 9.6% from 2025 to 2034. The phytosterols market is growing due to rising awareness of heart health benefits and increasing use in functional foods and dietary supplements. Additionally, the shift towards plant-based and clean-label products is boosting demand.

Phytosterols Market Key Takeaways

- Europe dominated the phytosterols market revenue share of 52% in 2024.

- North America is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the beta-sitosterol segment dominated the market with revenue shares in 2024.

- By product, the campesterol segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the food ingredients segment held the largest market share in 2024.

- By application, the pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is Innovation Impacting the Phytosterols Market?

Phytosterols are natural plant-based compounds structurally similar to cholesterol that help reduce LDL (bad) cholesterol levels and support heart health when consumed through diet or supplements. Innovation is significantly driving growth in the phytosterols market by enabling the development of advanced formulations and new delivery formats such as fortified foods, beverages, and dietary supplements. Companies are investing in microencapsulation and bioavailability enhancement technologies to improve absorption and efficacy. Additionally, the focus on clean-label and plant-based ingredients is pushing manufacturers to create sustainable and natural phytosterol solutions, expanding their application across functional foods, nutraceuticals, and personal care products.

What are the Key trends in the Phytosterols Market in 2024?

- In June 2024, Azelis entered a distribution partnership with BASF to supply various nutritional ingredients, including emulsifiers and phytosterol esters, in China. This collaboration supports Azelis' strategy to enhance its presence in the food sector by offering sustainable and innovative solutions while broadening its product range and customer base.

- In April 2024, Kensing is set to present its portfolio of natural antioxidants and plant sterols featuring synthetic phytosterols, vitamin E, and tocopherols at Stand K34.

How Can AI Affect the Phytosterols Market?

AI can impact the market by optimizing product development, enhancing supply chain efficiency, and predicting consumer trends. It enables faster formulation of functional foods by analyzing large datasets on health benefits, ingredient interactions, and consumer preferences. AI-driven tools also support personalized nutrition, allowing companies to tailor phytosterol-based products to individual health needs. Moreover, AI can streamline quality control and reduce production costs, making phytosterol products more accessible and market competitive.

- For Instance, In May 2024, UK-based ProBiotix Health PLC launched CholBiome CH, a dual-action bi-layer tablet combining Lactobacillus plantarum LPLDL with plant sterols/stanols to help reduce both dietary and internal cholesterol. The use of AI in its development sped up the process and enabled a more precise and effective approach to supporting heart health.

Report Scope of Phytosterols Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.92 Billion |

| Market Size by 2034 |

USD 4.38 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

BASF SE, Arboris, LLC, Archer-Daniels-Midland Company, Cargill Inc., Pharmachem Laboratories, Inc,, The Lubrizol Corporation, Advanced Organic Materials, Ashland Global Holdings, Inc., Gustav Parmentier GmbH. |

Market Dynamics

Driver

Growing Demand for Personal and Healthcare Products Fueled by Aging Populations

The growing elderly population is fueling demand for natural ingredients that support aging, making phytosterols increasingly popular in personal care and healthcare products. With their proven benefits in lowering cholesterol and promoting heart health, phytosterols are becoming the population’s preference for preventive healthcare and natural solutions, encouraging manufacturers to expand their product lines with phytosterols-enriched formulations tailored to age-related health needs.

Restraint

High Production Cost and Complex Extraction Process

The phytosterols market faces limitations due to the intricate and resource-intensive methods needed for extraction and processing. These procedures involve advanced equipment and energy consumption, driving up manufacturing costs and reducing profit margins. As a result, the final products often come at a premium, restricting their appeal among price-sensitive consumers. This cost barrier also discourages broader adoption in low- and middle-income regions, hindering widespread use and slowing the growth potential of phytosterols-based applications across industries.

Opportunity

Rising Prevalence of Chronic Diseases

The increasing burden of chronic conditions like heart disease and metabolic disorders is creating growth potential for the phytosterols market. Consumers are becoming more health-conscious and are turning to plant-based ingredients that offer preventive benefits. Phytosterols, known to help manage cholesterol and support overall wellness, are being recognized as a natural option in daily nutrition. This shift in consumer preference is opening doors for innovative product development in functional foods, nutraceuticals, and dietary supplements.

Segmental Insights

How will the Beta-sitosterol Segment Dominate the Phytosterols Market in 2024?

Beta-sitosterol holds the largest share in the phytosterols market owing to its broad therapeutic application and strong presence in plant-based sources. It is frequently incorporated into health products targeting cholesterol management, prostate support, and immune enhancement. Its effectiveness, combined with consumers' trust and availability, has led to widespread use across multiple industries. This widespread utility and demand have positioned beta-sitosterol as the leading product type within the global phytosterols market.

The campesterol segment is expected to witness the fastest growth in the phytosterols market due to its growing incorporation in health-oriented products aimed at cardiovascular wellness. Ita ability to aid in reducing cholesterol levels, along with anti-inflammatory and antioxidant benefits, makes it increasingly attractive for use in functional foods and nutraceutical. Rising awareness of nutral ingredients and consumers preference for plant-derived compounds are further accelerating its demand across both developed and emerging health-conscious markets.

Why Did the Segment Dominate the Phytosterols Market in 2024?

In 2024, the food ingredient segment held the largest share of the phytosterols market due to increasing integration of these compounds into everyday food products aimed at promoting heart health. As consumers prioritize preventive nutrition and plant-based diets, manufacturers are fortifying products like spreads, cereals, and dairy substitutes with phytosterols. Supportive health regulations and growing public awareness of their cholesterol-lowering effects have made functional foods a preferred delivery method, boosting the market dominance.

The pharmaceutical segment is anticipated to grow at the highest CAGR in the phytosterols market due to increasing interest in natural compounds for managing chronic conditions like cardiovascular diseases and prostate disorders. Phytosterols are being explored for their therapeutic potential beyond cholesterol reduction, leading to their inclusion in various pharmaceutical formulations. Growing investment in clinical research and consumer preference for plant-based health solutions are further accelerating their adoption in the pharmaceutical industry during the forecast period.

By Regional Insights

How is Europe Contributing to the Expansion of the Phytosterols Market?

Europe dominated the market in 2024 due to growing health awareness, a strong focus on preventive healthcare, and widespread adoption of functional foods. Supportive regulations by European health authorities have encouraged the use of phytosterols in food and dietary supplements. Additionally, the region’s well-established food and pharmaceutical industries, along with consumer preference for natural, plant-based ingredients, have driven the demand for phytosterol-enriched products, making Europe a key market for phytosterol applications.

How is North America approaching the Phytosterols Market in 2024?

North America is projected to experience the fastest CAGR in the market during the forecast period due to several key factors. A growing awareness of cardiovascular health, fueled by high rates of heart disease and obesity, is increasing demand for cholesterol-lowering plant-based ingredients. Regulatory support, such as FDA GRAS status and permissible health claims, encourages the development and marketing of phytosterol-enriched products. Together with a mature supplement industry and strong product innovation, these dynamics are driving North America’s rapid growth.

- For Instance, In September 2023, Nutrartis introduced Cardiosmile, a plant sterol-based supplement, to the U.S. market. This product aims to support heart health by helping lower LDL cholesterol and triglyceride levels, utilizing the proven benefits of phytosterols.

Some of The Prominent Players in The Phytosterols Market Include:

- BASF SE

- Arboris, LLC

- Archer-Daniels-Midland Company

- Cargill Inc.

- Pharmachem Laboratories, Inc,

- The Lubrizol Corporation

- Advanced Organic Materials

- Ashland Global Holdings, Inc.

- Gustav Parmentier GmbH.

Recent Developments in the Phytosterols Market

- In August 2023, Cargill expanded into the European market with the introduction of “Plant-Based Boost,” a heart-health-focused beverage enriched with phytosterols. Made using soy and pea proteins, the drink reflects Cargill’s effort to align with shifting consumer demand for plant-based, functional nutrition options.

- In July 2023, Ingredion announced its merger with DuPont’s nutrition division, forming a powerful global player in the plant-based ingredients sector. This strategic move expands their product offerings and strengthens their international footprint, enhancing their position in the competitive phytosterol market.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Phytosterols Market.

By Product

- Beta-Sitosterol

- Campesterol

- Stigmasterol

- Others

By Application

- Pharmaceutical

- Cosmetics

- Food Ingredients

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)