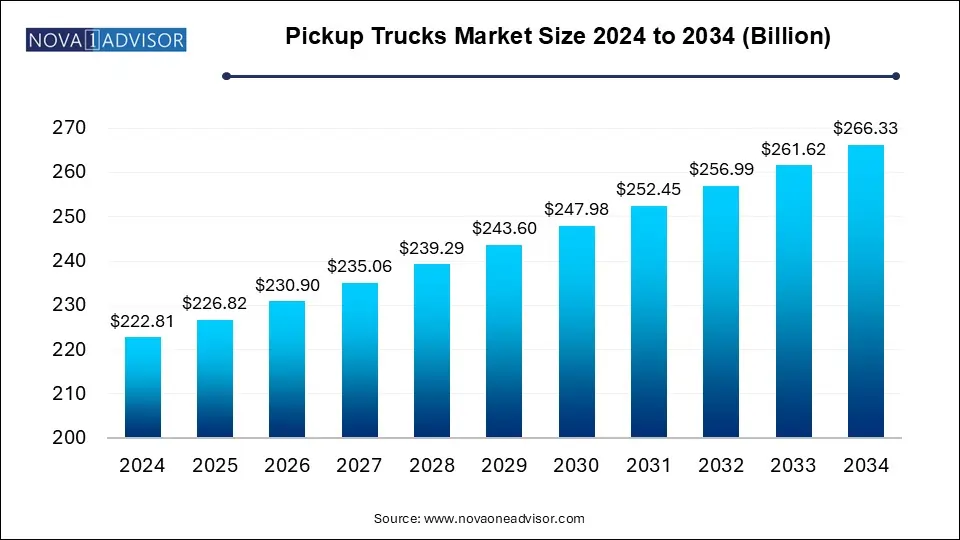

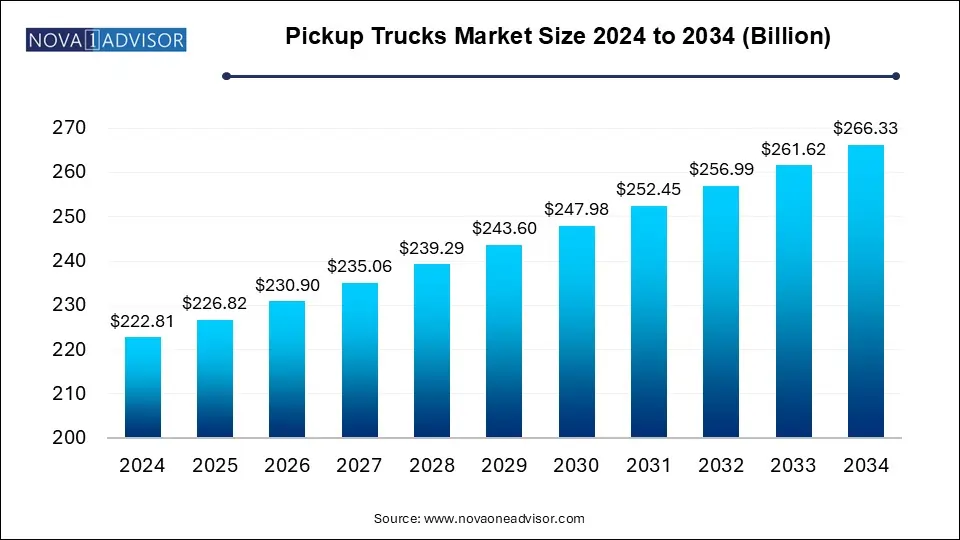

The global pickup trucks market size was exhibited at USD 222.81 billion in 2024 and is projected to hit around USD 266.33 billion by 2034, growing at a CAGR of 1.8% during the forecast period of 2025 to 2034.

Market Overview

The global pickup trucks market has been experiencing steady growth in recent years, driven by increasing demand for versatile vehicles that offer a combination of utility, durability, and performance. Pickup trucks are known for their ability to carry heavy loads, transport goods, and provide off-road capabilities, which make them popular among both consumers and businesses. These vehicles are often used in industries like construction, agriculture, and transportation, as well as for personal use in outdoor recreational activities.

The pickup truck market includes various segments, with different types of fuel, vehicle platforms, and designs catering to specific customer preferences and regional demands. In the coming years, the market is expected to expand further as manufacturers continue to innovate, integrating advanced technologies such as electric drivetrains, autonomous driving features, and improved fuel efficiency.

Growth Factors

- Increasing Consumer Demand for Versatile Vehicles: Pickup trucks are highly regarded for their combination of personal comfort and commercial utility, which has resulted in growing demand across different consumer segments. Both urban and rural consumers prefer pickup trucks for their ability to serve multiple purposes, such as personal transport, work-related tasks, and recreational activities.

- Rising Popularity of Pickup Trucks for Personal Use: Traditionally, pickup trucks were mainly used for work-related purposes, but there has been a significant shift toward their use for personal transport. This has been particularly evident in markets like the U.S., where consumers value pickup trucks for their cargo space, towing capabilities, and off-road performance.

- Technological Advancements in Pickup Truck Design: Manufacturers are continuously enhancing the design, efficiency, and performance of pickup trucks. Technological innovations such as advanced driver-assistance systems (ADAS), infotainment upgrades, and improved fuel efficiency are making these vehicles more attractive to buyers.

Pickup Trucks Market Report Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 222.81 Billion |

| Market Size by 2034 |

USD 266.33 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 1.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Fuel Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Stellantis N.V.; Ford Motor Company; Toyota Motor Corporation; Nissan Motor Co. Ltd.; Volkswagen Group; Tata Motors Limited; Ashok Leyland Ltd.; General Motors Company; Hyundai Motor Company; Suzuki Motor Corp.; Kia Corp.; Mahindra & Mahindra Ltd. |

Driver

One of the primary drivers of the pickup trucks market is the increasing demand for light-duty pickup trucks. These vehicles combine the utility and cargo capacity of a commercial truck with the comfort and ease of use of a passenger vehicle. Light-duty pickup trucks are suitable for a wide range of applications, from personal transportation to small business needs. As urbanization increases and consumers seek more versatile and durable vehicles, the popularity of light-duty trucks is expected to continue growing.

Another key driver is the shift towards electric vehicles (EVs), especially with the development of electric pickup trucks. As governments introduce stricter emissions regulations and provide incentives for electric vehicle adoption, manufacturers are responding by releasing more electric pickup models. These EV pickups offer lower operating costs and reduced environmental impact, making them an attractive option for environmentally conscious consumers and businesses.

Restraint

Despite the positive growth prospects, several factors may act as restraints to the growth of the pickup trucks market. One of the primary challenges is the high cost of ownership, particularly for light-duty and heavy-duty pickup trucks. The initial purchase price, along with ongoing fuel and maintenance costs, can be significant, which may deter some consumers, especially in emerging markets.

Additionally, fuel efficiency concerns remain a major issue for traditional internal combustion engine (ICE) pickup trucks, especially as fuel prices fluctuate and environmental regulations become stricter. Although advancements in engine technology have led to better fuel economy, the high fuel consumption of large trucks continues to be a concern for both consumers and regulators.

Opportunity

The growing popularity of electric pickup trucks presents a significant opportunity for market expansion. With several automakers launching or planning to launch electric pickups, including high-profile models like the Tesla Cybertruck and the Ford F-150 Lightning, there is a clear shift towards EV adoption in the pickup truck market. This transition presents a lucrative opportunity for manufacturers to tap into the eco-conscious consumer segment while also addressing government mandates on reducing emissions.

Segments Insights:

Fuel Type Insights

The diesel segment is expected to continue dominating the U.S. pickup trucks market in 2024. Diesel engines are widely favored in the commercial segment due to their superior towing capacity, better fuel efficiency for long-haul driving, and overall durability. Diesel-powered pickup trucks are preferred for heavy-duty tasks, such as transporting large loads and navigating rough terrains, which is why this fuel type continues to hold a dominant market share. However, the rise of electric pickup trucks and hybrid vehicles presents a growing challenge to the diesel segment, as more consumers and businesses explore greener alternatives.

Vehicle Type Insights

In 2024, light-duty pickup trucks maintained their position as the most popular vehicle type in the U.S. pickup truck market. These trucks are in high demand for their ability to serve as both personal and commercial vehicles. The combination of higher fuel efficiency, lower maintenance costs, and improved design has made light-duty pickups more accessible and practical for a wider range of consumers.

Regional Insights

The North American market continues to lead the pickup truck market in 2024, largely driven by high demand in the United States. Pickup trucks are deeply ingrained in American culture, with many consumers preferring them for both personal and professional use. The market is characterized by a strong presence of major automakers such as Ford, General Motors, and RAM, which dominate the light-duty and heavy-duty pickup truck segments. The demand for diesel and gasoline-powered trucks remains strong, although electric pickup trucks are beginning to make an impact in this region, with new models like the Tesla Cybertruck and Ford F-150 Lightning receiving significant attention.

Asia Pacific is expected to be the fastest-growing region for the forecast period. Countries like China and India are seeing a rapid increase in disposable income, urbanization, and demand for versatile vehicles. The increasing number of businesses that rely on pickup trucks for logistics and transportation purposes is contributing to the growth of the market in this region. As infrastructure and manufacturing capabilities continue to improve, demand for pickup trucks is expected to rise significantly, particularly in countries where trucks have traditionally not been a dominant vehicle choice.

Some of the prominent players in the pickup trucks market include:

- Stellantis N.V.

- Ford Motor Company

- Toyota Motor Corp.

- Nissan Motor Co. Ltd.

- Volkswagen Group

- Tata Motors Ltd.

- Ashok Leyland Ltd.

- General Motors Company

- Hyundai Motor Company

- Suzuki Motor Corp.

- Kia Corporation

- Mahindra & Mahindra Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pickup trucks market.

Fuel Type

- Diesel

- Petrol

- Electric

- Other

Vehicle Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)