Plasma Fractionation Market Size and Growth

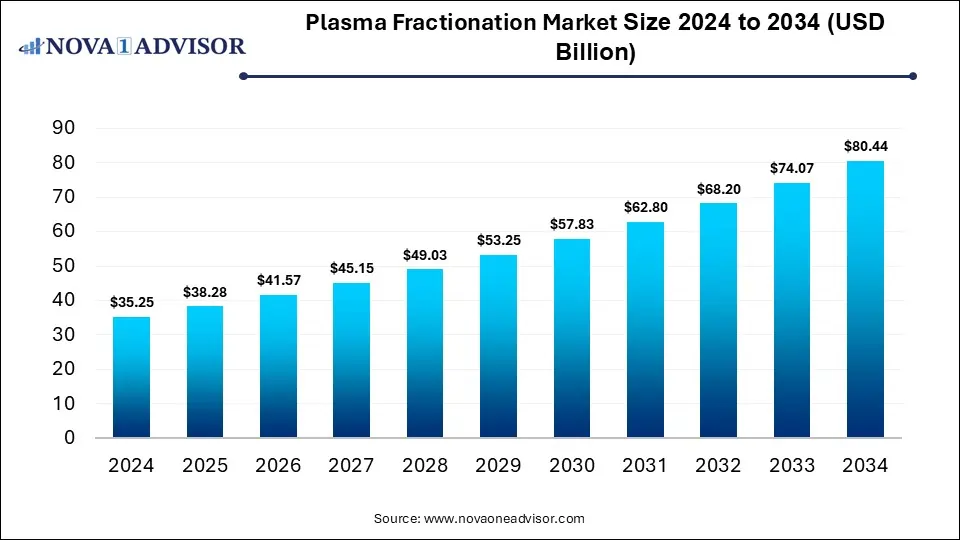

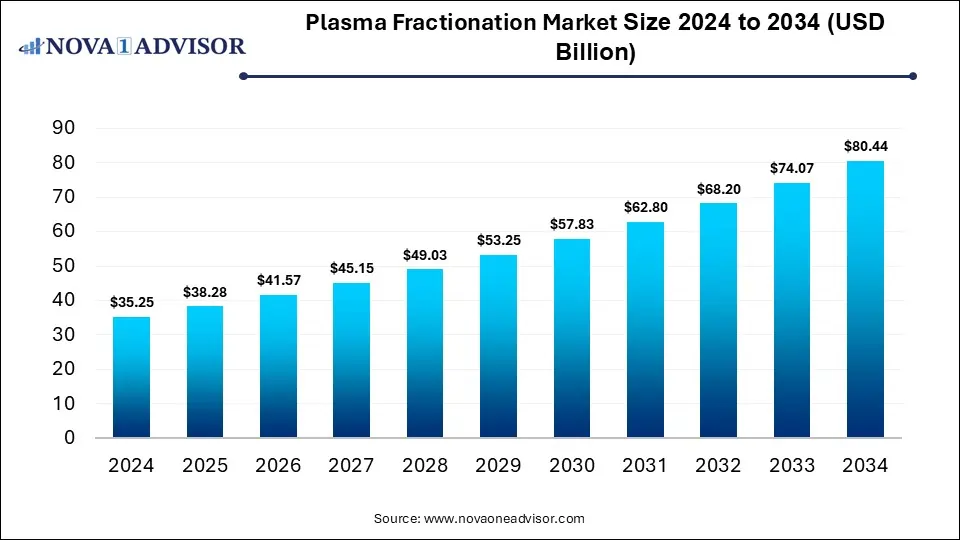

The plasma fractionation market size was exhibited at USD 35.25 billion in 2024 and is projected to hit around USD 80.44 billion by 2034, growing at a CAGR of 8.6% during the forecast period 2025 to 2034. The market is growing due to rising demand for plasma-derived therapies in treating rare and chronic diseases, including immunodeficiency and hemophilia. Additionally, increasing plasma collection centers and advancements in fractionation technologies are driving market expansion.

Plasma Fractionation Market Key Takeaways:

- North America dominated the plasma fractionation market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the immune globulin segment held the largest market share in 2024.

- By type, the coagulation factor segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the hospital segment dominated the market with a major revenue share in 2024.

- By application, the retail pharmacy segment is expected to grow at the fastest CAGR in the market during the forecast period.

Which Factors are Driving the Growth of the Plasma Fractionation Market?

Plasma fractionation is the process of separating human plasma into its individual protein components, such as albumin, immunoglobulin, and clotting factors, which are then purified and used for therapeutic and medical applications. The market is expanding due to the rising use of plasma protein in surgical procedures, trauma care, and burn treatment. Increasing healthcare expansion, improving diagnostic facilities, and greater adoption of advanced biologics are fueling demand. Moreover, the surge in chronic lifestyle-related conditions, the strong pipeline of plasma-derived products, and growing biopharmaceutical research activities are contributing to market growth. Strategic collaborations between key players and expansion into emerging markets further accelerated the development and accessibility of plasma-based therapies.

- For Instance, The World Health Organization estimates that by 2030, the global population aged 60 and above will reach 1.4 billion, leading to a higher need for therapies addressing age-related health conditions.

What are the Key trends in the Plasma Fractionation Market in 2024?

- In July 2024, Biotest AG finalized plans with Kedrion to fully commercialize and distribute its immunoglobulin product, Yimmugo, in the U.S., following FDA approval of its Biologic License Application (BLA).

- In March 2024, argenx reported that Japan approved VYVGART (efgartigimod alfa) for use in treating primary immune thrombocytopenia.

How Can AI Affect the Plasma Fractionation Market?

AI can significantly impact the plasma fractionation market by optimizing plasma collection, improving protein purification processes, and enhancing quality control through real-time monitoring. It enables faster identification of plasma-derived proteins, supports predictive maintenance of fractionation equipment, and reduces operational costs. Additionally, AI-driven data analytics can forecast demand for plasma therapies, streamline supply chain management, and accelerate clinical research for new applications. These advancements collectively improve efficiency, ensure safety, and expand access to plasma-based treatments worldwide.

Report Scope of Plasma Fractionation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 38.28 Billion |

| Market Size by 2034 |

USD 80.44 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Method, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Grifols S.A.; CSL Limited; Takeda Pharmaceutical Company Limited; Octapharma AG; Kedrion S.p.A; LFB S.A.; Biotest AG; Sanquin; Bio Products Laboratory Ltd.; Intas Pharmaceuticals Ltd. |

Market Dynamics

Driver

High Burden of Immunodeficiency and Rare Disorders

The rising prevalence of immunodeficiency and rare disorders drives the plasma fractionation market as these conditions increase the demand for innovative therapeutic solutions. Patients often need specialized plasma-derived proteins to stabilize immune function and manage disease progression. Growing research into rare disease mechanisms and the development of targeted plasma-based products are fueling adoption. Furthermore, government support for orphan disease treatments and patients assistance support for orphan disease treatment patient assistance programs enhances accessibility, making plasma fractionation a critical area of growth in healthcare.

- For Instance, According to the U.S. Department of Health & Human Services, by the end of 2023, around 39.9 million people globally were living with HIV, including 38.6 million adults and 1.4 million children.

Restraint

Limited Availability of Plasma Donors

The shortage of plasma donors restricts the plasma fractionation market as it limits the scalability of production and disrupts supply chains. Seasonal fluctuation, geographic disparities in donation rates, and cultural or social barriers towards plasma donation further worsen the gap. Inadequate donor recruitment programs and longer donation procedures discourage participation, making it difficult to maintain a steady plasma pool. These challenges reduce the industry’s ability to meet global demand, slowing overall market expansion.

Opportunity

Technological Advancements

Technological advancements create future opportunities in the plasma fractionation market by enabling faster scalability, improved recovery of rare plasma proteins, and integration of single-use systems that lower operational complexities. Innovation in cryopreservation, filtration, and chromatography techniques is helping extend product shelf life and improve stability. Moreover, the adoption of advanced monitoring devices and smart manufacturing platforms supports consistent quality and regulatory compliance. These developments open pathways for broader therapeutic application and strengthen the global supply of plasma-derived products.

- For Instance, In June 2024, Dyadic International, Inc. entered into a partnership with Proliant Health and Biologicals (PHB) to collaborate on the development and commercialization of purified proteins for use in diagnostics, nutrition, and cell culture applications.

Segmental Insights

How did Immune Globulin Segment dominate the Plasma Fractionation Market in 2024?

In 2024, the immune globulin segment held the largest market share 2024 due to widely prescription for off-label uses, including infections, inflammatory conditions, and post-transplant complications. Growing utilization in hospital settings, coupled with rising recommendations in clinical guidance, strengthened its demand. Moreover, continuous product launches, improvement policies enhanced accessibility. These factors, along with increasing reliance on immunoglobulin therapies in both acute and long-term care, secured the market growth.

- For Instance, In September 2023, a report from the American Association for Cancer Research (AACR) highlighted that intravenous immunoglobulin (IVIg) lowered the risk of severe infections by 90% in multiple myeloma patients undergoing therapy with an anti-BCMA bispecific antibody.

The coagulation factor segment is expected to witness the fastest growth as advancements in surgical procedures, trauma care, and transplant treatments are driving higher usage of clotting factor therapies. Growing application in managing acquired bleeding complications, along with the development of long-acting formulations, is further boosting demand. In addition, increased healthcare spending, strong pipeline products under clinical evaluation, and expanding treatment availability in emerging markets are creating new opportunities, positioning the rapid expansion in the coming years.

- For Instance, According to the National Institute for Health and Care Excellence (NICE), data from 2023 showed that in the U.K., about 9,316 individuals were affected by hemophilia A, with 2,230 classified as severe cases. The report also noted 2,069 people living with hemophilia B, including 374 severe and 351 moderate cases.

Plasma Fractionation Market Size By Type, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Albumin |

8.81 |

9.49 |

10.23 |

11.02 |

11.87 |

12.78 |

13.76 |

14.82 |

15.96 |

17.18 |

18.50 |

| Immune Globulin |

15.86 |

17.34 |

18.96 |

20.72 |

22.65 |

24.76 |

27.06 |

29.58 |

32.33 |

35.33 |

38.61 |

| Coagulation Factor |

7.05 |

7.69 |

8.40 |

9.17 |

10.00 |

10.92 |

11.91 |

13.00 |

14.19 |

15.48 |

16.89 |

| Others |

3.53 |

3.75 |

3.99 |

4.24 |

4.51 |

4.79 |

5.09 |

5.40 |

5.73 |

6.07 |

6.43 |

What made the Hospital Segment Dominant in the Plasma Fractionation Market in 2024?

In 2024, the hospital segment led the market as hospitals increasingly adopted advanced biologics and complex infusion therapies that require close monitoring. Growing inpatient admissions for chronic and rare disorders, coupled with the availability of reimbursement support, strengthened hospital reliance. Moreover, centralized procurement systems and collaboration with biopharmaceutical companies ensured consistent product supply. The role of hospitals in clinical trials and specialized treatment programs further reinforced their position as the leading revenue-generating application segment.

- For Instance, In June 2023, Grifols, S.A., in partnership with Egypt's National Service Projects Organization (NSPO), announced the launch of the first plasma-derived therapies made available for hospital use to treat Egyptian patients.

The retail pharmacy segment is projected to record the fastest CAGR as these outlets are becoming vital channels for chronic therapy refills and follow-up treatments. Growing penetration of specialty pharmacies, digital ordering platforms, and doorstep delivery services is driving patient reliance on retail access. Furthermore, rising awareness campaigns, loyalty programs, and pharmacist-led counselling for plasma-derived products are strengthening trust and compliance. These evolving service model are making retail pharmacies a preferred option, fueling their rapid market expansion.

Plasma Fractionation Market Size By Application, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospital |

22.91 |

24.81 |

26.86 |

29.08 |

31.48 |

34.08 |

36.89 |

39.94 |

43.24 |

46.81 |

50.68 |

| Retail Pharmacy |

7.05 |

7.73 |

8.48 |

9.30 |

10.20 |

11.18 |

12.26 |

13.44 |

14.73 |

16.15 |

17.70 |

| Other |

5.29 |

5.74 |

6.24 |

6.77 |

7.35 |

7.99 |

8.67 |

9.42 |

10.23 |

11.11 |

12.07 |

Regional Insights

How is North America Contributing to the Expansion of the Plasma Fractionation Market?

In 2024, North America led the plasma fractionation market as a result of increasing collaborations between healthcare providers and industry players to expand therapeutic access. The presence of numerous specialty treatment centers and higher patient enrollment in clinical trials supported strong uptake. Additionally, strategic government initiatives for plasma security and robust funding toward novel biologics development reinforced regional dominance. Growing use of advanced distribution channels and emphasis on personalized therapies further boosted North America’s share in the global market.

- For Instance, In March 2023, BioLife Plasma Services, part of Takeda, opened its 200th plasma donation center in the U.S., adding new facilities in West Springfield, Massachusetts, and Pearland, Texas. These expansions are expected to support market growth in the country.

How is Asia-Pacific Accelerating the Market?

Asia Pacific is projected to grow at the fastest CAGR as the region experiences a surge in biotechnology innovation and adoption of advanced therapeutic solutions. Expanding pharmaceutical manufacturing hubs and favorable regulatory reforms are attracting global market players to establish operations locally. Moreover, rising middle-class populations with better access to private healthcare, along with digital health initiatives improving treatment reach, are fueling demand. These factors, combined with an increasing focus on self-sufficiency in biologics, are accelerating market growth in the region.

- For Instance, In May 2023, Plasma Gen Biosciences inaugurated a modern plasma product manufacturing facility in Bangalore to meet the rising demand for cost-effective plasma-based therapies.

Plasma Fractionation Market Size By Regional, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

13.4 |

14.5 |

15.6 |

16.9 |

18.2 |

19.7 |

21.3 |

23.0 |

24.8 |

26.8 |

29.0 |

| Europe |

9.9 |

10.7 |

11.6 |

12.5 |

13.5 |

14.6 |

15.8 |

17.1 |

18.6 |

20.1 |

21.7 |

| Asia Pacific |

7.8 |

8.5 |

9.4 |

10.3 |

11.4 |

12.5 |

13.8 |

15.1 |

16.6 |

18.3 |

20.1 |

| Latin America |

2.5 |

2.7 |

2.9 |

3.2 |

3.4 |

3.7 |

4.0 |

4.4 |

4.8 |

5.2 |

5.6 |

| Middle East and Africa (MEA) |

1.8 |

1.9 |

2.1 |

2.3 |

2.5 |

2.7 |

2.9 |

3.1 |

3.4 |

3.7 |

4.0 |

Top Companies in the Plasma Fractionation Market

- Syntegon

- CSL Behring

- Mitsubishi Tanabe

- Octapharma AG

- Hualan Bio

- Kedrion S.p.A

- Takeda Pharmaceutical Company Ltd.

- LFB Group

- Intas Pharmaceuticals Ltd.

- Biotest AG

- Bio Product Laboratory Ltd.

Recent Developments in the Plasma Fractionation Market

- In September 2024, GEFD, a joint venture of Grifols and Egypt’s National Service Project Organisation (NSPO), introduced a national initiative aimed at achieving self-sufficiency in plasma-derived medicines. The project features a plasma laboratory, storage facility, 20 donation centers, and a modern manufacturing plant to support the production of essential plasma-based treatments.

- In August 2024, Nanoform Finland partnered with Takeda Pharmaceutical Company to work on pre-clinical plasma-derived therapies. The collaboration focuses on creating advanced formulations aimed at treating rare diseases.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the plasma fractionation market

By Type

- Albumin

- Immune Globulin

- Coagulation Factor

- Others

By Application

- Hospital

- Retail Pharmacy

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)