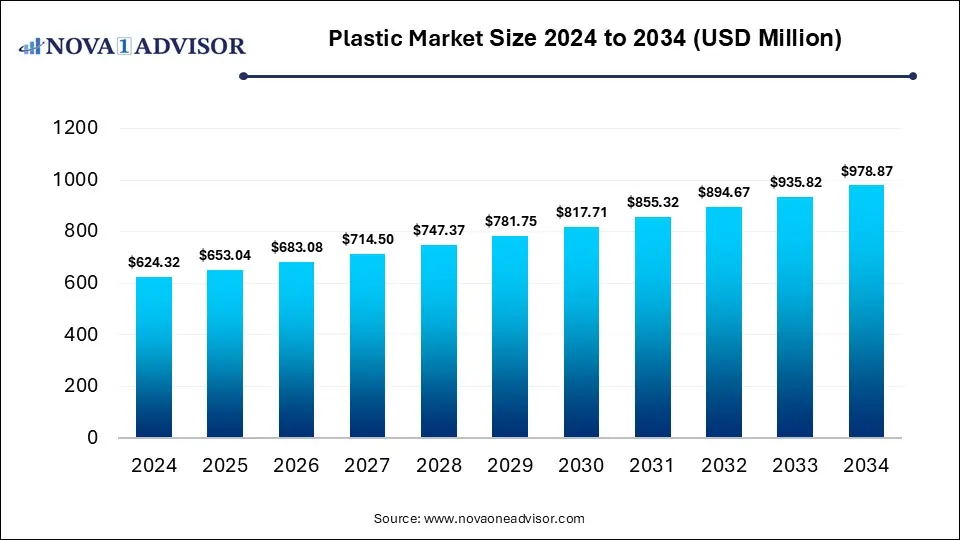

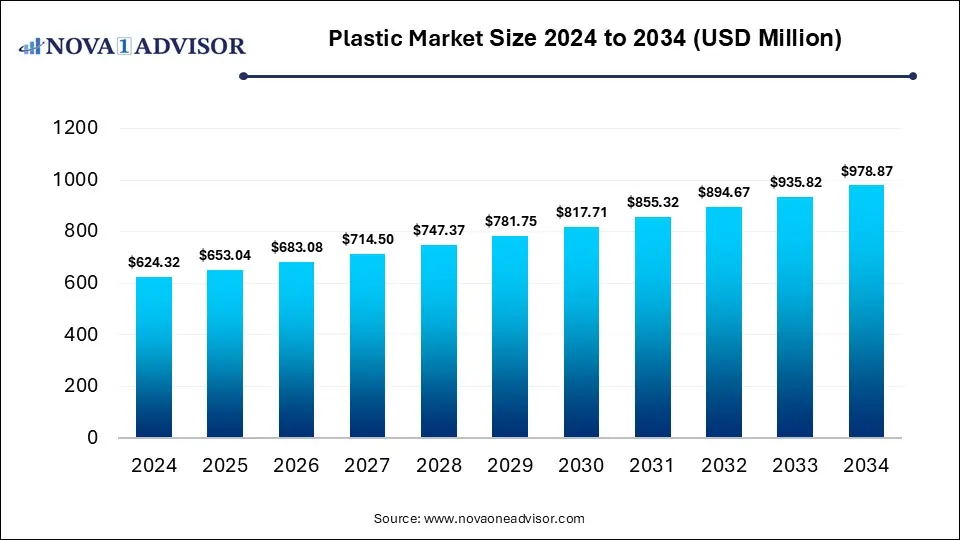

Plastic Market Size and Forecast 2025 to 2034

The global Plastic market gathered revenue around USD 609.2 million in 2024 and market is set to grow USD 820.1 million by the end of 2034 and is estimated to expand at a modest CAGR of 4.9% during the prediction period 2025 to 2034.

Growth Factors:

Increasing automotive production and a subsequent rise in plastic consumption in automotive component fabrication because of regulatory policies pertaining to vehicular weight reduction and fuel efficiency are expected to drive the market over the forecast period. Plastics facilitate fuel saving in automotive applications on account of reduced car weight and density as compared to conventional materials, such as metals or rubber.

Since the last decade, there has been a substantial demand for the products as a replacement for metals and ferrous alloys across various industries, such as consumer goods, automotive, and industrial machinery. The growth of the market criticality lies in various factors, such as the ever-increasing requirement of end users in terms of product specification and versatility influencing consumption dynamics. Other factors such as socio-political, production process, and feedstock availability events also have a significant impact on industry trends.

Rapidly developing construction and automobile markets in Asia Pacific are expected to increase the demand for plastics in interiors, exteriors, and under the hood components. Its major applications include under the hood components in the automotive industry, building interiors and exteriors in the construction and infrastructure industries, and various applications in electronics and durables.

This research report purposes at stressing the most lucrative growth prospects. The aim of the research report is to provide an inclusive valuation of the Plastic market and it encompasses thoughtful visions, actualities, industry-validated market findings, historic data, and prognoses by means of appropriate set of assumptions and practice. Global Plastic market report aids in comprehending market structure and dynamics by recognizing and scrutinizing the market sectors and predicted the global market outlook.

COVID-19 Impact Assessment on Market Landscape

The report comprises the scrutiny of COVID-19 lock-down impact on the income of market leaders, disrupters and followers. Since lock down was instigated differently in diverse regions and nations, influence of same is also dissimilar across various industry verticals. The research report offers present short-term and long-term influence on the market to assist market participants across value chain makers to formulate the framework for short term and long-lasting tactics for recovery and by region.

Plastic market Report empowers readers with all-inclusive market intelligence and offers a granular outline of the market they are operational in. Further this research study delivers exceptional combination of tangible perceptions and qualitative scrutiny to aid companies accomplishes sustainable growth. This report employs industry-leading research practices and tools to assemble all-inclusive market studies, intermingled with pertinent data. Additionally, this report also emphases on the competitive examination of crucial players by analyzing their product portfolio, pricing, gross margins, financial position, growth approaches, and regional occurrence.

Report Scope of Plastic Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 653.04 Million |

| Market Size by 2034 |

USD 978.87 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 6.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, End-use Region Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

BASF SE; SABIC; Dow Inc.; DuPont de Nemours, Inc.; Evonik Industries; Sumitomo Chemical Co., Ltd.; Arkema; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Co., LLC; Lotte Chemical Corporation; Exxon Mobil Corporation; Formosa Plastic Corporation; Covestro AG; Toray Industries, Inc.; Mitsui & Co. Plastic Ltd. |

By Product analysis:

In terms of revenue, polyethylene held the largest share of more than 27.2% in 2024. It is primarily used in the packaging sector, which includes containers and bottles, plastic bags, plastic films, and geomembranes. It finds use in various applications. Based on its molecular weight, there are different types of polymers of PE such as HDPE, LDPE, and LLDPE. For instance, low molecular weight polymers of PE find use in lubricants, medium molecular weight polymers are used as wax miscible with paraffin, and high molecular weight polymers are commonly used in the plastic industry.

Rising demand for packaged food, trays, bottles for milk and fruit juices, crates, caps for food packaging, drums, and other liquid food packaging owing to restrictions on the movement of people to reduce the spread of COVID-19 across the world is expected to drive the demand for polyethylene in the coming years. Acrylonitrile butadiene styrene (ABS) is one of the promising product segments in the market. ABS is widely used in consumer goods and electrical and electronics applications and is gaining popularity owing to its excellent rigidity, high strength, and dimensional stability.

Plastic Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Polyethylene (PE) |

134.02 |

140.08 |

146.43 |

153.07 |

159.94 |

167.2 |

174.75 |

182.65 |

190.91 |

199.5 |

208.5 |

| Polypropylene (PP) |

115.75 |

121.22 |

126.95 |

132.95 |

139.24 |

145.82 |

152.71 |

159.93 |

167.48 |

175.39 |

183.68 |

| Polyurethane (PU) |

42.64 |

44.91 |

47.29 |

49.8 |

52.44 |

55.22 |

58.14 |

61.23 |

64.47 |

67.89 |

71.48 |

| Polyvinyl chloride (PVC) |

67.01 |

69.73 |

72.54 |

75.47 |

78.51 |

81.66 |

84.93 |

88.32 |

91.84 |

95.5 |

99.28 |

| Polyethylene terephthalate (PET) |

60.92 |

64.61 |

68.51 |

72.65 |

77.03 |

81.66 |

86.56 |

91.75 |

97.25 |

103.06 |

109.21 |

| Polystyrene (PS) |

36.55 |

37.74 |

38.96 |

40.2 |

41.48 |

42.77 |

44.1 |

45.45 |

46.82 |

48.22 |

49.64 |

| Acrylonitrile butadiene styrene (ABS) |

30.46 |

31.86 |

33.32 |

34.84 |

36.44 |

38.11 |

39.85 |

41.67 |

43.58 |

45.57 |

47.66 |

| Polybutylene terephthalate (PBT) |

12.18 |

12.73 |

13.3 |

13.89 |

14.52 |

15.17 |

15.84 |

16.55 |

17.29 |

18.06 |

18.86 |

| Polyphenylene Oxide (PPO) |

6.09 |

6.4 |

6.72 |

7.05 |

7.41 |

7.78 |

8.17 |

8.58 |

9 |

9.46 |

9.93 |

| Epoxy Polymers |

15.23 |

16.12 |

17.06 |

18.06 |

19.11 |

20.22 |

21.4 |

22.64 |

23.95 |

25.34 |

26.81 |

| Liquid Crystal Polymers |

3.66 |

3.97 |

4.3 |

4.66 |

5.04 |

5.44 |

5.88 |

6.35 |

6.84 |

7.37 |

7.94 |

| Polyether ether ketone (PEEK) |

2.44 |

2.69 |

2.96 |

3.24 |

3.56 |

3.89 |

4.25 |

4.63 |

5.04 |

5.48 |

5.96 |

| Polycarbonate (PC) |

24.37 |

25.91 |

27.54 |

29.27 |

31.11 |

33.05 |

35.12 |

37.3 |

39.62 |

42.08 |

44.68 |

| Polyamide (PA) |

21.32 |

22.58 |

23.91 |

25.32 |

26.81 |

28.39 |

30.05 |

31.81 |

33.68 |

35.65 |

37.73 |

| Polysulfone (PSU) |

3.05 |

3.26 |

3.49 |

3.74 |

4 |

4.28 |

4.57 |

4.89 |

5.22 |

5.58 |

5.96 |

| Polyphenylsulfone (PPSU) |

2.44 |

2.62 |

2.82 |

3.03 |

3.26 |

3.5 |

3.76 |

4.03 |

4.32 |

4.63 |

4.96 |

| Others |

31.07 |

32.62 |

34.26 |

35.97 |

37.77 |

39.66 |

41.65 |

43.73 |

45.92 |

48.22 |

50.63 |

By Application analysis:

In terms of revenue, the injection molding application segment held the largest share of over 44.2% in 2024. Injection molding is a commonly used method for producing custom plastic parts. It is a discontinuous process as the plastic parts are produced in molds and required to be cooled before being removed. This process requires an injection molding machine, molds, and plastic materials. The molten plastic is injected into a mold cavity and then cooled to create the final product. It is generally used in the production of automobile parts, containers, and medical devices among others.

Calendering is one of the potential application segments in the market. It is used to process thermoplastic materials into films and sheeting. It is mainly used for PVC as well as certain other modified thermoplastics. The process consists of five steps, pre-blending, fluxing, calendering, cooling, and winding-up.

Plastic Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Injection Molding |

170.58 |

179.43 |

188.74 |

198.53 |

208.83 |

219.66 |

231.05 |

243.02 |

255.61 |

268.86 |

282.78 |

| Blow Molding |

85.29 |

89.52 |

93.97 |

98.63 |

103.53 |

108.67 |

114.07 |

119.73 |

125.68 |

131.92 |

138.47 |

| Roto Molding |

18.28 |

19.28 |

20.35 |

21.47 |

22.65 |

23.89 |

25.21 |

26.59 |

28.05 |

29.58 |

31.2 |

| Compression Molding |

36.55 |

38.18 |

39.89 |

41.67 |

43.53 |

45.47 |

47.5 |

49.62 |

51.83 |

54.14 |

56.56 |

| Casting |

24.37 |

25.35 |

26.37 |

27.43 |

28.53 |

29.67 |

30.86 |

32.09 |

33.37 |

34.7 |

36.08 |

| Thermoforming |

54.83 |

58.11 |

61.57 |

65.24 |

69.12 |

73.22 |

77.55 |

82.14 |

86.98 |

92.1 |

97.51 |

| Extrusion |

194.94 |

203.7 |

212.83 |

222.39 |

232.36 |

242.8 |

253.66 |

265.04 |

276.92 |

289.32 |

302.28 |

| Calendering |

12.18 |

12.77 |

13.39 |

14.03 |

14.71 |

15.41 |

16.16 |

16.94 |

17.75 |

18.61 |

19.5 |

| Others |

12.18 |

12.71 |

13.25 |

13.82 |

14.41 |

15.03 |

15.67 |

16.34 |

17.04 |

17.77 |

18.53 |

By End-use analysis:

The packaging end-use segment held the largest revenue share of more than 36.2% in 2024. Packaging is a high-potential end-use segment with moderate penetration. Plastics have been an integral part of the packaging industry. Furthermore, the advent of bio-based plastic has also played a significant role in food, pharmaceutical, and beverage packaging applications. Plastics such as Polyethylene Terephthalate (PET) and Polycarbonates (PC) are increasingly being used in the packaging of beverages, consumer goods, appliances, toys, and apparel. The packaging of appliances is expected to offer lucrative growth opportunities for the segment.

Plastic Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Packaging |

219.32 |

229.33 |

239.8 |

250.75 |

262.19 |

274.16 |

286.66 |

299.74 |

313.42 |

327.71 |

342.66 |

| Construction |

121.84 |

127.12 |

132.63 |

138.37 |

144.35 |

150.59 |

157.1 |

163.88 |

170.95 |

178.32 |

186.01 |

| Electrical & Electronics |

73.1 |

76.97 |

81.05 |

85.34 |

89.85 |

94.6 |

99.6 |

104.87 |

110.41 |

116.24 |

122.37 |

| Automotive |

67.01 |

70.59 |

74.35 |

78.31 |

82.49 |

86.88 |

91.51 |

96.38 |

101.5 |

106.9 |

112.58 |

| Medical Devices |

27.41 |

29.26 |

31.21 |

33.29 |

35.5 |

37.84 |

40.33 |

42.97 |

45.77 |

48.74 |

51.89 |

| Agriculture |

30.46 |

32 |

33.63 |

35.33 |

37.12 |

39 |

40.98 |

43.05 |

45.23 |

47.52 |

49.93 |

| Furniture & Bedding |

21.32 |

22.36 |

23.44 |

24.58 |

25.78 |

27.03 |

28.34 |

29.72 |

31.16 |

32.68 |

34.26 |

| Consumer Goods |

33.51 |

35.45 |

37.51 |

39.68 |

41.98 |

44.41 |

46.97 |

49.67 |

52.53 |

55.55 |

58.74 |

| Utility |

9.14 |

9.65 |

10.18 |

10.75 |

11.34 |

11.97 |

12.63 |

13.33 |

14.07 |

14.84 |

15.66 |

| Others |

6.09 |

6.32 |

6.56 |

6.81 |

7.07 |

7.34 |

7.61 |

7.9 |

8.19 |

8.5 |

8.81 |

Regional analysis:

Asia Pacific (including China) dominated the market and accounted for over 46.0% share of the global revenue in 2024. The growing manufacturing sector is expected to propel the demand for plastic in the automotive, construction, packaging, and electrical and electronics industries. In the recent past, India and China have witnessed a spike in automotive production owing to technology transfer to the sector from the Western markets.

In addition, a well-established manufacturing base for electrical and electronics in Taiwan, China, and South Korea is anticipated to provide further impetus to the market. India has a strong chemical manufacturing industry base, which strengthens its plastic production. Rapid urbanization, improving economic conditions, and increasing infrastructural activities are the factors supporting the growth of the market in Asia Pacific.

China is the largest supplier and producer of plastic components in this region. The growth of the automotive and electronic market and subsequent demand for lightweight components to improve the efficiency of the vehicle and reduce the weight of electronics components are the major factors contributing to the demand for plastic in the country.

Plastic Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

146.21 |

152.73 |

159.55 |

166.66 |

174.09 |

181.85 |

189.95 |

198.4 |

207.23 |

216.45 |

226.07 |

| Europe |

134.02 |

139.95 |

146.14 |

152.6 |

159.34 |

166.37 |

173.71 |

181.37 |

189.36 |

197.71 |

206.41 |

| Asia Pacific |

274.14 |

288.86 |

304.34 |

320.66 |

337.85 |

355.96 |

375.01 |

395.1 |

416.25 |

438.51 |

461.97 |

| Latin America |

36.55 |

38.53 |

40.62 |

42.83 |

45.15 |

47.59 |

50.17 |

52.88 |

55.74 |

58.75 |

61.92 |

| Middle East & Africa (MEA) |

18.28 |

18.98 |

19.71 |

20.46 |

21.24 |

22.05 |

22.89 |

23.76 |

24.65 |

25.58 |

26.54 |

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Plastic Market include: BASF SE; SABIC; Dow Inc.; DuPont de Nemours, Inc.; Evonik Industries; Sumitomo Chemical Co., Ltd.; Arkema; Celanese Corporation; Eastman Chemical Company; Chevron Phillips Chemical Co., LLC; Lotte Chemical Corporation; Exxon Mobil Corporation; Formosa Plastic Corporation; Covestro AG; Toray Industries, Inc.; Mitsui & Co. Plastic Ltd.

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2021 to 2034 and covers subsequent region in its scope:

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl chloride (PVC)

- Polyethylene terephthalate (PET)

- Polystyrene (PS)

- Acrylonitrile butadiene styrene (ABS)

- Polybutylene terephthalate (PBT)

- Polyphenylene Oxide (PPO)

- Epoxy Polymers

- Liquid Crystal Polymers

- Polyether ether ketone (PEEK)

- Polycarbonate (PC)

- Polyamide (PA)

- Polysulfone (PSU)

- Polyphenylsulfone (PPSU)

- Others

By Application

- Injection Molding

- Blow Molding

- Roto Molding

- Compression Molding

- Casting

- Thermoforming

- Extrusion

- Calendering

- Others

By End-use

- Packaging

- Construction

- Electrical & Electronics

- Automotive

- Medical Devices

- Agriculture

- Furniture & Bedding

- Consumer Goods

- Utility

- Others

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific