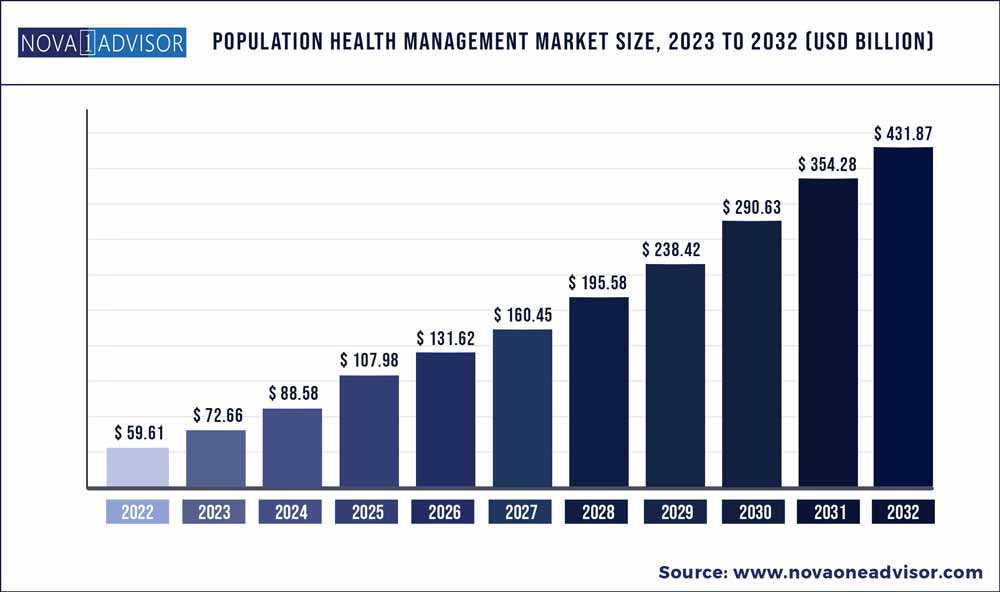

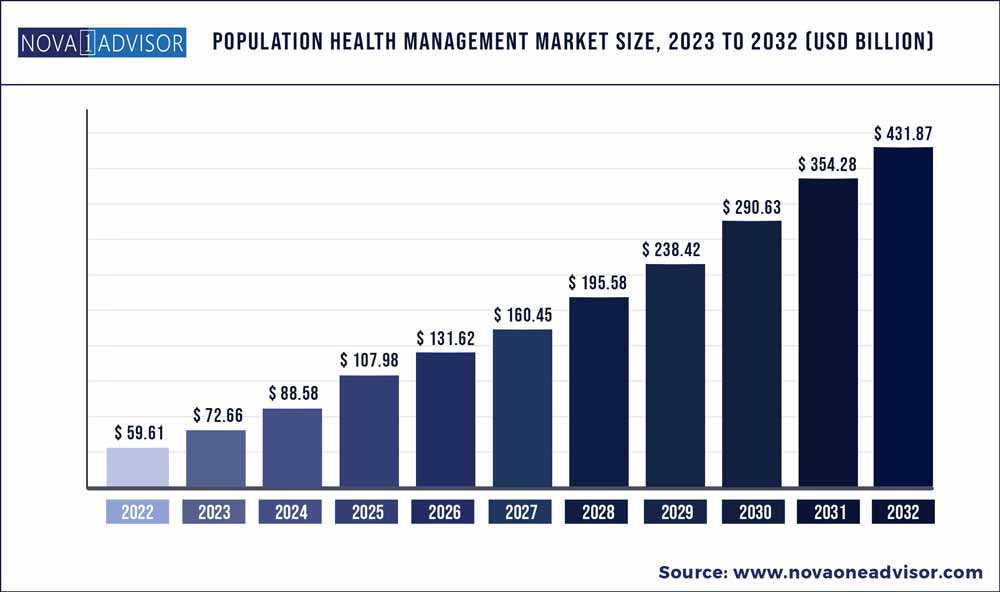

The global Population Health Management market size was exhibited at USD 59.61 billion in 2022 and is projected to hit around USD 431.87 billion by 2032, growing at a CAGR of 21.9% during the forecast period 2023 to 2032.

Key Pointers:

- The services segment dominated the market for population health management and accounted for the largest revenue share of more than 52.9% in 2022.

- The healthcare providers segment dominated the market for population health management and accounted for a revenue share of 49.11% in 2022.

- North America dominated the population health management market and accounted for a revenue share of 47.19% in 2022.

- Total healthcare spending in the U.S. is expected to reach up to USD 4.98 trillion in 2022, accounting for nearly 25% of Gross Domestic Product (GDP) by 2022.

Population health management (PHM) is the process of analyzing and managing the health outcomes of a specific group of individuals, often defined by factors such as geography, demographics, or health status. It involves identifying and addressing health disparities, managing chronic diseases, promoting preventive care and wellness, and improving the overall health of a given population. Population health management (PHM) relies on the integration of healthcare data, technology, and care coordination to provide tailored and proactive healthcare interventions to individuals within a defined population.

The current edition of the report consists of an updated market overview for each country in the geographic analysis chapter. Country-wise market size and market share have also been provided. The factors driving market growth include the need to maintain regulatory compliance, the rising need to curtail healthcare costs, and the growing demand for patient-centric healthcare. However, the dearth of skilled IT professionals and security concerns are challenging the growth of this market to a certain extent.

Population Health Management Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 72.66 Billion

|

|

Market Size by 2032

|

USD 431.87 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 21.9%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

By Component, Mode of delivery, End-user, and region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Cerner Corporation (US), Epic Systems Corporation (US), Koninklijke Philips (Netherlands), i2i Population Health (US), Health Catalyst (US), Optum (US), Enli Health Intelligence (US), eClinicalWorks (US), Allscripts Healthcare Solutions (US), IBM Corporation (US), HealthEC LLC (US), Medecision (US), Arcadia (US), athenahealth (US), Cotiviti (US), NextGen Healthcare, Inc. (US), Conifer Health Solutions (US), SPH Analytics (US), Lightbeam Health Solutions (US), Innovaccer (US), Lumeris (US), Zeomega (US), HGS Healthcare, LLC (US), Persivia (US) and Color Health, Inc.(US).

|

Population Health Management Market Dynamics

Driver: rising geriatric population and subsequent growth in the burden of chronic diseases

The rising geriatric population and subsequent growth in disease burden are expected to impact the healthcare systems in various countries significantly. The impact of the increasing geriatric population is even more pronounced given the growing pressure on government budgets, the decline in the number of health personnel in various regions, and the higher incidence of chronic diseases. Some of the important statistics in this regard have been mentioned below:

- The number of people aged 65 or older is projected to grow from an estimated 524 million in 2010 to nearly 1.5 billion by 2050, with most of the increase occurring in developing countries (source: WHO).

- In the US, the number of people aged over 65 is expected to double between 2005 and 2030 (source: National Institute on Aging, Maryland, US).

- According to the National Council on Aging, approximately 92% of older adults have at least one chronic disease, and 77% have at least two. Four chronic diseases—heart disease, cancer, stroke, and diabetes—cause almost two-thirds of all deaths each year in the US.

With a colossal pool of geriatric individuals requiring health and long-term care services, the healthcare cost per person is expected to increase in many countries. Moreover, with the growing expectations of citizens regarding healthcare services and social care, the burden on healthcare systems across the globe is increasing. In this regard, many strategies are being pursued by stakeholders to control costs while maintaining the quality of care. Population health management is one such approach that could enhance care quality while simultaneously reducing costs. Solutions such as EHR and population health management solutions are being employed to reduce the burden on the overworked healthcare delivery systems in most countries. As a result of these market conditions, the adoption of population health management solutions is increasing globally.

Opportunity: increasing focus on value-based medicine

Value-based medicine is redefining healthcare by capturing results-oriented data and making it usable. Business intelligence (BI) helps healthcare organisations determine what data they actually need and further helps them analyze, evaluate, and utilise this data to understand the overall costs versus benefits and gain a competitive advantage. It also enables transparency in all processes to examine every purchase from the standpoint of value, utility, and outcomes.

Moreover, governments, health insurance companies, and healthcare providers seek new opportunities to reduce costs as the current healthcare model is unsustainable across the globe. Besides, the growing volume and availability of healthcare data and the rising need to deliver quality care to patients will increasingly require healthcare organisations to rely on these new methodologies. This will serve as a strategic competency to differentiate themselves from their competitors and take advantage of the growth opportunities. The rapid transition from fee-for-service (FFS) payments to value-based reimbursement models and the key role of analytics in new pay-for-performance models like accountable care organisations (ACOs) will provide an impetus to the growth of the population health management market.

Restraint: Data Breach Concerns

In healthcare, approximately one-third of data breaches result in medical identity theft, mainly due to a lack of internal control over patient information, a lack of top management support, outdated policies and procedures or non-adherence to existing ones, and inadequate personnel training, all of which contribute to the rise in data breaches and medical identity theft cases in the industry. This makes patient confidentiality a major challenge in the healthcare industry.

A major concern with cloud-based population health management solutions is that data hosted by vendors is not as secure as its on-premise counterparts. Patient information is highly sensitive, and a high degree of privacy needs to be maintained to ensure access only to authorised users. Moreover, the digitization of medical and patient information has created greater data risks and liabilities and increased the chance of data breaches. In the US, the HIPAA Journal recorded 616 healthcare data breaches in its 2020 breach list, an increase of 66% over the total number of breaches tracked in 2018. According to a publication from the HIPAA Journal, HIPAA-covered companies and business associates paid around USD 13.6 million for HIPAA violations in 2020 and around USD 15.3 million in 2019. Thus, creating a secure communication platform is a major challenge faced by IT vendors catering to the healthcare industry. Thus, concerns over the security and privacy of sensitive patient information are limiting the adoption of cloud-based population health management solutions.

Challenge: Interoperability issues

The lack of interoperability is a major challenge for effective population health management. A critical factor in population health management is engaging patients with meaningful information about their health, including providing them with a summary of the care received, along with information on labs, medications, and images. Such information is particularly important when patients want to engage in shared decision-making with their physicians (regarding a care plan or course of treatment). However, the inability of patients to access their health records affects population health management outcomes.

The lack of interoperability across healthcare settings is also a barrier to advancing population health management. Confronted with poor interoperability, hospitals typically build or licence interfaces to import and export data from both internal and external sources, such as the hospital's EHR, laboratories, admit/discharge/transfer processes, medical devices, as well as outside laboratories. Thus, a single hospital may employ a few dozen interfaces, while a large health system with many sites may have to employ hundreds or even thousands of interfaces. For care coordination models, far more complicated interfaces will be necessary to accommodate data exchange. These interfaces prove to be expensive and difficult to maintain and require highly skilled technicians for their efficient operation. The health information exchanges employed by hospitals as a solution to interoperability barriers also pose several challenges, including capital-intensive operations as well as technical difficulties in their management.

Product Insights

The services segment dominated the market for population health management and accounted for the largest revenue share of more than 52.9% in 2022. Growing preference for in-house systems in hospitals and other care providers to avoid involving third parties to assess patient data is driving the services segment. The rising need for integrated healthcare systems is also responsible for the increasing demand for PHM.

As healthcare costs are increasing, manufacturers are investing in research and development to launch innovative products to help healthcare organizations. For instance, in October 2020, Allscripts announced its agreement of selling the CarePort Health business to WellSky Corp. for an upfront payment of USD 1.55 billion, and in June 2019, Health Catalyst, Inc. announced the launch of its Population Health Foundations solution. The product includes DOS Marts, Excel-friendly Analysis Tools, Population Builder: Stratification Module, Leading Wisely: Population Health, and Community Care as its technology components and PHM Solution Optimization and PHM Opportunity Analysis as its service components.

End-use Insights

The healthcare providers segment dominated the market for population health management and accounted for a revenue share of 49.11% in 2022. PHM improves clinical outcomes by aiding in better disease management, resulting in reduced in-patient stay and overall observation hours of physicians. Hence, providers can focus more on patient-centric care and reduce overall costs.

Payers are the third-party entities that finance or reimburse the cost of health services. Predictive analytics competency gives payers an advantage over other providers in interpreting population behavior and unstructured clinical content. This competitive advantage is instrumental in increasing the demand for PHM software for payers and is expected to propel segment growth significantly over the forecast period.

Regional Insights

North America dominated the population health management market and accounted for a revenue share of 47.19% in 2022. Total healthcare spending in the U.S. is expected to reach up to USD 4.98 trillion in 2022, accounting for nearly 25% of Gross Domestic Product (GDP) by 2022. Thus, the alarming increase in healthcare costs is, in turn, escalating the demand for an effective PHM. The government is focusing on increased incentives and investments to improve national health by accurately tracking the health of the population and its subgroups. The factors, such as pressure on the healthcare industry to reduce medical costs, rising use of information technology in healthcare, cloud computing, regulatory scenario, and increasing diseases are driving the market for population health management in North America.

For instance, the U.S. government implemented the ACA which is the Affordable Care Act for the prevention of diseases, and the adoption of IT in healthcare, this will boost the market growth and create opportunities for the service provider to effectively collect and maintain patients' data. In Asia Pacific, the market for population health management is anticipated to experience the fastest growth over the forecast period due to improving healthcare infrastructure and rising healthcare expenditure. Furthermore, the incidence of chronic diseases is expected to double from 2001 to 2025 in the Asia Pacific region. Managing the data generated from this increase will require advanced data analytics, which is expected to boost the growth of the market for population health management in the region.

Some of the prominent players in the Population Health Management Market include:

- Cerner Corporation (US),

- Epic Systems Corporation (US),

- Koninklijke Philips (Netherlands),

- i2i Population Health (US),

- Health Catalyst (US),

- Optum (US),

- Enli Health Intelligence (US),

- eClinicalWorks (US),

- Allscripts Healthcare Solutions (US),

- IBM Corporation (US),

- HealthEC LLC (US),

- Medecision (US),

- Arcadia (US),

- athenahealth (US),

- Cotiviti (US),

- NextGen Healthcare, Inc. (US),

- Conifer Health Solutions (US),

- SPH Analytics (US),

- Lightbeam Health Solutions (US),

- Innovaccer (US),

- Lumeris (US),

- Zeomega (US),

- HGS Healthcare, LLC (US),

- Persivia (US)

- Color Health, Inc.(US).

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Population Health Management market.

By Product & Service

- Introduction

- Software

- Services

By Mode of Delivery

- Introduction

- On-premise

- Cloud-based

By End User

- Introduction

- Healthcare Providers

- Healthcare Payers

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)